Inside China rare earths export controls and the Latin America bet that outlives hashtags

Nov 13, 2025

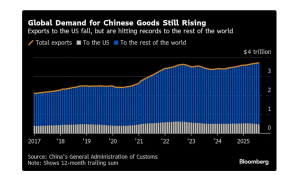

Strip the speeches out of it. What moves the board now isn’t a podium—it’s paperwork. China rare earths export controls tightened again, and the controls don’t just squeeze ores; they reach downstream into magnet alloys and the tooling to make them, touching EV drivetrains, missiles, wind turbines, and chip equipment. That’s leverage, not theater. The West keeps narrating “resilience.” Beijing keeps closing valves. When valves move, supply chains obey.

2010–2015: Belt and Road ramps; upstream resource ties deepen; early rare earths skirmishes teach everyone how valuable midstream processing really is.

2016–2019: Processing scale and port/logistics stakes expand across Africa and Latin America; magnet capacity quietly multiplies at home.

2020–2022: Sanctions era; dual circulation formalized; focus pivots to legacy chips (the kind that guide missiles) and supply-chain insulation.

2023–2025: China rare earths export controls tighten again—trace-content and tooling rules start to bite extraterritorially; magnets pulled under the umbrella; uncertainty becomes policy, on purpose (Al Jazeera: https://www.aljazeera.com/news/2025/10/10/china-tightens-export-controls-on-rare-earth-metals-why-this-matters; Reuters: https://www.reuters.com/world/china/china-tightens-rare-earth-export-controls-2025-10-09/; CSIS: https://www.csis.org/analysis/chinas-new-rare-earth-and-magnet-restrictions-threaten-us-defense-supply-chains).

2025+: Latin America logistics assets come online; export controls proliferate globally; the chokepoint logic becomes the playbook, not the exception.

The choke-chain (where the pain really happens)

Mining is not the choke. Separation is. The chain runs: mining → separation/solvent extraction → alloying → magnetization (NdFeB, SmCo) → motors/systems. Controls at mid and downstream can “reach back” and neutralize upstream diversification. Add trace-content rules (even a little Chinese content triggers licensing) plus restrictions on critical tooling, and procurement officers discover that geography doesn’t equal independence. This is why “new mine” headlines feel strong but don’t cure the ache; the bottleneck sits one floor down.

Neodymium-iron-boron magnets sit at the heart of guidance systems, drones, EV drivetrains, industrial motors, and chip tools. Substitute alloys help at the margin, and dysprosium/terbium intensity can be engineered down, but there’s a reason the world standardized on these materials: energy density, heat resistance, cost, scale. When licensing shifts, lead times stretch, redesigns multiply, and capex migrates from marketing to metallurgy. You don’t read this on a hype deck; you hear it on earnings calls when “supplier issues” and “qualification timelines” suddenly grow teeth.

Latin America: the quiet flanking maneuver

While controls tightened, Beijing spent a decade wiring the Americas. Brazil first: BYD’s Bahia plant on a former Ford site is a flag planted in the EV market—up to mid-six-figure units per year as it ramps, and paired with mineral rights in Brazil’s Lithium Valley to feed batteries. Chinese firms keep scooping stakes in ports, pipelines, dams, and terminals; China Merchants Port’s acquisition in crude logistics is a clean example of how throughput becomes policy. Layer on hydro investments (China Three Gorges, State Power Investment) and you get power security for industrial assets, not just headlines.

Peru is the logistics keystone. Las Bambas (MMG/Minmetals) and Toromocho (Chinalco) are metal lungs; their expansions were financed with Chinese policy-bank oxygen. Now add the Port of Chancay—roughly $3–4 billion—with COSCO in the operator seat, designed to cut shipping time to Asia and shift the cost curve. Phase 1 targets a million TEUs, with land-sea corridors planned to push copper and agricultural goods through faster pipelines. This is what “influence” looks like when you stop tweeting about it and pour concrete.

Constraints ledger (because nothing is magic)

China’s risks: local-debt stress, demographics, environmental enforcement tightening, overcapacity whiplash, political brittleness that can muzzle the dissent healthy systems need. The West’s risks: permitting paralysis, fragmented procurement, excessive reliance on legacy chips we don’t control, and a cultural addiction to quarterly optics over decadal capacity. Steelman both sides and you get a sober read: one system is compounding labs and logistics now; the other is busy writing memos about it.

