Market Trends 2024: Think Long, Not Short, Short-Term Traders Get Shot

As we navigate the complex landscape of financial markets in 2024, a crucial lesson emerges the importance of long-term thinking over short-term speculation. This essay explores the dangers of short-term investing and thinking, drawing insights from mass psychology, cognitive psychology, evolutionary psychology, and technical analysis. By understanding these perspectives, investors can make more informed decisions and avoid the pitfalls that often ensnare short-term traders.

The Perils of Short-Term Thinking

While potentially lucrative, short-term trading carries significant risks that can lead to financial ruin. Dr Terrance Odean, a behavioural finance expert at the University of California, Berkeley, has extensively studied the performance of individual investors. His research shows that frequent traders tend to underperform the market significantly. “The more you trade, the less you earn,” Odean concludes, highlighting the counterintuitive nature of short-term trading strategies.

One of the primary dangers of short-term investing is the increased exposure to market volatility. Dr. Andrew Lo, professor of finance at MIT Sloan School of Management, explains, “Short-term traders are essentially trying to time the market, which is notoriously difficult even for professionals.” This approach often leads to emotional decision-making, where fear and greed drive actions rather than rational analysis.

Moreover, short-term trading incurs higher transaction costs and taxes, eroding potential profits. As Dr. Brad Barber of the University of California, Davis, notes, “After accounting for trading costs, the average individual investor underperforms a market index by 1.5% per year.” This performance gap widens for more active traders, emphasizing the hidden costs of frequent trading.

Mass Psychology and Market Behavior

We must delve into mass psychology to understand why short-term trading can be so difficult. Dr Robert Shiller, Nobel laureate in economics, argues that financial markets are driven by “animal spirits” – the emotional and irrational factors influencing human behaviour. These psychological forces can lead to market bubbles and crashes, particularly dangerous for short-term traders.

The concept of herd behaviour, a cornerstone of mass psychology, is especially relevant in financial markets. Dr Hersh Shefrin, a pioneer in behavioural finance, explains, “Investors often follow the crowd, buying when others are buying and selling when others are selling. This creates self-reinforcing cycles that can drive prices far from their fundamental values.”

Short-term traders are particularly susceptible to these psychological traps. The fear of missing out (FOMO) can lead to impulsive buying at market peaks, while panic selling during downturns can lock in losses. Dr Daniel Kahneman, psychologist and Nobel laureate, describes this as the “hot-cold empathy gap,” where individuals in an emotional state struggle to predict their behaviour in a different emotional state.

Cognitive Biases and Short-Term Trading

Cognitive psychology offers further insights into the pitfalls of short-term trading. Dr. Amos Tversky and Dr. Daniel Kahneman’s work on prospect theory reveals that individuals are more sensitive to losses than to equivalent gains. This loss aversion can lead short-term traders to hold onto losing positions too long or cut winning positions too early.

Another cognitive bias that plagues short-term traders is the illusion of control. Dr. Ellen Langer, professor of psychology at Harvard University, has shown that individuals often overestimate their ability to influence outcomes in situations governed by chance. In the trading context, this can lead to overconfidence and excessive risk-taking.

Confirmation bias, the tendency to seek information confirming pre-existing beliefs, is also prevalent among short-term traders. Dr. Raymond Nickerson, a cognitive psychologist, warns that this bias can lead to a distorted view of market conditions and missed opportunities for course correction.

Evolutionary Psychology and Risk-Taking

Evolutionary psychology provides a fascinating perspective on why humans are prone to short-term thinking and risk-taking behaviours in financial markets. Dr. Gerd Gigerenzer, director of the Harding Center for Risk Literacy, argues that our brains evolved to make quick decisions in uncertain environments, which can be maladaptive in modern financial markets.

The “fight or flight” response, a remnant of our evolutionary past, can lead to impulsive decisions in high-stress trading situations. Dr. John Coates, a former Wall Street trader turned neuroscientist, has studied the biology of risk-taking. He found that testosterone levels in male traders rise during winning streaks, potentially leading to excessive risk-taking and irrational exuberance.

Furthermore, our ancestors’ focus on immediate survival may explain our difficulty in planning for the long term. Dr. David Buss, an evolutionary psychologist at the University of Texas, suggests that our brains are not naturally wired for long-term financial planning, making it challenging to resist the allure of short-term gains.

Technical Analysis and Long-Term Trends

While technical analysis is often associated with short-term trading, it can provide valuable insights for long-term investors. Dr Andrew Lo’s Adaptive Markets Hypothesis proposes that market efficiency is not constant but varies over time. This theory suggests that technical analysis can be practical when markets are inefficient, but its usefulness diminishes as markets become more efficient.

