Introduction: The Market Storm: Mastering Mass Emotion Before It Devours You

Oct 7, 2025

Mark Twain understood markets better than most investors who spend their lives buried in spreadsheets. He didn’t need Bloomberg terminals, sentiment dashboards, or algorithmic feeds to read the truth. “Whenever you find yourself on the side of the majority,” he warned, “it’s time to pause and reflect.” He wasn’t being witty. He was giving you a blade.

Twain’s Razor cuts through the illusions that drive every market frenzy. It separates those who are swept away from those who quietly profit as the tide turns. Applied well, it turns mass delusion into strategic clarity, hysteria into opportunity, and collective blindness into precise entry and exit points.

The Majority Is Always Late

The crowd doesn’t discover opportunity. It chases it. By the time the herd arrives, the smart money has already set the table and chosen the exits. This isn’t cynicism; it’s structure. Herd behaviour is reactive by design. It waits for confirmation. It moves only when others move. It acts not from insight, but from fear of being left behind.

Look back at the dot-com boom. Valuations dissolved into fever dreams. Taxi drivers traded IPOs at stoplights. Analysts produced hallucinations dressed as forecasts. When the final tremor came, the herd was still dancing at the cliff’s edge, drunk on easy gains. The few who paused, reflected, and acted while laughter still echoed were already gone.

The same psychology ruled 2008. As fear coated every headline, banks begged for oxygen, and liquidity evaporated, the herd sold in blind panic. A small number stepped in—quiet, calculating, unshaken. They didn’t guess the bottom; they read the emotional phase shift. Twain’s Razor is not rebellion for its own sake. It’s the decision to step out when others stampede in, and step in when others scatter.

When the crowd feels safest, risk peaks. When it feels doomed, opportunity whispers.

Mass Emotion Is the Tell

The crowd never whispers. It roars. Its voice is everywhere—social media chatter, analyst consensus, breathless headlines, option volumes, investor forums. This isn’t noise. It’s the heartbeat of collective psychology. Herd conviction always reveals itself before reality collapses it.

Euphoria and despair are the herd’s only languages. Both are loud. Both are predictable. Both create asymmetric opportunities for those who can read the emotional landscape instead of being consumed by it.

When everyone is telling the same story, fragility is at its maximum. One unexpected tremor and the chorus turns to screams. Twain’s Razor works because mass conviction is both a signal and a weakness.

Strike Timing Is Everything

Suvorov didn’t fight fair. He struck where the enemy’s mass became liability. Markets work the same way. When the herd gathers tightly—whether in euphoric rallies or panicked sell-offs—it leaves its flank wide open. You don’t need omniscience. You need clarity, discipline, and the nerve to act before the herd pivots.

This is why applying Twain’s Razor isn’t about bravado. It’s about psychological positioning. Rebels don’t wait for ringing bells. They listen for cracks in the chorus. When cheers hit a pitch too perfect, when dissent evaporates, when caution is mocked—that’s the time to sharpen the blade.

Likewise, when despair drowns the airwaves, when silence follows panic, when the herd retreats to the safety of its own echo chamber—that’s the moment to advance.

The crowd gives away its timing if you know how to listen.

The Illusion of Safety Is the Real Trap

Crowds cling to safety like shipwrecked sailors to floating debris, believing that proximity to others guarantees survival. But in markets, safety doesn’t live inside the majority. It lives on the edges—either early in their delusion, before the mania metastasizes, or first out, before the collapse begins.

Most investors mistake collective comfort for security. They enter positions only after seeing everyone else celebrate. They interpret rising prices as validation, headlines as certainty, and other people’s conviction as proof. But when everyone believes the same story, fragility peaks, because there’s no one left to buy higher.

The cycle is brutally predictable. Investors pile in late, convinced the “trend is strong,” just as smart money begins unloading. When the inevitable shock comes, the crowd hangs on, waiting for reassurance. By the time fear breaks through their denial, exits are jammed. They buy at peaks dressed as stability and sell at troughs dressed as collapse, calling it bad luck, bad timing, or black swans. It’s none of those things. It’s obedience to mass emotion masquerading as prudence.

