Feb 5, 2023

The monthly chart of the Dow highlights the Path it and general markets follow could be similar to the 73-74 and 08-09 eras. More attention is being given to the former dates as there are more similarities between the two-time frames—for example, inflationary forces, war, et cetera.

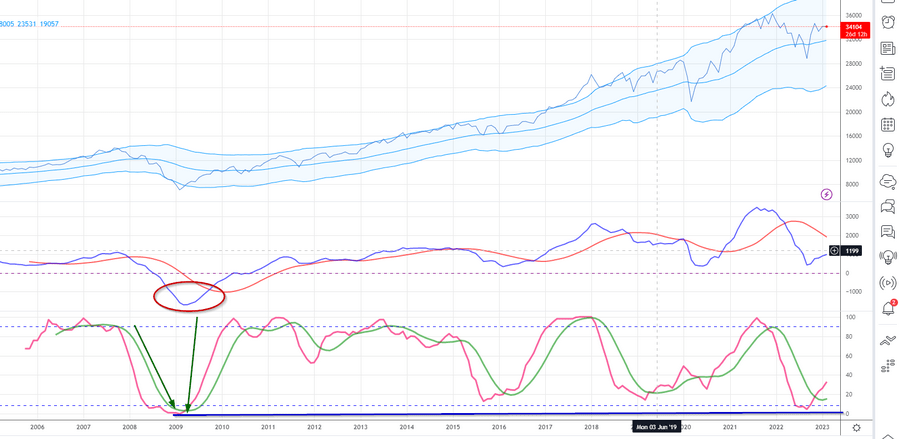

Let’s start by looking at the 2008-2009 pattern

The 2008 financial crisis provides valuable insights into the market trends, particularly in regard to the Dow Jones outlook. The MACD moved from extremely oversold to insanely oversold ranges, followed by a prolonged period of RSI in the oversold ranges. This pattern suggests that extreme market corrections are followed by extended bull markets, resulting in significant gains for investors who approached the Market in a calculated and emotionless manner. However, it’s essential to remember that investing should always be approached with a clear and rational mindset, as emotions have the potential to impact investment decisions and lead to suboptimal outcomes. In other words, Park your emotions outside, or they will drive you out of the game

Sometimes, bears win and sometimes, bulls win, but pigs always get slaughtered.

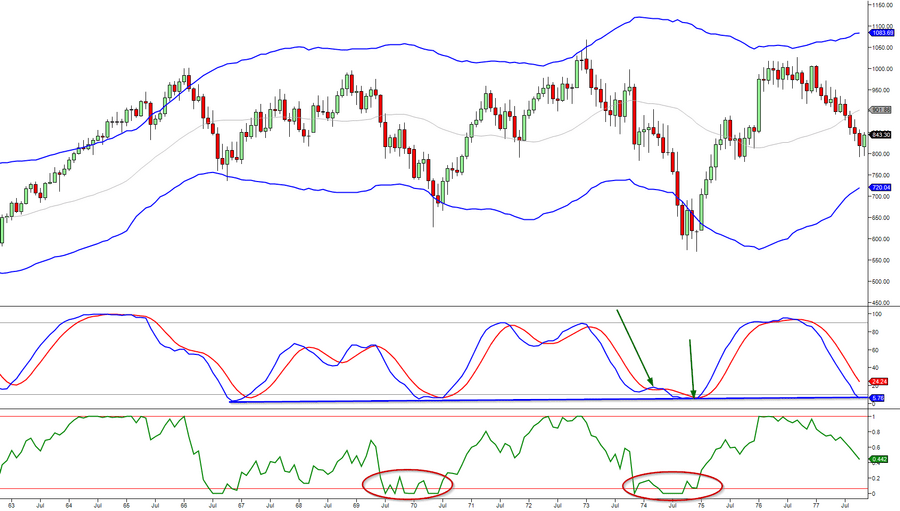

Dow Jones Outlook: Historical chart of the Dow (1963 to 1977)

In both cases, 08-09 and 73-74, when the MACDs hit the extreme oversold Zone and the RSI traded sideways in the highly oversold Zone for an extended period, the Dow Jones new lows or test the previous lows.

What happened in 08-09 took place in 73-74, where the MACD moved from the highly oversold Zone to the insanely oversold Zone (illustrated by the green arrows above) and traded to new lows.

