Unveiling HIMX Stock: A Small Company with Big Potential

Updated March 15, 2024

Himax Technologies (NASDAQ: HIMX) has seen tremendous growth and innovation over the past few years. As a leading fabless semiconductor company specializing in display imaging processing technologies, Himax is at the forefront of critical trends like augmented reality (AR), virtual reality (VR), and 3D sensing.

With the surging demand for consumer electronics and automotive displays, Himax expects its full-year 2022 revenues to increase by over 60% compared to 2021. This rapid expansion underscores the massive market opportunity as technologies like AR/VR and 3D sensing gain broader adoption.

A key growth driver lies in Himax’s revolutionary WiseEye ultralow power AI sensing solution. WiseEye enables advanced AI capabilities in edge devices like laptops, tablets and IoT gadgets via an integrated system-on-chip.

Himax is collaborating with industry leaders across the automotive, consumer electronics, and healthcare sectors to integrate WiseEye into next-generation products. One example is Himax’s partnership with Tier-1 automotive supplier VAST to develop an in-cabin 3D vehicle sensing system using WiseEye.

With game-changing innovations like WiseEye, Himax is poised to maintain its leadership in imaging processing technologies. As these solutions become embedded in mass-market consumer and automotive products over the next decade, Himax represents an exciting semiconductor growth story.

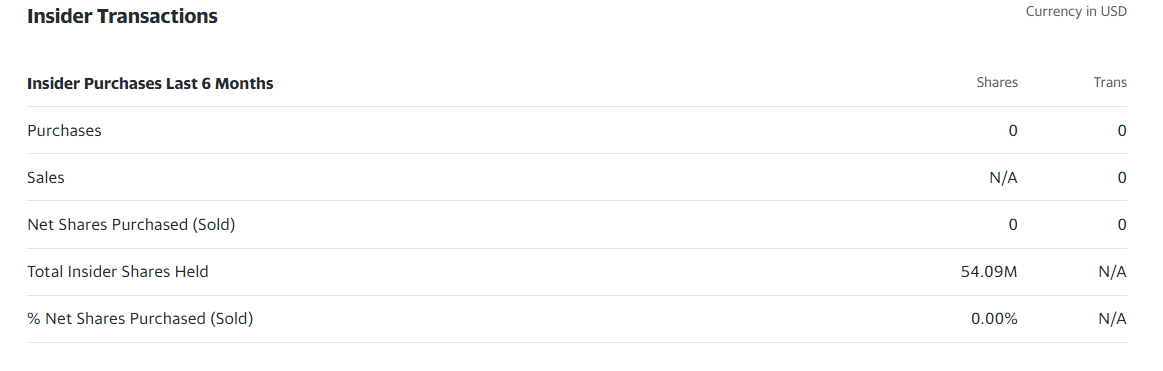

HIMX Stock Price Trend Based on Insider Action

When analyzing the company’s insider activity, there appear to have been no recent significant insider buys or sells. Consequently, this aspect doesn’t provide specific clues about the stock’s potential.

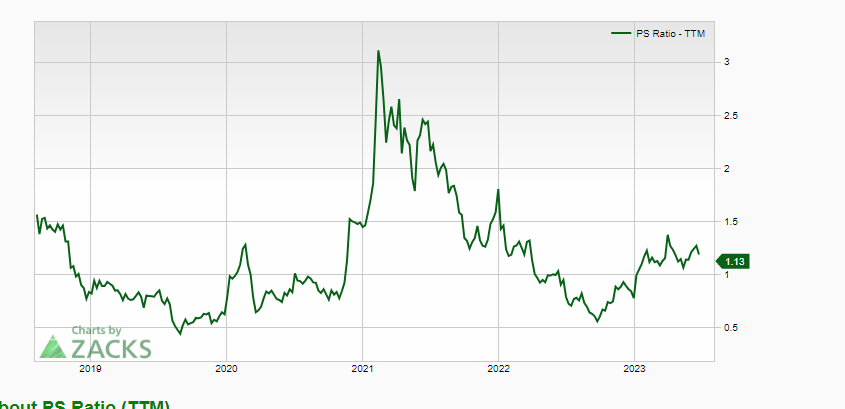

Analyzing the Price-to-Sales (P/S) ratio can be valuable when considering a stock’s investment potential. A low P/S ratio indicates the stock may be undervalued relative to its revenue generation.

Combining a low P/S ratio with technically oversold stock on the monthly charts can also be a compelling long-term buy signal. The oversold condition suggests that the stock’s price has dropped significantly and may be due for a rebound, while the low P/S ratio further supports the notion that the stock is undervalued.

HIMX Stock P/S Ratio Trend

Based on historical data, the stock’s P/S ratio appears relatively low, which can be a positive sign for potential investors. Combined with the data from the monthly charts, which indicate that the stock is trading in the highly oversold zone, this further reinforces the notion that this could be a favourable long-term investment opportunity.