Long-term trend-following strategies based on technical analysis have shown promise in capturing major market moves while avoiding the pitfalls of short-term noise. Dr. Clifford Asness, co-founder of AQR Capital Management, has demonstrated that trend-following strategies can provide significant returns over long periods while offering protection during market downturns.

The Power of Long-Term Thinking

In contrast to the dangers of short-term trading, long-term investing offers numerous advantages. Warren Buffett, perhaps the most famous proponent of long-term investing, once said, “The stock market is designed to transfer money from the active to the patient.” This wisdom is supported by empirical evidence.

Dr. Jeremy Siegel, professor of finance at the Wharton School, has extensively studied long-term stock market returns. His research shows that over periods of 20 years or more, stocks have consistently outperformed other asset classes, providing a compelling argument for patience in investing.

Long-term thinking also benefits investors from compound interest, which Albert Einstein allegedly called “the eighth wonder of the world.” By reinvesting dividends and allowing investments to grow over time, long-term investors can harness the power of exponential growth.

Moreover, a long-term perspective enables investors to weather short-term market volatility and economic cycles. Dr. Robert Novy-Marx, professor of finance at the University of Rochester, has shown that value investing strategies, which typically require patience and a long-term outlook, tend to outperform over extended periods.

Example: Covid Crash 2020

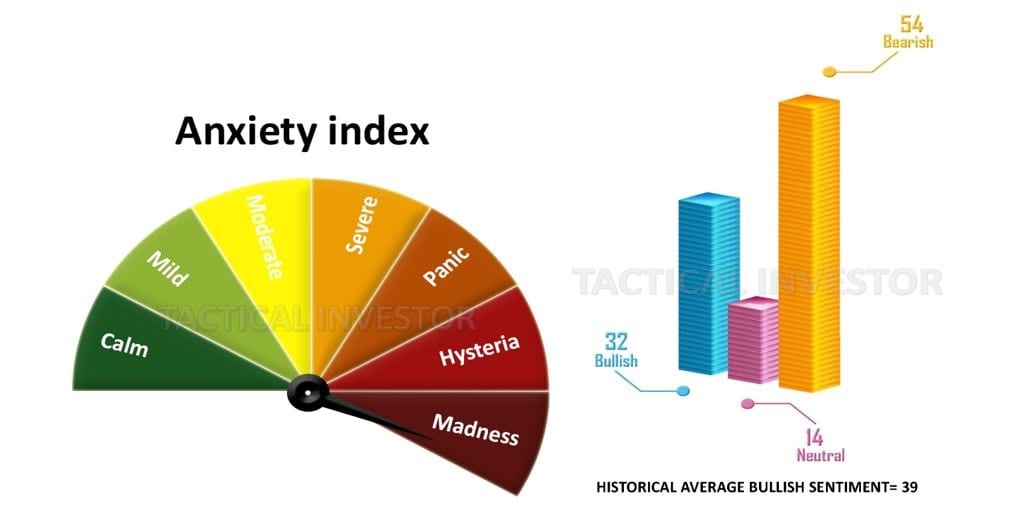

The masses are hysterical over the coronavirus issue, leading them to dump valuable stocks indiscriminately. History indicates this is the best time to open large positions, exactly what we do at the Tactical Investor. We are investing strategically in some of the best companies in the technology and AI sectors. These companies were selling at hefty premiums just a few weeks ago, but now they are almost being given away.

Conclusion: Embracing the Long View

As we look ahead to market trends in 2024 and beyond, the evidence overwhelmingly supports the adage “think long, not short.” The dangers of short-term trading – increased volatility, higher costs, and susceptibility to psychological biases – make it a risky proposition for most investors.

Investors can develop strategies that align with their long-term goals by understanding the insights from mass psychology, cognitive psychology, evolutionary psychology, and technical analysis. This approach offers the potential for superior returns and provides peace of mind in market turbulence.

Dr Meir Statman, a behavioural finance expert at Santa Clara University, wisely notes, “The road to financial well-being is paved with patience, not panic.” By embracing long-term thinking and resisting the urge to engage in short-term speculation, investors can position themselves for success in the ever-changing landscape of financial markets.

Ultimately, the markets of 2024 and beyond will likely reward those with the discipline to think long-term, while short-term traders may find themselves metaphorically “shot” by the volatility they seek to exploit. As we navigate the complexities of modern financial markets, let us heed the lessons of history, psychology, and empirical research and embrace the power of patience and long-term thinking in our investment strategies.

Other Articles of Interest

Dow theory no longer relevant-Better Alternative exists