Capitalizing on the Copper Shortage: A Compelling Long-Term Opportunity

Updated Jan 12, 2024

A Copper Shortage will impact this market for years unless swift action is taken to tackle the supply gaps. The solution lies in boosting exploration and mining output. However, starting a new mining operation is neither quick nor straightforward; it’s a slow and intricate process. As a result, copper demand will likely outpace supply for an extended period.

The copper supply is predicted to face major deficits until 2030 due to unrest in Peru and rising demand from the energy transition industry, according to Wood Mackenzie’s Robin Griffin. Peru’s protests have led to mine closures, impacting its 10% global copper supply contribution. Chile, the top copper producer at 27%, also saw a 7% YoY decline in output. Despite disruptions, experts like Timna Tanners foresee new mines in 2023. China’s reopening and the energy transition’s demand have strained copper resources. The supply deficit might persist until 2024-2025, potentially doubling copper prices. Electrification, especially in EVs and charging infrastructure, will escalate copper demand due to their copper-intensive nature. The energy transition’s growth poses a significant long-term challenge for copper supply.CNBC

McKinsey’s Forecast: Impending Global Copper Shortage

McKinsey predicts that global electrification will raise copper demand to 36.6 million tonnes by 2031, while supply is estimated at 30.1 million tonnes, creating a 6.5 million tonne deficit. Green uses of copper are set to rise from 4% in 2020 to 17% by 2030, and achieving “net-zero emissions” would necessitate an extra 54% of copper. S&P Global envisions demand nearing 50 million tonnes by 2035, but mining output growth of 2.69% annually would still only reach 31 million tonnes. Experts stress the current and future supply gaps, driven by the demand surge from EVs, renewables, and electricity grids. The copper market faces tightening supply constraints and a substantial gap over the next decade. Mining.com

Investing in Copper Stocks: A Balanced Approach

Optimizing your copper stock strategy involves navigating a bit of turbulence. If you find yourself holding a surplus of copper stock options, it’s wise to trim them when you spot some gains or even consider closing them out with a modest profit or at breakeven. And a crucial note: exercising caution with call options is key. It’s prudent to allocate an amount for calls equivalent to what you’d invest in purchasing shares. For instance, if you can afford 2000 shares, limit your call purchases to no more than 20. Additionally, break down your investment into smaller portions since commodity markets can be unpredictable.

Why emphasize that the best scenario involves some discomfort? Because markets rarely follow a straight path, and if you’re fixated on short-term gains, you might encounter some challenges. However, the outlook for copper is promising for those with a long-term perspective. So, while a bumpy ride might be in store, the overall journey for long-term investors is compelling.

