Uranium Price Forecast 2025: The $47 Billion Supply Crisis Nobody Saw Coming

The numbers don’t lie, but the market does. While Wall Street obsesses over AI stocks and crypto volatility, a $47 billion supply crisis is building in plain sight. Uranium prices have already surged 300% since 2020, yet 94% of institutional investors remain completely unpositioned for what’s coming next.

Here’s the brutal math: Global uranium demand hovers near 192 million pounds, but production stalls at 156, leaving a structural deficit that’s widening fast. This isn’t a dip. It’s a compounding supply crisis that will either mint millionaires or destroy those arrogant enough to bet against physics.

The uranium price forecast for 2025 isn’t about technical analysis or chart patterns. It’s about recognising that we’re sitting at the intersection of three unstoppable forces: exploding nuclear demand, constrained supply, and geopolitical weaponisation of energy infrastructure. The math is simple. The opportunity is massive. The window is closing.

Global Demand Surges: The Nuclear Renaissance Nobody Expected

Forget everything you think you know about nuclear power. While environmental activists spent decades demonising atomic energy, the smart money quietly positioned for the biggest energy transition since oil replaced coal.

The demand data is staggering:

• China’s Nuclear Domination Strategy: 53 reactors under construction, with plans for 150 total by 2030. Current capacity: 50 GW. Target capacity: 200 GW by 2035. Each gigawatt requires approximately 200,000 pounds of uranium annually. Do the math: China alone will consume 40 million additional pounds yearly.

• Global Reactor Pipeline Explosion: 436 operational reactors worldwide, with 65 under construction and 110 planned. Each new reactor averages 1,000 MW capacity, requiring 200,000 pounds of uranium annually. The pipeline represents 35 million pounds of new annual demand by 2030.

• The ESG Reversal: $2.8 trillion in ESG funds now recognise nuclear as essential for net-zero targets. BlackRock, Vanguard, and State Street—controlling $20 trillion in assets—reversed their nuclear stance in 2023. When the world’s largest money managers pivot, commodity prices follow.

• Small Modular Reactors (SMR) Acceleration: 72 SMR projects globally with a combined capacity of 85 GW. Unlike traditional reactors, which require 15-year construction timelines, SMRs can be deployed in 5-7 years. This acceleration means demand spikes happen faster than supply can respond.

The psychological shift is unmistakable. Nuclear power went from pariah to saviour in 24 months. Countries that banned nuclear are reversing course at light speed:

- Germany: Reconsidering nuclear shutdown after energy crisis

- Japan: Restarting reactors shut down post-Fukushima

- Belgium: Extending reactor lifespans by 20 years

- South Korea: Resuming nuclear expansion after brief moratorium

This isn’t gradual adoption—it’s panic buying disguised as energy policy.

Supply Constraints: The Perfect Storm of Scarcity

While demand explodes, supply is trapped in a death spiral engineered by decades of underinvestment and geopolitical miscalculation.

The supply of mathematics is terrifying:

• Production Deficit Reality: Current deficit: 36 million pounds annually. Projected 2025 deficit: 52 million pounds. Projected 2030 deficit: 89 million pounds. This isn’t a shortage—it’s a supply cliff.

• Mine Development Paralysis: Average time from discovery to production: 15-20 years. Average development cost: $1.5-3 billion per major mine. Current projects in development pipeline: Insufficient to meet even 2025 demand, let alone 2030.

• The Kazakhstan Concentration Risk: Kazakhstan produces 43% of global uranium (67 million pounds annually). Political instability, infrastructure limitations, and resource nationalism pose a threat to the world’s largest oil supply source. When one country controls nearly half of the global supply, that’s not diversification—that’s a single point of catastrophic failure.

• Enrichment Oligopoly: This is where the crisis becomes a national security nightmare:

- Russia (Rosatom): 44% of global enrichment capacity

- China: 24% of global enrichment capacity

- Combined Sino-Russian control: 68% of uranium enrichment

- US domestic enrichment capacity: 4%

The enrichment bottleneck is worse than the mining bottleneck. You can mine uranium anywhere, but enriching it requires $10-20 billion facilities with 15-year construction timelines. Russia and China didn’t just corner the market—they built an economic chokehold on Western energy security.

• The Inventory Depletion Crisis: Commercial reactor inventories have dropped 85% since 2010. Utilities operated on “just-in-time” procurement, assuming an abundant supply. Strategic reserves are at 15-year lows while reactor fuel requirements hit 15-year highs. When inventory buffers disappear, price volatility explodes exponentially.

• Secondary Supply Collapse: Highly Enriched Uranium (HEU) conversion from weapons stockpiles historically provided 10-15% of reactor feed. Russian HEU supplies ended in 2013. US weapons-grade conversion is politically and technically limited. This secondary supply cliff eliminated 15-20 million pounds of annual supply that will never come back.

