Unravelling Stock Market History: A Closer Look at Market Crashes

Updated May 2023

We will use real examples to demonstrate how we behaved during periods of market distress to support our argument that stock market crashes present excellent long-term buying opportunities. The critical factor that distinguishes the crowd from the astute investor is fear. While the group succumbs to panic, the intelligent investor, often called “smart money,” takes a different approach. They seize the opportunity to buy when there is significant turmoil in the market, akin to blood flowing in the streets. On the contrary, the masses react impulsively, selling their assets and exacerbating the already challenging situation.

History is clear on this topic; the masses never learn. From the Tulip Mania to the Coronavirus Pandemic crash, nothing has changed. The masses panic when they should be bullish and turn bullish when caution is warranted. If you walk away with only one thing from today’s update, walk away with this piece of data; when your body and soul tell you it’s time to buy, it’s usually time to sell and vice versa. Until one has mastered the basic principles of mass psychology, one’s instinct is on par with foul trash when it comes to the markets.

This market could run higher, but chasing stocks at this point is like getting in towards the tail end of the move. Ask yourself why you hesitate when stocks are on sale and why you jump in when the market is roaring. If you answer that question honestly, you will see something that the masses refuse to see; most individuals have a secret desire to lose. Look at their behaviour, and how you could arrive at any other conclusion. Logically speaking, based on historical trends, one would buy when everyone is selling. Yet, the masses sell even more when the selling starts, and they go on a buying spree when the market/specific sector will top out.

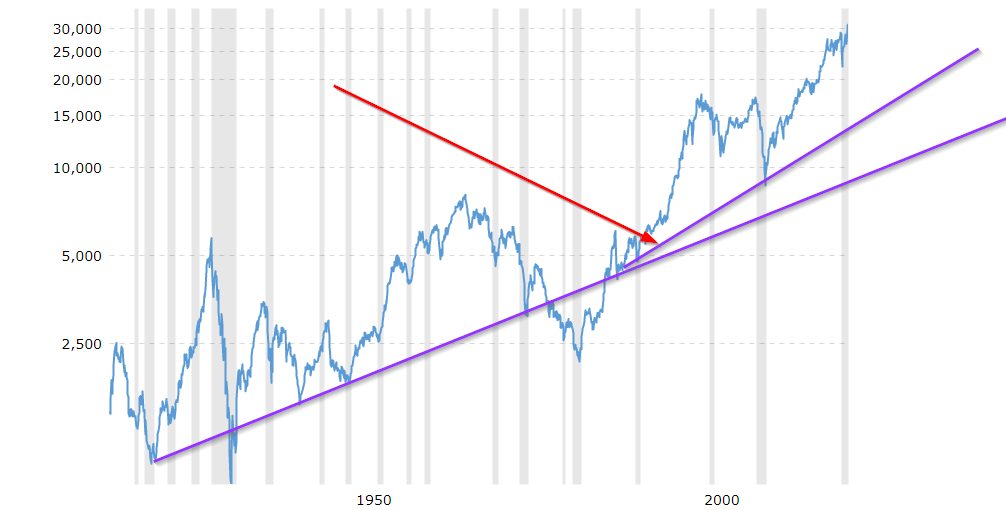

Source: https://www.macrotrends.net/

Decoding Market Behavior: Masses vs. Fed’s Mission for Stability

The above chart above proves that the average Joe has a secret desire to lose when it comes to investing in the markets. In every instance the Dow experienced a “crash-like move”, the masses panicked; there is no exception in history. And they always bought at or close to the top. However, what one notices is that despite all the BS the experts claimed at the time, the financial markets never collapsed; they always recouped and then went on to soar to new heights. Now with tools like the Trend indicator and Mass psychology, we can limit the downside damage and fine-tune our entry points, but the main thing to understand is that the masses are always on the wrong side of the equation when examined from a long-term perspective.

The red arrow indicates the start of the Fed’s new program. Pump money into the markets to stabilise them, and with the passage of each day, the mantra gathers momentum. Currently, the Fed has one mission: stabilising the markets at any cost. That means they will destroy anything or anyone that stands in their way. If you understand the masses stance and the Fed’s mission, you also understand that there will be a plethora of opportunities before this market hits a brick wall. Patience pays well, and impatience kills.

This is why, unlike the masses and the experts; we don’t obsess about stock market corrections. If the trend is positive, there is only one course of action. Embrace all pullbacks regardless of whether they are mild or wild. The greater the deviation from the norm, the better the buying opportunity.

Conclusion

The weekly charts are exerting more pressure for now on the indices. While the experts will view this as a negative development, it is a positive development. Nothing moves up in a straight line. It is healthy for a market to let out some steam when the primary trend is positive. The weak hands are flushed, and the smart money has the chance to scoop quality shares on the cheap.

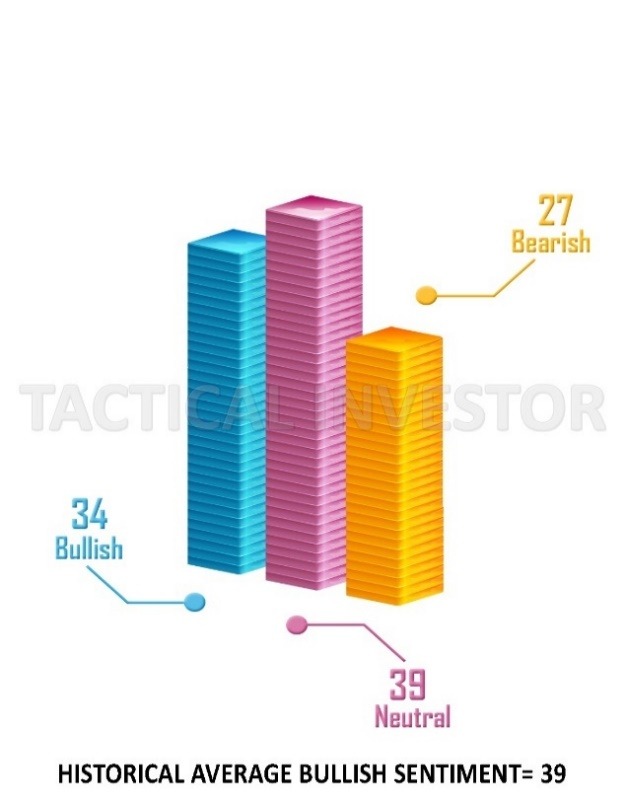

This correction is occurring when bullish sentiment is already trading below its historical average. Every bull market has ended on a note of extreme euphoria. The current trend is so strong that even if the Dow were to drop all the way to 27K, which would look terrible on the charts, it would have no effect on the trend. Are we stating that the Dow is going to drop to 27k? We are not. We are saying that it makes no sense to focus on the correction because many sharp pullbacks will be mistaken for the end of this bull market. The higher the market’s trend, the higher the volatility. In other words, firm corrections are to be expected and should be viewed as buying points unless the primary trend turns negative. Market Update July 19, 2021

Nothing and we mean absolutely nothing, can trend upwards in a straight line forever. It is very healthy for a bull market to let out a dose of steam, especially this one, as it has been on a tear for a while.

Instead of writing pages, we will repeat what we have repeated before. Unless the trend turns negative or bullish sentiment is trading north of 50% for weeks on end, every correction ranging from mild to wild should be embraced. This correction will probably end faster than it began, which means the bulk of individuals who jumped out will fail to get back into this market on time.

Maximizing Equity Markets with Behavioral Technical Analysis

It’s worth noting that gaining a solid grasp of technical analysis is of paramount importance. This knowledge equips individuals with the ability to pinpoint market shifts and navigate the intricate dynamics of collective behaviour, groupthink, and the bandwagon effect. These psychological elements can profoundly influence investment results, often unfavourable outcomes. However, by integrating the tenets of Mass Psychology into your investment methodology and adopting contrarian investing, you can counteract the perils of unthinkingly following the masses. This holistic strategy aids in circumventing emotional biases that can obscure judgment, enabling you to make enlightened decisions grounded in objective analysis.

Translating Investment Tactics into Life

When perceived through a unique lens, life mirrors the craft of investing. Hence, it’s wise to implement the same tactics used to amplify one’s market prospects into one’s life trajectory. However, as we pursue financial security, focusing on personal growth can become progressively demanding. Therefore, let’s delve into various steps that can be undertaken to boost our economic prospects in the upcoming years.

An Efficacious Fusion: Mass Psychology, Technical Analysis, and Contrarian Investing

An effective investment strategy encompasses a potent fusion of mass psychology and technical analysis. By deciphering the collective behavior of market players, one can glean invaluable insights into the market’s heartbeat. Market psychology is instrumental in spotting trends; the rest follows with relative ease once these trends are discerned. Moreover, integrating the core principles of contrarian investing can enhance your trading prowess, particularly when amalgamated with the crowd’s wisdom and technical analysis.

Originally Published: July 28, 2021 | Updated: May 2023

Other Articles of Interest

IBM Stock Price Today NYSE: Finesse in Financial Movements

Investor Sentiment in the Stock Market: Riding the Right Wave

When is the Best Time to Visit Colombia? Uncover the Ideal Season

What Is Price to Sales Ratio in Stocks?: A Gem-Spotting Metric

What is Behavioral Psychology?: Secrets of Human Behavior

What’s a Contrarian?: Out-of-the-Box Thinkers and Action Takers

Mass Hysteria Examples in America: Let the Tales Unfold

What is Oleic Acid Good For: Unveiling Its Health Benefits

The Ultimate Guide to Finding the Best Time to Visit Colombia

Stock Market Crash History: Learn from the Past or Be Doomed

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity

Third Wave Feminism is Toxic: Its Impact on America

A Crisis of Beliefs: Investor Psychology and Financial Fragility

Copper ETF 3X: Rock On or Get Rolled Over