Embracing the Nasdaq TQQQ: A Reflective Look at Risks & Rewards

Updated Dec 15, 2023

The Nasdaq TQQQ, a leveraged exchange-traded fund (ETF), is designed to deliver triple the daily performance of the Nasdaq-100 Index. This means that when the Nasdaq-100 Index increases by 1%, the TQQQ should theoretically increase by 3%. This leverage can magnify both gains and losses, making the TQQQ a high-risk, high-reward investment vehicle.

The TQQQ’s allure lies in its potential for outsized returns. When the Nasdaq-100 performs well, the TQQQ can provide exponential gains. However, this leverage works both ways. If the Nasdaq-100 declines, the TQQQ’s losses can be severe. This inherent volatility makes the TQQQ a tool best suited for experienced investors who understand the risks.

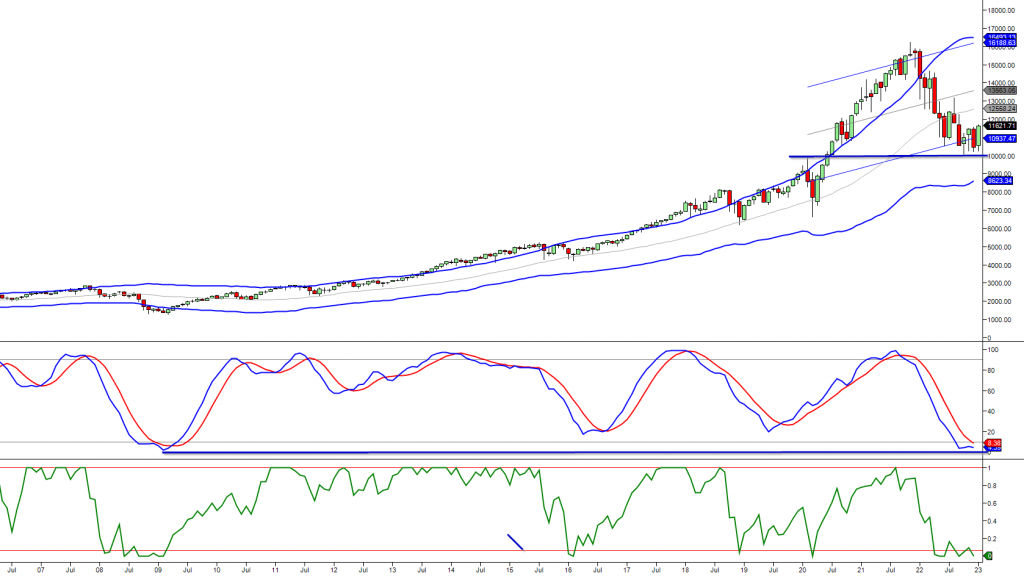

The current market conditions, with the Nasdaq index’s oversold status and the MACDs nearing their 2009 lows, suggest a potential buying opportunity. However, it’s crucial to remember that the TQQQ is not a buy-and-hold investment. Its structure is designed for short-term trading, and holding it for extended periods can lead to significant losses, especially in volatile markets.

With the MACDs hovering close to their 2009 lows, the Nasdaq TQQQ offers an enticing opportunity for those seeking a “screaming buy.”

However, like any Orwellian narrative, the journey is uncertain. History suggests that the markets often experience one more downward move after an unusually long correction. Therefore, it is essential to remain cautious and vigilant when considering the Nasdaq TQQQ.

The Risks and Rewards of Nasdaq TQQQ

It’s important to note that the TQQQ is designed to deliver triple the daily performance of the Nasdaq-100 Index. This means that while it can provide substantial gains when the Nasdaq-100 is performing well, it can also experience significant losses when the index declines. The leverage inherent in the TQQQ amplifies both the upside and downside potential, making it a high-risk investment.

Investors considering the Nasdaq TQQQ should carefully assess their risk tolerance and investment goals. It is not suitable for conservative or long-term investors seeking stable returns. Instead, it is better suited for experienced traders who actively monitor the market and are comfortable with the potential volatility.

Furthermore, timing is crucial when investing in the TQQQ. As the market fluctuates, it’s important to be aware of the Nasdaq’s technical levels and monitor indicators such as the monthly closing price. Understanding the broader market trends and having a well-defined exit strategy can help mitigate potential losses and maximize gains.

A Reflective Approach to Nasdaq TQQQ Investing

By taking a reflective approach, investors can assess their risk tolerance and investment goals before allocating funds to the Nasdaq TQQQ. It’s important to understand that the TQQQ is a leveraged ETF, which means it aims to deliver triple the daily performance of the Nasdaq-100 Index. This leverage can amplify both gains and losses, making it crucial to consider the potential risks involved carefully.

One strategy to mitigate risk is to use limit orders when entering the market. This allows investors to set specific price levels at which they are willing to buy or sell, ensuring precise entry points and avoiding impulsive decisions driven by market fluctuations. Investors can make more informed choices by taking the time to reflect on their investment decisions and setting clear parameters.

Additionally, staying informed about the market conditions and trends is crucial. Regularly monitoring the performance of the Nasdaq-100 Index and conducting thorough research on individual stocks can provide valuable insights for making investment decisions. This reflective approach helps investors navigate the ever-changing investing landscape and make informed choices based on their analysis.

