Updated Sep 29, 2023

Editor: Philip Ragner | Tactical Investor

In the world of economics, the term “Goldilocks economy” has gained prominence, capturing the imagination of investors, policymakers, and the general public alike. But what exactly does it mean? In this comprehensive article, we will delve into the intricacies of a Goldilocks economy, exploring its characteristics, implications, and the factors that contribute to its delicate balance.

Defining the Goldilocks Economy

The Tale of Goldilocks

To truly grasp the essence of a Goldilocks economy, let’s continue our journey with Goldilocks herself. In the classic fairy tale, Goldilocks explores the home of the Three Bears, discovering not only their porridge conundrum but also the matter of their beds—some too hard, some too soft, and one that is just right. Her quest for the perfect fit resonates with the economic concept of balance that defines the Goldilocks economy.

In economic terms, this balance manifests in the pursuit of an ideal state for a nation’s economy—much like Goldilocks seeking that perfect bowl of porridge or a comfortable bed. The Goldilocks economy, just like Goldilocks’ choices, is neither extreme nor unpredictable. It avoids the scalding heat of an overheated economy and the icy chill of a recession, settling for conditions that are, as Goldilocks would say, “just right.”

Much like Goldilocks’ journey through the Three Bears’ home, a Goldilocks economy navigates the complexities of fiscal and monetary policies, labour markets, and global trade to find the sweet spot that fosters sustainable growth, low unemployment, and stable prices. It’s a delicate dance, much like Goldilocks testing each bowl of porridge or bed for that perfect fit. And like Goldilocks, it’s the search for that harmonious balance that defines the story of a Goldilocks economy.

The “Just Right” Economy

In economic terms, a Goldilocks economy refers to a scenario where economic conditions are “just right.” It’s not too hot, characterized by rampant inflation and unsustainable growth, nor too cold, marked by recession and high unemployment. Instead, it strikes a harmonious balance between growth and stability.

Characteristics of a Goldilocks Economy

Moderate Economic Growth

A hallmark of a Goldilocks economy is moderate but sustained economic growth. This means that the economy is expanding, but at a pace that is neither too rapid nor too sluggish.

Stable Inflation

Inflation, the rise in the prices of goods and services over time, is kept in check. In a Goldilocks economy, inflation rates are typically within a reasonable and predictable range, avoiding the extremes of hyperinflation or deflation.

Low Unemployment

Job opportunities are abundant in a Goldilocks economy, with low unemployment rates. This aspect is crucial for a healthy and prosperous society.

Steady Interest Rates

Interest rates, set by central banks, are neither too high nor too low. They are at a level that encourages investment and borrowing without overheating the economy.

Factors Contributing to a Goldilocks Economy

Prudent Monetary Policy

The role of central banks is pivotal in maintaining a Goldilocks economy. Through careful management of interest rates and money supply, central banks aim to keep economic conditions stable.

Fiscal Responsibility

Government policies, including taxation and government spending, play a role in achieving economic balance. Responsible fiscal policies can contribute to the sustainability of a Goldilocks economy.

External Factors

Global economic conditions and trade relationships can impact a nation’s economy. A Goldilocks economy may also benefit from a stable international environment.

Implications and Benefits

Market Confidence

A Goldilocks economy fosters confidence in financial markets. Investors are more willing to participate, and businesses are more likely to invest and expand.

Job Creation

Low unemployment rates mean more job opportunities for the workforce, leading to improved living standards and reduced income inequality.

Inflation Control

Stable inflation rates ensure that the purchasing power of a nation’s currency remains relatively constant. This benefits consumers and businesses alike.

Challenges and Risks

Maintaining Balance

The quintessential challenge in managing a Goldilocks economy lies in preserving its delicate equilibrium. Just as Goldilocks meticulously gauged the porridge’s temperature and the bed’s comfort, maintaining the ideal economic conditions requires vigilance and adaptability.

External Shocks: A Jolt to Stability

In the story of Goldilocks, unforeseen circumstances led to an abrupt disruption. Similarly, external shocks—sudden and unpredictable events—can jolt a Goldilocks economy off course. These shocks can come in various forms, from natural disasters and geopolitical tensions to economic crises on a global scale. The ability to absorb these shocks without derailing the economy is a testament to its resilience.

Policy Precision: The Fine Art of Adjustment

Much like Goldilocks’ discerning palate for porridge, policymakers must delicately calibrate their strategies to keep the economy on track. This involves fine-tuning interest rates, fiscal policies, and regulatory measures to ensure that the economy neither overheats nor stagnates. Policy missteps, just like overcooked porridge, can lead to unwanted consequences, such as inflation spikes or economic downturns.

Adaptation: Learning from Goldilocks

In the face of changing circumstances, a Goldilocks economy must adapt. Just as Goldilocks adjusted her preferences to find the “just right” choice, economies must evolve. This entails recognizing emerging trends, embracing technological advancements, and addressing social and environmental challenges.