Base: Controls persist. Non-China separation/refining projects inch forward. Chancay and Brazil ramp in stages. Then: focus on midstream exposure with signed offtakes and commissioning dates you can visit. Track magnet composition shifts (less heavy-REE intensity). Expect OEM redesigns to reduce dependency; don’t bank on schedules behaving.

Stress: New control tranche hits magnets and trace-content. Licensing delays multiply; defense stockpile buys accelerate; lead times spike. Then: overweight resilient midstream (separation/refining with multiple customers), underweight OEMs with heavy-REE intensity and single-source risk. Expect policy headlines to gap prices both directions—keep a cash buffer and pre-committed levels.

Breakthrough: China closes the advanced-semi gap faster than expected. Then: price a structural re-rating in China-linked indices; anticipate Western counter-measures (tariffs, subsidies, fast-lane permits) and expanded controls beyond REEs (graphite, gallium, germanium, specialty steels). Watch for a scramble in legacy chips that feed defense supply chains.

Your monthly watchlist (receipt-driven, not vibes)

Licensing cadence: volumes, turnaround times, carve-outs. Separation capacity: commissioning updates in Australia/Japan/EU/US—real dates, not slideware. Magnet indices: NdFeB price/lead-time changes; alloy composition notes (dysprosium/terbium substitutes). OEM redesigns: guidance on REE intensity and qualification timelines. Logistics: Chancay throughput milestones, Bahia plant production run-rate, port dwell times. Policy prints: US/EU/Japan stockpile buys, subsidy tranches, permitting fast lanes. Defense tells: long-lead orders pulled forward, legacy-chip inventory disclosures.

Al Jazeera’s explainer outlines how the newest wave of China’s rare earth export controls widened scope and deepened enforcement, with timing that coincided with diplomatic pressure points (https://www.aljazeera.com/news/2025/10/10/china-tightens-export-controls-on-rare-earth-metals-why-this-matters). Reuters details the rule expansions, licensing webs, and the “escalate then negotiate” rhythm (https://www.reuters.com/world/china/china-tightens-rare-earth-export-controls-2025-10-09/). CSIS describes magnet and technology restrictions that threaten defense supply chains and bite extraterritorially via trace-content and tooling controls (https://www.csis.org/analysis/chinas-new-rare-earth-and-magnet-restrictions-threaten-us-defense-supply-chains). None of this is a surprise if you’ve been counting valves instead of quotes.

Markets reward timed nerve, not constant motion. Two windows: mid-morning and mid-afternoon. Rule-of-Three to act: for example, a new control tranche + magnet lead-time spikes + separation delays. Emotion gate before any order: rate your state 1–5; above 3, pause 90 seconds, halve size. Orders-only on policy days—trade the plan you wrote yesterday, not the feed your amygdala loves. Pre-commit trims on weekly parabolas; re-add only after 8–15% cool-offs or when term structure normalizes. This isn’t monkhood; it’s self-defense.

What Latin America bet actually buys

Brazil gives industrial depth (EVs, batteries, power) and critical upstreams (lithium) within friendlier time zones for China. Peru gives metal lungs and a Pacific chute (Chancay) pointed at Asia. Argentina/Chile/Ecuador fill copper and lithium gaps, with Chinese operators on the cap table and policy banks in the stack. None of this is ideological. It’s distance shaved, risk diversified, and time bought. The more marginal growth shifts out of U.S.-linked lanes, the less Washington’s threats clear in practice. Influence isn’t declared—it ships.

China’s rare earths export controls are not a press-conference topic; they’re architecture. The magnet throat explains the leverage; Latin America explains the logistics. If you want to stop being surprised, build an operator’s map: upstream ore, midstream separation, downstream magnet capacity, plus the policy text that governs them. Track receipts monthly. When three signals rhyme, act; when they don’t, sit on your hands. Rails will stay in dollars—pipes that wide don’t get replaced by speeches. Ballast will keep migrating to commodities and custody that resist political reach. Adults don’t trade adjectives. They trade receipts. Less foghorn, more hinge. Less hashtags, more port throughput. That’s how you cross a moving river without drowning in commentary.

Leaving a Mark: Impactful Articles