Navigating Stock Market Woes: How to Avoid the Pitfalls That Many Investors Fall Into

Feb 20, 2023

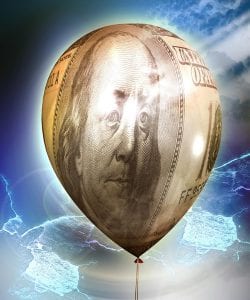

The stock market has long been viewed as a way for individual investors to grow their wealth over time. However, recent research suggests that the crowd often loses in the stock market due to several cognitive biases and behavioural factors.

In recent years, numerous cases of stock market woes have left individual investors feeling uncertain and unsure about the future of their investments. While following the crowd in these situations may be tempting, research suggests this approach is often a recipe for disaster. The stock market can be a complex and volatile place, and it’s essential to be informed, disciplined, and patient to avoid the pitfalls that many investors fall into.

One of the primary reasons the crowd loses in the stock market is the influence of emotions. Fear, greed, and panic are all common emotions that can lead investors to make poor decisions. For instance, when the market drops, fear can drive investors to sell their holdings and lock in their losses, while greed can lead them to pour money into the market and buy at the top, just before a correction. The emotional cycle of the stock market can be challenging to navigate, and it’s crucial to avoid letting emotions dictate investment decisions.

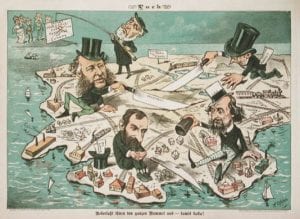

In addition to emotions, misinformation and groupthink are also major contributing factors to the crowd’s losses in the stock market. A recent study by the University of California, Los Angeles, found that many investors rely on financial advisors who may not always have their best interests at heart. This can result in poor investment decisions and missed growth opportunities. Furthermore, the media often sensationalizes market events, leading to widespread confusion and misunderstandings among investors.

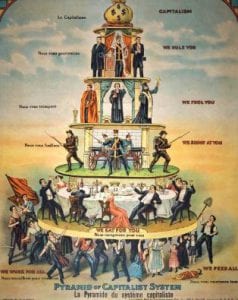

Herd Mentality contributes to Stock Market Woes.

The herd mentality, a phenomenon in which investors follow the crowd even if it’s not in their best interest, is another factor that contributes to the crowd’s losses. This often leads to buying high and selling low, as investors blindly follow the trend instead of relying on their analysis and instincts. This can be particularly problematic regarding “hot” stocks or market sectors quickly becoming overcrowded.

In contrast, contrarian investors adopt a different approach to the stock market. Rather than following the crowd, they are willing to invest in stocks that are out of favour or undervalued. A recent study by the University of Chicago Booth School of Business found that contrarian investors outperformed the market by 2.5% per year over 20 years. This is due to their willingness to rely on informed analysis and a long-term investment strategy rather than being swayed by emotions or groupthink.

Stock Market Woes Solution: Focus on the long term

Furthermore, a study by Vanguard found that a long-term investment approach can result in higher returns and lower volatility compared to a short-term investment strategy. Contrarian investors are patient and willing to hold onto their investments for the long term, allowing them to weather market corrections and reap the benefits of a well-diversified portfolio over time.

The key to success in the stock market is to avoid being swayed by emotions, misinformation, and groupthink. By relying on informed analysis, having a well-diversified portfolio, and taking a long-term investment approach, investors can avoid the pitfalls that often lead the crowd to lose in the stock market. By adopting a contrarian approach, investors can outperform the market and achieve their investment goals over time.

Article Summary

The Role of Herd Mentality in Stock Market Woes and How to Avoid Them:

Recent research suggests that the crowd often loses in the stock market due to several cognitive biases and behavioural factors, including emotions, misinformation, and groupthink. Fear, greed, and panic are common emotions that can lead investors to make poor decisions. Misinformation from financial advisors and sensationalized media coverage can lead to poor investment decisions and missed growth opportunities. The herd mentality, a phenomenon in which investors follow the crowd even if it’s not in their best interest, is another factor that contributes to the crowd’s losses.

Contrarian investors who rely on informed analysis, a well-diversified portfolio, and a long-term investment approach can outperform the market and achieve their investment goals over time. A recent study found that contrarian investors outperformed the market by 2.5% per year over 20 years. Additionally, a long-term investment approach can result in higher returns and lower volatility compared to a short-term investment strategy.

To avoid the pitfalls that often lead the crowd to lose in the stock market, investors should focus on the long term and avoid being swayed by emotions, misinformation, and groupthink. By adopting a contrarian approach and relying on informed analysis, investors can succeed in the stock market and avoid stock market woes.

Articles and studies

These articles and studies support the idea that the crowd often loses in the stock market due to emotions, misinformation, and groupthink. At the same time, a contrarian investment approach that is based on informed analysis and a long-term focus can lead to better outcomes.

1. Strategies for Overcoming Stock Market Woes – Tactical Investor

2. Groupthink: Collective Delusions in Organizations and Markets

3. Do fundamentals—or emotions—drive the stock market? – McKinsey & Company

4. Contrarian Investing – Management Study Guide

5. What Is a Contrarian? Strategy in Trading, Risks, and Rewards – Investopedia

6. What Is Contrarian Investing? | The Motley Fool

7. What Is Contrarian Investing? – Forbes Advisor

8. Avoid The Psychological Traps Of The Market With The Dreman Screen – Forbes

Other Articles of Interest

A Muslim Woman’s Perspective: Why I Voted for Trump

Decoding 1400 Years of Islam in 5 Minutes

Digital Immortality: Is it possible?

AI Chip Manufacturers: Navigating Challenges in a Dynamic Market

Random Reflections on AI

The Rich Get Richer: Understanding Wealth Inequality

Market Trend Analysis: Only The Trend is your friend

What is inflation? Central Bankers Main Weapon Is Inflation

The United States Central Bank: Catalyst for New Servitude

Stock Market Trends 2023: Market on the Verge of a Crash?

The Good Price to Sales Ratio: Unleashing Investment Insights

The Banksters Band: Exploiting the Poor to Enrich the Wealthy

The Disciplined Investor: A Guide to Enduring Trading Success

Bull vs Bear Market; the Dow Index is getting ready to Soar