Updated Jan, 2024

Death Trap: A Closer Look at Median Household Income Trends

In the past decade, the narrative of the middle-income squeeze has been a persistent theme in economic discussions. The term refers to the stagnation or decline in median household income, which, when adjusted for inflation, suggests that the average family is not significantly better off than they were years ago. This stagnation is often juxtaposed with rising living costs, including healthcare, education, and housing, further exacerbating middle-class families’ financial pressures.

As of the latest data, median household income has shown signs of fluctuation, with periods of growth followed by stagnation or decline. The economic impact of the COVID-19 pandemic, for instance, caused significant disruptions in 2020, with recovery patterns varying widely across different sectors and demographics. However, the years following the pandemic have gradually recovered employment rates and a corresponding increase in median household income in some regions.

Wage Growth in Context

The growth of average hourly wages has been a critical factor in assessing economic health. While the 1970s and 1980s saw robust year-over-year wage increases, recent years have witnessed more modest growth. For example, the average hourly wage for non-management private-sector workers has risen. Still, when this figure is adjusted for inflation, the purchasing power parallels that of several decades ago. This suggests that while nominal wages may be rising, the real value of those wages has not kept pace with the cost of living.

Inflation is a silent force that erodes purchasing power over time. A salary that once afforded a comfortable lifestyle may now be insufficient to cover basic expenses. The Consumer Price Index (CPI), which measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, is often used to gauge inflation. When wages do not rise in tandem with inflation, households may find it increasingly difficult to maintain their standard of living.

Economic policies play a significant role in shaping the trajectory of median household income. Tax policies, minimum wage laws, and social welfare programs directly impact disposable income. For instance, changes in tax brackets or the introduction of new tax credits can alleviate or exacerbate the financial burden on middle-income families.

The Future of Median Household Income

Looking ahead, the future of median household income will likely be influenced by various factors, including technological advancements, globalization, and demographic shifts. Automation and artificial intelligence, for example, are expected to transform the job market, potentially displacing certain types of employment while creating new opportunities in other areas.

The middle-income squeeze is a complex issue with roots in various economic, social, and policy-related factors. While recent data shows some improvement, the long-term trend of median household income will depend on many variables, including wage growth, inflation rates, and the effectiveness of economic policies designed to support the middle class. As we continue to navigate the post-pandemic economic landscape, monitoring these trends and implementing strategies that promote sustainable growth and equitable income distribution will be crucial.

Let’s examine the situation from a historical perspective. Learning from history helps avoid repeating mistakes.

Median household income declining: The losing game

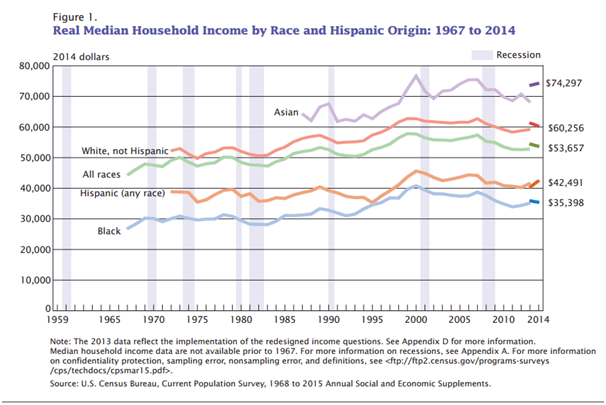

This chart clearly illustrates that median household income has declined over the years, despite big claims from the BLS that more people are working and that the economic outlook is improving. How can the situation improve if people work longer hours and take home less pay? In fact, since 2000, household income for every race has been dropping. This is not what an economic recovery should look like. This is what an economic decline looks like.

Median household income declining: Some facts to consider

The average Hourly wage for Non-Management private sector workers in Sept 2015 was $20.67, 2.3% higher year over year. Considering that wages usually increased 8%-9% year-over-year in the ’70s and ’80s, this mediocre increase is laughable.

Things get worse when adjusted for inflation; today’s average hourly wage has the same purchasing power as in 1980. A salary of $4.03 an hour in 1973 has the same purchasing power as roughly $23.00 (to be exact, the figure is $22.41)

Unraveling the Enigma of Obama’s Economic Recovery

In the intricate tapestry of economic dynamics, the ominous trend of declining median household income casts a foreboding shadow over the aspirations of millions. As we delve into the labyrinth of statistics and trends, a disturbing truth emerges: the heralded recovery under the Obama administration may be nothing more than a mirage, leaving the average American grappling with the harsh reality of financial decline.

