This essay reflects on our historical stance on the dollar in 2015, highlighting the cyclical nature of economic trends and the importance of learning from history. At that time, we accurately predicted the dollar’s rise in strength. Today, we observe a contrasting scenario: the dollar is weakening and may eventually be displaced. This shift underscores our commitment to understanding and navigating financial markets, reinforcing the adage that those who do not learn from history are doomed to repeat it.

A Historical Look at Tactical Investor’s Market Insights: Talking the Talk and Walking the Walk

Is the US Dollar in a Bull Market? We Believe So

Over the past few months, we have extensively discussed the US dollar’s trajectory. Here, we present excerpts from previous updates, focusing particularly on the market update from December 16th.

The dollar is currently testing a two-year support zone, and as long as it remains above this level every month, the outlook will stay bullish. Additionally, the dollar is forming a falling wedge pattern, which is typically bullish. It continues to issue new positive divergence signals almost weekly. With a large short position in the dollar, a strong upward move could trigger a short squeeze, potentially leading to a domino effect. We observe that extreme movements are impacting nearly every asset class, and historically, such extremes often lead to solid counter-movements.

Signs of a Changing Outlook

For the outlook to shift, the dollar needs to trade within the 75.80-76.00 range for at least five consecutive days. If it achieves this, it could target the 80 mark. (Market update: Nov 24, 2009)

We’ve consistently stated that the dollar is poised for a turnaround, even as many predict its decline. While we agree with the long-term bearish outlook, we believe that in the short to intermediate term, the dollar will make one last significant move. The dollar is a formidable entity, and it will not capitulate without a fight.

#### The Dollar’s Breakout from a Falling Wedge

This bullish pattern contrasts with the euro, which is breaking down from a bearish rising wedge. A significant bullish indicator we believe many have missed is the action in the gold markets. Gold reached new highs as the dollar weakened.

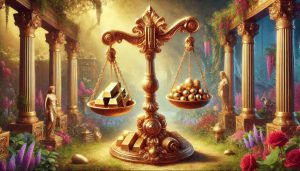

In the past 24 months, the dollar has hit three significant lows, which we will list chronologically.

Something Unusual is Happening

Gold surpassed its 1980 high of approximately 850 several months ago. When gold traded past its March 17, 2008 high of 1014, the dollar should have tested its low from that day. However, despite gold trading past 1100 and then 1200, the dollar did not drop below 74.50, nor did it close below 75 on a monthly basis.

The Glaring Discrepancy

This is the most striking discrepancy we’ve noticed, yet it remains unaddressed. Gold enthusiasts and mainstream media rave about the rush into gold, even mentioning central bankers supposedly buying gold. However, weren’t these central bankers selling gold when it traded in the 300-700 range? They are likely buying gold to mislead the majority into believing gold will soar without correction. Printing more money costs them nothing.

Gold traded 21% above its March 17, 2008 high, reaching 1227 before pulling back. Logically, the dollar should have traded 3-5% lower than its March 17 low, but instead, it traded 4% higher. This data suggests the dollar is putting up a strong fight. Observe how quickly gold pulled back when the dollar rallied slightly. Imagine what could happen if the dollar trades to and possibly beyond the 80 mark.

Psychologically, nearly everyone believes the dollar is doomed, viewing commodities (especially gold) and competing currencies as the best alternatives. It’s estimated that close to 99% of traders think the dollar is finished. Extremism in sentiment often leads to the opposite result, potentially a dollar rally. Once a contrarian investment, gold is now mainstream. Markets are forward-looking, and we believe that, in the short to intermediate term, the worst for the dollar is already priced in.

Conclusion

The dollar is universally despised, with sentiment at historic lows. Mass psychology suggests that when an investment is so widely loathed, it often stages a powerful rally. A strong dollar rally could hinder market rallies, trigger commodity sector pullbacks, and affect precious metals and bonds. The dollar’s fate will be crucial in determining market movements next year.

The dollar could confirm its strength by closing above 77.50 on a weekly basis or taking a two-stage approach: trading past 76.43 on a weekly basis and then above 77.50 for three consecutive days. The latter path is slightly more bullish, suggesting the dollar could trade past 82.00. Market Update: December 16, 2009

Every asset class has rallied in response to a weaker dollar, so a strong dollar rally could negatively impact the entire market. Individuals shouldn’t be complacent about the dollar’s decline, as they might overlook significant issues in their own regions. The EU’s challenges could boost the dollar beyond our targets. If investors become skittish about the Euro, it could trigger a rush to the exits. While we’re not predicting this, the large deficits of several EU members suggest potential trouble. Greece, in particular, could face severe consequences without swift action. (Market update: Jan 5, 2010)

Future Outlook

The pattern has shifted slightly, requiring the dollar to close above 78.50 on a weekly basis, which it did with ease, nearly reaching 80 before pulling back. A monthly close above 81 would be a strong bullish signal, potentially pushing the dollar to new highs around 90. The EU’s turmoil adds to the dollar’s strength, with France and Germany’s reluctance to help Greece revealing key insights from a mass psychology perspective.

If the EU’s situation worsens, Germany might consider exiting, which would end the EU. While dramatic, nations are growing weary of assisting others while struggling themselves. We are witnessing several phases:

1. The “devalue or die” currency battle.

2. The “survival of the fittest” stage.

3. The protectionism era, with high tariffs on imports, especially from China.

Regarding the dollar, we have both daily and weekly buy signals, maintaining a bullish outlook. Conversely, the Euro has weekly and daily sell signals, suggesting it could fall to the 125 range. If the dollar issues a monthly buy signal, it would indicate an extremely bullish outlook and a potential 7-9 month gold consolidation/correction, impacting the entire commodities sector. Current trends in copper and oil markets indicate potential broader sector weaknesses.

Remember, don’t focus solely on one aspect but keep an eye on the broader picture as well.

There is genius in persistence. It conquers all opposition, instills confidence, and overcomes obstacles. Everyone believes in a determined individual. When they undertake a task, the battle is half won because their rule is to accomplish whatever they set out to do. — Orison Swett Marden (1850-1924)

Articles of interest:

India stock market trend: What lies ahead for investors?

What lessons can we learn from John Templeton’s investment strategy today?

Mass Sentiment: Break the Mold, Beat the Crowd

Why Do Fear Mongers Like to Fear Monger? Defy Them, Don’t Ask Why

FUD Meaning: Stop Explaining It, Start Beating It

Positive vs Negative Divergence: Master Them to Win, Not Lose

What is AJ Ayer’s logical positivism?

What Is a Double Bottom in Stocks: Reliable Buy Signal or a Trap?

What is the most effective ETF investing strategy for building wealth?

What’s the difference between first and second level thinking?

Disadvantages of Investing in Gold: The Good, the Bad, and the Ugly Truth

What are the essential behavioral finance books?

Stock market trend 10 years—what’s the pattern?

Fearless Finance: Harnessing Stock Market Fear for Contrarian Victories

Charlie Munger Net Worth: Secrets to His Financial Success

Sheep mentality psychology: Why do people follow the crowd?

Bull and Bear Market History: Intriguing Insights