Jan 18, 2024

Harmony in Investing: Merging Mass Psychology with TA

Technical analysis and mass psychology are two sides of the same coin in investing. They work hand in hand, each complementing the other to provide a comprehensive perspective on market trends and investment opportunities.

Mass psychology sets the stage, providing a broad understanding of market sentiment. It reflects the collective attitudes of investors, fluctuating between periods of fear or pessimism and times of confidence or optimism. This sentiment often drives market trends, influencing the ebb and flow of stock prices.

Once mass psychology has painted this broad picture, technical analysis steps in to add the finer details. It involves studying price charts, patterns, and indicators to make informed investment decisions. It’s like a magnifying glass, highlighting the intricate details that might be missed in the broader strokes of mass psychology.

For instance, during a market crash, mass psychology can help identify the overall sentiment of fear and panic. However, technical analysis allows investors to pinpoint the precise entry points for investment. It helps investors understand the market’s momentum, volatility, and other key characteristics, providing insights into its past performance to predict future trends.

Moreover, technical analysis is built on price movements reflecting mass psychology. Investors’ fear, panic, confidence, and optimism are all encapsulated in the price trends of stocks. Therefore, a skilled technical analyst can use these price trends to understand the underlying mass psychology, making more informed investment decisions.

Technical analysis is pivotal in complementing mass psychology in investing. While mass psychology provides a broad understanding of market sentiment, technical analysis adds depth and precision, helping investors fine-tune their investment strategies. Together, they offer a comprehensive toolkit for navigating the financial markets, enabling investors to capitalize on market trends and seize investment opportunities.

Independent Investing: Crafting a Resilient Stock Portfolio

In dividend investing, the path to financial empowerment begins with recognising that no universal guidebook guarantees success. The allure of a one-size-fits-all strategy is a myth; real financial acumen is built through hands-on experience and a nuanced understanding of market dynamics.

Investing is inherently dynamic, shaped by many factors, including geopolitical events and technological advancements. A successful investor adapts to these changes with agility, employing a flexible strategy rather than following a rigid set of rules.

While investment literature can offer valuable insights and foundational knowledge, the practical application of these concepts truly cultivates expertise. Real-world experience, market observation, and an appreciation for the subtleties of various investment vehicles are what forge a seasoned investor.

Moreover, a deep comprehension of market dynamics is essential. It involves grasping how different factors impact the financial markets and how investor sentiment can drive market trends. Understanding strategic timing and patience are vital in thriving amidst market volatility and building a robust stock portfolio.

Essential Chart Patterns in Technical Analysis

Technical analysis studies distinctive price chart patterns, revealing insights into future price directions. Explore key patterns:

Head and Shoulders: A trend reversal pattern with two shoulders flanking a higher head, confirmed by a price drop below the neckline.

Double Top and Double Bottom: Reversal patterns signalling trend shifts after prolonged moves, indicating potential upward or downward trends.

Triangles: Continuation patterns signalling trend persistence, categorized as ascending, descending, or symmetrical.

Wedges: Converging trend lines indicating trend continuation or reversal.

Cup and Handle: Bullish continuation pattern resembling a cup with a handle, signalling potential upward trend continuation.

Pennants or Flags: Short-term continuation patterns indicating brief consolidation before trend resumption.

Rounding Bottom: Long-term reversal pattern resembling a “U” shape, signaling a shift from bearish to bullish trends.

Identifying these patterns aids in predicting market consolidation, trend continuations, or reversals. While powerful, these insights should complement a comprehensive analytical approach, acknowledging their informative but not infallible nature.

Harmony in Investing: Crafting Your Portfolio of Exceptional Stocks

Successful investors build their list of great stocks rather than relying on someone else’s formula. These companies have a proven track record of paying handsome dividends even in tumultuous times. For instance, certain companies have consistently paid dividends during market crashes and downturns, making them attractive investments.

Consider blue-chip companies in financials, consumer staples, or industrials. These companies often have a long history of stability and consistent dividend payments, making them a safe bet during market downturns. They might not offer the highest growth potential, but they provide a steady income stream, which can be particularly valuable in uncertain times.

Another strategy is to invest in diversified equity funds. These funds hold various stocks, providing exposure to multiple companies and economic sectors. This diversification can help mitigate risk and provide a steady stream of dividends.

Mass Psychology and Market Dynamics

The onset of the COVID-19 pandemic triggered a wave of fear and uncertainty, gripping global financial markets and leading to a dramatic sell-off. In March 2020, the Dow Jones Industrial Average experienced its steepest drop since 1987, while the S&P 500 plummeted by 34%, erasing years of gains in weeks. This behaviour was a textbook example of mass psychology in action, with investors collectively rushing to liquidate their positions in the face of a potential global recession.