Ideal Setup

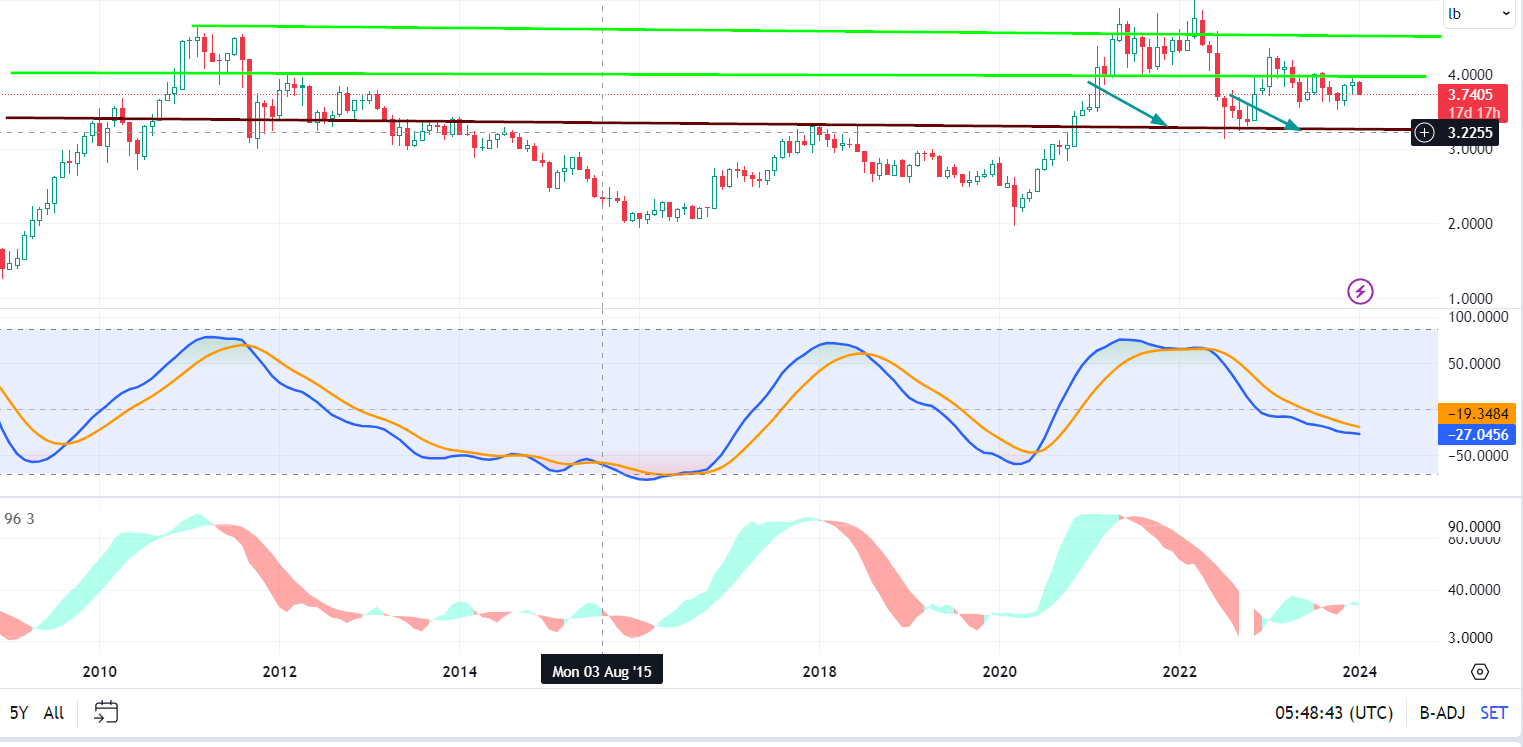

The preferred setup envisions copper targeting the $4.20 to $4.44 range, followed by a decline to $3.00 to $3.30 range, potentially overshooting to $2.90. This sequence might seem counterintuitive, but it’s based on a deep understanding of market dynamics and the collective mindset of investors. When copper prices drop, many investors might panic and sell, but a contrarian would see this as a buying opportunity.

Why? Because if this sequence unfolds, there’s a strong likelihood, nearly 90%, that several of our indicators will trigger a massive positive divergence signal. This signal often indicates that the market is about to turn around, making it an ideal time to invest.

This approach requires a willingness to go against the grain and make decisions that might seem unconventional. It’s not about being different for being different but about thinking independently and making decisions based on a unique perspective.

So, when the market is in turmoil, and prices are falling, remember this: the best scenario often entails some pain. But if you’re willing to think independently and go against the grain, you might find the best opportunities hidden in plain sight.

Remember, when the market is in turmoil, don’t panic. Instead, take a deep breath, think independently, and seize the opportunity.

Key Insights

In summary, the optimal scenario involves copper exploring the range of 4.20 to 4.44, followed by a descent to the 3.00 to 3.30 range, potentially dipping slightly to a pullback at 2.90. If this sequence plays out, there’s a robust probability, nearing 90%, that numerous indicators will signal a substantial positive divergence. At such a juncture, the most prudent move would be to seize the opportunity and back the truck up.

There are a couple of resistance points to consider:

- The first resistance point comes into play within the range of 3.90 to 4.02. A weekly close at or above 3.90 (ideally higher) should lead to a test of the range between 4.25 and 4.44.

- The second resistance point is at 4.47. If there’s a monthly close at or above this level, copper will be poised for a significant rise. This will result in several stocks nearly tripling in value, with some smaller companies like TGB, HBM, and LUNMF potentially seeing gains of up to 600% from their lowest to highest points.