The stock’s current P/S ratio towards the low end of its four-year range adds another compelling aspect to consider when evaluating its investment potential. Historically, buying stocks when their P/S ratio is low compared to their historical levels has proven advantageous.

HIMX Stock Price: Unveiling Exceptional Value and Untapped Potential

Moreover, it’s impossible to overlook the incredible value proposition that Himax offers. The company’s shares are trading at an enticing forward multiple of only 15.15x, which positions it as a bargain compared to projected earnings, outperforming approximately 74.64% of its competitors.

Now, let’s discuss Wall Street’s excitement about HIMX. Analysts are bullish on the stock, giving it a “moderate-buy” rating. Their average price target for HIMX is an impressive $9, suggesting a potential upside of nearly 32%.

But that’s not all. HIMX is also trading well below its book value, with a current book value of 9.47, underscoring its undervalued status. Additionally, the company offers investors a substantial dividend yield of almost 8.5%, making it an attractive income opportunity. It boasts a modest forward P/E ratio of 9.4, making it an even more tempting prospect for investors seeking growth and income.

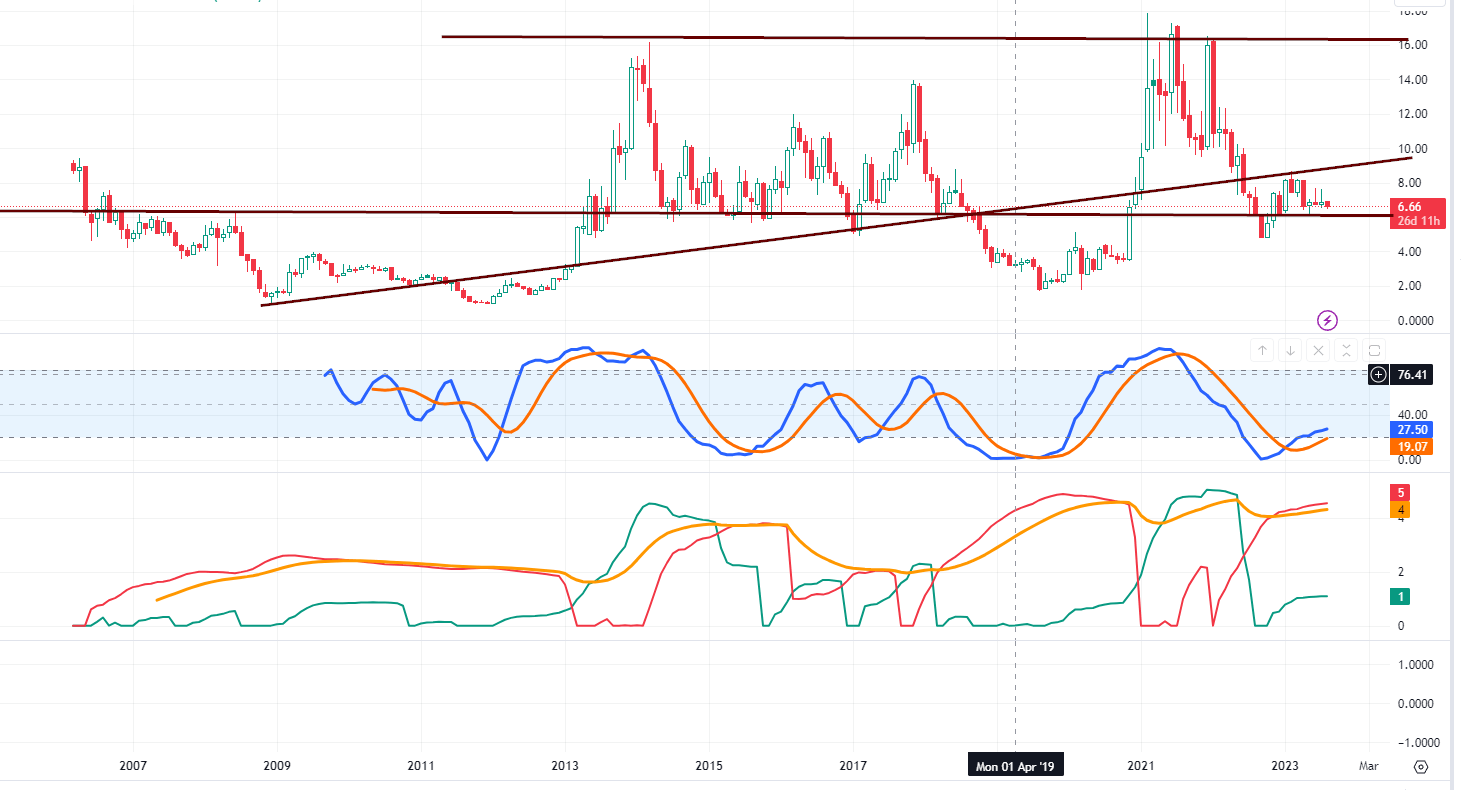

Long-Term HIMX Stock Price Outlook

The stock exhibits a robust support zone within the 4.80 to 5.10 range. As long as this level holds every month, the outlook remains bullish. The view would be even more promising if it stays above the higher end of the range, at 5.10.