In essence, maintaining the balance of a Goldilocks economy is an ongoing endeavor. It requires not only sound economic policies but also the ability to anticipate, react to, and learn from unforeseen events. The tale of Goldilocks reminds us that equilibrium, while fragile, is attainable with vigilance, prudent decisions, and the capacity to adjust when necessary.

Income Inequality

A Goldilocks economy, with its attributes of steady growth, low unemployment, and controlled inflation, undoubtedly offers several advantages. However, it’s essential to acknowledge that while it can mitigate unemployment, it may not inherently tackle the issue of income inequality, which continues to loom large in numerous economies.

Income Disparities: A Persistent Challenge

Income inequality refers to the unequal distribution of income among a nation’s population. It is characterized by substantial disparities in earnings and wealth between various segments of society. Despite the overall economic stability of a Goldilocks economy, these disparities may persist or even widen.

Root Causes: Understanding the Divide

To address income inequality, it’s crucial to recognize its underlying causes. Factors such as differences in education, access to opportunities, and systemic biases can contribute to income disparities. While a Goldilocks economy can provide job opportunities and wage growth for many, it may not inherently rectify these systemic issues.

Complementary Policies: The Need for a Comprehensive Approach

Efforts to combat income inequality often require targeted policies and social initiatives. These might include improving access to quality education, affordable healthcare, and affordable housing. Additionally, progressive taxation and wealth redistribution programs can help narrow the income gap.

The Role of Education: A Path to Equal Opportunity

Investing in education and vocational training is a particularly potent tool in addressing income inequality. By providing individuals with the skills and knowledge needed to access better-paying jobs, a Goldilocks economy can contribute to a more equitable society.

In conclusion, while a Goldilocks economy can make strides in reducing unemployment and promoting economic stability, it does not automatically resolve the complex issue of income inequality. A holistic approach, encompassing targeted policies and social initiatives, is essential to bridge the income gap and create a fairer, more inclusive society.

Environmental Considerations

Amid the pursuit of economic prosperity in a Goldilocks economy, one critical consideration emerges—balancing this growth with environmental sustainability. In an era where climate change and ecological degradation loom large, achieving this equilibrium is essential not only for the well-being of the economy but also for the long-term health of the planet.

Resource Utilization: A Delicate Balance

A growing economy often places increased demands on natural resources, from energy and water to land and raw materials. Striking a balance between resource utilization for economic expansion and safeguarding the environment is a formidable task.

Environmental Impact: Consequences of Growth

Rapid economic growth can have adverse environmental consequences, including air and water pollution, deforestation, habitat destruction, and greenhouse gas emissions. These consequences, if left unchecked, can contribute to climate change and harm ecosystems, endangering both human and ecological well-being.

Sustainable Practices: A Necessity

A Goldilocks economy, while promoting growth and stability, must be accompanied by sustainable practices. This includes adopting clean and efficient technologies, reducing carbon emissions, conserving natural habitats, and transitioning toward renewable energy sources.

Policy and Innovation: Driving Sustainability

Government policies and technological innovations play pivotal roles in promoting sustainability within a Goldilocks economy. Incentives for green industries, regulations to limit pollution, and investments in research and development can all contribute to a more sustainable economic model.

In conclusion, balancing economic growth with environmental sustainability is an ongoing challenge that cannot be overlooked. A Goldilocks economy, while striving for equilibrium in economic conditions, must also prioritize responsible resource management and ecological preservation. Only by embracing sustainable practices can we ensure the prosperity of both our economies and our planet in the long run.

Conclusion: The Quest for Economic Balance

In conclusion, a Goldilocks economy represents a state of economic equilibrium, where growth, stability, and opportunity coexist. Achieving and maintaining this balance requires prudent economic policies, responsible governance, and adaptability to changing circumstances.

While a Goldilocks economy is an ideal scenario, it’s important to remember that economic conditions are rarely static. The quest for balance continues, and the ability to adapt to new challenges and opportunities remains critical in the ever-evolving world of economics.

Other Articles of Interest

Potential of Silver ETF-s: A Wise Investment Choice

USD Dollar Index Investing: A Posh Way to Hedge Against Currency Fluctuations

Are ESOPs Good for Employees? Weighing the Benefits and Risks

Copper ETF: The Great Investment Debate – Buy-In or Miss Out?

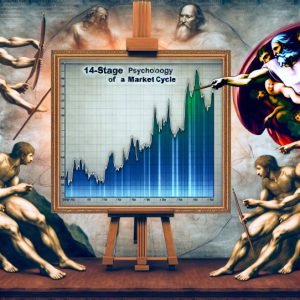

Stock Market Psychology Pdf: Mastering the Facts, Not the PDF

What Causes Mob Mentality: Unraveling the Psychology

Cracking Market Cycle Psychology: Navigating the Ups and Downs

Best Silver ETFs: Shining Bright in Your Investment Portfolio

Harnessing the Psychology of a Market Cycle: Thrive in Bull and Bear Markets

ETF Definition: A beginner’s guide to exchange-traded funds

What is a Bull Market Simple Definition: Understanding the Basics of a Thriving Market

Home Mortgage Interest Rates Forecast: Timing is Key

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Breaking Free: Embracing Early Extreme Retirement