Copper weekly chart

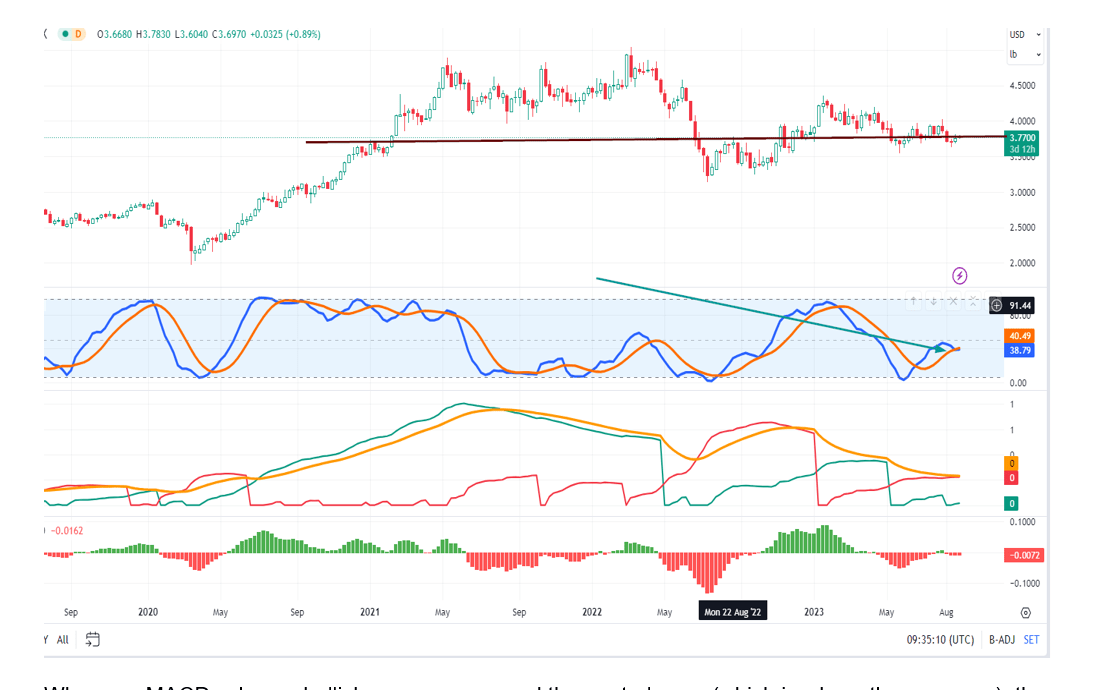

When our MACDs show a bullish crossover around the neutral zone (where they are now), the movement tends to be swift and intense. The bullish crossover is nearly finished; if it is completed, copper should be capable of testing the range of 4.25 to 4.44 without much difficulty. This implies that stocks like TGB should do well. Unfortunately, there aren’t 2025 options available for this stock. The pattern looks promising, but the stock is taking its time to gain momentum.

Insights from Previous Market Updates

Copper stocks are already diverging, indicating that the metal will likely play catch up in the coming months. So from a long-term perspective, recent declines in copper’s price should be viewed through a bullish lens. A weekly close at or above $3.90 could propel it very quickly to the $4.25 to $4.44 range.

There are signs that copper may put in a double top formation, pull back sharply, bottom and then rally to new highs. In other words, an elaborate head fake setup may be in the works. Regardless of any short-term volatility, the long-term outlook remains bullish, given the divergence in copper stocks and their signal that the metal is poised for gains. Market Update July 10, 2023

Copper stocks continue to outperform the metal in terms of gains, with only a few stocks lagging behind. On the weekly charts, it still has significant potential to run higher before reaching the overbought zone. Additionally, on the monthly charts, it is trading in the extremely oversold zone. Therefore, any sharp pullbacks should be seen as opportunities for investment.

A positive development is that it managed to close above 3.90 on a weekly basis. As long as it doesn’t close below 3.60 on a weekly basis, it should remain in a position to challenge the 4.25 to 4.44 range, with a possibility of surpassing it and reaching 4.60. Market Update August 16, 2023

Conclusion

In conclusion, the global copper market faces ongoing supply deficits and surging demand, impacting industries vital to the economy. Copper’s crucial role in electrification and infrastructure development underscores its immense value, making it a pivotal factor in economic growth and sustainability. Investors should vigilantly track these developments, recognizing the profound economic significance of copper in our modern world.

FAQ

Q: What is the current status of the global copper supply?

A: The global copper supply faces significant challenges, including supply deficits, unrest in major copper-producing countries like Peru, and rising demand from the energy transition industry.

Q: How long is the copper shortage expected to last?

A: Experts suggest a copper shortage may persist until at least 2024-2025, potentially doubling copper prices.

Q: What factors are contributing to the copper shortage?

A: Factors such as protests in Peru leading to mine closures, declining output in top copper producer Chile, China’s reopening, and increased demand from the energy transition industry are straining copper resources.

Q: How does electrification affect copper demand?

A: The push for electrification, particularly in electric vehicles (EVs) and charging infrastructure, is significantly increasing copper demand due to its copper-intensive nature.

Q: What do experts predict for future copper demand and supply?

A: Projections indicate that copper demand will continue to rise, potentially creating a substantial gap (copper shortage) between demand and supply over the next decade, driven by the surge in demand from EVs, renewables, and electricity grids.

Q: Are there any potential investment opportunities in the copper market?

A: Some experts believe the copper market presents investment opportunities, especially if specific price ranges and technical indicators are met. However, investing in commodities involves risks, and careful consideration is advised.

Intriguing Articles for Knowledge Seekers

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

What Happens If The Market Crashes?

Investment Journal: Charting the Course Toward Financial Triumph

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology

Herd Mentality: Understanding the Pros and Cons of Conformity

Projected Silver Prices: Setting Sail for Precious Metal Ascension

Which Of The Following Is A Cause Of The Stock Market Crash Of 1929