A significant breakthrough would occur with a monthly close at or above 8.70, which could trigger substantial gains in the stock. There seems to be minimal resistance until the 14.00 to 14.50 range, potentially yielding over 60% in revenues if this objective is achieved.

Considering the risk-to-reward perspective, having some exposure to this stock appears sensible. Additionally, the fact that it offers a generous dividend of almost 7% as of the current writing adds to its appeal to investors. However, as with any investment, it is essential to carefully assess the overall market conditions and the company’s performance before making any decisions.

Short-Term HIMX Stock Price Trends

A bullish outlook is expected if the stock does not close below 5.70 in the short term. However, to potentially challenge the 8.40 to 9.00 range, it must achieve a weekly close at or above 7.50. Until this milestone is reached, the stock is likely to remain stagnant. Nevertheless, given the bullish long-term pattern, investors willing to take on some additional risk may find it advantageous to use any pullbacks as opportunities to add to their positions in the stock.

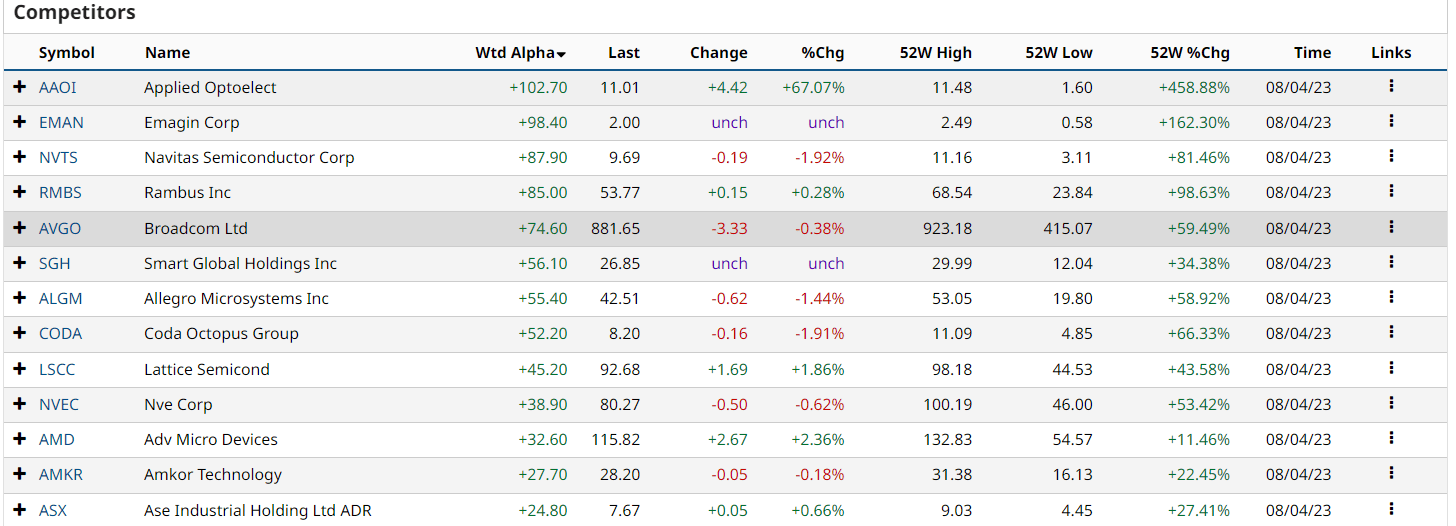

Weighted Alpha and Competitors

The weighted alpha of all stocks indicates that the sector is not overbought and has the potential for further growth. However, what holds greater significance is the industry’s overall upward trend. Observing this trend, we can confidently state that the industry is moving positively.

This trend suggests there is still room for the sector to continue its upward trajectory. Given the potential for ongoing growth, investors might find it an opportune time to consider investments within the industry.

Although HIMX appears promising, other candidates mentioned above have even stronger performance based on the weighted alpha metric. As such, it might be a more prudent approach to diversify the investment and spread the money into at least one or two of these stronger candidates.

Diversification can help mitigate risks and enhance potential returns by gaining exposure to multiple opportunities with varying strengths. While HIMX shows potential, considering other strong contenders could provide a more well-rounded investment strategy.

