Updated Feb 27, 2024

The Dangers of Helicopter Money

Helicopter money has become a hot topic of discussion in economic circles, particularly after the unprecedented global economic impact of the COVID-19 pandemic. This concept refers to an aggressive form of monetary stimulus where the central bank directly finances government spending or even distributes money to the public to stimulate the economy, akin to dropping money from a helicopter. This policy is often considered when traditional monetary policy tools have lost effectiveness.

The term ‘helicopter money’ was first introduced by economist Milton Friedman in 1969 as a theoretical concept in his paper “The Optimum Quantity of Money.” The idea is to create and distribute money directly to individuals or businesses to increase spending and boost economic activity.

Historically, the direct distribution of money to the public without a corresponding increase in goods and services has been rare. However, measures akin to helicopter money have been seen in the wake of financial crises. For instance, during the 2008 financial crisis, the U.S. government issued tax rebates and emergency spending measures to stimulate the economy, which can be compared to helicopter money even though it was debt-financed.

More recently, during the COVID-19 pandemic, many governments issued direct payments to citizens to offset the economic downturn caused by the pandemic. Several rounds of stimulus checks were sent to Americans in the United States as part of the CARES Act and subsequent relief packages. While the Federal Reserve’s money creation did not fund these, through increased government debt, they served a similar purpose by injecting liquidity directly into the economy.

The acceptance and demand for more helicopter money may appear illogical to some, as it defies traditional economic principles, particularly regarding managing national debt. However, in severe economic downturns, the public and policymakers often prioritize immediate relief over long-term financial considerations.

As for the dollar’s response to such measures, conventional wisdom suggests that rampant money printing could devalue the currency. Yet, the U.S. dollar has held its value and appreciated relative to other currencies. This could be attributed to its status as the world’s reserve currency, providing a buffer against the inflationary pressures that might otherwise result from such monetary expansion.

While helicopter money is not without its critics, it has become an increasingly discussed policy option in times of severe economic distress. The long-term implications of such policies on national debt and currency value are complex and not fully understood. Still, historical precedents indicate that the outcomes may not always align with traditional economic predictions.

Helicopter Money: Risks and Consequences for the Economy

Risks and Consequences

Using helicopter money can lead to risks and unintended consequences for the economy. While it may provide a short-term boost to economic activity, the long-term implications can be detrimental if not managed carefully. One primary risk is inflation. By injecting a large amount of money into the economy without a corresponding increase in the production of goods and services, there is a risk that prices will rise, leading to inflation or even hyperinflation if the policy is used excessively.

Another risk is the devaluation of the currency. While the U.S. dollar has maintained its value despite significant monetary expansion, other currencies might not fare as well. If investors lose confidence in a currency due to excessive money printing, they might divest, leading to a sharp devaluation.

Historical Examples

An infamous historical example of the risks associated with helicopter money is the hyperinflation in the Weimar Republic in the early 1920s. The government printed money to pay for war reparations and internal spending, which led to rampant hyperinflation and currency collapse.

A more recent example, although not a case of pure helicopter money, is Zimbabwe in the late 2000s. To address its economic problems, the Zimbabwean government printed money at a dramatic rate. This led to hyperinflation, with the Zimbabwean dollar eventually becoming worthless.

Prospects for the Future

The statement that central banks will pump more money into the system over the next five years than in the previous fifty reflects a stark shift in monetary policy. Since the beginning of the COVID-19 pandemic in March 2020, central banks, including the U.S. Federal Reserve, have adopted aggressive economic stimulus measures.

The positive public perception of central banks as “saviours” can be attributed to the immediate relief such stimulus measures provide. However, the concern raised is that this relief comes at a cost. The accumulation of national debt and the potential for long-term inflation could lead to economic issues in the future.

Hypothetical Scenario

Imagine a country, Letitia, which decides to implement helicopter money by giving every citizen a significant sum to boost spending. Initially, consumer confidence soars and there is a surge in economic activity. However, as the production of goods and services has not significantly increased within a year, prices begin to rise. The Letitian currency starts to lose value as inflation takes hold, and foreign investors pull out, fearing currency devaluation. The central bank of Letitia responds by printing more money to sustain the economy, leading to a vicious inflation cycle. This hypothetical scenario illustrates how helicopter money can lead to economic instability if not coupled with productivity increases.

