AI Chip Manufacturers: Overcoming Headwinds

July 15, 2023

Less than two weeks ago, we stated that AI chip manufacturers particularly will soon face challenges, As AI can now be used to reverse engineer and then come out with a comparable if not better product. It does not matter whether NVDA employs the same tactic, for this will lead to price drops. The huge profit margins it boasts will be eroded because it has no competition. In the first mentioned story (below), the chaps managed to design a chip without any coding knowledge. Now imagine what top-notch programmers can achieve with the right amount of funding. By the way, Chatgpt, Claude, and other LLM models can be boosted to be 2-5X more effective than the ones the public has access too.

In simpler terms, companies use APIs to connect their models and train them or create more advanced versions of chatbots. These bots are programmed to learn from their mistakes. They keep trying to complete a task, learn from their failures, and use that knowledge to improve until they successfully solve the task.

Advancements in AI Chip Manufacturing: Exploring Generative AI’s Impact on Hardware Design and Market Competition

A group of researchers used generative AI to design a microprocessor, which was considered a significant achievement. Generative AI tools, like ChatGPT, enable people to research, learn, and create new ways. The researchers from NYU aimed to understand the capabilities and limitations of AI models in hardware design, and their project, Chip Chat, served as a proof of concept. This approach helps overcome the challenge of hardware definition languages (HDLs), which require specialized knowledge. By leveraging AI assistants, engineers can focus on more complex tasks while AI accelerates the generation of hardware designs, making the process more accessible. Allaboutcircuits

Cerebras Systems Inc and Graphcore are also entering the competition to secure significant portions of the AI chip market. As more players enter the market, competition intensifies, often lowering prices. The presence of these companies further contributes to the changing dynamics of the AI chip industry.

Rise of Generative AI Chip Players: Cerebras Systems, Graphcore, and ThirdAI Corp

Cerebras Systems Inc., a chip company based in Sunnyvale, California, is capitalizing on the growing interest in generative AI, and it has achieved a valuation of $4.1 billion. According to CEO Andrew Feldman, as demand continues to rise, it creates opportunities for startups to thrive. U.K.-based Graphcore Ltd., another player in the market, offers specialized hardware and software for AI applications, helping to lower compute costs and benefiting from the increasing number of AI startups.

ThirdAI Corp., based in Houston, has seen increased demand for its technology that efficiently runs complex AI algorithms on cheaper CPUs. Chip startups are shifting their focus towards supporting large language models, but challenges include funding and adapting quickly. Established companies like Intel, with their software ecosystem and optimization capabilities, may have an advantage over startups. The demand for generative AI is expected to increase as businesses adopt it more widely. Wallstreet Journal

Microsoft is currently developing its own AI chip, meaning the AI chip market will undergo significant changes in the next 12 months.

According to The Information, Microsoft has developed its artificial intelligence (AI) chips since 2019. This move aims to reduce the company’s reliance on Nvidia’s GPUs, which have become increasingly expensive due to market scarcity. The chips, codenamed “Athena,” are being tested by Microsoft’s machine-learning staff and OpenAI’s developers. While the specific use of these chips by OpenAI remains unclear, its CEO, Sam Altman, suggests a shift away from giant AI models towards alternative improvements. This development comes amidst a busy period in the AI sector, with Amazon introducing its own models and Elon Musk announcing the forthcoming launch of TruthGPT. Cointelegraph

AMD’s MI300X: Threatening Nvidia, Reshaping AI Chip Market

Advanced Micro Devices Inc (AMD) has introduced a new chip, the MI300X, which poses a significant threat to Nvidia’s dominance in the AI chip market. AMD’s GPU is aimed at competing with Nvidia’s H100 GPU and is designed for large language models and cutting-edge AI applications. With potentially lower pricing than Nvidia’s offering, AMD’s chip could impact the development of costly generative AI applications. CEO Lisa Su sees AI as AMD’s largest long-term growth opportunity.

The success of AMD’s chip will depend on developer adoption, as AI developers have favoured Nvidia’s well-established software package CUDA. AMD has developed its own software, ROCm, for its AI chips. Amazon is reportedly considering AMD’s chips for its AI efforts. Meanwhile, Intel is investing globally in chip assembly and test facilities to regain its chip-making leadership position. Intel also recently rebranded its consumer CPU. AMD’s newest chips have the potential to reshape the AI chip landscape, but their success depends on widespread adoption by developers. Finance.Yahoo

Cerebras Systems: Open-Source LLMs Redefining Generative AI Landscape, Challenging NVIDIA and AI Chip Manufacturers

Cerebras Systems has released a series of open-source large language models (LLMs) trained on their Andromeda AI supercomputer. Unlike other companies, Cerebras claims to have trained models with up to 13 billion parameters without relying on GPUs. They also share the models, weights, and training recipes under an Apache 2.0 license. Cerebras is entering the generative AI space, following in the footsteps of NVIDIA. NVIDIA’s success in AI and machine learning was propelled by its CUDA platform and hardware developments for deep understanding.

Cerebras aims to compete directly with NVIDIA, emphasizing its ability to train large-scale models with high accuracy and cost efficiency. They completed training in record time using their CS-2 systems and unique weight-streaming architecture. Cerebras’ open-source efforts have been well-received in the community. The generative AI domain is booming, and NVIDIA dominates the GPU market. Cerebras aims to provide an alternative by offering high-performance models and open-source accessibility. Analyticsindiamag

Reshaping AI Chip Market: Challenging NVDA’s Monopoly with LLM Training

If even half of this is true, Cerebras has unequivocally demonstrated that LLMs can be trained without relying on GPUs and at a significantly reduced cost. This fact strongly suggests that it is only a matter of time before other industry players flock to this field. NVDA cannot expect to monopolize this lucrative territory unchallenged, especially when aided by AI. It must succeed in both the efficiency/performance and price battlegrounds.

Suppose another company develops a chip that matches or comes close to NVDA’s capabilities but at a considerably lower price. In that case, NVDA will be compelled to lower its costs, thus impacting its profit margins. As a result, investors may become more hesitant to pay exorbitant premiums. This scenario holds true for every company within this sector. In the near future, this once-exclusive domain will inevitably transform into a fiercely competitive battlefield.

Discover Exceptional and Informative Reads

The Mob Psychology: Why You Have to Be In It to Win It

What Is Collective Behavior: Unveiling the Investment Enigma

What is the Rebound Effect? Unlock Hidden Profits Now

Dividend Collar Strategy: Double Digit Gains, Minimal Risk, Maximum Reward

Dividend Capture Strategy: A Devilishly Delightful Way to Boost Returns

BMY Stock Dividend Delight: Reaping a Rich Yield from a Blue-Chip Gem

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

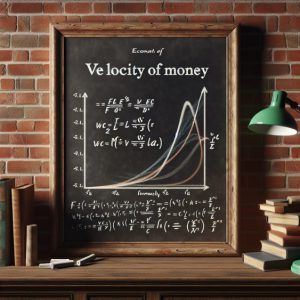

What Is the Velocity of Money Formula?

What is Gambler’s Fallacy in Investing? Stupidity Meets Greed

Poor Man’s Covered Call: With King’s Ransom Potential

How to Start Saving for Retirement at 35: Don’t Snooze, Start Now

The Great Cholesterol Scam: Profiting at the Expense of Lives

USD to Japanese Yen: Buy Now or Face the Consequences?

How is Inflation Bad for the Economy: Let’s Start This Torrid Tale