Soak The Rich: History Reveals the Folly of This Approach

Updated Dec 31, 2023

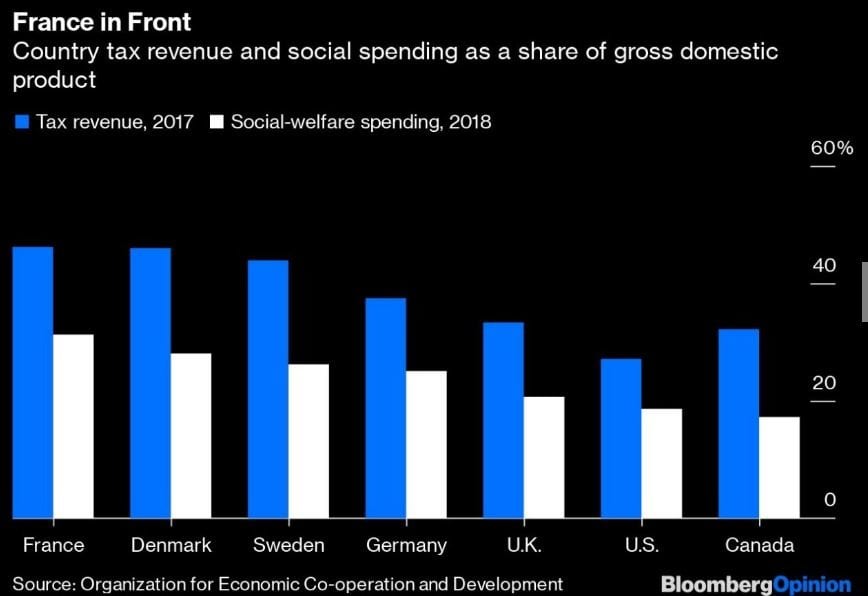

Historical experience is helpful because the U.S. had high top-income taxes in the 1950s, but economic conditions could be very different now. One way to predict the possible effects of the taxes is to look at a country that tried something similar: France, where Piketty, Saez, and Zucman all hail from.

The wealth tax might have generated social solidarity, but as a practical matter, it was a disappointment. The revenue it raised was relatively paltry, only a few billion euros at its peak, or about 1% of France’s total income from all taxes. At least 10,000 wealthy people left the country to avoid paying the tax; most moved to neighbouring Belgium, which has a large French-speaking population. When these individuals left, France lost their wealth tax revenue, income taxes, and other taxes. French economist Eric Pichet estimates that this cost the French government almost twice as much revenue as the total yielded by the wealth tax. When President Emmanuel Macron ended the wealth tax in 2017, it was viewed mainly as a symbolic move.

Another French experiment was the so-called supertax, a 75% levy on incomes of more than 1 million euros. Introduced by socialist President François Hollande in 2012, the supertax added to the departure of wealthy individuals, most notably actor Gerard Depardieu and Bernard Arnault, chairman of LVMH Moet Hennessy Louis Vuitton. Star soccer players threatened to go on strike, and there was fear that France would become a wasteland for entrepreneurs. Meanwhile, the supertax raised much less money than the wealth tax had — only 160 million euros in 2014. The unpopular tax was repealed two years after its adoption. Bloomberg

To Soak the Rich is a bad idea.

The elites gathered at the World Economic Forum in Davos denounced the idea, naturally. Still, among the hoi polloi, there’s a willingness to contemplate a notion that would have been unthinkable just a few years ago.

The marginal tax rate in the United States indeed peaked at 91 per cent in 1960 for people with incomes over $400,000, which was only a few thousand households. But few, if any, people paid that rate. The tax code then included a range of legal loopholes such as deducting your golf club membership that reduced the effective tax rate (the rate that the IRS actually collected) to around 45 per cent. It’s also true that there was less income inequality in the 1950s and 1960s, but you can’t prove that the higher rates led to less inequality. The many loopholes and abuse of the loopholes were driving forces for the Reagan-era tax reforms of the 1980s, which simultaneously lowered tax rates and closed loopholes.

The same concept was at the heart of the 2017 tax cut, which lowered the corporate tax rate to 21 per cent from 35 per cent. This was widely assailed as a tax break for the rich; the top personal income-tax rate was also lowered slightly, though the cap on deductions for state taxes means the rich in states like California and New York often will wind up paying more. More crucially, before 2017, few American corporations, significantly larger, global ones, paid 35 per cent. Instead, multinationals such as Apple kept considerable profits overseas, trillions of dollars in total, to take advantage of lower corporate rates elsewhere, making the effective corporate rate about 24 per cent.

Judging from the past, a hike in the marginal rate and a wealth tax is unlikely to generate the promised revenue. With some effort and inconvenience, Bezos and other tech executives could park billions of their assets outside the US to avoid those rates, just as Apple and other companies did. Warren has promised that the rate would be applied to assets outside the US, but enforcing that would be nearly impossible. Full Story

If you try to Soak the Rich, they can move, while the Poor Can’t

The primary issue with the eat-the-rich approach to public policy is capital flight. People are generally invested in keeping as much of their money as possible. When we file our federal taxes, we seek to maximize our deductions and lower our tax burdens. This behaviour is logical and prevalent across all income brackets. Higher taxes only increase the incentive to practice legal tax avoidance.

Capital flight can’t easily be avoided in a dynamic global economy. The wealthy aren’t going to sit around and wait to be robbed by the state. They and their army of money managers monitor elections and legislation for political risk. At the first sign of trouble, before any law can take effect, the bulk of their wealth will be moved to tax shelters. Understandingly, a panel of economic experts from America’s most prestigious universities overwhelmingly agreed that a Warren-style wealth tax would be difficult to enforce. Full Story

Other Stories of Interest

The Best Turkish Food in Istanbul: Exploring Culinary Delights

Maximizing Gains: Mastering Market Sentiment Indicators

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams

Sophisticated Strategies for US Dollar Index Investing: Elevate Your Forex Game

How much has the stock market dropped in 2023?

Visionary Views: How to Achieve Financial Freedom Before 40

A Major Problem with ESOPs is That Employees Can Lose Big

The Sophisticated Guide to Cryptocurrency Investing for Dummies PDF

Considering the Impact of Inflation, Why Is Investing Important for Long-Term Financial Stability?

What the NASDAQ Composite is Trading at in Today’s Market

What Is Contrarian Investing Unleashing Creative Perspectives

ETF Newsletter: Customized Options for Astute Investors

ETF Service Providers: In-House Options for the Tactical Investor

Fearlessly Trade Your Way to Financial Freedom

Unlocking Radiance: Hemp Benefits for Skin Illumination

Negative Thinking: How It Influences The Masses