History repeats this trick endlessly. In 2007, U.S. homebuyers poured in at the very top, lulled by analysts, television hosts, and neighbors insisting real estate “never goes down.” They bought into the illusion of permanence. When the tremor hit, they weren’t just financially trapped; they were psychologically paralyzed.

In 2021, retail investors piled into meme stocks after the frenzy hit mainstream television. The real money had already been made by those who struck during the whisper phase. The latecomers interpreted the roar of the crowd as a safety net. It was a trapdoor.

This is why Twain’s Razor matters. It is the scalpel that cuts obedience out of your decision-making. It reminds you that safety doesn’t lie in joining the crowd, but in understanding when their conviction is the most dangerous signal of all. When comfort feels absolute, risk is highest.

The crowd mistakes comfort for safety. The contrarian sees comfort as the setup.

Harnessing Mass Emotion with Twain’s Razor

Today’s cycles spin faster. Algorithms, retail platforms, and social media have compressed time, turning what once unfolded over months into days or hours. Meme stocks erupt overnight, collapse by the weekend. Crypto frenzies ignite in a whisper and implode before most understand what happened. News doesn’t spread; it detonates.

Yet beneath the acceleration, the structure remains stubbornly human: whisper → imitation → frenzy → collapse. The tools have evolved. Human instinct hasn’t. Emotional contagion remains the engine. The herd still arrives late, still mistakes noise for signal, still hands over liquidity at the worst possible moment. Twain’s Razor still slices clean through the fog—it’s just that the window to act is narrower.

Consider GameStop in early 2021. The whisper phase was months earlier, on obscure message boards. The imitation phase began as small traders copied each other’s buys. By the time CNBC blared the story, the frenzy was in full roar. Those entering then weren’t early—they were liquidity for the exits. When the collapse came, they weren’t unlucky. They were late.

Crypto followed the same rhythm in 2017 and again in 2021. Early adopters whispered. Speculators imitated. Institutions feasted on the frenzy. Retail investors, drawn by headlines and collective FOMO, arrived to buy the top and sell the crash.

This is where Twain’s Razor turns from concept to weapon. When you feel that gravitational pull—the euphoric swell, the panic stampede—pause. Reflect. Ask three surgical questions:

• Who arrived first? If it’s not you, you’re already behind the emotional curve.

• Who is setting the narrative? Narratives crafted by those who got in early are usually exit signals, not invitations.

• Who will slip out the side door when the frenzy peaks? Follow them, not the noise.

If your answers place you in the thick of the stampede, step back. Clarity lives outside the mob. That distance is where Twain’s Razor cuts cleanest. It allows you to see the emotional phase shift not as a blur but as a structure: predictable, exploitable, deadly for the inattentive.

Mass emotion moves markets. Twain’s Razor lets you decide whether you surf the wave or drown beneath it.

Conclusion: The Blade Is in Your Hands

Twain’s Razor isn’t a slogan. It’s a weapon forged from human nature itself. The majority waits for confirmation. By then, they’ve become the confirmation. They provide liquidity for the exits. They are the soft underbelly of every turning point.

The few who use Twain’s Razor don’t always get it right. But they are never late. They act when emotion crests, not when consensus nods. They step in when silence falls, not when analysts catch up.

This is the quiet power of contrarian timing. It’s not loud. It’s not romantic. It’s not rebellion for applause. It’s precision in a storm.

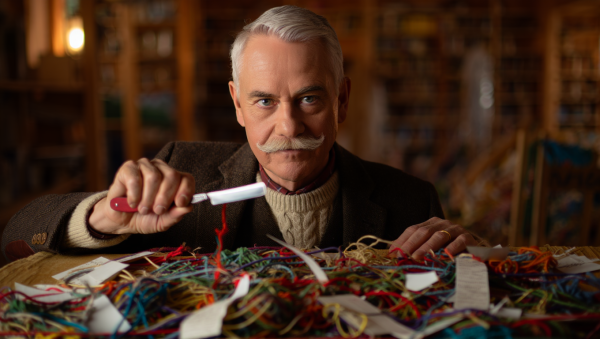

The market will always have crowds. The crowds will always stampede. But you don’t have to be inside it. You can stand on the ridge, watching their rhythm, blade in hand, moving clean while they crash against each other in panic.

The herd gives you the map. Twain gives you the knife. Your job is to use it.