Currency War and Negative Rates

If you had told individuals before 2009 that we would be living in a negative rate environment in the near future, most would have treated you like a lunatic who had just escaped from Ward 12. Fast-forward a few years, and viola, bankers all over the world are embracing negative rates. Today, China devalued the Yuan to five-year lows, adding further fuel to the already blazing fire.

This means that the Fed will have no option but to lower rates and then Jump onto the negative rate bandwagon. Don’t listen to the crap the Fed has been mouthing for months that all is well; we can already see the all is good slogan breaking down to “it’s not as good as we thought” slogan. This will eventually change to “oh my God it’s darn right ugly out there” and we need to lower rates to prevent a catastrophe slogan. The same strategy has been used again and again; it works marvellously, so why stop now?

Pavlov his Dogs and A Currency War

The masses like Pavlov’s dogs have been trained very well, so there is no need to change the game plan. Keep the lie simple, repeat it over and over again and the masses will swallow it hook line and sinker. Crowd psychology clearly illustrates that the mass mindset is self-destructive; individuals with this mindset claim they are looking for something better but their actions speak otherwise. We will cover this issue in more detail in a separate article.

The first experiment was to maintain a low-rate environment. The second one was to Flood the system with money, which was achieved via QE. The third phase was to get the corporate world in on the act of flooding the markets with money, which was achieved through massive share buyback programs. The next stage is to introduce negative rates to the world to fuel the mother of all bubbles, which is currently underway.

In A Currency War, Savers are punished.

Central bankers are aware that people will save more and more due to fear; uncertainty is a great catalyst and moves a person from calm to panic rather rapidly. They know that many will remain wary even when banks start charging them a fee to hold onto their money. People are saving increasingly because of uncertainty; they don’t know the future, so they save even though it means taking on a loss. Experts will state that central bankers miscalculated, but the truth is that they did not miscalculate; this event was planned years in advance and with meticulous precision. Watch with surprise how the rate hike slogan will fizzle into “the cut the rates slogan”; Yellen already sounds more dovish with the passage of each day.

Many experts have stated that negative rates are a bad idea; this is true to a degree, but it depends on the angle of observation. If you sit down and take no action, then the response is “yes they are terrible”. However, you can use negative rates to your advantage if you are proactive. For example, this family is getting paid interest on their mortgage instead of paying interest to the bank. In other words, they are getting paid to take a mortgage.

Stock markets will trend higher.

Cheap Money leads to speculation and the stock market is the best place to speculate. Expect corporations to borrow even more money and use these funds to buy back their shares, thereby artificially boosting EPS. There is no shred of decency left in Wall Street, and as corporate officers, bonuses are tied to performance.

These chaps will do whatever it takes to boost share prices, even if it means creating an illusion that earnings are rising when, in fact, they could be flat or even dropping. All they want to do is make a killing; they could care less about the small guy. It’s easy, and Congress has deemed it to be legal, so there is nothing to stop them and everything in place to encourage this behaviour. We covered this topic in detail several times in the past 12 months and repeatedly stated that every pullback would be viewed as a buying opportunity.

Property prices will rise.

Negative rates will lower the cost of mortgages, and in many cases, individuals will receive a check from the banks for interest payments on the mortgage. Negative rates are already fuelling a property bubble in Sweden, a topic we covered recently. Property prices are also surging in the U.K, so it’s a matter of time before we experience the same phenomenon in the U.S. Bankers will almost certainly lower lending standards in the US; Barclays Bank has recently announced 0% down mortgages.

Improving GDP

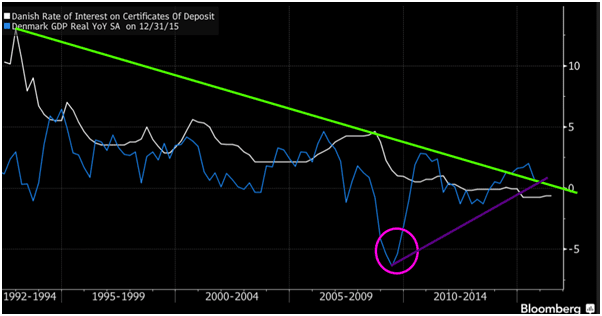

While such a proclamation appears insane, the chart below clearly reveals the opposite. Negative rates do create the illusion that the economy is working, and the masses seem to agree silently.

Denmark’s GDP started to rise, which was the program’s whole purpose. Note that shortly after the crisis of 2008-2009, rates were pushed lower faster than at any period before in the last 20 years; the lower they

dropped, the higher the GDP; in fact, one can conclude that it’s in an uptrend.

Game Plan

China’s decision to devalue on the Yuan clearly illustrates that the “devalue or die” program is being embraced worldwide. Nations will continue to devalue their currencies to stay competitive; the global economy is weak, and only hot money creates the illusion that all is well. Mass psychology indicates that the masses love to be told a sweet lie instead of the blunt truth. In that sense, they will get what they secretly desire: a market that looks magnificent from the outside but is rotten to the core from the inside. As we have yet to embrace negative rates, this market has a lot more upside.

A currency war will help Push Asset Prices Through the Roof.

This market will not soar because of fundamentals; fundamentally speaking, this market should be in the toilet. It will soar higher because of hot money. We expect property prices to continue trending upwards in the US, and eventually, when lending standards are lowered, we expect another property bubble to unfold. Regarding the stock market, the sentiment is negative, and a lot more money will flood this market once negative rates are here. Thus, the prudent, contrarian investor who does not let his emotions think, should view all strong pullbacks/corrections as buying opportunities.

Other Articles of Interest

Millennials being squeezed out of Housing Market (20 May)

Problem is Fractional Reserve Banking-we don’t need Gold Standard (15 May)

BBC Global 30 Index Signals Dow Industrial Index will trend higher (11 May)

Stock Market Bull not ready to buckle (4 May)

Fear mongers are parasites that profit from your fear (2 May)

Gold Bugs think & stop listening to Fear mongers (1 May)

Fear mongers are parasites that profit from your fear (27 April)

Which means that this market will fly to the moon one day before it crashes to Hell. The average person is too busy sucking his thumb and watching TV (Khardishans and other crap) to realize what’s going on.

Thoroughly enjoy your take. Thanks for posting.

You are welcome. Slowly more individuals are coming on board to the idea that this market is being driven higher by pure fraud; in other words, hot money that is created out of thin air

You seem to have a good grasp of what’s going on

Excellent explanation of rates and futures. I wish I could find a good explanation of where the USD vs CAD valuation will be in the future, so I can decide when to exchange my CAD to USD.