Explain why diversification is such an important concept when it comes to investing for your future

Updated April 29, 2024

Introduction

Beginning with the query, ‘Explain Why Diversification Is Such an Important Concept When It Comes to Investing for Your Future,’ the answer is simple: without diversification, you are a gambler. Putting all your eggs in one basket invites trouble. Investors diversify, while gamblers risk everything on one bet.

Much like a game of chess, investing requires strategic moves to secure your financial future. Diversification is one of the most essential strategies in an investor’s arsenal, acting as a safeguard against potential pitfalls and a pathway to maximizing returns. By spreading your investments across various assets, you reduce risk and gain exposure to different sectors and markets, ultimately improving your long-term financial outlook. This essay will explore the critical nature of diversification in investing and why it is crucial for anyone planning their financial future.

The Dangers of Putting All Your Eggs in One Basket

The age-old saying, “Don’t put all your eggs in one basket,” rings especially true when investing. Putting all your money into a single investment is incredibly risky, no matter how promising it may seem. History is littered with companies or industries that seemed infallible, only to face sudden and drastic downturns.

Consider the case of Enron, once a Wall Street darling whose shares plummeted from $90 to less than $1 in 2001 due to fraudulent activities. Or the 2008 financial crisis, where many investors lost a significant portion of their wealth by heavily investing in the seemingly stable housing market. By diversifying your investments, you avoid putting your financial future at the mercy of a single company, industry, or asset class.

Out-of-the-Box Thinking in Investing

Diversification encourages investors to think outside the box and explore various investment opportunities. It pushes investors to conduct thorough research and due diligence, evaluating different sectors, markets, and asset classes. By diversifying, you can identify and capitalize on unique investment strategies that may be overlooked.

For instance, an investor with a diversified portfolio might allocate some funds to emerging markets, gaining exposure to high-growth potential regions. Another portion could be invested in stable, dividend-paying stocks, providing a regular income stream. Additionally, diversifying across asset classes such as stocks, bonds, real estate, and commodities can further reduce risk and provide a hedge against inflation.

Avoiding the Bandwagon Mentality

Following the crowd is a common pitfall in investing. When a particular stock or asset class becomes widespread, it can lead to a bandwagon mentality, with investors piling into the same investments, often at the peak of their value. This herd behaviour can result in significant losses when the market corrects or a bubble bursts.

Diversification helps protect against this by encouraging independent thinking and decision-making. A well-diversified portfolio is less likely to be influenced by short-term market volatility or the actions of the masses. It provides a long-term perspective, allowing investors to focus on their financial goals rather than getting caught up in the hype of the latest investment trends.

The Gambler’s Mindset vs. the Investor’s Mindset

It is essential to distinguish between gambling and investing. While gambling often involves high-risk bets with the potential for quick gains or losses, investing should be approached with a long-term, disciplined mindset. Treating investing like gambling can lead to impulsive decisions, such as chasing “hot” stocks or making emotionally driven trades, often resulting in significant losses.

Diversification fosters the investor’s mindset by encouraging a thoughtful, strategic approach. It emphasizes the importance of asset allocation, risk management, and long-term growth over short-term speculation. By diversifying, investors are likelier to stick to their financial plans and avoid the impulsive decisions that often characterize gambling.

The Benefits of Diversification

Diversification offers a range of benefits that protect and enhance an investor’s financial future. First, it minimizes risk by spreading it across multiple investments. When one investment performs poorly, others can offset those losses, providing protection against market fluctuations and unexpected events.

Secondly, diversification maximizes potential returns. By allocating funds across various sectors and asset classes, investors gain exposure to different growth opportunities. Some investments may perform exceptionally well, while others may underperform, but overall, a diversified portfolio aims to deliver consistent, long-term returns.

Lastly, diversification achieves balance and resilience. A well-diversified portfolio is designed to weather market storms and stabilise during economic downturns. It allows investors to remain calm and confident, knowing their investments are not dependent on the success or failure of a single entity.

