Panic Selling: Where the Weak Lose and the Wise Win

Panic isn’t a strategy. It’s surrender.

July 11, 2025

We’ve seen it before—subscribers misreading caution as doom, scrambling to close positions at the worst possible moment. A soft warning turns into full-blown fear, and before you know it, solid positions are dumped like rotten fruit. The assumption? A crash is coming. The result? They sell into weakness, locking in losses, and handing opportunity to someone with a stronger stomach.

Let’s set the record straight: we don’t panic. Ever. We bank gains when they’re sizable, yes. But fear-driven exits? That’s not trading—it’s self-sabotage. When others see chaos, we see value mispriced by emotion. Panic creates the very opportunities most traders spend years chasing—but they’re too shaken to act.

As noted in our August 2021 market update, the correction we expected would shake out the weak hands, but it wouldn’t spell collapse. It never does—not in the way fear-mongers imagine. These pullbacks are engineered by emotion and fueled by misunderstanding. If you’re new to the game, use moments like this to start a trading journal. Watch how people react. Track how you feel. This is where you start learning—not about markets, but about yourself.

To beat fear, you don’t suppress it—you study it. Fear is a liar dressed as a guardian. It promises protection but delivers losses. It pushes people to dump quality stocks for pennies just because the tape looks ugly. But the wise? They know better. They wait. Or they buy.

Because in every panic, someone’s bleeding—and someone else is buying that blood. Choose which side you’re on.

Not one investor can prove that giving in to panic paid off over the long run.

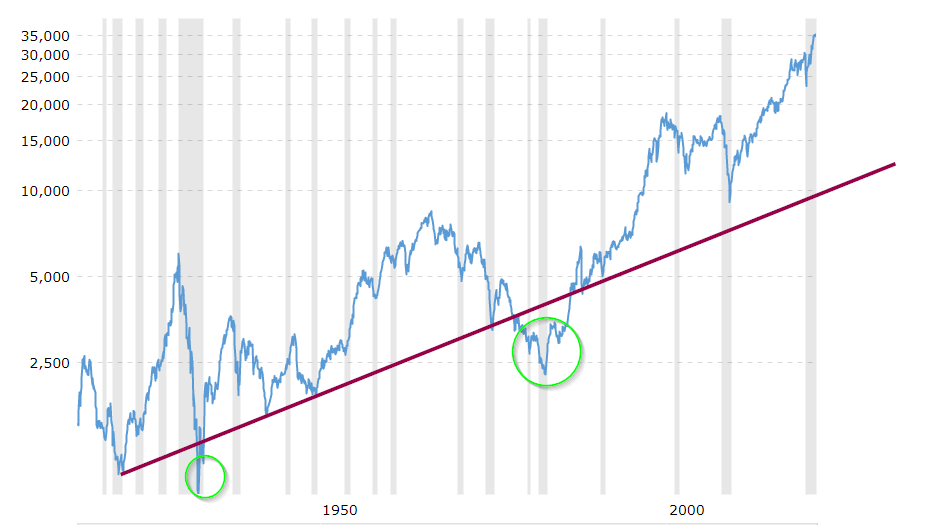

If they dare attempt to take this challenge, this chart buries the argument where it belongs—six feet under.

This 100-year Dow Jones chart is the graveyard of panic-sellers. Every circle on that graph marks a moment where fear peaked, headlines screamed, and weak hands bailed. And every single time? The market roared back, crushing doubt and rewriting valuations.

The Tactical Investor’s Fearless Approach to Panic Selling

The market isn’t built for the timid. It rewards the ones who step into the fire while others run. It doesn’t pay the most to the smartest. It pays the most to the calmest.

This is war, not roulette. And that chart is the battlefield map.

Look closely:

- The Great Depression — The Dow got eviscerated. Yet those who entered at the depths saw a 20x return over time.

- 1974 Oil Crisis — The media screamed, “End of Capitalism.” The market bottomed, then doubled in a few years.

- 2008 Collapse — Wall Street melted. But so did valuations. Buffett bought. So did a few others. The rest watched those buys 10x.

In 1990, when the Dow dipped below its long-term trendline, doomsayers pounded the table with crash warnings. Meanwhile, institutional players quietly accumulated. Fast forward—those “panic dips” were slingshots.