Yet, amid this widespread panic, savvy investors recognized a historic buying opportunity. Drawing parallels to the 2008 financial crisis, where post-crisis investments yielded substantial returns, these investors looked beyond the immediate turmoil. By strategically acquiring high-quality stocks at significantly reduced prices, they positioned themselves for the eventual market recovery.

Indeed, by July 2021, the S&P 500 had recouped its losses and reached new record highs, vindicating those with the insight to act against the tide of mass psychology. This episode serves as a potent reminder of the importance of strategic timing and the potential rewards of patience during periods of market volatility.

Technical Analysis Refines the Approach

During the tumultuous market conditions of the pandemic, technical analysis emerged as a pivotal tool for investors navigating the unpredictable financial landscape. This analytical method, which scrutinizes past market data to forecast future price movements, was a critical navigational aid amidst the volatility.

Investors adept at deciphering chart patterns and indicators, such as the “double bottom” reversal pattern and the Relative Strength Index (RSI) emerging from oversold conditions, could anticipate market recoveries. This foresight allowed for strategic entries into the market at depressed asset prices, setting the stage for substantial gains during the subsequent rebound.

For example, astute investors who recognized the bullish signal when the 50-day moving average crossed above the 200-day moving average in June 2020 and acted upon it by investing in the S&P 500 reaped the rewards as the market surged to new heights in the following months.

Technical analysis, therefore, provided a structured approach during a period of market chaos, enabling investors to make precise and informed decisions. It highlighted the significance of identifying promising investment opportunities and the critical timing of when to capitalize on them, optimizing returns in a volatile market environment.

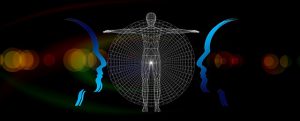

The Power of Understanding Stock Market Psychology

Understanding the stock market psychology cycle is crucial for successful trading and investing. This field of study focuses on the emotions and perceptions, such as fear, greed, optimism, and pessimism, that traders and investors experience when participating in the market. These emotions significantly influence buying and selling decisions, often leading to observable patterns on price charts.

Technical analysis is a method used to interpret these patterns, identifying trends and reversals believed to be the result of market psychology. Various technical indicators, such as the Moving Average Convergence Divergence (MACD) and the Average Directional Indicator (ADX), can reveal insights about market sentiment.

Support and resistance levels, critical aspects of technical analysis, identify price points on a chart where the probabilities favour a pause or reversal of a prevailing trend. These levels are shaped mainly by human emotion and psychology.

A standard market psychology cycle illuminates how emotions evolve and their effect on our decisions. By understanding the stages of this cycle, investors can better manage their emotional responses to market movements.

.

Conclusion

In the aftermath of the pandemic-induced market turmoil, it’s evident that successful investing requires a harmonious blend of understanding mass psychology and employing technical analysis. Mass psychology provides the broader context, helping investors grasp the collective sentiment that often dictates market trends. On the other hand, technical analysis serves as a refined instrument, allowing investors to navigate the intricate details of price movements, patterns, and indicators.

Imagine mass psychology as the conductor, setting the tempo for a symphony of market movements. It establishes the overarching mood, whether fear during a downturn or confidence in a bullish market. Technical analysis, then, is the ensemble of skilled musicians, each playing a specific instrument to create a harmonious and well-timed melody. Together, they form a powerful duo that enhances investors’ ability to make informed decisions.

This partnership becomes crucial during significant market disruptions like the COVID-19 pandemic. While mass psychology highlighted the widespread panic and fear, technical analysis pinpointed the strategic entry points amid the chaos. Investors who recognized the patterns and signals were better positioned to capitalize on the market’s eventual rebound.

In conclusion, successful investing involves orchestrating a harmonious interplay between mass psychology and technical analysis. It’s akin to playing a musical composition where understanding the broader sentiment sets the tone, and employing technical precision brings out the nuanced melodies. By mastering this symphony, investors can enhance their ability to identify opportunities, weather market storms, and ultimately, build a portfolio that resonates with success.

Bridging Divides: Compelling Cross-Discipline Reads

Copleston and Russell: Dialogue of Great Minds

IBM Stock Price Today NYSE: Finesse in Financial Movements

What Is the Velocity of Money Formula?

Investor Sentiment in the Stock Market: Riding the Right Wave

When is the Best Time to Visit Colombia? Uncover the Ideal Season

What Is Price to Sales Ratio in Stocks?: A Gem-Spotting Metric

What is Behavioral Psychology?: Secrets of Human Behavior

What’s a Contrarian?: Out-of-the-Box Thinkers and Action Takers

Mass Hysteria Examples in America: Let the Tales Unfold

What is Oleic Acid Good For: Unveiling Its Health Benefits

The Ultimate Guide to Finding the Best Time to Visit Colombia

Stock Market Crash History: Learn from the Past or Be Doomed

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity

Third Wave Feminism is Toxic: Its Impact on America