HIMX Stock Performance through AI Advancements: The WE2 Processor and Beyond

HIMX is making significant advancements in Artificial Intelligence (AI), particularly in developing its next-generation WE2 AI processor. This processor is a follow-up to the highly regarded WE1 processor. It excels in performing contextual awareness AI tasks, especially in detecting user engagement levels based on subtle cues like presence and movement.

The WE2 processor incorporates advanced computer vision capabilities that allow it to recognize images from greater distances with improved accuracy, speed, power efficiency, and inferencing performance. With this exceptional AI processing power, the WE2 processor enables more comprehensive and detailed object detection, including facial landmarks, hand landmarks, and body skeleton tracking. This allows precise AI detection for various real-life applications and use cases.

One notable application of the WE2 processor is developing next-generation bright notebooks, set to hit the market in 2024. HIMX is actively collaborating with top laptop brands, CPU manufacturers, and AP SoC partners to enhance AI features on these notebooks. This collaboration aims to provide users with enriched AI capabilities for an enhanced computing experience.

Furthermore, HIMX’s business scope is expanding to cater to the diverse needs of IoT players in various domains. They are excited to be at the forefront of innovative developments in this field. With increasing customer adoption across different disciplines, HIMX is dedicated to the ongoing development of the WiseEye product line. They are also leveraging a wide network of ecosystem partners to tap into the vast opportunities presented by AI at the endpoint.

Liqxtal™ Graph Display Glasses: Groundbreaking Technology Unveiled at Vision Expo West 2023

Himax Technologies and its subsidiary Liqxtal Technology have unveiled the patented Liqxtal™ Graph Display Glasses, set to debut at Vision Expo West 2023 in Las Vegas from September 27-30. This groundbreaking technology utilizes a reflective TFT liquid crystal architecture to display vibrant coloured digital content, such as text, images, and animations, directly on the outer surface of the glasses lenses without compromising the wearer’s line of sight.

Key features of the Liqxtal Graph Display Glasses include:

– Transforming conventional eyewear into an interactive display platform by leveraging Internet of Things (IoT) technology

– Enabling a wide range of applications like real-time signage, interactive gaming, social media interaction, and more

– Ultra-low power consumption, making it ideal for wearable devices

– Displaying personalized, colourful content on the outer lens for others to see while ensuring clear visibility for the wearer

Liqxtal Technology, a subsidiary of Himax Technologies, specializes in developing liquid crystal optical components and has expertise in electrically tunable lenses. They also integrate novel display solutions like tunable backlights with local dimming powered by FPGA for niche applications.

Himax Technologies is a leading fabless semiconductor solution provider that designs display driver integrated circuits and timing controllers for various consumer electronics. As of June 30, 2023, Himax had 2,872 patents granted and 380 patents pending approval worldwide.

Interested parties can experience the Liqxtal Graph Display Glasses firsthand at Liqxtal’s exhibition booth, F3093, at the Venetian Expo during Vision Expo West 2023. This innovation represents a significant leap forward in eyewear technology, with Liqxtal committed to advancing optical solutions for the world’s benefit.

HIMX Q3 FY2023: Exceeding Expectations with Mixed Signals and Growth Prospects

Himax Technologies (HIMX) reported its Q4 FY2023 and full-year 2023 results, reflecting its resilience amidst industry challenges. For Q4 FY2023, revenue reached $262.3 million, a 10% increase compared to Q3 FY2023. The quarter’s earnings per share (EPS) stood at $0.08, improving from the previous quarter’s $0.06.

For the full year 2023, Himax recorded revenue of $1.2 billion, a 5.2% increase compared to FY2022. The company’s gross margin for FY2023 was 32.1%, slightly declining from 33.7% in FY2022. However, the company maintained its profitability with a net annual income of $108.5 million.

Himax’s cash position remained strong, with cash and cash equivalents of $364.8 million at the end of FY2023. The company’s inventory management showed further improvement, with Inventory Days Outstanding decreasing to 140 days in Q4 FY2023.

Regarding Q1 FY2024, Himax provided cautious guidance due to ongoing market uncertainties and customer inventory adjustments. The company expects revenue to be between $210 million and $230 million, with a gross margin of around 31.5% to 33.5%.

Despite the near-term challenges, Himax remains focused on its long-term growth strategies, particularly in the automotive and AIoT segments. The company continues to invest in research and development to strengthen its position in these high-growth areas.

As investors assess Himax’s prospects, they must consider its strong financial position, improving operational efficiency, and strategic focus on key growth segments. While the near-term outlook remains cautious, Himax’s long-term potential in the evolving technological landscape should not be overlooked.

Unearth Extraordinary Articles for Your Curiosity

Unveiling Falsehoods: Which of the Following Statements About Investing is False

Which of the Following is True When the Velocity of Money Falls? Economic Slowdown

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies