Herd Panic: The First Law of Market Destruction

Updated Aug 21, 2025

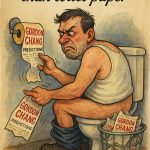

Stop. Listen. Because right now, as you read these words, another mass panic is brewing somewhere in global markets. It’s not a question of if, but when. The destructive power of fear-driven herd mentality in markets is relentless—an ancient instinct repackaged for modern chaos. When the crowd runs, logic dies. Fortunes are razed, and careers are erased. In the stampede for the exits, the only certainty is carnage.

Why does this happen again and again? Because investors, despite their sophistication, are still human—wired for survival, not rationality. The brutal lesson: the market rewards the few who resist the crowd, and punishes the many who follow it blindly. If you want to understand hot stocks today, start by understanding the crucible in which they are forged—the chaos of collective fear, the forge of outliers, and the lawless edge where opportunity is born.

Unmasking Market Panic: Fear, Bias, and the Cost of Chaos

To understand why markets unravel, start with the mind. Loss aversion means a dollar lost hurts roughly twice as much as a dollar gained feels good. Confirmation bias pushes investors to seek headlines that validate their worst fears. Herd instinct then finishes the job—safety in numbers, even when the stampede is headed for a cliff. Markets aren’t tidy trendlines; they’re turbulent, multi-dimensional terrains where emotion and information braid into unpredictable currents.

History keeps the receipts. In 1929, the first tremors triggered waves of selling that magnified the crash. In 2008, Lehman’s failure set off a chain reaction—roughly $2 trillion vanished from equities in a matter of weeks. And in March 2020, COVID panic sent indexes into a vertical drop—only for the bold to scoop up the hot stocks today that would anchor the recovery. These aren’t isolated episodes; they’re recurring case studies in financial psychology.

Here’s the paradox: fear destroys, but it also creates. The same panic that wrecks portfolios opens once-in-a-decade entry points for investors who can see past the smoke. Outliers—the few who step in while others run—often become the architects of the next bull market. Like myth, markets reward those willing to brave the underworld while the crowd freezes at the gate.

Contrarian Mastery: Courage With a Compass

Contrarians aren’t born—they’re forged in turmoil. Warren Buffett’s mantra—“Be fearful when others are greedy, and greedy when others are fearful”—is just the starting point. Think Charlie Munger, distilling “elementary, worldly wisdom” to cut through confusion, or Jesse Livermore, who read the tape with a gambler’s nerve and a scientist’s discipline. They thrive not by defying the crowd blindly, but by understanding the forces that move it.

What sets them apart is vector thinking: reading markets as intersecting forces rather than a straight path from A to B. They track nonlinear spillovers—how a policy shift in Washington can amplify a supply shock in Taiwan, or how online sentiment can ignite a short squeeze in London. They know the hot stocks today rarely emerge from consensus, but from the white heat of uncertainty.

Consider 2020: as panic gripped the tape and tech was dumped indiscriminately, a handful of investors accumulated names like Amazon, Nvidia, and Zoom. Bets that looked reckless in real time were celebrated a year later. Those decisions weren’t lucky swings; they were calculated risks mapped on a multi-dimensional chessboard—bold, but never blind.

Fear-Exploiting Strategies: Premium Harvesting and LEAPS

Let’s get surgical. When volatility explodes, so too do put option premiums. Most investors run for the hills; the contrarian steps into the storm, selling puts to collect fat premiums from the fearful. This is not bravado; it’s strategy. By selling puts on robust companies, investors either pocket the premium or buy the hot stocks today at a steep discount if assigned.

For example, during the 2022 tech meltdown, selling puts on Nvidia at a $120 strike, with three months to expiry, netted $10 per contract—an 8% return for a quarter. If assigned, the investor acquired a market leader at a fire-sale price. If not, the premium was pure profit.

The next layer? Reinvest those premiums into LEAPS—long-term, deep-in-the-money call options on the same momentum stocks. It’s leverage without recklessness: limited downside, explosive upside. Imagine cycling $10,000 in collected premiums into LEAPS on Meta at the start of 2023—by year-end, a 30% move in the underlying could translate to a 100% gain on the options. This is emergent synthesis: two independent strategies, interacting to amplify returns.

Disciplined Boldness: The Difference Between Courage and Folly

None of this works without discipline. Bullishness without boundaries is suicide. The market is littered with those who confused guts with preparation. The true greats—think Stanley Druckenmiller—win not because they are always right, but because they have ironclad risk management. They simulate edge cases, anticipate chaos, and prepare for the worst before acting.

When the next panic sweeps in—and it will—the disciplined will be the ones buying the hot stocks today while the crowd sells at any price. They will have plans, not prayers. They will seize opportunity from the jaws of fear, multiplying when others divide.

This is the paradox at the heart of markets: risk is the price of reward, but only for those who respect its power. Reckless courage destroys; disciplined boldness creates generational wealth. The market crowns only those who know the difference.

