The Illusion of Investment Gurus: Navigating the Volatile Market

Updated Dec 2023

We’re looking at this topic from a historical perspective. Learning from history helps avoid mistakes and losses. It also shares our actions during the significant COVID crash of 2020.

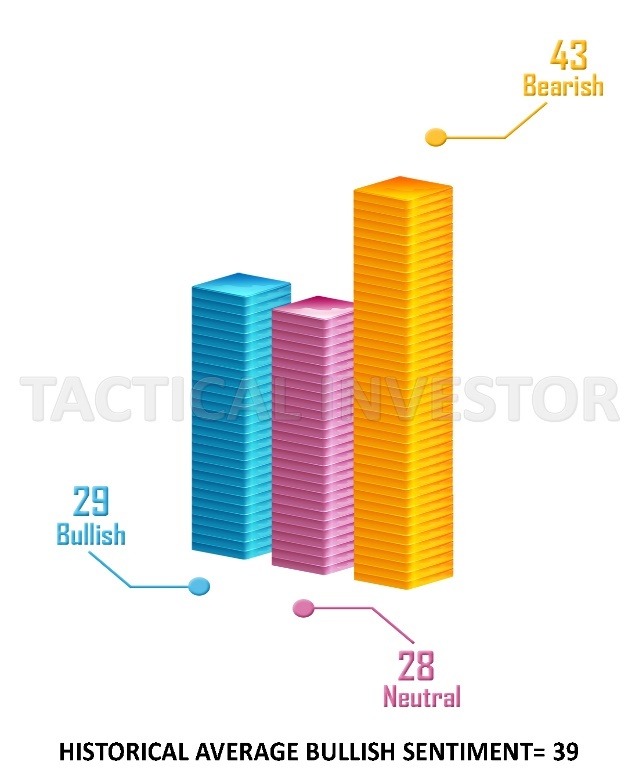

It is quite interesting to note that despite the Nasdaq putting in a series of new highs, bullish sentiment refuses to trade above its historical average. Even more puzzling/intriguing is the refusal of the gauge in the anxiety index to move out of the newly created madness zone. Note that this zone was created less than 12 months ago. One would expect the gauge to have at least moved to the hysteria zone by now.

These two developments alone (and we have mentioned other factors in past issues) seem to cement the argument that the Nasdaq is destined to soar to unimaginable heights. Let’s Party Like It 1999 will eventually become the theme song for this incredibly insane bull market. Everyone remembers what happened in 1999. In case you forgot, the Nasdaq ended the year up 85.6%. However, the current bull market will make the stock market bull of 1999 seem tame in comparison as, on a conservative level, there is 100X more (hot money) chasing stocks, not to mention the enormous amounts of liquidity the Fed keeps injecting into this market.

Unlocking the Breakout: Bullish Sentiment Below Historical Average

Bearish sentiment pulled back a bit, but it continues to outpace bullish sentiment, which has been going on for weeks. At this point in the game, bullish sentiment should be trading in the 45 to 50 range, bearish sentiment should be in the 25 to 30 range, and neutral sentiment should be roughly the 20 to 25 range. Bullish sentiment is now trading below its historical average for 24 weeks in a row. Market Update Aug 21, 2020

Looking at the current setup and the mass mindset, we suspect that we might have to start exploring the unimaginable. What might that be? The Nasdaq could surpass the Dow before this bubble pops. In other words, the Nasdaq could catch up and exceed the Dow numerically—for example, Dow 40K and Nasdaq 42K.

The “market of disorder” is going to drive everyone insane; by everyone, we refer to those who refuse to accept that the old way of doing things (90% of players) is dead. We are warning all our subscribers early on in the cycle, the cycle of insanity has just begun, so be prepared for things you would have once deemed unimaginable to come to pass. Market Update August 11, 2020

The Dangers of Investment Gurus: Separating Reality from Snake Oil

Clueless’ investors keep driving this ‘stupidly bullish’ stock market higher, CNBC’s Jim Cramer says

The “Mad Money” host says, ‘Never underestimate the power of enthusiastic buyers who do not know what they’re doing.” https://yhoo.it/3gaVfPb

Cramer is one to talk, he is a jackass masquerading as an Investment guru, but I digress. This market seems to be taking its toll on some of these so-called experts, as evidenced by the story above. Before this bull market ends, many experts must close shop or look for new careers.

The next trend in its infancy is the death of the financial guru, as most of the gurus in this sector are nothing but snake oil salesmen. Forget the Investment guru and instead focus on the market sentiment, for when the masses panic, it’s the best time to buy and vice versa.

On the weekly charts, the Nasdaq is now trading in the overbought ranges, but the MACDs would need to hit the 90 ranges, and the RSI would need to trade north of 78 before hitting the extreme/insanely overbought zones. In theory, these indicators could change higher before consolidating. Given that the bearish sentiment is so high, it is difficult to determine whether the pullback will be mild or wild. The monthly charts have a long way to go before they trade into the extremely overbought ranges, and bullish sentiment continues to sell well below its historical average.

Therefore, until the trend changes, no matter how sharply the market pulls back, if you are a Tactical Investor, you have only one option: embrace every pullback regardless of intensity, like a lost love. While the current move might appear to be stupendous, you have not seen anything yet. The word stupendous will have a new meaning before this bull bites the dust. Market Update Aug 21, 2020

Stimulating Articles That Encourage Reflection

Sentiment Investing: Mass Psychology Holds the Key