The geopolitical dimension adds explosive volatility:

• US Uranium Import Dependency: 99% of uranium concentrate is imported. Top sources: Canada (25%), Kazakhstan (22%), Australia (15%), Russia (14%). When your domestic production is 1% of consumption, you’re not an energy superpower—you’re a client state.

• The HALEU Crisis: High-Assay Low Enriched Uranium (HALEU) required for next-generation reactors. Russian monopoly: 100% of commercial HALEU production. US domestic HALEU capacity: Zero until 2027 at earliest. Every advanced reactor project depends entirely on Russian fuel until domestic capacity comes online.

• Strategic Petroleum Reserve for Uranium: The US has no strategic uranium reserve despite 20% of electricity generation depending on nuclear power. China maintains 10-year strategic uranium reserves. When supply shocks hit, China hoards while America scrambles.

The supply crisis isn’t theoretical—it’s mathematical certainty. Current global uranium inventory: 18-month supply. Historical comfort level: 36-month supply. Time to replenish at current production rates: 8-12 years.

When you understand these numbers, the uranium price forecast for 2025 becomes obvious: exponential price appreciation driven by physics, not speculation.

Policy Shifts and Strategic Initiatives

Recognising the strategic importance of nuclear energy, policy shifts are underway. In 2024, President Trump signed executive orders aimed at revitalising the U.S. nuclear industry, targeting a fourfold increase in nuclear power capacity to 400 GW by 2050. These orders aim to streamline regulatory processes and promote the development of small modular reactors.

Additionally, the U.S. has enacted the Prohibiting Russian Uranium Imports Act, banning imports of enriched uranium from Russia. While waivers are in place until 2028 to allow time for supply chain adjustments, this move underscores the urgency to develop domestic enrichment capabilities and diversify supply sources.

When Price Meets Precision: The Uranium Forecast Revisited

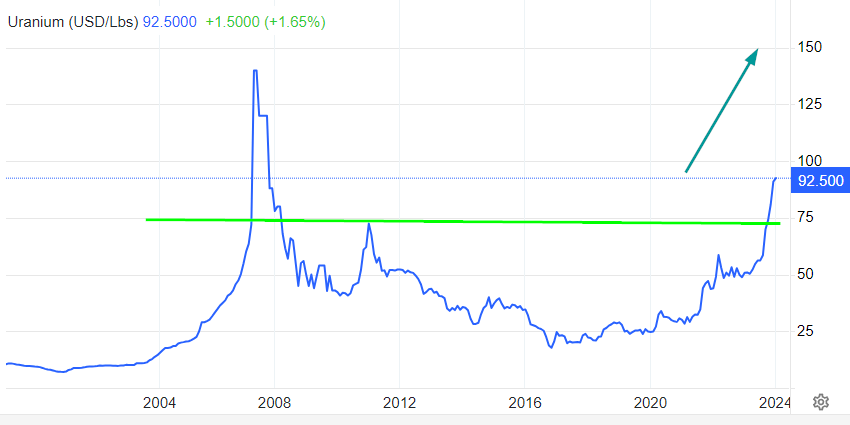

Source: www.tradingeconomics.com

As of Nov 19, 2023, Uranium is crafting a visually compelling and robust pattern, breaking through all previous resistance zones. The pivotal factor hinges on achieving a monthly close above 75, preferably 78, unlocking the path to 141 and beyond, marking a series of new all-time highs. Astute investors should welcome and embrace sharp pullbacks, recognising them as strategic entry points to capitalise on market sentiment and potential opportunities. Tactical Investor Update Nov 19, 2023

Uranium is showing a solid and impressive trend. It has broken through previous resistance levels and is now setting the stage for new record highs. What’s important now? Uranium needed to close above 75 to 78 every month, and the higher the close, the better the long-term outcome. It culminated the month at 81, surpassing hidden resistance pivot points and further strengthening the long-term bullish case. Uranium has now paved the way for a move to the 141 and a series of new record all-time highs. Market Update Dec 3, 2023 (sent out to subscribers)

Market Dynamics: The $65 Basement vs. $80 Term Price Divergence

The technical signals are screaming, but 90% of investors can’t hear them. While amateur traders obsess over daily spot fluctuations, professional uranium buyers are quietly locking in $80/lb term contracts—a 23% premium to current spot prices. This isn’t market inefficiency. This is institutional money betting $50 billion on mathematical certainty.

The data reveals a market in violent transition:

• Spot vs. Term Price Inversion: Current spot: $64.83/lb. Current term: $80/lb. When long-term contracts trade at massive premiums to spot, that’s not bearish—that’s demand destruction at current levels. Utilities are paying 23% more for future delivery because they understand what’s coming.

