ETF Service Providers: Tailored Solutions for Tactical Investors

Exchange-traded funds (ETFs) combine the ease of stock trading with the diversified approach of mutual funds, echoing the investment strategies of icons like John Bogle. Our specialized service, the ETF Trend Trader, is crafted for those who aim to strategically invest in top-performing sectors, embodying Peter Lynch’s principle of understanding your investments.

We understand that many investors are pressed for time, so our service simplifies sector investing, reducing the risks linked to individual stock investments. Echoing Warren Buffett’s sentiment, we believe that risk arises from uncertainty, and our service strives to equip tactical investors with the knowledge to make confident decisions.

The ETF Trend Trader service offers a concentrated examination of ETFs and comprehensive market insights. It’s designed for investors who recognize the value of acting now to shape a prosperous financial future.

Strategic Investment: Capitalizing on Market Opportunities with ETFs

Our commitment to excellence is exemplified by our Bread and Butter portfolio, a collection of low to medium-risk large-cap stocks with a high success rate, currently over 84%. This portfolio is a nod to the idea that opportunities must be seized when they present themselves. It’s a strategic choice for those looking to adopt a proven approach to financial advancement. Our ETF service providers have also broadened their scope to include analyses of long-term market trends, covering various currencies and commodities.

For those inclined towards higher risk for potentially more significant returns, we offer a portfolio that includes leveraged ETFs and digital currencies. This selection is inspired by John Neff’s contrarian stance, catering to investors who are comfortable with risk and approach it with a level-headed strategy.

Subscribers to the ETF Trend Trader service will receive complimentary access to the Bread and Butter portfolio for a limited period. This bonus remains available for your active subscription, providing an edge to your investment strategy.

Conservative Portfolio Construction: ETF Service Providers Catering to Prudent Investors

At the core of our ETF Trader service are portfolios that resonate with the conservative investor’s desire for caution and stability. The Main ETF Portfolio and the Bread and Butter Portfolio are tailored to those who prefer a measured approach to investing. This mirrors Charlie Munger’s investment philosophy, favouring selective, high-quality investments over broad diversification, ensuring alignment with the conservative investor’s preference for steady growth.

Following this approach, the assets selected for these portfolios are meticulously chosen for their long-lasting value and strong track record of performance, perfectly matching the risk-averse investor’s desire for stability and consistent growth.

Maximizing Gains with Leveraged ETFs: Calculated Risk-Taking

For the investor with a higher risk tolerance, we present a portfolio that delves into leveraged funds, such as 2x and 3x ETFs. These funds offer the potential for increased returns but also have the risk of more significant losses. This strategy is for those who, like Peter Lynch, believe in investing knowledgeably to achieve substantial growth, understanding that the key to success in stocks is maintaining confidence through market fluctuations.

Concluding Insights on ETF Selection for Contrarian Investors

For the contrarian investor, the ideal ETF is often not currently in the spotlight but shows promise according to our trend indicators. Our focus is on ETFs that may be undervalued by the market but have the potential for growth, a strategy that would have resonated with Sir John Templeton. This contrarian approach is central to our methodology at ETF service providers, where we seek out ETFs ready for an upward trend. To learn more about the ETF Trend Trader service and to sign up, click here:

In summary, aligning your choices with your investment goals and risk profile is essential when selecting ETFs. Understanding the ETF’s underlying assets, fee structure, and performance history is crucial, and expert guidance from ETF service providers can be invaluable in this process. Adopting a long-term perspective and focusing on the intrinsic value of the ETF holdings is key, especially for contrarian investors who often take the path less travelled in search of ETFs with solid fundamentals.

Break the Mould: Articles That Challenge

What Is the Key to Successful Investing? Patience and Discipline

How Can Economic Crises Lead to the Acceptance of Totalitarian Governments?

Future Market Insights: Move Beyond, Embrace the Trend

Collective Behavior Is Easy to Study: Let’s Dive In

long term vs short term investing in stocks: Understanding Key Differences

SPX 200-Day Moving Average: Unlocking Profitable Trading Strategies

What Percent of 18-29 Year Olds Are Investing in the Stock Market?

What Top Stocks to Buy Now: Mastering Your Entry Timing

History of Stock Market Crashes: Embrace Fear, Ignore the Noise

Rise in Sexual Immorality: Alarming Trends

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

Giving Content to Investor Sentiment: The Role of Media in The Stock Market

Considering the impact of inflation, Why Is Investing Important?

Technical Analysis of Stocks and Commodities: Unveiling Insights

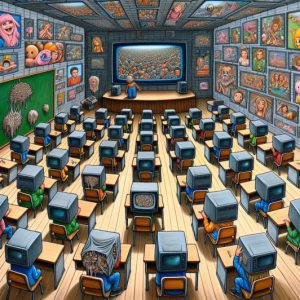

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon