TGB Stock Forecast: Time to Buy or Wait?

June 30, 2024

Introduction:

Taseko Mines Limited (TGB), a stalwart in the Canadian mining industry, has established a formidable presence in the dynamic copper sector. The company’s strategic positioning and innovative projects like the Gibraltar Mine and the Florence Copper Project underscore its robust operational framework and commitment to sustainable mining practices. With the global demand for copper driven by electric vehicles and renewable energy sectors, TGB is poised to capitalize on these trends. However, the copper market’s inherent volatility, shaped by fluctuating supply and demand dynamics and geopolitical influences, presents challenges and opportunities for TGB.

Copper: The Red Metal Powering the Green Revolution

Copper’s significance in the global economy is surging, driven by its crucial role in clean energy and electric vehicle (EV) technologies. The International Energy Agency (IEA) projects copper demand to double by 2040, with renewable energy sectors alone requiring 3 million tonnes annually, up from 1 million in 2020.

The EV industry is a major catalyst for copper consumption. Bloomberg New Energy Finance forecasts over 500 million EVs on roads by 2040, a staggering increase from 7 million in 2020. Each EV demands four times more copper than traditional vehicles, intensifying market pressure.

However, supply challenges loom. Strikes, like the 2017 Escondida mine incident in Chile, can significantly disrupt production. Environmental regulations and community opposition often hinder new mining projects. The capital-intensive nature of copper mining, requiring years of development and billions in investment, further complicates supply expansion.

Recent data from the International Copper Study Group (ICSG) shows a tight market. In 2023, the global refined copper market had a deficit of about 27,000 tonnes, highlighting the delicate balance between supply and demand.

Despite these hurdles, copper’s long-term outlook remains robust. The metal’s integral role in green technologies positions it as a critical resource in the global transition to sustainable energy, promising sustained demand and potential price strength in the coming decades.

TGB Price Targets: From Underperformer to Potential High-Roller

In the copper sector, TGB stands out as one of the underperformers, currently falling under the category of a “dog.” However, every dog eventually has its day in the sun. Despite positive earnings and future prospects, it struggled to close at or above 1.50 on a weekly basis – a milestone it recently achieved. A more significant development would be a close at 1.55 or better. TGB’s price action could serve as an early signal for copper. If TGB manages to surge to 1.80, it would be a very bullish long-term development. Market update February 19, 2024

TGB has surged past 1.80, signalling two significant long-term trends. First, the developed world will be scrambling for copper, caught off guard and will pay a heavy price for their oversight. Second, the developing world, backed by Russia and China, will weaponize copper, eventually shipping only the finished product rather than the ore.

On a side note, France will likely be ousted from New Caledonia sooner rather than later, mirroring a global trend where Western-installed corrupt regimes are overthrown, cutting off access to cheap resources.

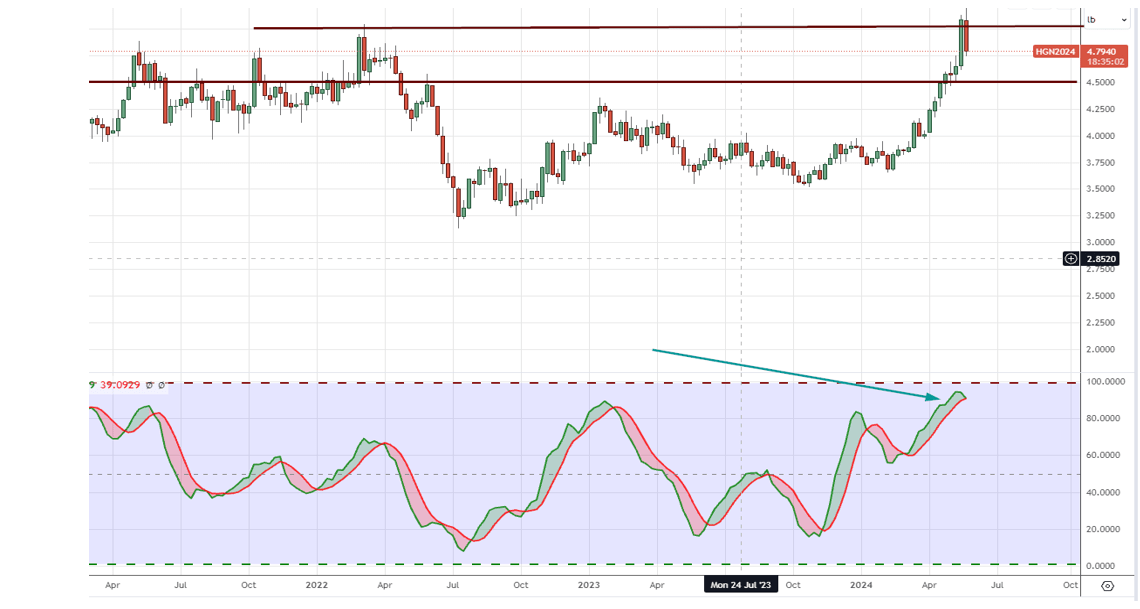

TGB is still projected to trade to and beyond 7.50 eventually. Surprisingly, despite its strong run-up, copper still trades in the neutral zone on the monthly charts, indicating significant upside potential. At this stage, patience is required as the technical indicators need to pull back into the oversold zone.

