Feb 1, 2024

In the world of investing, fear can often lead to irrational decisions. However, understanding market fear can present profitable opportunities. This 1800-word article aims to provide a comprehensive overview of market fear, its implications, and how investors can leverage it to their advantage.

Fear is a powerful emotion, and in investing, it can be both a hindrance and an ally. The key is understanding its nature, triggers, and impact on market trends and investor behaviour.

Unfavorable economic indicators, geopolitical tensions, regulatory changes, or disappointing corporate earnings generally trigger fear in the market. It manifests in various forms, such as panic selling, overreaction to negative news, or a herd mentality where investors follow the crowd rather than their judgment.

For instance, the Fear and Greed Index gauges the sentiment of the market. When the index swings towards fear, it typically indicates that investors are overly bearish, which can lead to undervalued stocks. This is where opportunities arise for the discerning investor.

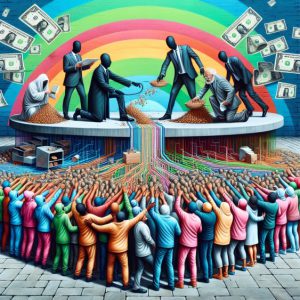

Contrarian investors often capitalize on market fear. They go against the grain, buying when others are selling out of fear. Warren Buffet’s famous adage, “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful,” embodies contrarian investing.

Let’s investigate how understanding market fear can lead to profitable opportunities.

Fear as a Buying Signal

Much like the world’s natural ecosystems, financial markets experience periods of boom and bust, ebb and flow. These fluctuations are a part of their organic nature. Just as the tides recede before a wave, the markets often retract before surging forward. One of the primary drivers of these tidal swings in the market is fear.

Fear is a potent force in financial markets. It can cause investors to react impulsively, leading to stock overselling. This overselling, driven by fear, can push the price of stocks below their actual or intrinsic value. Intrinsic value is a company’s perceived or calculated value, including tangible and intangible factors, using fundamental analysis. When the market price falls below this inherent value, it presents a unique buying opportunity for discerning investors.

One can draw parallels with a marketplace during a heavy downpour. The rain (fear) causes sellers (investors) to lower their prices in a hurry to sell off their goods (stocks), even when the quality (intrinsic value) of the goods remains the same. Shrewd buyers (investors), equipped with umbrellas (knowledge and patience), can then buy these goods (stocks) at bargain prices.

The financial crisis of 2008 offers a prime example of this phenomenon. The crisis instilled a sense of widespread fear among investors, leading to a significant oversell in the market. Stock prices plummeted, and the market was awash with undervalued stocks. However, investors who could see through the veil of fear, recognizing the intrinsic value of fundamentally strong companies, seized this opportunity. They bought these undervalued stocks, holding onto them despite the fear-driven market chaos. When the market recovered, these investors reaped significant rewards, their investments appreciating.

In conclusion, while often viewed negatively, fear can serve as a valuable signal when navigating the financial markets. It can lead to market overselling and undervaluation of stocks, providing astute investors with lucrative buying opportunities. The key lies in understanding and harnessing market fear rather than being overpowered by it.

Fear and Risk Management

In investing, understanding market fear becomes crucial to effective risk management. Markets, like life, are not always calm seas; they often echo the turbulence of a storm. Fear becomes the dominant sentiment during these turbulent times, leading to increased market volatility. While providing profit opportunities, this volatility can also lead to substantial losses if not managed effectively.

A volatile market is like a roller coaster ride, with prices soaring and plunging unpredictably. Fueled by fear, this unpredictability can cause investors to make hasty decisions that could lead to significant financial losses. Thus, understanding and managing fear becomes essential in navigating volatile markets.

Stop-loss orders are one of the most effective ways of managing risk in a fear-driven market. A stop-loss order is a tool that allows investors to limit their potential losses by setting a predetermined level at which their stocks will be sold automatically.

Imagine you’re on a ship in a stormy sea. The stop-loss order is your lifeboat, ready to take you back to shore when the waves get too high. Setting a stop-loss order ensures that even if the market takes an unfavourable turn, your losses are capped at a level you’re comfortable with.

But it’s not just about limiting losses. Effective risk management also involves recognizing when fear drives the market and making informed decisions instead of reacting impulsively. It means staying calm amidst the market storm, assessing the situation rationally, and making strategic decisions.

Understanding market fear is crucial to risk management in investing. A fear-driven market is volatile and can lead to significant losses. However, through effective risk management strategies such as using stop-loss orders and making informed decisions, investors can safely navigate these stormy market seas. The key is not to eliminate fear but to understand it, manage it, and use it as a tool to guide investment decisions.

