Thriving with Financial Psychology Mastery: A Counter-Cyclical Discourse

As a man handles his troubles during the day, so he goes to bed at night as a General, Captain, or Private. Edgar Watson Howe

Updated Sept 27, 2023

Welcome to the compelling world of financial psychology, where the ebbs and flows of market sentiment can create a rich tapestry of opportunities. This counter-cyclical discourse aims to illuminate the symbiotic relationship between major historical events and their impact on the financial markets.

Consider, for instance, the tumultuous political landscape of the Trump vs. Hillary election. Politics, in its very essence, often appears to be a battleground for power-hungry individuals, a realm dominated by those who thrive amidst chaos and uncertainty. However, beneath this unsettling veneer lies a treasure trove of financial opportunities for the discerning investor.

When the Trump vs. Hillary battle reached its crescendo, it created ripples of uncertainty that echoed through the financial markets. Yet, in this very uncertainty, astute investors found a silver lining. The market turmoil presented a golden opportunity to buy low and sell high once the dust settled, turning perceived instability into substantial financial gain.

History, in its wisdom, provides invaluable lessons. We can identify patterns and strategies to capitalize on future market fluctuations by examining and understanding past events. If Trump were to run for president again, despite his plethora of controversies, the ensuing uncertainty could offer another lucrative opportunity for savvy investors.

We must clarify that this discourse does not comment on any political figure’s merits or shortcomings. Instead, it’s about recognizing and seizing financial opportunities arising from the unpredictable dynamics of global events. Whether you are a seasoned investor or a novice, understanding the psychology behind financial markets can equip you with the insight to navigate uncertainties and turn them into profitable ventures.

By mastering financial psychology, we can tap into the market’s pulse, transforming tumultuous periods into fruitful opportunities. This journey demands a keen eye for detail, an understanding of historical patterns, and the courage to venture into the untamed territories of the financial world. Let’s embark on this journey together, harnessing the power of financial psychology to thrive in the ever-evolving economic landscape.

Capitalizing on Election Debate Volatility: A Market Perspective

Contrary to popular belief, the recent election debate is not just a political affair but a market-moving event. Despite initial optimism surrounding Donald Trump’s presence, the markets quickly turned downward. Regardless of personal opinions on the former president, it cannot be denied that his impact on the market is reminiscent of the Brexit fallout – albeit on a smaller scale.

However, the market reaction would be much larger if Trump were to win the election. The positive market response to Hillary Clinton’s performance in the first debate further solidifies our long-standing argument that pullbacks should be viewed as opportunities for savvy investors.

It’s time to challenge conventional wisdom and embrace the reality of the market’s reaction to political events. The market’s response to the election is a testament to the power of polarizing individuals and their impact on the financial world. The smart move is to embrace the volatility and turn it into a profitable opportunity.

Enhancing Your Understanding of Stock Market Psychology: A Contrarian Perspective

From a contrarian perspective, a Trump victory in the election could be seen as a positive development. While non-contrarians may question this stance, the principles of mass psychology suggest that the majority is often misguided.

In the event of a Trump win, uncertainty would likely arise, causing the masses to panic and sell off their investments. This, in turn, could present a buying opportunity for those who can maintain a level head and see past the fear.

Conversely, if Hillary were to win, markets would initially rally before pulling back due to the “buy the rumour, sell the news” effect. On the other hand, a Trump victory would elicit a strong reaction, which could be interpreted as a chance to buy.

According to mass psychology, the key to successful investing is to sell when the masses are overly optimistic and buy when they are pessimistic. With a Trump win, widespread pessimism may present an investment opportunity.

Please note that this perspective does not represent any political stance but rather a viewpoint on market behaviour.

