The Enigma of Market Psychology and Crowd Dynamics: Adapt, Adjust or Vanish

March 24, 2024

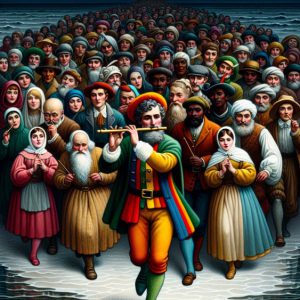

In the ever-shifting tides of the financial markets, a profound truth echoes through the ages: “The crowd is untruth.” This timeless wisdom, imparted by the philosopher Søren Kierkegaard, encapsulates the essence of market psychology and crowd dynamics. In this realm, the masses often succumb to the allure of herd mentality, leaving those who dare to think independently to reap the rewards.

As legendary Benjamin Graham sagely observed, “The investor’s chief problem—and even his worst enemy—is likely to be himself.” This human element, the interplay of emotions, biases, and collective behaviour, shapes the ebb and flow of market trends, creating peril and opportunity for those who can decipher its intricate patterns.

Seizing Opportunity Amidst Chaos: Buying When Others Flee in Fear

In the markets, the wise investor recognizes that the greatest opportunities often arise when the crowd is gripped by fear and uncertainty. As the ancient Roman philosopher Seneca counselled, “It is in times of security that the spirit should be preparing itself for difficult times; while fortune is bestowing favours on it, it is then the time for it to be strengthened against her rebuffs.” While devastating to the unprepared, market crashes present an unparalleled opportunity for astute investors to acquire assets at deeply discounted prices.

The aftermath of the 2008-2009 financial crisis serves as a prime example. In the depths of that turmoil, when fear and panic gripped the masses, those with the fortitude to buy when others were selling were handsomely rewarded. A stealthy bull market emerged from the ashes, arguably lasting until the COVID-19 crash over a decade later. This extended period of growth underscores the immense potential of contrarian investing during market chaos.

Uncertainty, too, can be a powerful ally for the discerning investor. Asset prices often languish when the crowd lacks conviction and is paralyzed by indecision and doubt, creating opportunities for those who can see beyond the fog of uncertainty. As the philosopher Heraclitus observed, “No man ever steps in the same river twice, for it’s not the same river, and he’s not the same man.” In this ever-changing market landscape, embracing uncertainty and acting decisively can yield substantial rewards.

The key lies in recognizing that the crowd’s fear and uncertainty are often rooted in emotion rather than reason. While the masses flee at the first sign of trouble, the contrarian investor sees these moments as potential entry points, opportunities to acquire undervalued assets that the herd has discarded in its panic. By maintaining a disciplined, rational approach and resisting the siren call of herd mentality, the wise investor can capitalize on the crowd’s missteps and forge a path to enduring success.

Unraveling the Tapestry of Mass Psychology

“The crowd is untruth,” echoed the ancient philosopher, a sentiment that resonates profoundly in market psychology. For it is in the collective consciousness of the masses that the seeds of irrational exuberance and unfounded fear take root, driving asset prices to dizzying heights or plunging them into the depths of despair. This herd mentality, fueled by emotion rather than reason, can create distortions in the market that defy fundamental analysis and rational valuation models.

Yet, within this chaos lies a hidden order, a tapestry woven by the threads of human emotion and behaviour. The ability to decipher these intricate patterns separates the truly successful investors from the rest of the herd. To unravel the mysteries of mass psychology, one must embrace the teachings of the sages, those who have mastered the art of deciphering the crowd’s ebb and flow.

At the heart of this endeavour lies the recognition that markets are not merely driven by cold, hard data but by the complex interplay of human emotions, biases, and collective behaviour. Fear, greed, overconfidence, and herd instinct all shape market trends, creating opportunities for those who can maintain a rational, disciplined approach amidst the chaos.

By studying the patterns that emerge from this tapestry of mass psychology, the astute investor can anticipate shifts in sentiment, identifying potential turning points before the crowd has had a chance to react. This foresight and the courage to act against the prevailing tide can unlock significant rewards in an environment where the masses are often swayed by emotion and short-term thinking.

The Contrarian’s Edge: Defying the Herd

“Be fearful when others are greedy, and greedy when others are fearful,” counselled the Oracle of Omaha, Warren Buffett, a mantra that encapsulates the essence of contrarian investing, for it is in the moments when the crowd is consumed by euphoria or paralyzed by the dread that the actual opportunities emerge, like diamonds forged in the crucible of market turmoil.

Armed with a deep understanding of market psychology and crowd dynamics, the contrarian investor dares to tread where others fear to venture. They recognize that the masses are often swayed by emotion, chasing the latest fad or fleeing at the first sign of trouble, leaving undervalued assets in their wake.

Technical Analysis: Unveiling the Market’s Heartbeat

Yet, to truly harness the power of market psychology and crowd dynamics, one must also embrace the art of technical analysis. As the legendary trader Jesse Livermore once quipped, “The sitting, not the trading, makes the money.”

The technical analysis unveils the market’s heartbeat, revealing the intricate patterns and trends that emerge from the collective behaviour of market participants. By studying these patterns, the astute investor can anticipate shifts in sentiment, identifying potential turning points before the crowd has had a chance to react.

The Sage’s Wisdom: Embracing Uncertainty, Seizing Opportunity

Uncertainty is the only constant in the market’s ever-changing landscape. As the philosopher Heraclitus observed, “No man ever steps in the same river twice, for it’s not the same river, and he’s not the same man.”

In this crucible of uncertainty, the true masters of market psychology and crowd dynamics thrive. They embrace the chaos, recognizing that within the turmoil lie the most significant opportunities for those with the wisdom and fortitude to seize them.

As the ancient Chinese strategist Sun Tzu taught, “Amid the chaos, there is also opportunity.” The sage investor harnesses this chaos, born of the crowd’s irrational exuberance and unfounded fear, capitalizing on the masses’ missteps to forge their path to enduring success.

Ignite Your Intellect: Dive In!

Mastering Options Trading: Unveiling the Real Secrets

Which of the Following Is an Example of Collective Behavior?

4X ETF: Deadly Risks and Realities

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Best Tech Stocks To Buy Now: Spotting the Trend

CPNG Share Price: Buy, Sell, or Hold?

Rolling Over Options: The Ultimate Guide to Mastery

Fearless Finance: Harnessing Stock Market Fear for Contrarian Victories

Market Timing Strategies: Debunking Flawless Predictions

Dow 30 Stocks with Dividends: A Winning Strategy for Income Investors

Collective Behavior Generally Takes Which of the Following Forms?

Harnessing Collective Behavior: Strategies for Investment Success

Unlocking Value in Equal-Weighted Index Funds: Benefits and Strategies

What Caused the 1987 Stock Market Crash: Could It Happen Again?

Active vs Passive Investors – The Power of Discipline