Leading Economic Index Signals Economic Turbulence Ahead

March 26, 2023

The Eurozone economy has been grappling with a slew of challenges, including the COVID-19 pandemic, geopolitical risks, trade tensions, and structural issues, which have dampened its growth prospects and increased its vulnerability to external shocks.

The region’s recovery from the pandemic-induced recession has been uneven, with some countries rebounding faster than others and some sectors benefiting more. The services sector, which accounts for a large share of the Eurozone’s GDP and employment, has been particularly affected by the pandemic. Many activities require face-to-face interaction and have been disrupted by lockdowns and social distancing measures.

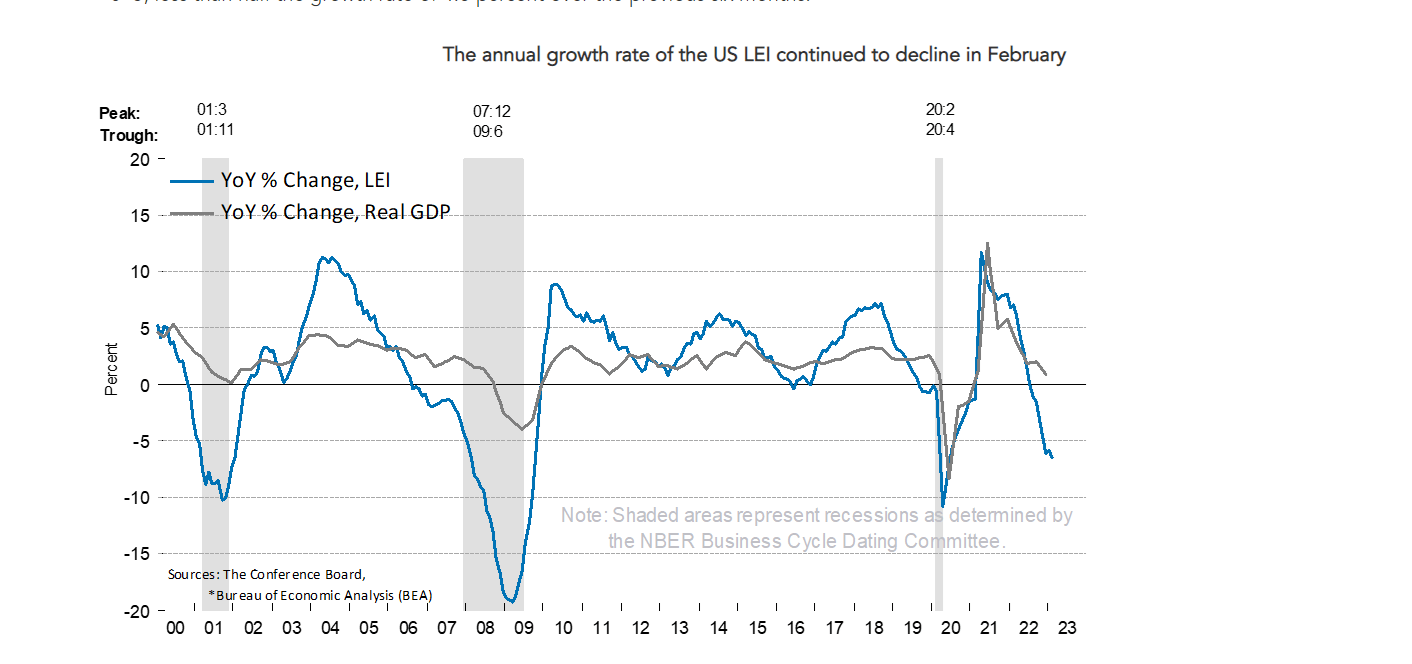

The manufacturing sector, which is more export-oriented and less affected by COVID-related restrictions, has been a bright spot in the Eurozone economy, benefiting from solid demand from China and the United States and the global shortage of semiconductors, which has boosted the prices of electronic goods. However, the recent decline in the Leading Economic Index suggests that the manufacturing sector may face headwinds in the coming months, as global supply chain disruptions, inflationary pressures, and policy uncertainties could weigh on demand and investment.

The Conference Board’s projection of a recession in the Eurozone is not unique, as many other institutions and experts have warned of a similar risk. The International Monetary Fund (IMF), for instance, has lowered its growth forecast for the Eurozone for 2023 from 4.4% to 4.2%, citing the persistence of the pandemic, supply chain bottlenecks, and the potential for financial market turbulence. The European Central Bank (ECB) also cautioned about the economic outlook, highlighting the need for continued policy support and vigilance.

Mixed Signals: Coincident and Lagging Economic Indexes Show Divergent Trends

The ECB has maintained its accommodative monetary policy stance, keeping its key interest rates at historic lows and continuing its asset purchase program to provide liquidity to the banking system and support borrowing conditions for households and businesses. The ECB has also launched a new monetary policy strategy review, which aims to reassess its inflation target, communication, and toolkit and reflect the changing economic and social realities of the Eurozone.

The Leading Economic Index for the Eurozone has fallen sharply, indicating the region’s recession risk. While there are some positive signs in the economy, such as the growth of the manufacturing sector and the rebound in the stock market, the overall outlook remains uncertain and fragile. Policymakers and investors should be vigilant and prepared for various scenarios, including the possibility of a recession and the need for further stimulus and reforms.

The Eurozone’s recovery from the pandemic and its long-term growth prospects depend on its ability to address its structural challenges and transform its economy towards a more sustainable, resilient, and inclusive path.

