Stock Market Fear Index & Murphy’s Law

Updated April 30, 2024

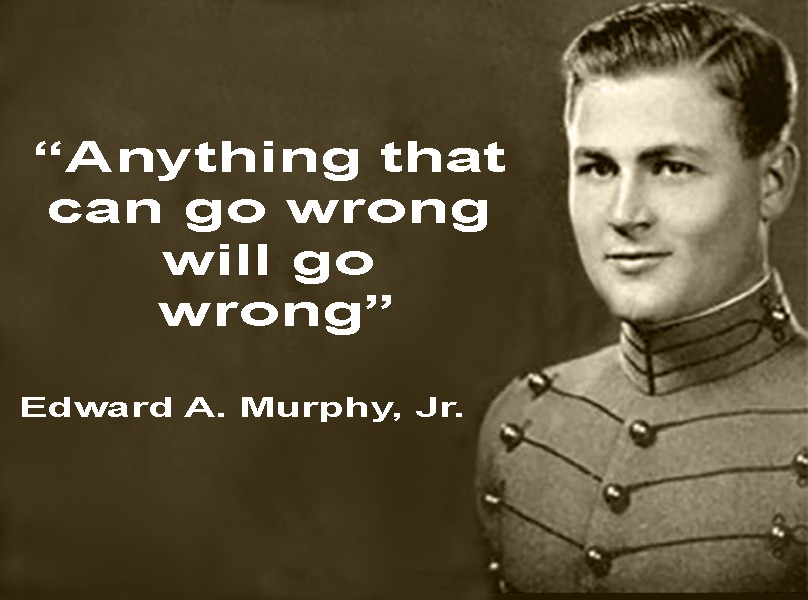

The cyclical behaviour of investors during bullish and bearish market phases remains a central theme in financial discourse. While contemporary dialogue often leverages Murphy’s Law— “Anything that can go wrong will go wrong”—to highlight the inherent risks of market volatility, a historical perspective can offer a deeper, strategic insight into managing these uncertainties.

From the annals of history, figures like Thales of Miletus, an ancient Greek philosopher from around 600 BC, and Kuan Chung, a revered Chinese statesman and strategist from the 7th century BC, stand out not only for their philosophical and political insight but also for their savvy financial strategies, which demonstrate profound patience and discipline.

Thales of Miletus and Market Strategy**: Thales, known for his pioneering use of options in olive presses, exemplifies strategic foresight. He once said, “The most difficult thing in life is to know yourself.”Applying this introspective wisdom to investing, Thales would likely advocate for a deep understanding of one’s risk tolerance and investment objectives rather than reactive shifts influenced by market highs and lows.

Kuan Chung and Financial Wisdom: Kuan Chung, on the other hand, was known for his policies that led to economic prosperity in Qi. He famously stated, **”To plan secretly, to move surreptitiously, to foil the enemy’s intentions and baulk his schemes, so that at last the day may be won without shedding a drop of blood.”** His approach to economic strategy was akin to playing chess, emphasizing the importance of strategic planning and patience over rash actions.

These historical figures embody the principle that true investing requires an understanding beyond the superficial ebb and flow of market trends. Their philosophies underscore a disciplined investment approach that values steady, informed decision-making over erratic speculation driven by the fear of missing out or the thrill of potential gains.

In conclusion, Thales and Kuan Chung’s teachings resonate with modern financial principles, advocating a systematic and self-aware approach to investing. By heeding their advice, modern investors can navigate market complexities more effectively, potentially turning what Murphy’s Law deems inevitable pitfalls into opportunities for substantial growth and stability.

Disciplined Approach to Risk Management

True investors distinguish themselves through a disciplined approach to risk management, characterized by a well-defined investment strategy that remains steadfast regardless of market conditions or emotional influences. This strategy is meticulously crafted based on personal risk tolerance, investment goals, and a long-term outlook, ensuring alignment with individual financial objectives.