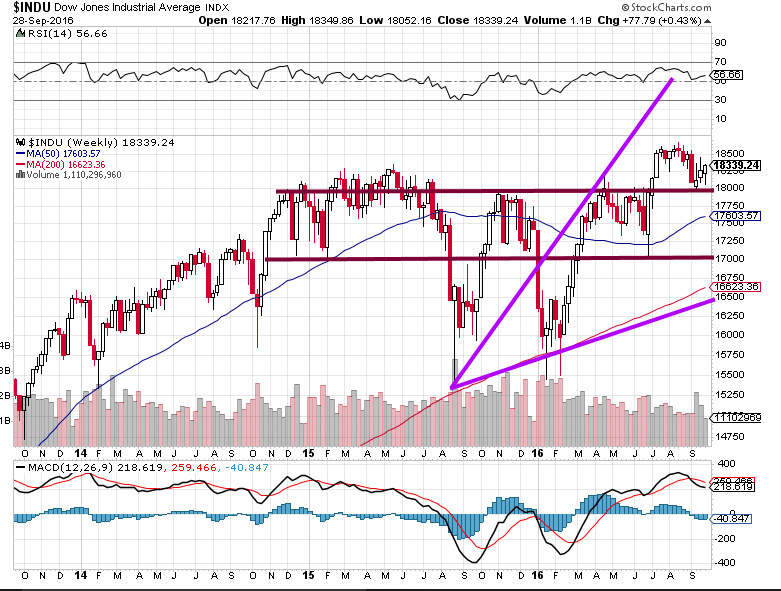

Financial Psychology and Market Trends: Unraveling Charts and Contrarian Outlook in the Stock Market

Charting the Ebb and Flow of Market Action

Permit me to present a different perspective on the current market trend and the impact of the upcoming election. It has been observed that, in the eyes of a contrarian, a potential victory for Mr Trump could be viewed as a positive development. The masses, as it were, are often found to be on the wrong side of the equation according to the principles of Mass Psychology.

In the event of a Trump win, uncertainty would be anticipated to grip the market, leading to a sharp pullback. However, this presents a buying opportunity for those who do not allow their emotions to govern their actions. On the other hand, if Mrs Clinton were to win, the market would likely rally initially, only to pull back subsequently due to the “buy the rumour, sell the news” effect.

It is worth noting that before the current pullback, we had predicted that the Dow was more likely to test the 18,000 range than reach 20,000, as the media had become overly bullish. This came to pass as the Dow traded briefly below 18,000. Subsequently, we expected the market to rally towards the 19,000 range. Still, the uncertainty generated by Mr Trump’s recent resurgence has acted as a new VIX factor, causing the market to trend in that direction. However, trading significantly beyond 19,000 may be limited until the election outcome is determined.

If Mr Trump’s numbers improve, expect an intense about of volatility in the market. Conversely, if his numbers decrease, the market will be less volatile.

Market Outlook in the Wake of a Hillary Victory:

We must delve into the contrarian realm and consider the election’s potential outcomes. Before the recent market pullback, it was noted that the Dow Jones was likely to touch the 18,000 range rather than reach the highly-touted 20,000 mark, as the media was becoming overly optimistic. Indeed, the Dow briefly dipped below 18,000, leading us to anticipate a rally towards 19,000.

However, with the resurgence of Mr Trump, uncertainty has once again gripped the masses, and, in a sense, he has become the new VIX factor. The trend should continue in this direction, though it may be difficult for the Dow to surpass 19,000 until the elections have come and gone. If Mr Trump’s numbers improve, we can expect great market volatility. If, on the other hand, his numbers decline, market volatility will be less pronounced.

In the event of a victory for Mrs Clinton, we expect the Dow to rally initially, followed by profit-taking and a modest pullback. But if Mr Trump wins, there is a strong likelihood of the Dow breaking through the first layer of support in the 17,800 to 18,000 range, leading it to drop as low as 17,000. This would present a fantastic buying opportunity for the astute investor.

It has been some time since this market has undergone a significant correction, and a Trump victory would provide the perfect backdrop for the market to release pent-up steam. And, if the masses were to panic, the Dow could drop even further, to the 16,500 to 16,800 range, presenting a “screaming buy” scenario from a contrarian perspective.

Political Divisiveness & its Negative Impact on Markets and Investors

dance when the crowd panics and standstill when they jump up with joy. Sol Palha

From a contrarian standpoint, a Trump victory in the elections may be viewed as a positive development in the financial market. Mass psychology clearly illustrates that the masses are misguided and on the wrong side of the equation. Thus, a win for Trump, who represents uncertainty, may result in a sharp sell-off. However, this will be an opportunity for those who can control their emotions.

On the other hand, a win for Hillary, who is as corrupt as sin, could lead to an initial rally followed by a pullback as traders bank their profits. The reaction may not be as strong as it would be in case of a Trump victory. But the overreaction to a Trump win will prove to be a buying opportunity.

