Market Trading Range: Great For Short Term Gains

Updated May 2023

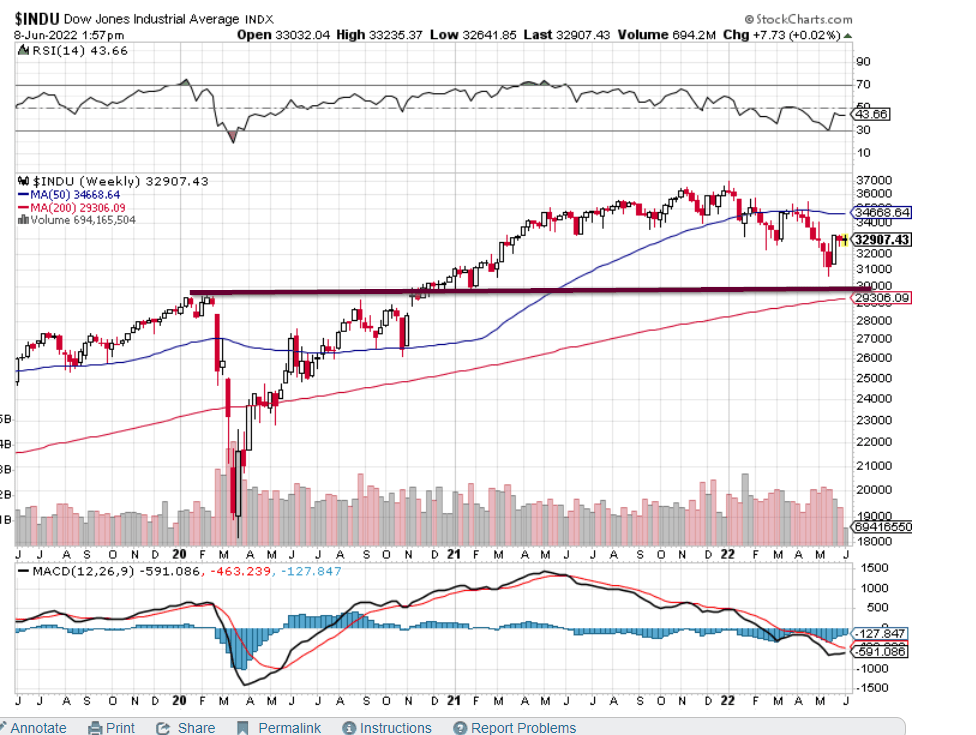

The markets will be stuck in a trading range until the short-term trend reverses. A solid zone of support for the Dow falls in the 29100 to 29,550 range. To indicate the correction is over, the Dow would have to close above 34,800 on a monthly basis. For the SPX, there is a strong layer of support in the 3600 to 3800 ranges. While the NDX and Russell 2000 tested support and bounced higher, the Dow and the SPX don’t have to take the same path. The indices could diverge over the short-term timelines, but eventually, both the Dow and the SPX are likely to test these levels.

Remember, the more volatile and nerve-racking the current action, the better the opportunity. The rally phase will last at least 2X longer, but we suspect, at a minimum, it will last 3X longer, and the intensity will triple that of the downward phase. The actual rally phase count starts only after a long-term bottom is in; if it holds, the current bottom will fall under the intermediate category.

A final selling wave will set the bedrock for the next massive rally. Investors don’t understand that the best time to buy is when everything looks bleak; instead, they wait for things to look bright before jumping in and feel very grim when the bottom falls out.

Conclusion

A blistering 3-day rally will probably mark the end of the second version of shock and awe. Market Update May 11, 2022

If the above comes to pass, it will be the best signal that a bottom is in place and that the markets are ready to blast out of their trading range. While the markets have rallied for three days (25th to 27th of May), Wednesday’s move was mediocre. It is acceptable but not perfect—ideally, the Dow tacks on 120 plus points (per day) for three days in a row.

The equation must balance, and a more decisive upward move will always follow a substantial correction. Market Update May 11, 2022

The equation always balances; human heads lack balancing, for they want everything to work out ASAP. The markets don’t give a damn about our wishes and desires, and the result is not a pretty sight to those who attempt to defy them. This correction will resolve, as it has since the day we got off the Gold Standard. There is no other direction but upwards over the long run; the long term does not imply years and years; in today’s world, it generally means less than 12 months.

Trading Range Game Plan?

The game plan is always the same; politicians and central bankers have to find a way to help their real masters. These big chaps only favour one thing; lots of money.

Remember these quotes from the May 11, 2022, update; they will serve you well in times of volatility.

The same playbook has been used since the inception of the markets. The masses never learn as their reasoning is always the same “it’s different this time“. The crowd lives in a never-ending loop of plutos allegory of the cave.

They will never stop using this narrative, for it never fails to produce the desired result. Quality shares are being given away, and the big players are only too happy to grab them.

While the markets are stuck in a trading range, they appear to be building momentum to mount a rally that could last until the 1st quarter of 2023. After that, we expect the markets to experience a relatively robust correction.

Market Trading Range Update

The current market conditions may seem daunting to some, with the stock market stuck in a trading range. But fear not, for opportunities can be had even in such circumstances.

One approach is to utilize range-bound strategies, which involve buying stocks at the lower end of the trading range and selling them at the upper end. This can be profitable, especially if one is patient and willing to wait for the right opportunity.

Another strategy is to focus on high-quality, dividend-paying stocks. These types of stocks tend to perform well in volatile markets and can provide investors a steady income stream.

Furthermore, it’s essential to keep an eye on crucial support levels, such as the solid zone of support for the Dow in the 29100 to 29,550 range and the strong layer of support for the SPX in the 3600 to 3800 range. If these levels hold, it could signal a potential buying opportunity.

It’s also crucial to remain patient and disciplined during these times of volatility. Remember, the best time to buy is often when things look bleak, and the worst is when things look bright.

Ultimately, the key to success in the stock market is to stay focused on the long term and not be swayed by short-term fluctuations. If one can maintain this mindset and utilize sound investment strategies, opportunities can be had even amid a trading range.

As for the current market outlook, a rally could be building momentum and may last until the 1st quarter of 2023. However, it’s important to remain vigilant and prepared for a potential correction afterwards.

Expand Your Perspective: Dive In

Fiat Money Example: The Dollar Shines as a Prime Illustration

What is a Bull and Bear Market – A Comprehensive Explanation

Corn-Eating Hamster Cannibals: Unveiling the Mystery

Stock Market History: Unveiling the Secrets of Market Crashes

Geopolitical Events and Currency Markets: A Compelling Connection?

Trading Psychology: The Trend Is Your Friend

Demystifying the Price to Sales Ratio: A Comprehensive Guide

Navigating Prosperity: Stock Market Trends 2020 Unveiled

Unlocking Growth Investing: Accelerate Your Wealth Potential

A Deeper Look into Currency Debasement

Navigating the Stock Market Bottom: Profitable Investing Strategies

Middle East Oil Wars: Saudi Arabia’s Decline and China’s Rise

Investment strategies for Beginners: Follow The Trend

Crude Oil Exploration

Why is Petroleum a Fossil Fuel?

Mass Psychology & Financial Success: An Overlooked Connection