From a low of roughly 573 (Oct 74) to a high of 1018 (March 76), the Dow Jones tacked on a stunning 77%. This proves, once again, that crisis investing pays off handsomely. However, one has to have the fortitude to understand that significant gains don’t come easy. If it were easy, every Individual with a PhD in economics would be a multi-millionaire.

MACDs and RSI

Whenever the MACDs trades to new lows and the RSI trades sideways for an extended period, it indicates a decisive upward move is in the works for the Dow Jones.

In summary, when it looked like the markets were ready to bottom, they mounted fake rallies, and the MACDs traded to new lows instead of experiencing a bullish crossover. In the process, the RSI traded sideways for an extended period.The only difference between the two time periods (73-74 and 08-09) and today is that if the MACDs trade to new lows, they will satisfy one key ingredient for FOAB (father of all buys).

Suppose this condition is met, the odds of a FOAB being triggered for the Dow Jones rise to 60%. So, that’s how valuable this criterion is if it comes to pass. At a minimum, there must be a 12-year gap between the lows. If the MACDs trade to new lows today, the gap would amount to roughly 14 years—the more significant the time gap, the better the opportunity. Taking an educated guess, as things stand, there is a 60% chance that at least a MOAB (Mother of all buys) will be triggered for the Dow Jones

Conclusion

The Dow Jones outlook is interesting, it keeps issuing new signs of strength almost on a weekly basis. This is why we keep raising the trigger points. Technically, there are some indications that the Dow could rally until late December and Possibly early January. This, in turn, means there is still time for the Nasdaq to mount a blistering turnaround. The Nasdaq could easily tack on 2000 plus points in under 21 trading days. That’s how coiled up it is. However, can and will are not the same thing. Hence it’s best to wait for more data to pour in before turning aggressive.

Once the Dow hits 32,9100, high-risk players should consider abandoning the above strategy. Instead, focus on slowly banking gains on the longs opened when the markets were tanking. Market Update November 9, 2022

In general risk, takers should use rallies to trim the longs they opened when the markets were correcting. Unless the Nasdaq or Russell 2000 (RUT) give new buy signals. If this happens, we will notify everyone, at which point risk-takers can look to deploy capital into companies in the Nasdaq or RUT.

Here are a few top sources that provide research on the benefits of crisis investing:

The Global Financial Crisis and the Investment Management Industry – McKinsey & Company

This research report provides insights into how the investment management industry was affected by the 2008 financial crisis and highlights the benefits of crisis investing, including the opportunity to acquire high-quality assets at attractive prices.

Dow Jones Outlook: Navigating Market Volatility Through Crisis Investing – The Journal of Alternative Investments

This study analyses the impact of market volatility on the Dow Jones and explores crisis investing as a strategy to navigate uncertainty and achieve long-term investment goals.

Global Financial Crisis and Opportunistic Investment Strategies – The Journal of Alternative Investments

This study analysed the impact of the 2008 financial crisis on various investment strategies and found that crisis-driven market downturns can present significant investment opportunities for those who are prepared to take advantage of them.

The Dow Jones Outlook and Crisis Investing: A Path to Long-Term Growth – Cambridge Associates

This publication provides an overview of the Dow Jones outlook in the context of crisis investing, exploring how investors can benefit from market downturns and achieve long-term growth through disciplined and strategic investment decisions.

Opportunities in Crisis Investing” – Cambridge Associates

This publication provides an overview of crisis investing and the opportunities it presents, including the ability to invest in high-quality assets at lower valuations, to take advantage of market inefficiencies, and to benefit from the eventual recovery of the Market.

Dow Jones Outlook: Opportunities in Crisis Investing – McKinsey & Company

This research report provides insights into how the Dow Jones has been affected by market downturns and highlights the benefits of crisis investing as a means to take advantage of opportunities and achieve long-term investment success.

Crisis Investing: An Opportunity for Long-Term Investors – BlackRock

This report explains the concept of crisis investing and its potential benefits, including the ability to achieve higher returns, to invest in undervalued assets, and to benefit from the eventual recovery of the Market.

Dow Jones Outlook: Crisis Investing for Long-Term Investors – BlackRock

This report explains the Dow Jones outlook in the context of crisis investing, emphasising the potential benefits of investing in undervalued assets and benefiting from market recovery over the long term.