If Trump does win, the market may likely drop to the 17,000 range, providing an attractive buying opportunity for contrarian traders. However, in a panic, the market may overshoot to the 16,500-16,800 range, creating an even better buying opportunity.

It would be wise to heed the advice of market experts and embrace corrections, whether in the wake of Brexit or a Trump victory, as buying opportunities. The naysayers may loudly predict doom and gloom. History has shown us that such predictions are often misguided. Ultimately, the decision on who makes a better candidate is left to the individual reader.

if Trump wins. All the Naysayers from every crack and crevice will emerge screaming the end of the world and when the world does not end they will be forced to crawl under the rock again. Sol Palha

The Complex Relationship Between Politics and the Stock Market

It is widely acknowledged that election outcomes can impact the stock market, but the relationship between political events and market performance can be complex. Some experts believe that the election of President Biden and the Democrat’s control of Congress brought stability to the policy environment. However, others argue that the stock market has performed poorly, and inflation has been high under the Biden administration. The facts seem to support the latter, with 2022 being one of the worst years in market performance and inflation at a multi-decade high.

The ongoing political polarization in the United States is causing uncertainty and instability in the stock market, contributing to a toxic and divisive public discourse that has eroded public trust and reduced social cohesion. This, in turn, is causing investors to become increasingly risk-averse. While many factors influence the stock market, including economic conditions, geopolitical events, and investor sentiment, political events and policies can play a significant role in the market, especially when they are not in line with the desires and expectations of the nation’s citizens.

The Impact of Political Divisiveness on Investor Confidence

Michel de Montaigne’s Wisdom and Its Relevance to Market Polarization and Psychology

Meta Description: Explore how political divisiveness can harm investor confidence and learn how Michel de Montaigne’s insights can help you navigate the stock market in a polarized world.

Political polarization has reached new heights recently, with politicians and citizens becoming increasingly entrenched in their beliefs. While this may benefit political parties, it is unsuitable for the financial markets and investors. Political divisiveness can lead to increased volatility in the stock market, decreasing investor confidence and making it difficult for businesses to secure funding and for individuals to plan for their financial future.

The French Renaissance philosopher and writer Michel de Montaigne believed that the key to wisdom was to question one’s beliefs and consider alternative perspectives. He would likely argue that ongoing political divisiveness harms society, including the financial markets, if he were alive today. In the context of political divisiveness, politicians and citizens should consider the impact their actions and beliefs have on the financial markets and the economy.

Bad times have a scientific value. These are occasions a good learner would not miss.

Ralph Waldo Emerson

Originally published on September 29, 2016, this continuously updated piece includes the latest revisions as of September 27, 2023

FAQ: Understanding Financial Psychology

Q: What is the market reaction to the election?

A: The election is a market-moving event. The markets initially turned down but may present an opportunity for savvy investors.

Q: What is the contrarian perspective on a Trump victory?

A: A Trump victory may be seen as a positive development from a contrarian perspective. It presents a buying opportunity for those who can maintain a level head and see past the fear.

Q: How does mass psychology affect investing?

A: According to mass psychology, the key to successful investing is to sell when the masses are overly optimistic and buy when they are pessimistic.

Q: What is the outlook in the wake of a Hillary victory?

A: If Mrs Clinton were to win, the market would likely rally initially, only to pull back due to the “buy the rumour, sell the news” effect.

Q: What is the negative impact of political divisiveness on the market?

A: Political divisiveness can hurt the market and investors. Maintaining a level head is necessary, and not letting emotions govern investment decisions.

Other Articles of Interest

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

South China Sea Showdown: Intensifying Heat on the Horizon

Will the Stock Market Crash: Analyzing Possibilities and Implications

China Quantitative Easing: Battling Economic Slowdown

What is Data Manipulation: The Dark Side?

Corruption in China: Government’s Aggressive Crackdown on Wrongdoings

These Are The Things That Scare Americans The Most

The Observer vs. The Participator: Shaping Change

Exotic Art: The Fusion of Art and AI Brilliance

Inductive vs Deductive Approach: The Path to Massive Gains

China Stock Market Live News: Stay Informed for Smart Investing

China Super Power? Unveiling the Extraordinary Journey

Raytheon Company To Buy or To Flee

Iceland Porn: Tackling the impact of porn on youths

The AI Future of Work: Transforming Industries and Empowering Individuals