This is not hindsight bias. It’s strategic behaviour, tested through fire. The Tactical Investor does not flinch at drawdowns—they prepare for them. The game isn’t to avoid pain. It’s to know exactly when to pounce while others bleed.

Fear is the fuel of the transfer of wealth. That’s the uncomfortable truth. And the chart above? It’s the autopsy of every investor who sold too soon.

Confidently Tackling Panic Selling: The Tactical Investor’s Approach

At Tactical Investor, panic selling doesn’t exist. We don’t flinch. We don’t fold. Fear doesn’t drive our decisions—we drive through fear.

Market chaos? That’s our hunting ground.

Crashes like COVID-19 weren’t threats—they were golden invitations. While the masses clung to fear-soaked headlines, we quietly accumulated. The payoff? Outsized returns when the dust cleared.

Why Do Most Investors Fail?

Because they react instead of act.

Because they chase hype and dump despair.

Because emotions—not systems—dictate their trades.

Our edge? We invert that dynamic.

We buy when the herd panics.

We sell when the herd cheers.

We lean into volatility while others seek comfort.

H.L. Mencken said it best:

“The whole aim of practical politics is to keep the populace alarmed… and clamorous to be led to safety by menacing them with an endless series of hobgoblins.”

Replace “politics” with “markets” and you’ve cracked the modern playbook. Financial media thrives on fear. The herd obliges with blind panic—meanwhile, the patient and tactical scoop up their future at a discount.

Strategic Principles: The Tactical Investor’s Edge

1. Prudent Deployment: Smart Money Moves in Phases

We never go all-in blindly. Capital is deployed in layers. First exposure, then confirmation, then scale. No gambling—just tactical firepower.

2. Steady Progress: Precision Over Emotion

Stampedes trample the undisciplined. We move deliberately. Every action is rooted in structure, not adrenaline. That preserves not only capital, but peace of mind.

3. The Game Is Fun—Not Frantic

If investing becomes stressful, you’re playing it wrong. Ditch the obsession with financial noise. Tune into price action, sentiment shifts, and money flow. Master the rules—then enjoy the game.

Strategically Cautious: Thriving in Uncertain Markets

History proves it: A flooded money supply accelerates rebounds. Just look at COVID-19—one of the fastest recoveries in market history.

We don’t chase shadows. We anticipate. If the setup isn’t ideal, we don’t force trades—we switch to Plan B, Plan C. Always armed. Always ready.

Crashes aren’t anomalies—they’re engineered events. They follow a script:

- Create tension.

- Let it boil.

- Panic ignites.

- Retail sells into the abyss.

- Smart money buys in silence.

- Market rebounds.

- Retail FOMOs back in—too late.

Know the game, or be gamed.

Volatility: The Friend of the Astute, the Foe of the Weak

Volatility isn’t chaos—it’s currency. It’s the mechanism that transfers wealth from the impatient to the disciplined.

When liquidity floods the system, volatility spikes. That’s no accident. The big players—those who can’t just click “market buy”—need entries. They engineer fear to shake out the supply.

This has been happening for centuries. Institutions don’t evolve randomly—they inherit tactics. Their children are raised with blueprints in hand. The average investor? Still fumbling in the dark.

The Market’s Oldest Trick: Manufacturing Panic

New money floods in. Supply things. But big money won’t pay premium prices.

So they do what they’ve always done: create a crash.

The goal? Shake out the weak. Grab quality for pennies. Recycle the cycle.

It’s orchestrated. It’s deliberate. And it’s incredibly effective.

Flip the Script: See Panic as a Gift

When the herd bolts, you don’t follow—you feast. Panic creates premium entries. It reveals an opportunity hiding beneath fear.

If the major trend is intact, panic is a disguised invitation.

The herd screams collapse?

Contrarians sharpen their knives.

Most who claim contrarianism abandon it when the market shakes. They fold. They run. But real contrarians? They accumulate.

Potential Market Play: Watching the Next Correction

What we’re seeing hints at a possible two-wave correction:

- Wave 1: Sept–Oct shakeout.

- Wave 2: A stronger Jan–Feb washout.

But don’t jump the gun. This is intelligence, not a trigger. If the signals escalate, we’ll break it down surgically.

Until then, keep this truth locked in:

Volatility isn’t danger—it’s your greatest weapon, if you know how to wield it.