Hot Stocks Today? – The 2025 Market Leaders Table

Enough theory. Let’s turn insight into action. Here are the hot stocks today—the market leaders driving momentum right now, forged at the intersection of innovation, resilience, and explosive potential. Each is an outlier, each a vector of emergent change, each demanding respect and rigorous analysis.

| Rank | Company | Ticker | Industry | Reason for Momentum | 2025 YTD Performance |

|---|---|---|---|---|---|

| 1 | Nvidia | NVDA | AI & Semiconductors | AI hardware dominance, exponential data centre growth | +44% |

| 2 | Tesla | TSLA | EVs & Energy | Battery breakthroughs, global gigafactories, energy storage surge | +38% |

| 3 | Meta Platforms | META | Social/AI/Metaverse | VR/AR advances, ad rebound, AI-driven engagement | +27% |

| 4 | Eli Lilly | LLY | Biotech | Obesity/diabetes pipeline, blockbuster drug launches | +31% |

| 5 | Microsoft | MSFT | Cloud & AI | Generative AI, enterprise cloud leadership | +25% |

These hot stocks today are not mere beneficiaries of luck. Their momentum is the emergent result of technological innovation, strategic vision, and—critically—the willingness of investors to engage when the crowd cowers. Each stock listed is the result of edge-case thinking: Nvidia’s AI chips, Tesla’s energy storage, Meta’s metaverse, Eli Lilly’s biotech pipeline, Microsoft’s AI cloud empire. These are the vectors where opportunity and fear collide, and new fortunes are made.

Visionary Empowerment: Breaking Free from the Herd

The final lesson is not just financial—it’s existential. To escape the herd is to seize autonomy, to become the architect of your own destiny. The market is a vast, multidimensional game, shaped by paradox and contradiction,

where chaos and order constantly wrestle. To win, you must embrace this uncertainty, not shy away from it. The hot stocks today are not found by chasing consensus—they are found by standing at the crossroads of innovation and fear, by daring to act when others freeze, and by seeing what the crowd cannot or will not see.

Visionary empowerment begins with breaking the mental chains imposed by the herd. In markets, as in myth, the hero’s journey is solitary. Odysseus faced monsters, not crowds; Prometheus stole fire, not applause. The modern investor, armed with vector thinking and a willingness to probe extremes, rejects the safety of numbers for the power of insight.

It’s not enough to know which are the hot stocks today—you must understand why they are hot, and why the opportunity exists. Sometimes, the best opportunities emerge precisely because the crowd cannot stomach the volatility or uncertainty. The disciplined, the bold, the prepared—they step in, gather the spoils, and set the next market narrative.

The paradox is perpetual: the market’s greatest risks conceal its greatest rewards. The comfortable path leads to mediocrity; the uncomfortable, to potential greatness. In 2025, Microsoft’s relentless AI push, Nvidia’s hardware revolution, and Eli Lilly’s breakthrough drugs are not just stories of corporate triumph—they are case studies in emergent synthesis, where new realities are born from the collision of fear, innovation, and resolve.

Emergent Synthesis: The True Edge in Modern Markets

What does it all mean for you, right now? It means that every headline, every panic, every anomaly is a piece of a larger puzzle. Hot stocks today are signals—nodes within a complex network of evolving trends, competitive pressures, and psychological waves. The edge no longer belongs to those who merely copy past formulas, but to those who synthesise new insights from disparate domains.

This is why cross-disciplinary thinking—blending psychology, technology, and even mythology—isn’t an academic exercise, but a survival skill. In markets, emergent properties matter: the sum is always greater, weirder, and more potent than its parts. The investor who recognises this, who spots the subtle interaction between government policy, technological inflexion, and human emotion, is the one who picks the true winners.

Consider the rise of generative AI—a convergence of mathematics, computer science, and creative arts—fuelled Microsoft’s ascent. Or the obesity drug revolution at Eli Lilly, where biotech research, regulatory shifts, and societal trends combined to create a new multi-billion dollar market almost overnight. These are not linear stories; they’re emergent phenomena, born at the intersection of extremes.

This is the future: edge-case exploration, paradoxical thinking, and visionary synthesis. The market will always be a battlefield of emotion and intellect—those who master both will thrive, while those who cling to the herd will be trampled beneath it.

Conclusion: The Freedom of Contrarian Mastery

To dominate the markets in 2025 and beyond, you must become a contrarian not just in word, but in practice. Study the crowd, understand its fears, then act with bold, disciplined precision when opportunity presents itself. Use volatility as your ally, not your enemy. Sell puts when premiums spike, reinvest intelligently, and always—always—plan for the edge case.

Most will never break free. The cycle of panic and regret is comforting in its familiarity. However, for those willing to embrace the discomfort of uncertainty, to think in terms of vectors and paradoxes, the rewards are staggering: financial independence, intellectual autonomy, and the kind of self-mastery that transcends mere wealth.

The question is not just which are the hot stocks today, but whether you dare to seize them when it matters most. The market is a storm, and only those willing to step into its eye will ever see the sky clear.