While helicopter money can seem attractive during economic crises, its potential to create long-term financial instability through inflation and currency devaluation must be carefully considered. The historical examples of the Weimar Republic and Zimbabwe serve as cautionary tales of the risks associated with such policies.

The perils of Helicopter money

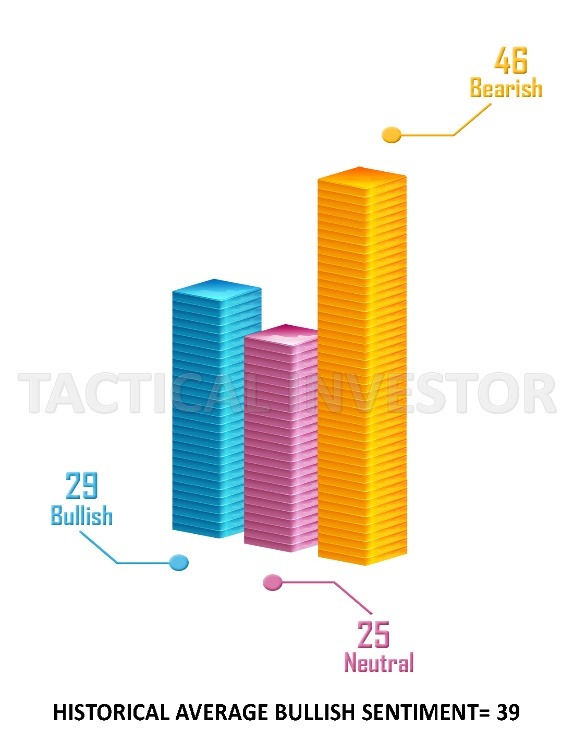

The perils of helicopter money are becoming increasingly evident as central banks deploy this strategy in response to economic downturns. The initial euphoria accompanying the influx of new money into the system can quickly give way to more sobering realities. For instance, while the Nasdaq and Dow Jones have shown remarkable resilience and growth, reaching new highs, the underlying bearish sentiment among investors remains a cause for concern. This paradoxical situation, where markets surge despite widespread investor nervousness, underscores the complexity of the economic environment we find ourselves in.

Investor sentiment is a critical factor in the financial markets, and the current climate suggests that many are still wary of the long-term implications of helicopter money. The fear is that the rapid increase in money supply will eventually lead to inflation, which could erode the value of assets and savings. Moreover, the increased national debt required to fund these monetary injections could become unsustainable, leading to a crisis of economic confidence.

From an investment perspective, the nervousness of the masses can be seen as a contrarian indicator. Historically, when the general public is wary of the stock market, it often means that there is potential for further growth, as was the case in the aftermath of the 2008 financial crisis. However, the situation we are facing now is unprecedented, with central banks venturing into uncharted territory with their monetary policies.

The long-term consequences of helicopter money are difficult to predict, but looking at past instances of excessive money printing can offer some insights. For example, the hyperinflation experienced by the Weimar Republic in the 1920s and Zimbabwe in the late 2000s are stark reminders of what can happen when monetary policy goes awry. While the current economic policies are not directly comparable to these historical events, they highlight the potential dangers of unchecked monetary expansion.

Helicopter money has temporarily boosted the economy and financial markets, but the risks associated with this policy are significant. The potential for inflation, currency devaluation, and an unsustainable increase in national debt are concerns that cannot be ignored. As central banks continue to navigate these uncertain waters, the true impact of their policies will only be revealed in time.

You will see some big names get destroyed before this bull is over as these big names, in their infinite wisdom, will decide to take on the Fed and as expected, they will end up dead, as in dead broke. Market update July 12, 2020

Challenge the Fed: End up Dead

The phrase “Challenge the Fed: End up Dead” captures the sentiment that opposing the Federal Reserve’s policies can have dire consequences for market participants. The Federal Reserve’s role in the economy has become increasingly prominent, especially since the onset of the COVID-19 pandemic, when it took dramatic steps to stabilize financial markets and support the economy. These steps included cutting interest rates to near zero and purchasing large quantities of government bonds and other securities.