Establishing a Clear Investment Strategy: It is crucial for investors, especially those with a low to medium risk appetite, to develop a clear and consistent investment strategy. This strategy should be immune to the allure of speculative investing, which often magnifies the risks associated with Murphy’s Law. As Warren Buffett advises, “Risk comes from not knowing what you’re doing.” Therefore, understanding your own risk profile and investment goals is fundamental to crafting a strategy that mitigates potential pitfalls and aligns with your long-term financial aspirations.

Accurately Assessing Your Risk Profile: Determining your risk profile involves a deep understanding of your financial goals and the level of risk you are comfortable taking. For instance, if capital preservation and stable income are your primary objectives, low-risk investments like bonds or fixed-income securities might be suitable. Conversely, if you are inclined towards maximizing returns, embracing higher-risk investments such as equities might align better with your risk tolerance.

Defeat Murphy’s Law: Accurately Assess Your Risk Profile

Once your risk profile is established, the next critical step is to create a well-diversified investment portfolio. Diversification is a key risk management strategy, helping minimize the impact of market fluctuations and reduce the overall risk of loss. By spreading investments across various asset classes, sectors, and geographic regions, you can buffer your portfolio against market volatility and enhance the likelihood of achieving your investment goals.

Creating a Diversified Investment Portfolio**: Benjamin Graham’s wisdom highlights the importance of diversification, noting that “The individual investor should act consistently as an investor and not as a speculator.” This means focusing on a diversified portfolio that can withstand market ups and downs rather than attempting to time the market or chase potential high returns through speculative bets.

Tactical Investor Stock Market Fear Index

The Hysteria Zone: A Sign of a Long-Term Market Bottom?

When the anxiety index (shown above) approaches the hysteria zone, it often signals a potential long-term market bottom. However, as many financial experts advise, it’s crucial to remember that no single tool or indicator should be relied upon in isolation. Integrating the stock market fear index with other analytical tools can provide a more comprehensive view, aiding investors in determining optimal entry and exit points.

Utilizing Multiple Indicators: As Benjamin Graham once suggested, the intelligent investor must consider the apparent market conditions and delve deeper into various indicators to make informed decisions. This approach helps mitigate the risks associated with emotional investing, which can often cloud judgment.

Stock Market Fear Index Conclusion

As the market enters a bullish phase and indicators point towards an “overbought zone,” adjustments in the cash requirements for those in the low to medium-risk categories might be necessary. This strategic shift is essential to manage risk effectively and sidestep potential pitfalls. Adapting risk profiles based on market trends can inadvertently lead to speculative behaviours, which more closely resemble gambling than investing.

Sticking to Your Investment Plan**: Warren Buffett emphasizes the importance of adhering to a well-thought-out investment plan, regardless of market fluctuations. This disciplined approach ensures that one’s investment strategy is not swayed by transient market sentiments but is driven by a clear understanding of one’s long-term financial goals and risk tolerance.

Conclusion

In summary, Murphy’s Law’s application to investment decisions underscores the necessity of maintaining a clear and consistent investment strategy. By thoroughly assessing one’s risk profile and constructing a diversified investment portfolio, investors can minimize the impact of market volatility and enhance the likelihood of achieving their investment objectives. Actual investors recognize that successful investing requires patience, discipline, and a steadfast commitment to strategic principles, allowing them to navigate through market highs and lows with informed confidence.

In conclusion, embracing a disciplined investment approach and accurately assessing your risk profile are essential to defeating Murphy’s Law in investing. True investors understand that investing is not a gamble but a strategic, long-term commitment. By adhering to these principles, investors can navigate market uncertainties with confidence, ensuring that their investment strategy remains robust in the face of the markets’ inherent unpredictability.

Embark on New Narratives: Explore Further

Is Disinflation Hitting Wall Street? Could be bad news for the fat cats

Experts Predicting Current Dow Jones Market To Crash

Meet the dollar vigilantes

How To Be Happy: Epicurus Had The Answer 1700 Years Ago