Editor: Vladimir Bajic | Tactical Investor

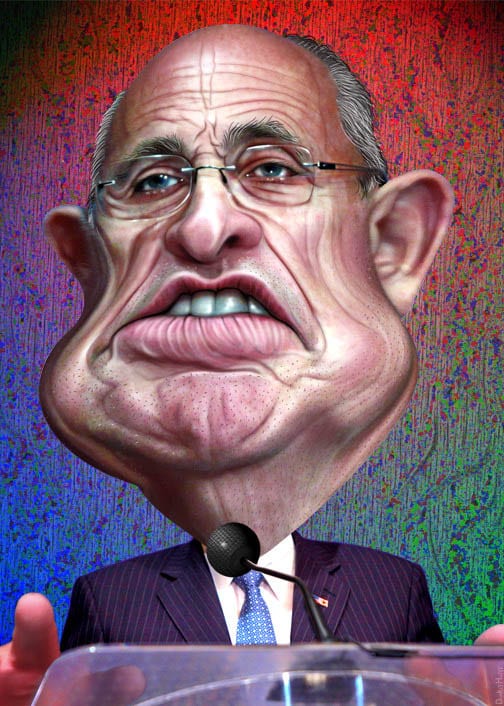

Giuliani would have convicted Hillary

Comey stated that while there was evidence of wrongdoing there was not enough evidence to convict Hillary. These were his exact words:

“Although there is evidence of potential violations regarding the handling of classified information, our judgment is that no reasonable prosecutor would bring such a case.”

“Many reasonable prosecutors have come to the conclusion that they would have brought such a case, I would have brought such a case. I would have won such a case,” Giuliani, who is also a former New York City mayor, said on ABC’s “This Week.”

“I’ve prosecuted cases like that in my years at the Justice Department,” Giuliani said. “Hillary Clinton skated because she’s running for president, she clearly violated the law.

Trending Story Of the Month

Now that we have covered the Giuliani would have convicted Hillary article lets move on to the story of the month.

A Market crash can be viewed as a monumental tragedy or a splendid opportunity depending on what side of the fence you sit on. If you decided to pour all your money into the market close to the top, then it would be viewed as a tragic event. If on the other hand, you got in early and as the market trended higher, you banked some of your profits then it would be viewed as a grand opportunity. Crisis investing dictates that all disasters are nothing but opportunities change the lens and the picture changes. Why market crashes are buying opportunities

Fear Mongers Thrive on Fear

But Astute Investors buy when the Masses Panic. Always remember that fear mongers are paid handsomely to stampede the masses; that is when the smart money makes the biggest killing. For them to make a killing they have to fleece thousands upon thousands of small players. In some cases they go for the juggler and fleece millions; two examples come to mind; the dot.com bubble and the housing bubble. Buffett has gone on record to state that it’s a virtual guarantee that stocks will rise in the years to come. What happens when the stock market crashes? You Jump in

Other Stories of Interest:

Investor Anxiety; Rocket Fuel for Unloved Stock Market Bull (Aug 6)

Most Unloved Stock Market Bull Destined To Roar Higher (Aug 5)

Student Debt Crisis Overblown & Due to Stupidity (Aug 4)

Despite Investor Angst Most hated stock market keeps trending higher (July 30)

False Information, Mass Psychology & this Hated Stock Market Bull (July 29)

Zero Percent Mortgage Debuts setting next stage for Stock Market Bull (July 27)

Long Term Stock Market Bears Always Lose (July 27)

Information overkill & trading markets utilising Mass Psychology (July 27)

Simple Common Sense Fix Ends Student Debt Problem (July 27)

Tactical Investor Anxiety Index; Best Market Sentiment Gauge (July 26)

Brexit Hidden Theme Continuation of Currency War Game (July 26)

Stock Market Bears Smashed Jan & Feb 2016 as Predicted (July 25)

Another reason this bull market will not buckle soon (July 22)