Copper is currently trading in the highly overbought range on the weekly charts. While a strong pullback isn’t necessary, a sharp one would be welcomed. The critical factor is for copper to reach an oversold state. Once this occurs, we will aggressively open positions in 3-4 copper companies.

Strategic Operations and Innovation at Taseko Mines:

Taseko Mines, a prominent Canadian mining company, has demonstrated its commitment to strategic operations and innovation through its portfolio of projects. The company’s flagship operation, the Gibraltar Mine, is one of Canada’s largest copper mines, showcasing Taseko’s ability to successfully operate a large-scale mining project.

However, it is the Florence Copper Project that truly highlights Taseko’s innovative approach to mining. This project employs an in-situ copper recovery (ISCR) technique, which involves dissolving copper in place and then pumping the solution to the surface for processing. This method has several advantages over traditional mining techniques, including:

1. Lower environmental impact: ISCR minimizes surface disturbance, as it does not require large open pits or extensive waste rock storage facilities.

2. Lower capital costs: ISCR requires significantly less upfront capital than traditional mining methods, eliminating the need for expensive infrastructure such as concentrators and tailings facilities.

3. Faster permitting and development: Due to its lower environmental impact, ISCR projects often face fewer regulatory hurdles and can be brought into production more quickly.

The Florence Copper Project is expected to produce an average of 85 million pounds of copper annually over its 20-year mine life, with a total production of approximately 1.7 billion pounds. This project demonstrates Taseko’s ability to innovate and secure the company’s long-term copper supply.

In addition to its operating and development projects, Taseko continues to explore and expand its resource base. The company’s ongoing exploration efforts aim to identify new copper deposits and extend the life of its existing operations, further strengthening its position in the copper market.

Taseko’s strategic operations and innovative approach to mining position the company well to navigate the challenges of the copper industry and capitalize on the growing demand for this essential metal. Taseko is ensuring its long-term success in the competitive copper market by focusing on efficient, environmentally responsible mining techniques and continually expanding its resource base.

Investment Perspectives on TGB:

From an investment viewpoint, Taseko Mines presents a compelling case. The contrarian perspective suggests that TGB’s current market valuation does not fully reflect its long-term growth potential, primarily due to its strategic projects and operational efficiencies. Furthermore, mass psychological trends indicate that periods of market pessimism, often driven by short-term supply gluts or economic downturns, could present lucrative investment opportunities for those looking at the bigger picture.

It managed to close above $1.55 on a weekly and monthly basis and then rally as expected. It makes sense to wait for it to consolidate at this stage before considering entry. Ideally, a drop to the $1.80 to $1.90 range would present a good opportunity. Overall, we anticipate TGB trading well past $5.50 in the months ahead. Strong pullbacks should be embraced, and if copper shortages persist as projected, TGB could be trading north of $7.20 before reaching a long-term peak.

Long-term Investment Potential:

The long-term outlook for copper remains positive, with the International Copper Study Group (ICSG) predicting a global copper deficit of 100,000 tonnes in 2023 and 270,000 tonnes in 2024. This anticipated shortfall is driven by the robust demand for copper in emerging technologies and infrastructure projects, particularly in the renewable energy and electric vehicle sectors.

According to a report by Wood Mackenzie, the global demand for copper is expected to reach 43 million tonnes by 2035, a 53% increase from the 28 million tonnes consumed in 2020. This surge in demand is primarily attributed to the accelerating transition towards a low-carbon economy, which heavily relies on copper for its conductive properties and durability.

On the supply side, copper production faces challenges due to declining ore grades, delays in project development, and increasing environmental and social pressures. The average grade of copper ore mined has fallen from 1.6% in 1990 to around 0.6% today, leading to higher production costs and lower output. Moreover, the development of new copper mines often faces significant obstacles, such as lengthy permitting processes and community opposition.

This combination of growing demand and constrained supply positions companies like Taseko Mines (TGB) advantageously as long-term investments. Taseko’s Gibraltar Mine, one of Canada’s largest copper mines, provides a stable production base. At the same time, its Florence Copper Project offers significant growth potential with its innovative in-situ copper recovery technology.

Furthermore, Taseko’s proactive approach to expanding its resource base through ongoing exploration efforts and strategic acquisitions strengthens its position in the copper market. The company’s experienced management team and strong balance sheet provide a solid foundation for long-term growth and value creation.

Conclusion:

In conclusion, Taseko Mines Limited (TGB) is strategically positioned to benefit from the burgeoning demand for copper, driven by global shifts towards sustainable technologies and infrastructures. Despite the challenges posed by the volatile nature of the copper market, TGB’s commitment to innovation, environmental stewardship, and strategic growth renders it a promising investment. Investors looking for exposure to a critical industrial commodity with a solid foundation in operational excellence and strategic foresight may find TGB an attractive option. As the global landscape evolves, particularly regarding renewable energy and technological advancements, TGB’s forward-looking initiatives will likely drive its success in the upcoming years, potentially making its stock a valuable component of a diversified investment portfolio.

Investors considering a long-term investment in Taseko Mines should be aware of the risks associated with the mining industry, such as commodity price volatility, geopolitical risks, and environmental and social challenges. However, the company’s diversified portfolio, innovative technologies, and strong financial position help mitigate these risks and position it well for long-term success in the copper market.

Unconventional Wonders: Worth the Journey

The Inflationary Beast: Understanding What Inflation is and What Causes It