The Alarming Numbers

The Mirage of Recovery

Amidst the political fanfare surrounding the Obama administration’s economic recovery, scrutinising the purported revival’s intricacies is crucial. The phrase “Obama Economic Recovery a sham” begins to echo in the corridors of discourse, challenging the prevailing narrative that paints a picture of sustained economic growth and prosperity.

Was the recovery a genuine upliftment of the average American, or did it merely serve as a smokescreen, concealing the underlying fragility of the economic structure?

Unveiling the Layers

To unravel this enigma, we must peel back the layers of economic policies and their impact on citizens’ daily lives. The Federal Reserve’s low-interest-rate policies, implemented to stimulate economic growth, have undoubtedly influenced the recovery trajectory. However, the ripple effect on household incomes reveals a different story.

While the financial markets experienced a bull run and corporate profits soared, the benefits failed to cascade to the average household. The chasm between Wall Street and Main Street widened, leaving the middle class to grapple with stagnating wages and a rising cost of living.

The Middle-Class Squeeze

The Psychological Impact

Beyond the numerical landscape, it is imperative to delve into the psychological impact of declining median household income. Financial strain transcends the realms of mere numbers; it seeps into the collective psyche of a nation. A population burdened by economic anxiety is prone to a myriad of societal repercussions, from strained familial relationships to diminished faith in the institutions that shape their financial reality.

Mass psychology, a subtle yet powerful force, begins to shape the narrative. The disillusionment stemming from the apparent disparity between political promises and lived experiences fosters a sense of resentment, creating a breeding ground for social unrest.

The Ripple Effect on Consumer Behavior

As the echoes of economic downturn reverberate through the collective consciousness, consumer behaviour becomes a pivotal factor in understanding the ramifications of declining median household income. A populace grappling with financial uncertainty tends to tighten their belts, curbing discretionary spending and creating a ripple effect across industries.

Businesses, in turn, respond to the shrinking consumer demand by tightening their own belts — a cyclical pattern that exacerbates the economic downturn. The very essence of a consumer-driven economy begins to waver, calling into question the sustainability of the touted recovery.

The Unseen Victims

Rethinking Economic Policies

In light of these revelations, a reevaluation of economic policies becomes imperative. The disparity between the economic elite and the average citizen cannot be dismissed as a mere coincidence. It demands a nuanced approach that prioritizes the well-being of the middle class and addresses the root causes of declining median household income.

This is not a call for a return to outdated economic models, but a plea for innovation that ensures the benefits of economic growth are distributed equitably. A sustainable recovery must be measured not just in GDP figures but in the tangible improvements in the lives of everyday citizens.

Conclusion

The facade of a robust economic recovery can be deceptive, with the stock market’s buoyant rally often concealing the grim reality experienced by a substantial portion of the population. Despite the apparent financial uptick, a pervasive recession persists, casting a shadow on the daily lives of many Americans.

While stock market indices surge to new heights, a stark contrast unfolds in the households of the average American. The notion that prosperity has returned eludes a significant fraction of the population as they find themselves navigating a financial landscape marred by difficulties and uncertainties. Fueled by soaring stock values, the prevailing narrative of a resurgent economy masks the harsh truth that many individuals lack the means or confidence to participate in the market.

A striking illustration of this disconnect is the prevalence of coffee consumption over stock ownership. Today, more Americans are reaching for a cup of coffee than delving into the complexities of stock investments. The underlying reasons extend beyond mere financial constraints; a pervasive perception of financial fragility discourages many from exploring investment opportunities, even when they may have the means to do so.

Unveiling the layers beneath seemingly rising salaries reveals a complex tapestry where inflation erodes the actual purchasing power of individuals. The nominal wage increase does little to alleviate the burdens faced by those who find themselves working longer hours for diminishing returns. The paradox of apparent economic growth juxtaposed with a surge in families seeking financial aid and reliance on food stamps highlights the persistent challenges that belie the notion of a full-fledged recovery.

In this intricate economic landscape, appearances often belie the underlying struggles a considerable segment of the population faces. As the market rallies, a closer examination of the daily lives of individuals reveals a more nuanced and challenging reality that complicates the narrative of a conclusive economic recovery.

Journey of Discovery: Fascinating Reads

The Hidden Hand: Exposing Media’s Mastery in Swinging Public Sentiment