Stock Price Of MSFT Trends

Updated Oct 2023

Microsoft’s focus on cloud services has paid off for investors in a big way. The tech giant’s stock price (Nasdaq: MSFT) reached over $300 per share in late 2022, doubling from pre-pandemic levels, as its Azure cloud platform continues to gain ground.

Azure is now the second largest cloud infrastructure business behind Amazon Web Services but is growing faster. In its latest fiscal year ending in June 2022, Azure revenue grew by 35% to surpass $25 billion. Thanks to Azure and other cloud-related offerings like Office 365, server products and cloud services accounted for over 50% of Microsoft’s quarterly sales for the first time in Q4 2022.

This cloud computing momentum has transformed Microsoft from a legacy software provider into a cloud juggernaut. It is now one of only two U.S. companies worth over $2 trillion by market cap, alongside Apple. In December 2022, MSFT reached over $325 per share intraday – an all-time high propelled by another quarter that beat Wall Street expectations.

Looking ahead, analysts see even more potential for growth as businesses and consumers continue migrating workloads and data to the cloud. Microsoft remains well-positioned with a diverse portfolio that includes cloud infrastructure, security, data analytics, and business applications. As long as it continues innovating and gaining Azure market share over rivals like Amazon and Google, the stock price of MSFT has room to climb higher in 2023 and beyond. morningstar

Microsoft’s focus on cloud computing has transformed the company from a software provider into a leading force in this dominant sector. Microsoft is well-positioned for further growth in 2023 and beyond through intelligent investments and strategic acquisitions.

The Power of Azure

Azure is Microsoft’s flagship cloud platform, which continues gaining ground on market leader AWS. In Q1 2023, Azure revenue grew 35% year-over-year as more businesses utilize its infrastructure, database, analytics and artificial intelligence services. Azure is growing faster than the overall cloud market, demonstrating its strength.

Beyond Infrastructure

Microsoft offers a unique portfolio that combines cloud infrastructure via Azure with business productivity tools. Popular apps like Office 365 and Dynamics 365 provide recurring revenue streams, while the GitHub acquisition boosts developer productivity in the cloud era.

New Horizons

AI and mixed reality technologies represent significant growth opportunities. Microsoft is well underway developing solutions leveraging Azure AI, as well as hardware like HoloLens. As hybrid work/learning trends take hold, these tools promise new avenues of enterprise spending.

Investing in the Future

With a massive cash pile and ongoing profits, Microsoft continues acquiring complementary products. Recent buys like Activision Blizzard position it at the forefront of the gaming industry’s pivot to interactive media and streaming.

All evidence suggests Microsoft’s determined focus on cloud services and next-gen technologies has revitalized the business. As digital transformation accelerates globally, MS stock stands poised to keep gaining well into 2023 and beyond. money.cnn.com

MSFT EPS Earnings Projections

Microsoft’s EPS is in a strong uptrend. Hence, logic dictates that the Astute investor will view sharp pullbacks and or crashes through a bullish lens. In other words, look at the long-term trend: the stock is trending upwards, EPS is rising, and insiders are not dumping the stock.

All in all, this indicates that MSFT will go on to put a series of new highs much faster than many of its peers. On a relative strength basis, it is far more potent than AMZN, GOOGL, or INTC, all of which make great long-term investments.