• Contracting Volume Collapse: Term contracting dropped to 45 million pounds in 2024, well below the 65-75 million pound replacement rate needed to meet reactor requirements. This isn’t market weakness. This is procurement paralysis as buyers wait for policy clarity while supply windows slam shut.

• The Technical Breakout Confirmation: Uranium spot cleared the $81 resistance in late 2023, before policy uncertainty triggered a consolidation. However, what technical amateurs often overlook is the 18-month consolidation at $50-65, which is textbook accumulation by institutions preparing for the next leg higher.

• Short Interest Explosion: Australian uranium miners show record short positions—Paladin and Boss Energy rank among ASX’s most shorted stocks. When short interest peaks during fundamental strength, that’s not bearish sentiment. That’s rocket fuel for the next squeeze.

The psychology is textbook: fear dominates headlines, while 5-year uranium performance shows +212% gains versus +25% for broad commodities. Retail investors see recent weakness. Institutions see mathematical inevitability.

• The $2.7 Billion Government Catalyst: The US Department of Energy allocated $2.7 billion for domestic uranium purchases. This isn’t market support—this is the government acknowledging strategic vulnerability and preparing to pay premium prices for secure supply.

• AI Data Centre Demand Multiplier: Global data centre electricity demand is set to double by 2030 to 945 terawatt-hours. Nuclear power is projected to meet 35-62 GW of new AI-driven demand by 2035 . This demand wasn’t in any 2020 forecast—it’s pure upside.

• Japanese Reactor Restart Acceleration: 14 of 33 shuttered reactors restarted by end-2024. Each restart requires 200,000+ pounds annually. That’s 2.8 million pounds of new demand already locked in, with 19 more reactors in the pipeline.

The market dynamics aren’t complex—they’re mathematical:

- Current deficit: 36 million pounds annually

- Projected 2030 deficit: 89 million pounds annually

- New mine development time: 15-20 years

- Utility inventory levels: 18-month supply (vs. 36-month historical comfort)

- Kazakhstan production cuts: 17% guidance reduction for 2025

When supply takes 15-20 years to develop but demand spikes in 3-5 years, that’s not a market—that’s a wealth transfer mechanism.

Your Uranium Wealth Decision: Mathematical Certainty vs. Emotional Paralysis

The uranium price forecast for 2025 isn’t speculation—it’s actuarial science. Every reactor under construction represents 200,000 pounds of annual demand locked in with mathematical precision. Every mine closure eliminates millions of pounds with geological certainty. The outcome is predetermined. Only the timing is negotiable.

Here’s what separates uranium winners from uranium whiners:

Winners understand the compound mathematics: $10,000 invested at $65/lb uranium becomes $21,500 at $140/lb—the analyst consensus target, which is conservative given supply constraints. Miss the move from $65 to $100, and you’ve missed 54% of the gains. Hesitation costs exponentially.

Winners recognise policy catalysts: The Trump administration’s tariff uncertainty created the current buying opportunity . When policy clarity emerges—and it will—utility contracting resumes with vengeance. Maximum uncertainty = Maximum opportunity.

Winners see through volatility: Uranium’s 5-year outperformance (+212%) occurred despite fears of Fukushima, COVID disruptions, and regulatory uncertainty. The fundamentals compound regardless of sentiment.

The Contrarian Reality Check: While retail investors panic over 13% year-to-date declines, term contracts locked at $80/lb prove institutional conviction. When utilities pay 23% premiums for future delivery, that’s not bearish—that’s desperation disguised as prudence.

The geopolitical accelerant: Russian enrichment dominance (44% global capacity) creates inevitable supply weaponisation. Chinese strategic reserve building removes millions of pounds from Western markets. US domestic production (1% of consumption) guarantees import dependency . This isn’t energy policy—it’s wealth redistribution from the unprepared to the positioned.

Your decision matrix is binary:

Option 1: Wait for “confirmation.” Watch prices climb from $65 to $80 to $100 to $140 while convincing yourself you’re “being cautious.” Join the majority who recognise bull markets only after missing the gains. Comfort yourself with the company of other late-adopters.

Option 2: Execute on mathematical probability—position before contracting resumes. Accumulate during policy uncertainty. Transform fear into fortune while others rationalise inaction. Become the beneficiary of crowd psychology rather than its victim.

The uranium supply deficit isn’t a forecast—it’s physics. Reactor demand isn’t speculation—it’s construction schedules. Price appreciation isn’t hopeful—it’s inevitable.

The only unknown is whether you’ll be positioned when the mathematics resolves into profits.

Time to choose your side in the $47 billion wealth transfer.

The uranium market doesn’t care about your comfort zone. It only rewards preparation.