Tactical Investor VIP Subscription Benefits

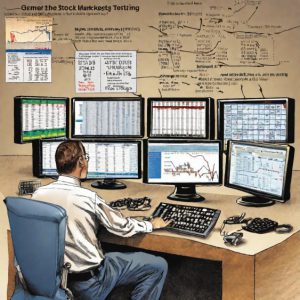

If you’re looking for an investment approach with a proven track record of success, then a VIP subscription to The Tactical Investor is something to consider. By subscribing to this service, you’ll have access to a team of experienced analysts who use the Tactical Investing methodology to identify trends and pinpoint crucial turning points in the market.

One of the benefits of the Tactical Investing approach is that it considers the emotional drivers behind market movements. This means that you’ll be able to make informed investment decisions more likely to yield positive results. Additionally, technical analysis can help you fine-tune your entry points and get into a given investment at the most favourable price.

Another advantage of subscribing to The Tactical Investor is that you can access various tools and resources to help you make informed investment decisions. These include trend analysis, charting tools, and market insights. With these resources, you can stay on top of market trends and make strategic decisions more likely to yield positive results.

The Success Rate

The success rate of the Tactical Investing methodology is also worth considering. The fact that over 80% of the plays issued have trended higher is a testament to the effectiveness of this approach. By subscribing to The Tactical Investor, you can tap into this success and potentially see positive investment returns.

In conclusion, if you’re looking for an investment approach that combines the principles of mass psychology and technical analysis, then a VIP subscription to The Tactical Investor is something to consider. By subscribing to this service, you can access various resources and tools to help you make informed, strategic investment decisions. Additionally, the success rate of the Tactical Investing methodology is impressive, which suggests that this approach has the potential to yield positive results for investors.

Other reads

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Contrarian Investing: The Art of Defying the Masses

Stock Market Psychology Chart: Mastering Market Emotions

Unveiling the 1929 Crash Chart: Decoding Market Turbulence

Murphy’s Law and the Stock Market Fear Index: A Cautionary Tale

The Yen ETF: A Screaming Buy for Long-Term Investors

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Best Chinese Stocks: Buy, Hold Or Fold

Contrarian King: Investing Beyond Fad Trends

Uranium Price Chart: Unveiling a Thrilling Long-Term Opportunity

Embracing Contrarian Meaning: The Magic of Alternative Perspectives

When is the Best Time to Buy Stocks?: Strategic Approach

Examples of Groupthink: Instances of Collective Decision-Making

The Gamblers Mindset: The Enigmatic Urge to Embrace Loss