Arguments for a recession in 2023

Higher interest rates: A crucial driver of a potential recession in 2023 is the impact of higher interest rates on the economy. The Bank of Canada raised its key interest rate six times since March 2022, from 0.25% to 2%, to curb inflation that reached a 30-year high of 8.1% in July 2022. Higher interest rates increase the cost of borrowing, reducing spending and investment power, and leading to a slowdown in economic activity, especially in sectors sensitive to interest rates, such as housing, autos, and consumer durables.

Global economic outlook: The global economic outlook is clouded by uncertainty and volatility. The ongoing COVID-19 pandemic, geopolitical tensions, supply chain disruptions, energy shortages, and climate change are some of the challenges that could weigh on global growth and trade. Canada, a small open economy that relies heavily on exports and imports, is vulnerable to external shocks that could dampen domestic demand and output.

Financial crisis or market correction: The possibility of a financial crisis or market correction is another factor that could cause a recession in 2023. The high levels of debt accumulated by households, businesses, and governments during the pandemic could pose a risk to financial stability if interest rates rise further or income falls. A sudden loss of confidence or a sharp decline in asset prices could trigger a wave of defaults, bankruptcies, and contagion effects that could spill over to the real economy.

Arguments against a recession in 2023

The resilience of the Canadian economy: The Canadian economy has shown resilience and adaptability in the face of adversity. Despite interest rate hikes and an inflation spike, the economy has grown moderately, supported by solid consumer spending, business confidence, and government stimulus. The unemployment rate fell to 5.6% in February 2023, close to its pre-pandemic level, and wages have increased faster than inflation. The economy has also benefited from robust commodity prices and export demand, especially from the United States, which is rapidly recovering.

Expected inflation easing: Inflationary pressures will ease as global supply chains normalize and energy markets stabilize. The Bank of Canada has projected that inflation will fall back to its 2% target by mid-2023, allowing the central bank to pause or reverse its monetary tightening cycle and provide more accommodative economic conditions.

Ample fiscal space and policy tools: The federal government has ample fiscal space and policy tools to support the economy if needed. The Liberals have promised to deliver additional measures to address affordability issues and invest in the clean energy transition in their upcoming budget. They have also signed long-term funding agreements with provinces on healthcare transfers, which could boost economic growth and create short- and long-term jobs.

Conclusion:

While predicting a recession in 2023 is not an exact science, investors should consider various data points to make informed decisions. Higher interest rates, the global economic outlook, and a financial crisis or market correction could trigger a recession.

However, the Canadian economy has shown resilience and adaptability, inflationary pressures are expected to ease, and the federal government has ample fiscal space and policy tools to support the economy. Policymakers must effectively respond to changing conditions for a sustainable economic recovery. The Leading Economic Index can provide valuable insights into the economy’s direction, and investors should monitor its trends to anticipate potential market turning points.

Article overview

This article discusses arguments for and against a potential recession in 2023 in Canada and the Eurozone. In Canada, higher interest rates, global economic uncertainty, and a possible financial crisis or market correction are factors that could contribute to a recession. However, the Canadian economy has shown resilience in the face of adversity, and inflationary pressures are expected to ease while the government has ample fiscal space and policy tools to support the economy.

In contrast, the Eurozone economy has been struggling with challenges related to the COVID-19 pandemic, geopolitical risks, and trade tensions, leading to a decline in the Leading Economic Index. The region’s recovery has been uneven, with the pandemic particularly affecting the services sector. While the manufacturing sector has been a bright spot, it may face headwinds due to global supply chain disruptions, inflationary pressures, and policy uncertainties.

The Conference Board has projected a recession in the Eurozone, echoing warnings from other institutions and experts. The European Central Bank has maintained its accommodative monetary policy stance, highlighting the need for continued support and vigilance. In conclusion, policymakers and investors should remain vigilant and prepared for various scenarios, including the possibility of a recession and the need for further stimulus and reforms to address structural challenges and transform the economy towards a more sustainable, resilient, and inclusive path.

References:

Canada recession will be mild, says RBC report | CTV News. https://www.ctvnews.ca/business/rbc-expects-mild-recession-in-canada-in-middle-of-2023-1.6317460 Accessed 27/03/2023.

As economy faces potential recession, Liberals to release ‘tricky’ budget Tuesday. https://www.surreynowleader.com/news/as-economy-faces-potential-recession-liberals-to-release-tricky-budget-tuesday/ Accessed 27/03/2023.

Bond Traders Go All-In on US Recession Bets That Defy Fed View. https://finance.yahoo.com/news/bond-traders-us-recession-bets-200000999.html Accessed 27/03/2023.

As economy faces potential recession, Liberals to release ‘tricky …. https://www.thestar.com/business/2023/03/26/as-economy-faces-potential-recession-liberals-to-release-tricky-budget-tuesday.html Accessed 27/03/2023.

Peter Hall: Why companies should invest now, even if a recession is coming. https://www.intelligencer.ca/news/economy/companies-invest-now-recession-coming Accessed 27/03/2023.

Discover More: Stimulating Articles That Will Captivate You

Is Value Investing Dead? Shifting Perspectives for Profit

What is the Bandwagon Effect? Exploring Its Impact

Stock Market Chaos: A Trap for the Ignorant and Uninformed

Benefits of Investing Early: Wealth and Serenity

Contrarian Thinking: The Power of Challenging the Status Quo

Black Monday 1987 Cause: Stupidity and Greed

Stock Market Predictions Today: Ignore the Noise, Follow the Trend

Share Market Fear and Greed Index: Ignore It, Focus on the Trend

Mob Psychology: Breaking Free to Secure Financial Success

Why is Inflation Bad for an Economy: Enriching the Few, Hurting the Many

What to Do When the Stock Market Drops: Back the Truck Up and Buy

Stock Market Timing Strategies: Patience and Discipline Required

Dow Jones Forecast: Navigating the Ups and Downs

Best Time To Buy Stocks: Embrace Panic & Seize Opportunity