Mastering the Chaos: The Investor’s Greatest Weapon

“A man ruled by emotion is a servant to the market. A man who masters emotion bends the market to his will.”

March 12, 2025

Markets don’t destroy wealth—emotions do. Fear paralyzes, greed blinds, and hesitation costs fortunes. Every crash is a test, every rally a trap. Those who react impulsively are devoured. Those who harness discipline in chaos emerge victorious.

Every great financial disaster has been fueled by emotion—panic selling at the bottom, reckless greed at the top. The 2008 crisis, the dot-com bubble, and the Great Depression—each one left carnage in its wake. But in every storm, the shrewd investor saw an opportunity while the masses saw doom. The cycle is eternal, the pattern predictable, yet most remain blind to it.

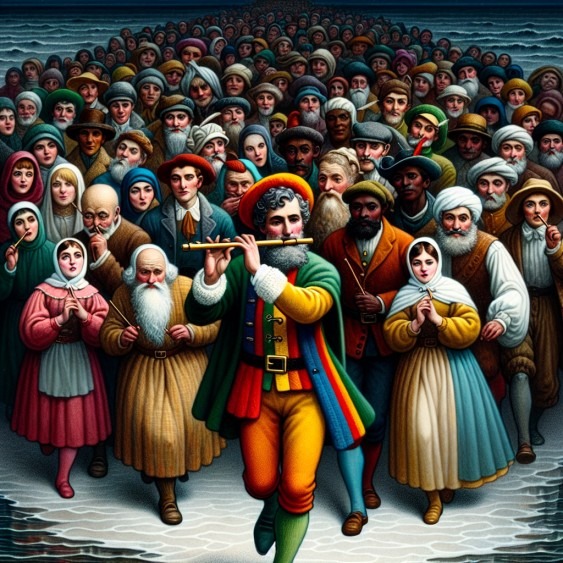

What separates the winners from the casualties? Mastery over the mind. Understanding market psychology is not just a tool; it’s a weapon. When fear spreads like wildfire, it’s time to buy. When euphoria makes everyone believe they’re a genius, it’s time to sell. The herd never learns, but the ones who study its folly do—and they profit from it.

Embracing Long-Term Emotional Resilience

The market is a warzone, and emotional resilience is your armour. It’s not just about picking the right stocks—it’s about withstanding the storms that shake out the weak hands. The difference between success and failure isn’t knowledge—it’s emotional endurance.

The best investors have always been masters of discipline. Benjamin Graham, unfazed by the Great Depression, found diamonds in the rubble. Baron Rothschild built an empire by doing what others feared most—buying when blood was in the streets. They knew that market collapses weren’t endings, but beginnings for those who had the nerve to act.

Look past the noise, resist the herd, and see the market for what it is—a battlefield of perception. The one who stays grounded, who sees fear and greed as mere distractions, is the one who turns volatility into victory.

The Iron Mind Wins the Game

From the South Sea Bubble to the crypto booms and busts, the story never changes—human nature remains the greatest market inefficiency. The world rewards those who can rise above their emotions and punish those who can’t.

The market’s greatest illusion? That you must follow its emotions.

The truth? Make your own rules—and let the fools feed your fortune.

Patience as an Emotional Anchor in Wealth Cultivation

Investment chronicles are studded with tales of individuals who have harnessed the power of patience to cultivate wealth. This patience is a testament to their ability to master their emotions in investing, a quality that has distinguished them in the annals of financial history.

From the 20th Century: Sir John Templeton

Sir John Templeton is a prime example of a 20th-century investor who demonstrated remarkable patience. Templeton’s global investment perspective led him to buy undervalued stocks worldwide, famously purchasing 100 shares of every stock trading below $1 per share on the New York and American Stock Exchanges during World War II. While others were consumed by short-term fears about the war’s outcome, Templeton’s patient approach paid off handsomely in the post-war boom. His tempered emotional response to market fluctuations allowed him to invest with foresight and discipline.

From the 18th Century: Thomas Jefferson

Rewinding to the 18th century, we see the patience of Thomas Jefferson, the third President of the United States and an astute land investor. Jefferson believed in the potential of agricultural land and its ability to produce wealth over time. Despite his era’s political and economic uncertainties, he remained focused on the long-term potential of his investments, often ignoring the speculative bubbles that distracted less patient investors.

These two figures underscore the timeless nature of patience as a crucial element in managing emotions when investing. By staying their course amidst market hysteria, they realized gains that those succumbing to short-term panic could not. It’s the investor who can wait out the market’s emotional storms who often reap the greatest rewards, proving that patience is more than a virtue in investing—it’s a strategy for enduring success.

Avoiding Impulsive Decisions

Patience is the bulwark against the siren song of impetuosity. It equips investors with the fortitude to transcend the ephemeral lures of market swings and emotional upheavals. A long-term outlook fortifies investors against the winds of change, anchoring them to their ultimate financial aspirations and safeguarding them against transient losses.

The patient investor is akin to a seasoned hunter, biding their time to strike when the moment is ripe. Market downturns and undervaluation periods are the hunting grounds for such investors, who, through their prudence, discern the opportune juncture to secure assets at bargain prices, setting the stage for future gains.

Harnessing the Power of Compounding

The magic of compounding is patience’s most profound gift. It is the silent multiplier, the force that turns a trickle into a torrent. Growing quietly but firmly, compound interest can transform modest initial investments into substantial wealth over extended periods, exemplifying the adage that time is money.

The ebb and flow of markets are as natural as the cycles of nature. Patient investors are the mariners who, rather than fighting the storm, ride out the waves. By maintaining their investment course through the storms of volatility, they emerge in calmer waters, often with their assets intact and primed for growth.

Historical data commend the virtues of longevity in investment. Buffeted by fewer extremes, long-term performance often yields a more predictable and favourable outcome. Investors who adhere to their strategies through thick and thin are more likely to reach their financial summit.

The Market’s Eternal Dance: Fear, Greed, and the Unyielding Few

“The market is a beast that feeds on fear and gorges on greed—only the disciplined escape its jaws.”

Markets rise, collapse, and resurrect in an endless cycle—this is their nature. Those who chase euphoria become sacrificial lambs when reality strikes. Those who panic at the bottom gift their wealth to those who kept their nerve. The pendulum of psychology never stops swinging, yet few dare to step back and see its rhythm.

The dot-com frenzy of the late ’90s was a spectacle of hysteria—fortunes made and lost overnight. The same story played out in 2008, in 2020, and will play out again. The untrained mind gets lost in the noise, but the master of psychology reads between the lines—waiting, watching, striking when the time is right.

Final Thoughts: The Art of Holding Steady When Others Shatter

The market does not test intelligence—it tests resolve. Survivors of crashes aren’t the smartest; they are the most unshakable.

From the Great Depression to the 2008 crisis, fortunes weren’t made by those who followed the herd—they were built by those who dared to see clearly when others saw chaos. The lesson is eternal: master yourself, and you master the market.