Unlocking the Mystery: What Are Dark Pools

Jan 24, 2024

Introduction

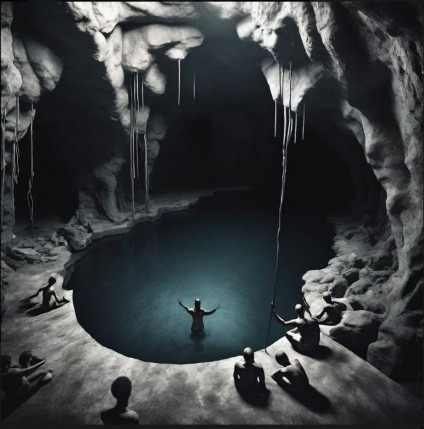

What Are Dark Pools: Hanging grounds for the rich to milk the poor. Sol Palha

Dark pools, or Black pools, sometimes referred to, are private trading venues where institutional investors trade large blocks of securities away from public eyes. These platforms emerged as a response to the market influence of large transactions, allowing for discreet execution without immediate price disruption. However, the secrecy of dark pools raises questions about market fairness, echoing Machiavelli’s insights on the use of power and the importance of appearances in governance. While serving a practical purpose in modern finance, the opacity of dark pools invites scrutiny and calls for a balance between the cunning use of strategic advantage and the need for transparency in the financial realm.

The Evolution of Dark Pools

Black pools originated to allow institutional investors to execute large trades without immediate market impact. As trading volumes increased with algorithmic and high-frequency trading, these venues became necessary to prevent large orders from moving market prices upon execution.

The core purpose of dark pools is to facilitate large trades discreetly. Trade details are revealed post-execution to minimize market disruption. However, this secrecy has raised concerns about market fairness and potential abuse.

The debate centres on whether dark pools create an uneven playing field, favouring institutional over retail investors. Critics argue that the opacity of dark pools can disadvantage smaller investors, reinforcing a divide in market access.

While dark pools are critical in accommodating large transactions discreetly, their opaque nature presents challenges regarding market transparency and fair access.

Black Pools: Navigating the Shadows of Financial Thievery

These nettwords are private financial forums or exchanges for trading securities not accessible by the investing public. Designed originally to facilitate block trading by institutional investors who did not wish to impact the markets with large orders and obtain disadvantageous prices for their trades, dark pools offer an alternative to the public stock exchanges. Market participants in dark pools are typically large financial institutions and high-net-worth individuals.

The term “dark pool” refers to the lack of transparency that characterizes these venues. Unlike public exchanges, where order books are visible to all participants, dark pools do not display the orders to other participants before execution. Trades are only made public after execution, so the market impact is significantly lessened for large orders.

While dark pools are legal and regulated by the Securities and Exchange Commission (SEC), they have been scrutinized for potentially undermining public markets’ fair and efficient operation. Critics argue that dark pools obscure the actual supply and demand for securities, potentially leading to pricing that does not accurately reflect the market. This lack of transparency can disadvantage retail investors, who cannot access the same information as institutional investors operating in these dark venues.

Furthermore, there are concerns that Black pools may contribute to market fragmentation and the development of a two-tiered market system where institutional investors can gain an advantage over retail investors through better pricing and anonymity.

The SEC has taken steps to regulate them with rules designed to protect investors and maintain fair markets. For example, Regulation ATS (Alternative Trading System) requires dark pools to register with the SEC and publicly report trade information to ensure transparency.

As for the tools to analyze dark pool data, these are sophisticated algorithms and analytics platforms that attempt to identify patterns or signals in the trading data that could indicate future market movements. By analyzing large blocks of trades and using technical analysis and an understanding of market psychology, some investors try to infer whether institutional players are predominantly buying or selling.

The patterns observed from dark pool trading data can sometimes suggest that institutional investors use strategies based on their market outlook or information that may not be publicly available. For instance, if a selling pattern is detected, it could indicate that these players are trying to exit their positions in anticipation of a market downturn or because they believe the market is overvalued.

In conclusion, while they play a legitimate role in the financial markets by allowing large trades to occur with minimal market disturbance, concerns about their opacity and potential to disadvantage retail investors remain. The debate about the fairness and impact of dark pools is ongoing, with regulatory efforts to ensure that all market participants compete on a level playing field.

The Legitimacy of Dark Pools

By their very nature, dark pools evoke a sense of mystery and exclusivity in the financial world. They were created to allow large institutional investors to execute significant trades discreetly, aiming to prevent the broad market impact that such trades could have if conducted on public exchanges. However, the secrecy that defines dark pools is precisely what casts doubt on their legitimacy.

From the perspective of Solon, the ancient Athenian lawmaker, such secrecy might undermine the principles of fairness and equality he championed. Solon’s reforms aimed at creating a more balanced society, and he might view dark pools as antithetical to these ideals, potentially exacerbating economic disparities.

Machiavelli, known for his pragmatic approach to power, might argue that such exchanges can be tools for strategic advantage. Still, their secretive nature could foster an environment ripe for manipulation and deceit. He might caution that the lack of transparency could lead to a loss of trust in the financial markets, as people are “ungrateful, disloyal, insincere and deceitful” when acting out of self-interest.

Both thinkers would likely agree that the absence of transparency in dark pools risks the integrity of financial markets. The potential for misuse and the advantage it gives to a select few go against the principles of a fair and equitable market. In the spirit of Solon’s reforms and Machiavelli’s insights into the nature of power, there is a strong case for advocating the reduction or elimination of these black pools to promote a more transparent and just financial system.

Conclusion

Black pools are private trading venues that contrast with the transparency of public stock markets. They emerged as a solution for institutional investors to execute large trades without affecting market prices. However, the secrecy of dark pools raises questions of fairness and market integrity.

From an ancient philosophical standpoint, Solon might argue that dark pools create an unequal playing field, favouring the wealthy and well-connected at the expense of ordinary investors. He would likely advocate for transparency and equal access to information as cornerstones of a just market system.

Machiavelli might view dark pools as a strategic tool for those in power. Still, he would also recognize the potential for misuse and the erosion of trust that secrecy can engender in a market system. He would caution that dark pools could undermine the market they are meant to serve without oversight.

The debate around these nefarious exchanges centres on balancing large entities’ need for discreet trading and the principles of an open and fair market. While they serve a practical purpose, the exclusion of retail investors and the potential for abuse call into question whether these exchanges should continue to operate in their current form.

Unearth Fascinating Articles on Various Topics

Media Manipulation; The Fraudulent Economic Recovery

Shanghai se Composite Index & The Margin Trading Story

Federal Reserve existence based on Fraud

Share Buybacks Deception- Corporate Share Buybacks Keeping Dow Bull Alive

The US Debt Dilemma: Navigating the Financial Storm

US Congress losing mind over Russian Arms Sales to Iran

Russia and China Gold Reserves Are Surging

Fed Head Will Shock Markets; Expect Monstrous rally

In The Midst of Chaos There is Opportunity

Central Bankers World Wide embrace race to the Bottom

Currency Wars & Negative Rates Equate To Next Global Crisis

Control Group Psychology: Stock Crash of 2016 Equates To Opportunity

Erratic Behaviour Meaning:Dow likely to test 2015 lows

Little Bird’s Trading Plan To Wealth

The Smart Investor IS buying While The Dumb Money selling

Selling Puts Made Simple: Easy, Concise, and Interesting Strategies