In conclusion, embracing the potential of the Nasdaq TQQQ requires a reflective and measured approach. By carefully assessing risk tolerance, using limit orders for precise entry points, and staying informed about market conditions, investors can position themselves to potentially benefit from the rewards offered by the Nasdaq TQQQ. However, it’s important to remember that investing always carries inherent risks, and seeking professional advice is advisable before making any investment decisions.

Aggressive Tactics for TQQQ Investment

Engaging in TQQQ, an ETF seeking three times the daily NASDAQ-100 Index performance, proves potent for bold investors. Yet, heightened returns coincide with escalated risk. Strategies for the daring investor:

1. Dollar-Cost Averaging:** Invest a fixed amount in TQQQ at regular intervals, mitigating the impact of volatility over time. Effective for risk-tolerant long-term investors.

2. Hedging with Inverse ETFs:** Consider hedging TQQQ with inverse ETFs like SQQQ, offsetting potential losses if the market declines. Requires vigilant monitoring.

3. De-Risking Approach:** Gradually reduce exposure to TQQQ upon financial milestones to secure gains and guard against losses.

4. Diversification:** Even in aggressive strategies, balance TQQQ investments with other assets for risk dispersion.

5. Regular Monitoring and Adjustment:** As TQQQ isn’t designed for long-term holding, frequent monitoring and adjustment are vital for alignment with daily objectives.

While TQQQ offers robust returns in a bullish market, understanding and managing associated risks are paramount. Investors must assess their risk tolerance and goals before diving into leveraged ETFs like TQQQ.

Conclusion

However, it is crucial to acknowledge the risks involved in investing in the Nasdaq TQQQ. The leverage inherent in the TQQQ amplifies both gains and losses, making it a high-risk investment vehicle. The potential for outsized returns comes with the potential for significant losses, especially in a declining market. Investors must carefully assess their risk tolerance and investment goals before considering the TQQQ as part of their portfolio.

Taking a reflective approach to Nasdaq TQQQ investing can help mitigate some of these risks. By carefully analyzing market conditions, monitoring technical indicators, and setting clear entry and exit points, investors can make more informed decisions. Utilizing limit orders can provide precise entry points and reduce the impact of impulsive trading decisions driven by market fluctuations.

Furthermore, staying informed about the broader market trends and conducting thorough research on individual stocks can provide valuable insights for making investment decisions. This reflective approach, combined with a strategic mindset, can help investors navigate the ever-changing investing landscape and potentially capitalize on the rewards offered by the Nasdaq TQQQ.

In conclusion, the Nasdaq TQQQ presents an enticing opportunity for investors seeking significant gains in the current market environment. However, it is crucial to approach this investment avenue with caution and a reflective mindset. Understanding the risks associated with leverage, setting clear parameters, and staying informed are essential components of a robust investment strategy. By carefully weighing the risks and rewards, investors can position themselves to benefit from the Nasdaq TQQQ’s potential while managing the inherent volatility and uncertainties of the market.

FAQs

| Question | Answer |

|---|---|

| What is the Nasdaq TQQQ? | The Nasdaq TQQQ is a leveraged exchange-traded fund (ETF) that seeks to deliver triple the daily returns of the Nasdaq 100 index. |

| What are the benefits of investing in the Nasdaq TQQQ? | The Nasdaq TQQQ offers potential significant gains for investors seeking to capitalise on the current market dynamics. Its inherent leveraged nature allows investors to amplify their returns as the Nasdaq recovers. |

| What are the risks associated with investing in the Nasdaq TQQQ? | The same leverage that allows investors to amplify their returns can also exacerbate losses in a declining market, making the Nasdaq TQQQ a double-edged sword. It is essential to remain cautious and vigilant when considering the Nasdaq TQQQ. |

| How should investors approach investing in the Nasdaq TQQQ? | To embrace the Nasdaq TQQQ’s potential, one must take a reflective and measured approach. As the Dow trades within specific ranges, investors can consider deploying a portion of their funds into various stocks using limit orders. This method allows for precise entry points and avoids the stress of hastily entering the market. |

| What should investors be aware of when considering the Nasdaq TQQQ? | After an unusually long correction, the markets often experience one more downward move. Therefore, weighing the associated risks carefully and adopting a reflective and strategic approach is necessary. It is also essential to remain cautious and vigilant when considering the Nasdaq TQQQ. |

Read, Learn, Grow: Other Engaging Articles You Shouldn’t Miss

The Cycle of Manipulation in Investments

Market Opportunity: Buy The Fear & Sell The Noise

Investor Sentiment Data Manipulation: Unveiling Intriguing Insights

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Stock Books For Beginners: Investing Beyond the Pages

Psychological Manipulation Techniques: Directed Perception

False Information and Its Consequences

Investor Beware: How Primal Fears Could Be Ruining Your Portfolio

Winning with Nasdaq 100 ETF: Riding the Right Side of the Trend

Stock Market Trend Analysis Decoded: Unveiling the Insights

Risk To Reward Ratio & Opportunity Vs Risk

What Is Fiat Money: USD Is Prime Example Of Fiat