HAL Stock Price Today Trend

Updated Aug 2023

Let’s begin by examining the profile of Halliburton.

Halliburton Company offers various services and products to global oil and natural gas companies. The company provides services to enhance production within the Completion and Production segment. This includes services like stimulation, sand control, and cementing services, which involve well bonding and casing. They also offer equipment related to casing.

Additionally, Halliburton offers completion tools that provide solutions and services below the ground. These encompass well-completion products and services, intelligent well completions, systems for liner hangers and sand control, and various service tools. The company extends its services to production solutions, which include coiled tubing, hydraulic workover units, and downhole tools. They also provide pipeline and process services, covering activities like pre-commissioning, commissioning, maintenance, and decommissioning.

Within this segment, Halliburton is involved in supplying chemicals and services for oilfield completion, production, and downstream water and process treatment. They also deal with electrical submersible pumps and offer artificial lift services.

Moving on to the Drilling and Evaluation segment, Halliburton offers drilling fluid systems, performance additives, completion fluids, solids control, specialized testing equipment, and waste management services. This segment also provides drilling systems and services.

Furthermore, Halliburton extends wireline and perforating services, encompassing activities such as open-hole logging, cased-hole services, and slackline operations. Their drill bit offerings and related services include roller cone rock bits, fixed cutter bits, and hole enlargement services. Full Story

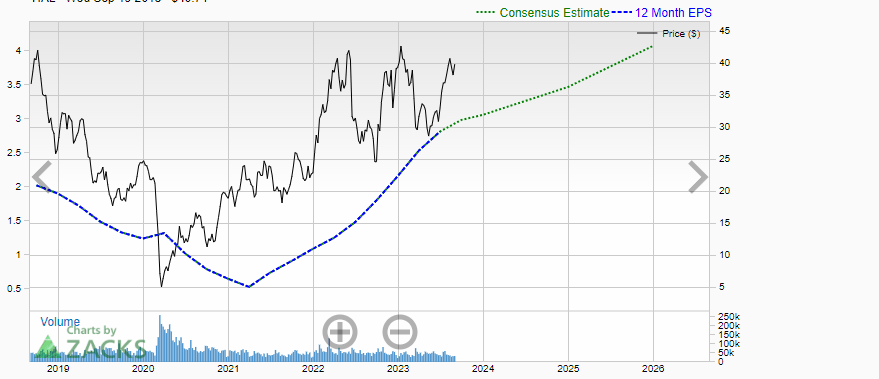

HAL Stock EPS Trend Forecast

Halliburton’s earnings per share (EPS) took a substantial hit during the COVID-19 crisis but has since rebounded on an impressive upward trend. This steadily rising EPS pattern, if sustained, could provide fundamental support for HAL to reach a price level above $55 in the future.

The pandemic’s severe impact on global energy demand caused Halliburton’s EPS to plunge in 2020. However, as the economy recovers, energy markets stabilize, and drilling activity picks back up, HAL has posted consecutive quarters of strong EPS growth.

Barring any disruptions, if Halliburton can continue improving its profitability and EPS at the current trajectory, it would demonstrate strengthening financial performance. This, coupled with potential expansion in oilfield services demand, could justify the stock price to climb towards and above the $55 level based on more robust earnings.

Of course, macroeconomic factors and industry trends need to remain favourable. But Halliburton’s EPS recovery to date shows its resilience and operational efficiency. If management executes effectively, HAL has meaningful upside potential in fundamentals and market value. The path to pre-pandemic EPS levels could propel the stock back towards its prior highs.

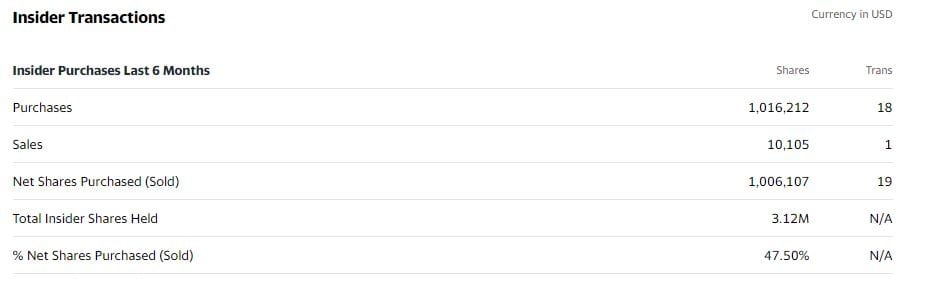

HAL Insider Buying Record

Significant buying activity has recently taken place, with over 1 million shares changing hands across 19 transactions. Typically, such transactions would warrant closer scrutiny. However, the current state of the oil markets is marked by two ongoing conflicts.

Firstly, there’s the substantial drop in demand for oil brought about by the coronavirus pandemic, creating an unprecedented challenge. Secondly, there’s an oil price war unfolding, involving Saudi Arabia, Russia, and the United States.

Given these circumstances, attempting to make investment decisions feels akin to trying to catch a falling dagger — a seemingly futile endeavour fraught with pain and uncertainty. We believe it prudent to exercise patience and wait for the turbulence to subside before considering any substantial moves.

HAL Stock Price Trend Forecast

Halliburton (HAL) has the potential for further upside if it can sustain monthly closes above $39. In that scenario, HAL could test the $48-41 range in the medium term, with a possible overshoot towards $55. However, after reaching those levels, some consolidation is likely over several months as HAL eventually builds momentum to break above $55.

With the stock currently trading in slightly overbought territory, hitting the aforementioned target ranges could push technical indicators into the extremely overbought zone. History shows HAL tends to see profit-taking and steam-releasing price action when this happens. For long-term investors, effective hedging tactics at that stage could include purchasing protective puts, selling covered calls, or a combination of both, using the call premium to offset the put cost.

HAL hitting extended overbought levels for shorter-term traders could present an opportunity to sell and aim to buy back at lower prices after the inevitable pullback. The key is timing the trade based on indicators and being patient for mean reversion before re-entering on the long side.

Other Stories of Interest

Which of the Following Investing Statements is True? Superior Returns

Copleston and Russell: Dialogue of Great Minds

IBM Stock Price Today NYSE: Finesse in Financial Movements

What Is the Velocity of Money Formula?

Investor Sentiment in the Stock Market: Riding the Right Wave

When is the Best Time to Visit Colombia? Uncover the Ideal Season

What Is Price to Sales Ratio in Stocks?: A Gem-Spotting Metric

What is Behavioral Psychology?: Secrets of Human Behavior

What’s a Contrarian?: Out-of-the-Box Thinkers and Action Takers

Mass Hysteria Examples in America: Let the Tales Unfold

Examples of Groupthink: Instances of Collective Decision-Making

What is Oleic Acid Good For: Unveiling Its Health Benefits

The Ultimate Guide to Finding the Best Time to Visit Colombia

Stock Market Crash History: Learn from the Past or Be Doomed

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity