Bad is never good until worse happens. Danish proverb

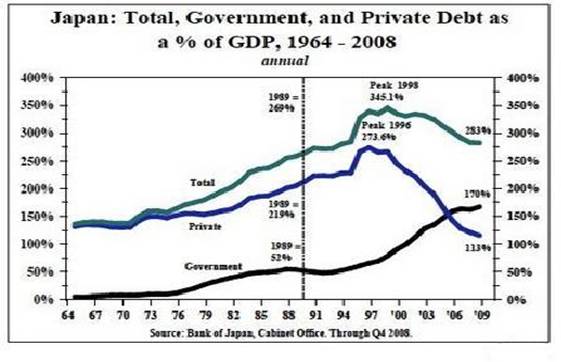

Source: Bank of Japan

We have a Debt Crisis in the making

The only question that remains is where will the next crisis emerge. The Japanese markets have still not recovered after the real estate bubble from 1986-1990 despite dropping interest rates to zero and throwing volumes of money at the problem. Look at the above chart. Total Debt in 1990 was roughly 150 of GDP: today, total debt is nearly 290%, and the market is still in a funk. Could this be what lies in store for the U.S?

In 1990 the Nikkei was at 40,000; today, almost 20 years later, it is having a hard time trying to make it to the halfway point despite all the money the government has infused into the economy. Worse yet, the primary downtrend line is still intact, and after all that money the Japanese government threw at the economy, the Nikkei is trading close to its lows; currently, it’s at 9,695, roughly 75% below its all-time high. Let’s remember that Japan is a significant exporter and manufacturer of goods. On the other hand, the US has lost most of its manufacturing capacity and imports far more than it exports. It’s starting off on an incredibly lousy note compared to the Japanese.

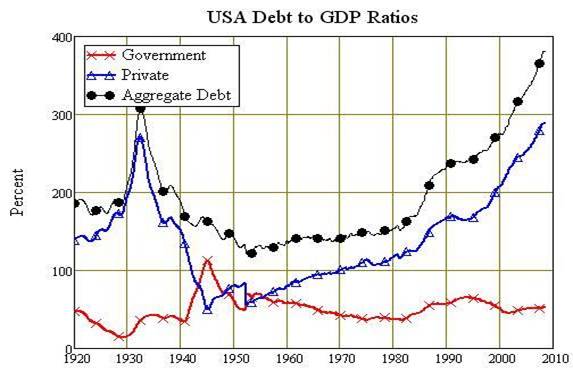

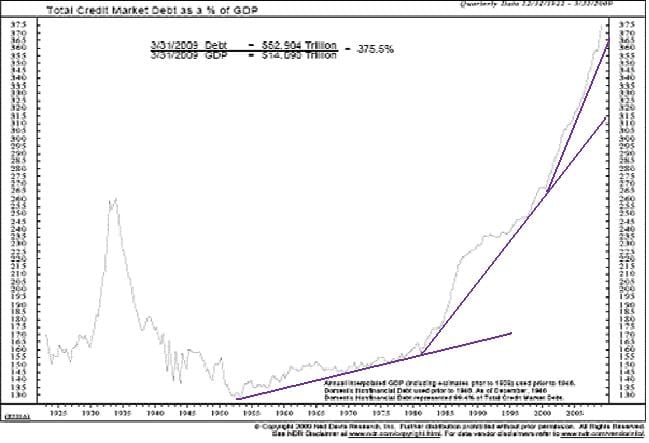

We have listed charts from two sources; the differences are mostly minuscule.

Surprise, surprise, the picture is utterly terrible. Total debt accounts for roughly 380% of GDP, and we have only begun spending. The Japanese started from 150, and it took them to 20 years to push it to 250%. On the other hand, we are baulking at almost 380%, and we have just begun our so-called stimulus programs.

The government is projecting a deficit of 9 trillion dollars in the next ten years; they moved this estimate up from 7 trillion to 9 trillion in less than one year. If they increased their estimates by almost 28% in one year, do you think this estimate will remain unchanged for ten years? They also raised the deficit for 2010 by 19% to 1.5 trillion.

Now here is the massive difference between the Japanese and the U.S. The Japanese consumer has saved a considerable amount of money and continued to do so. They can thus (and to some degree they have indirectly financed this debt by purchasing government paper. The U.S. consumer, on the other hand, is broke and strung by his heels with debt; we had two years where the savings rate was negative (2005 & 2006).

Talk about arrogance and foolhardiness. So we are entering into this mess with a Debt to GDP ratio that is 2.6 times larger than the Japanese and with the consumer completely broke. To make matters worse, we are fighting two wars and trying to solve many problems when the nation is almost bankrupt. Let’s not forget the rising unemployment rate, which is close to hitting 10%, but unofficially (the number of individuals that have given up looking for work plus those that are still looking for job) is probably well over 15%.

As we advance, the situation is only going to get worse as the government is going to have to continually create money out of thin air to fund many of its social programs, support the two large-scale wars that are costing this nation several billion dollars a month and pour billions and billions into Medicaid and eventually into social security.

The only hedge, therefore, would be to get into commodity-based assets. Investors should use all strong pullbacks to either add to or open up new positions. For example, right now, the natural gas sector is relatively cheap and undervalued. Some plays in the agricultural industry are also rather dirty, so some positions could be opened up in these sectors. We would wait for pullbacks in the other commodities-based industries before opening up new positions as many of them have experienced very strong upward moves in the past few months.

It is a painful thing to look at your trouble and knows that you, yourself and no one else has made it. Sophocles, BC 496-406, Greek dramatist

Other Articles of Interest:

Why Mechanical and Technical Analysis Systems Fail

The Limitations of Trend Lines

Inductive Versus Deductive reasoning

Mass Psychology Part I, Sept 26, 2007

Portfolio Management Suggestions