Editor: Johnathan Meyers | Tactical Investor

Greek Debt And European Disorder

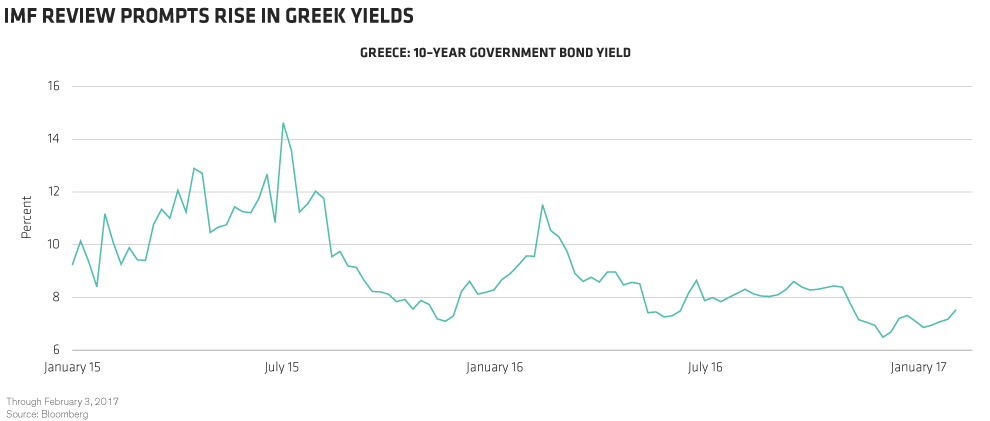

The result is that the IMF still helps monitor the program to satisfy countries like Germany and the Netherlands. Yet it refuses to commit new funding until debt sustainability has been assured, via far deeper debt relief than the EU is willing to consider—particularly during a crucial electoral period.

But this fudge creates a recurring problem. Greek debt sustainability—and, ultimately, its place in the euro—comes into sharper focus every time we approach a program review, which normally precedes the release of fresh funding. That’s exactly what happened in the first review last spring and it’s happening again now during the second review.

Another Compromise?

Last year, it ended with a compromise. This year, regional leaders know they must prevent things from coming to a head. With Dutch, French and German elections on the horizon, Brexit negotiations about to start and uncertainty from the Trump administration, the last thing EU leaders need is another full-blown Greek crisis.

Reaching a compromise won’t be easy. Greece wants the second review completed as soon as possible. However, the gaps between Greece, the EU and the IMF remain wide. Indeed, there’s still a fundamental disagreement between the EU and the IMF on debt sustainability, the need for debt relief and overall program design. Full Story

Other Articles of Interest

Gold Market Finally ready to breakout? Possibly it’s putting in a very interesting pattern (Jan 30, 2017)

Stock Market Bull destined to charge higher or is it time to bail out (Jan 13, 2017)

Feds Interest Rate stance equates to Rubbish-Economic recovery is illusory (Dec 24)

Stock Market Bulls, Stock Market fools-Market Crash next or is this just an Illusion (Dec 21)

Trump Effect Rally-Useless Dow Theory and Stock Market Crash (Dec 17)

Gold fools-dollar bulls and the long-term outlook for both Markets (Dec 9)

Inflation the Silent Killer Tax that’s destroying Middle-Class America (Dec 5)

Dominant Stock Market Trends under President Trump (Nov 22)

Bears State Crude Oil Destined to Crash-Utter Rubbish (Nov 18)

50 Trillion in Cash illustrates Mass Anxiety-Dow Industrials will soar not Crash (Nov 16)

Trump’s victory Does not Sink Global Markets Proving Experts are Jackasses (Nov 10)

Trump-The New Stock Market vix Factor (Nov 6)

Crude Oil Market-Higher prices or Market Crash (Oct 28)