Real-Life Examples of Diversification’s Impact

Real-life examples vividly illustrate the impact of diversification on investment success. For instance, during the 2008 financial crisis, diversified portfolios that included a mix of stocks, bonds, and real estate were better positioned to weather the storm compared to those heavily invested in a single asset class. The case of Enron serves as a cautionary tale, highlighting the perils of overreliance on a single company or industry. Additionally, success stories of investors who diversified into emerging markets, stable dividend-paying stocks, and alternative assets showcase the potential for growth and resilience offered by a well-diversified portfolio.

These real-world examples underscore the importance of diversification in mitigating risk, maximizing returns, and achieving long-term financial stability. By learning from these examples, investors can gain valuable insights into the tangible benefits of diversification and its role in shaping a robust investment strategy.

Conclusion

In conclusion, the answer to this query, ‘Explain Why Diversification Is Such an Important Concept When It Comes to Investing for Your Future,’ is simple. Without diversification, you are a gambler. Putting all your eggs in one basket invites trouble. Investors diversify, while gamblers risk everything on one bet.

Diversification is a cornerstone of successful investing and a key concept for anyone planning for their financial future. By diversifying your investments, you reduce risk, protect yourself from the pitfalls of mass psychology, and open up a world of creative investment opportunities.

As legendary investor Warren Buffett once said, “Don’t put all your eggs in one basket,” this wisdom should guide your investment journey. Start by evaluating your current portfolio and identifying areas where you can diversify. Remember, diversification is a long-term strategy, and it is never too early or too late to begin building a brighter financial future.

Impactful Words: Memorable Articles

Mob Rule Game: Conquer Stock Market Mayhem for Investing Success

SOS: Distress Signals from the American Economy in Trouble

Alarming Surge in Sexual Violence in Germany

Embracing Investing Psychology: Profiting from Negativity

Corn-Eating Hamster Cannibals: Unveiling the Mystery

Food for Thought Meaning: Exploring Intellectual Depths

Fragile Foundations: Central Banks Assault on Strong Currency

Chinese Recession 2016: Examining Its Impact on the Markets

Unveiling Mass Hysteria Cases: Insights into Noteworthy Examples

What is a Hedge Fund: Beyond the Basics, Embracing Volatility

Home Run with Homeschooling Ideas

Americans with No Emergency Funds: Progress & Challenges

Hookah Lounge: A Captivating Experience for Relaxation and Socialization

Anxiety Sensitivity Index Does Not Support Stock Market Crash

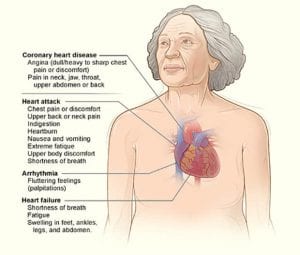

Unveiling the Silent Threat: Women and Heart Disease

FAQ: Explain Why Diversification Is Such an Important Concept When It Comes to Investing for Your Future

What is the danger of investing all your eggs in one basket?

Putting all your money into a single investment is extremely risky, regardless of how promising it may seem. History has many examples of companies or industries that appeared infallible but faced sudden and drastic downturns, such as Enron in 2001 and the housing market during the 2008 financial crisis.

How does diversification encourage out-of-the-box thinking in investing?

Diversification encourages investors to explore various investment opportunities and conduct thorough research across different sectors, markets, and asset classes. This allows investors to identify and capitalize on unique investment strategies that may be overlooked. For example, a diversified portfolio might include allocations to emerging markets for high-growth potential, stable dividend-paying stocks for regular income, and various asset classes like stocks, bonds, real estate, and commodities to reduce risk and hedge against inflation.

What are the key benefits of diversification?

Diversification offers several key benefits:

Minimizes risk: By spreading investments across multiple assets, losses in one investment can be offset by others, protecting against market fluctuations and unexpected events.

Maximizes potential returns: Allocating funds across various sectors and asset classes exposes investors to growth opportunities, aiming to deliver consistent, long-term returns.

Achieves balance and resilience: A well-diversified portfolio is designed to weather market storms and stabilize during economic downturns, allowing investors to remain calm and confident in their investment strategy.