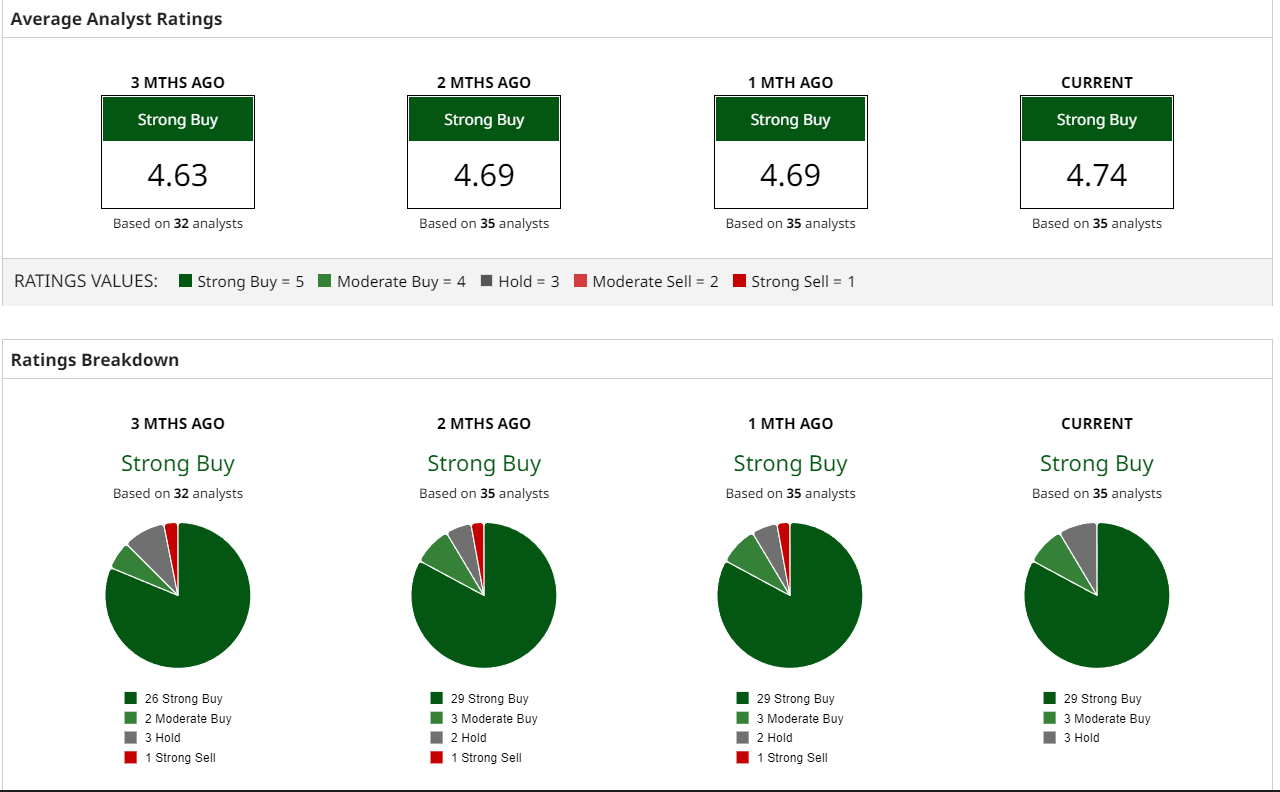

Market Insights on MSFT: Analyst Perspectives

source: barchart.com

Analysts generally hold a favourable view of MSFT, although we cautiously approach their advice. Typically, they strongly recommend a stock after it has experienced significant gains, which seems to be the case with MSFT. On weekly charts, the stock is trading in an overbought zone. However, the long-term outlook for the company appears promising, so savvy investors may consider utilizing pullbacks to enhance their positions.

Analysts often lag in issuing sell warnings and consistently make buy recommendations late. Therefore, focusing on the overall trend is advisable, which currently suggests that all substantial price pullbacks should be viewed as opportunities.”

Stock Price of MSFT: Current Analysis

MSFT is currently trading in the oversold range on the monthly charts, suggesting a substantial pullback may be imminent. While it’s not as highly oversold as it was in January 2023, there is still room for it to reach new highs before experiencing a downturn. A pullback from $290 to $300 presents an attractive opportunity to add to one’s position. An even more favourable entry point would be around $270.

Taking a longer-term perspective, if MSFT can achieve a monthly close at or above $366, it could potentially test the range of $405 to $420, with the possibility of surpassing $445.00

Microsoft (MSFT): Riding High in a Turbulent Market

The stock price of tech giant Microsoft (MSFT) has proven resilient in these uncertain times, currently trading around $319.00 per share as of late October 2023. While many watched their portfolios shrink during the 2022 bear market, MSFT shareholders experienced smoother sailing, thanks to the company’s robust fundamentals and diversified business model, and they are now reaping substantial gains.

MSFT maintains its dominance in enterprise software with popular solutions like Microsoft 365, Azure cloud services, and the Windows operating system. The pandemic accelerated the digital transformation of work and daily life, increasing demand for Microsoft’s productivity and collaboration tools as more activities shifted online. The latest quarterly earnings report showed an impressive 20% year-over-year growth for Azure, driven by increased cloud adoption.

Beyond software, Microsoft enjoys steady revenues from its Xbox gaming segment. The launch of the latest Xbox Series consoles in late 2020 coincided with more consumers seeking at-home entertainment during lockdowns and social distancing restrictions. Game pass subscriptions, Netflix-style access to games, gained widespread popularity and now boast tens of millions of users.

Through constant innovation and expansion into adjacent industries, Microsoft provides multiple avenues for consistent earnings. The stability of its stock price reflects investor confidence that MSFT can navigate economic challenges, thanks to diverse revenue streams and a massive customer base committed to the platform. For those seeking a reliable tech investment during market turbulence, MSFT shares may be a prudent choice. With the new year underway, will MSFT maintain its tradition of resilience for shareholders? Stay tuned for further updates on this tech powerhouse.

Conclusion

In conclusion, Microsoft’s focus on cloud services, particularly its Azure platform, has propelled its stock price (Nasdaq: MSFT) to impressive heights, reaching over $300 per share by late 2022. The company’s transformation from a legacy software provider to a cloud giant is evident, with Azure revenue growing by 35% to surpass $25 billion in the latest fiscal year. Cloud-related offerings now account for over 50% of Microsoft’s quarterly sales. This momentum has solidified Microsoft’s position as one of the few U.S. companies with a market cap exceeding $2 trillion, alongside Apple.

Microsoft is well-positioned for further growth, with a diverse portfolio encompassing cloud infrastructure, productivity tools, AI, mixed reality technologies, and strategic acquisitions. As businesses and consumers continue to embrace cloud computing, Microsoft’s stock price (MSFT) has the potential to climb higher in 2023 and beyond.

This content was originally published on April 20, 2017, but it has been continuously updated over the years, with the latest update conducted in October 2023.