Fear and Diversification

In the intricate dance of investing, fear often plays a pivotal role in shaping and shifting the market landscape. A market gripped by fear can seem like a daunting place for investors. Yet, within this fearful market, the importance of diversification comes to the fore.

In the context of investing, diversification refers to the strategy of spreading your investments across different asset classes to reduce the risk of significant losses. It resembles the old saying, “Don’t put all your eggs in one basket.” In the face of a fearful market, this strategy becomes particularly valuable.

A fearful market is a stark reminder that no sector is immune to downturns. Whether technology, healthcare, finance, or any other industry, each has its own challenges and risks, and each can fall prey to market volatility.

When fear permeates the market, these risks are amplified, increasing potential losses. However, by diversifying your investment portfolio, you can mitigate these risks. This is because asset classes often perform differently under the same market conditions. While one asset class may plummet, another may be stable or even rising.

For instance, while equity investments may suffer during a market downturn, bonds or other fixed-income securities may offer stability or even positive returns. Similarly, investments in alternative asset classes like commodities or real estate can provide a safety net when traditional asset classes perform poorly.

Diversification, therefore, serves as a kind of insurance against the fear-driven volatility of the market. It provides a safety net, cushioning your investment portfolio against severe downturns in any sector or asset class.

Fear in the market underscores the importance of diversification. By spreading investments across different asset classes, investors can create a resilient portfolio that can weather the storm of a fearful market. While fear may be an inevitable part of the investing landscape, through diversification, it need not dictate the fate of your investments.

Fear and Long-term Perspective

In the world of investing, fear often emerges as a formidable adversary. It can cloud judgment, trigger knee-jerk reactions, and steer investors away from their long-term goals. However, maintaining a long-term perspective can be the key to turning this adversary into an ally.

Having a long-term perspective in investing means focusing on the potential growth of investments over an extended period rather than being swayed by short-term market fluctuations. It is about keeping your eyes on the horizon, even when the seas are rough.

With its accompanying volatility, market fear can make these seas very rough. It can cause prices to plummet and portfolios to shrink seemingly overnight. During these times, an investor’s commitment to their long-term goals is truly tested.

However, it is crucial to remember that market downturns are temporary, no matter how severe. The nature of markets is cyclical, marked by periods of booms and busts. Historically, markets have always recovered post a downturn and not just recovered, they have often reached new highs.

Consider a forest after a wildfire. While the damage may seem devastating, the fire clears the undergrowth and makes way for new growth. Similarly, a market downturn, driven by fear, may seem catastrophic in the short term, but it also paves the way for potential growth opportunities.

For instance, the 2008 financial crisis saw the global markets in turmoil. Fear was rampant, and many investors suffered significant losses. However, those who maintained a long-term perspective and stayed committed to their investment goals saw their patience rewarded when the markets rebounded in the following years.

Market fear can test an investor’s resolve, but maintaining a long-term perspective can help navigate these challenging times. Remember, while fear can cause temporary market downturns, history assures us that these are temporary dips in a long-term upward trajectory. So, keep your eyes on the horizon and your hands steady on the wheel, and let your long-term goals guide you through the storm.

Fear and Emotional Discipline

Understanding market fear requires emotional discipline. Fear often leads to panic selling, but panic selling rarely benefits investors. Emotional discipline involves resisting the urge to sell during market downturns and maintaining a rational perspective.

In conclusion, fear in investing is not something to avoid but to understand and leverage. Investors can turn market fear into profitable opportunities by recognizing fear-driven market trends, implementing risk management strategies, diversifying investments, maintaining a long-term perspective, and practising emotional discipline.

Remember, as an investor, it’s not about avoiding fear but understanding it, managing it, and using it to your advantage. This understanding can open the door to profitable opportunities and help you navigate the tumultuous waters of the investment world with confidence and poise.

Mind-Bending Reads: Thought-Provoking Gems

An Exquisite Approach: How to Buy Gold Without Paying Sales Tax

Extra return generated through market timing strategies is not for risk

How to Buy Gold in Australia: A Captivating Roadmap to Glittering Riches

The Art of Portfolio Agility: Mastering the Tactical Asset Allocation Strategy

Stock Market Forecast for Tomorrow: Ignore Noise, Focus on the Trend

Defying the Crowd: Exploring the Stock Market Fear Index

Crowd Behavior Psychology: Deciphering, Mastery, and Success

Inflation vs Deflation vs Stagflation: Strategies for Triumph

What Is The Best Way For One To Recover After a Financial Disaster?

The Psychology of Investing: Shifting Focus from the Crowd to the Trend

What Development In The Late 1890s May Well Have Prevented Another Financial Disaster?

Mass Psychology of Stocks: Ride the Wave to Win

How Inflation Erodes Debt and Strategies for Smart Investing

Demystifying StochRSI Strategy: Easy Strategies for Winning