The impact of these policies has been profound. For example, the Nasdaq’s performance since March 2020 has been remarkable, with the index reaching new highs. This surge in the Nasdaq, along with the Dow Jones Industrial Average’s recovery of its losses, has occurred even as individual investors remain cautious, a sentiment that could be seen as a disconnect from the market’s performance.

The Federal Reserve’s actions have led to an environment where liquidity and interest rates are abundant, making bonds and money market accounts less attractive than stocks. This dynamic can drive more capital into equities, further inflating asset prices. The prediction that the Nasdaq could reach the 14,850 to 15,000 range before experiencing a significant correction reflects this trend.

When a correction occurs, there is expected to be a sharp pullback, leading to widespread panic among investors. However, such pullbacks can present buying opportunities for those who are strategically positioned. The suggestion that the Nasdaq could eventually surpass 30,000 points underscores the long-term bullish outlook held by some market observers despite the potential for short-term volatility.

The Federal Reserve’s influence on the markets is a double-edged sword. While its policies can create favourable conditions for asset price growth, they also raise concerns about market distortions and the potential for bubbles. The long-term effects of the Fed’s interventionist policies are yet to be fully understood. Still, the historical record shows that central bank actions can have lasting impacts on financial markets and the economy. For instance, the low-interest rate environment following the 2008 financial crisis contributed to a prolonged bull market in stocks. It led to concerns about excessive risk-taking and asset price inflation.

The Federal Reserve’s aggressive monetary policies since the start of the pandemic have had a significant impact on financial markets, with the Nasdaq and Dow Jones reflecting investor optimism fueled by these interventions. However, the potential for future corrections and the long-term implications of these policies remain a source of debate among investors and economists.

Exploring the Risks and Dangers of Helicopter Money

- Inflation: One of the main concerns with helicopter money is the risk of inflation. Direct cash transfers to the public can increase demand for goods and services, leading to higher prices and inflationary pressures. If inflation is not controlled, it can negatively impact the economy, such as reducing the purchasing power of consumers, increasing costs for businesses, and causing interest rates to rise.

- Moral Hazard: Another danger of helicopter money is the potential for moral hazard. If people come to expect regular cash transfers from the government, they may become less motivated to work or save, leading to long-term economic consequences. Also, helicopter money is a way to bail out failing businesses or sectors. In that case, it can create moral hazard by encouraging reckless behaviour and dependence on government support.

- Fiscal Sustainability: Helicopter money can also have implications for fiscal sustainability. If the government cannot fund the cash transfers through tax revenues or borrowing, it may resort to printing money, leading to inflation and devaluation of the currency. In the long run, this can adversely affect the economy and reduce the government’s ability to fund essential programs and services.

- Political Interference: Finally, helicopter money can be subject to political interference, particularly if the central bank’s independence is compromised. Suppose politicians have control over the distribution of cash transfers. In that case, they may use this tool for political gain or to appease certain interest groups rather than to benefit the whole economy.

In summary, while helicopter money can be an effective policy tool for stimulating economic growth and addressing downturns, it also poses risks and dangers. These include the potential for inflation, moral hazard, fiscal sustainability, and political interference.

Resources on Helicopter money

These articles offer different perspectives on the benefits and dangers of helicopter money. They may help gain a more comprehensive understanding of the issue.

- “The Risks of Helicopter Money” by Kenneth Rogoff (Project Syndicate, 2016): https://www.project-syndicate.org/commentary/helicopter-money-risks-by-kenneth-rogoff-2016-06

- “The Case for Helicopter Money” by Adair Turner (Project Syndicate, 2016): https://www.project-syndicate.org/commentary/case-for-helicopter-money-by-adair-turner-2016-03

- “Helicopter Money: A Beginner’s Guide” by Mark Gilbert (Bloomberg Opinion, 2020): https://www.bloomberg.com/opinion/articles/2020-04-15/helicopter-money-a-beginner-s-guide

- “The Helicopter Money Debate: Why Some Economists Love it – and Why Others are Skeptical” by Paul Solman (PBS NewsHour, 2016): https://www.pbs.org/newshour/economy/the-helicopter-money-debate-why-some-economists-love-it-and-why-others-are-skeptical

- “The Dangers of Helicopter Money” by David Marsh (MarketWatch, 2016): https://www.marketwatch.com/story/the-dangers-of-helicopter-money-2016-04-20