Gold Investment Options: Is Investing in Gold Right for You

Updated Feb 2023

Central bankers have embarked on a dangerous endeavour; they have maintained rates low for an unusually long period and are now embracing the era of negative rates. Low rates foster speculation, and we know that when people speculate, things don’t end well. Prudence dictates that one have a core position in precious metals; Gold, Silver or Palladium. You don’t purchase insurance on your home because you know your home is going to burn down. You buy it because if it burns down, you are protected. Hence, Gold bullion should be viewed along the same lines.

Gold: Why It Makes Sense?

- Diversification: Gold can be a valuable addition to an investment portfolio as it can provide diversification. Gold tends to have a low correlation to other asset classes, which means it can help reduce portfolio risk when combined with other investments. According to a study by the World Gold Council, adding gold to a traditional stock and bond portfolio improved its risk-adjusted returns over the long term.

- Inflation Hedge: Gold is often considered a hedge against inflation. When the value of the currency falls, gold prices tend to rise. This is because gold is priced in dollars, and a weaker dollar makes it cheaper for foreign investors to buy gold, driving up demand and prices. This makes gold a popular investment during times of inflation.

- Safe Haven: Gold is also considered a safe-haven asset in times of market turmoil or economic uncertainty. This is because gold is a tangible asset used as a store of value for centuries. When investors are concerned about the stability of financial markets or the economy, they often turn to gold as a safe haven investment.

- Potential for Capital Appreciation: Besides the benefits of holding physical gold, investing in gold stocks can provide the potential for capital appreciation. Gold stocks can offer exposure to the upside potential of gold prices and the potential for dividends and capital gains. This can make gold stocks an attractive investment for those seeking growth and the diversification benefits of gold bullion.

Gold Stocks to Consider for Your Investment Portfolio

There are several stocks we like, but at the moment, we are neutral on Gold stocks as our trend indicator has not turned bullish. However, the following stocks are good long-term plays for those unfamiliar with technical analysis or mass psychology. .

DRD Is more volatile but tends to move rapidly and in tandem with Gold. It’s a mid-tier Unhedged Gold producer. It has a P/E of only 9.9. It has an ROE of 21.9% and a levered free cash flow of 295 million.

RGLD: It sports a forward P/E of 28, has an ROE of 9% and operating cash of almost 500 million.

AUY: Sports, a forward P/E 0f 17, has a levered cash flow of 322 million, and it is trading in the highly oversold zone on the monthly charts.

Exploring the Advantages of Investing in Gold

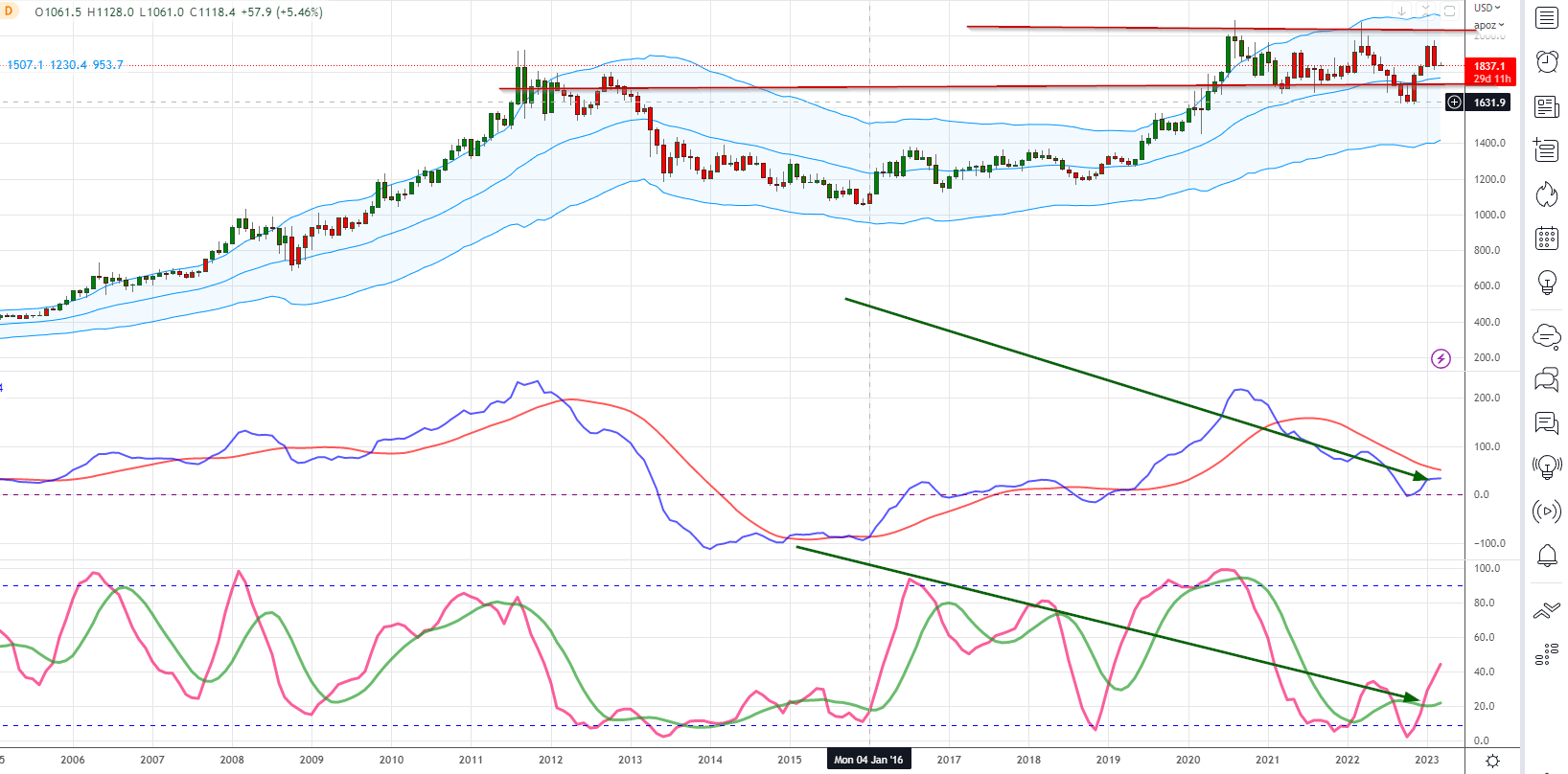

Courstesy of tradingview.com

Despite the continuing increase in money supply, gold prices have been somewhat contained due to the declining velocity of money (VM). This factor has kept the price of gold in check despite the significant amount of money created over the years. However, as the world moves away from the dollar, the outlook for gold may change.

China has already sold a significant portion of its U.S. Treasury holdings. Its gold holdings continued to grow in December as tensions with the U.S. rise and interest rates hiked. The U.S. Treasury Department reported a substantial 17% decline, equivalent to $173.2 billion, in Chinese holdings of Treasury securities in 2022 – the most significant decline since 2016.

The decline was largely due to the rapid interest rate increases by the U.S. Federal Reserve to combat inflation, which decreased bond prices, prompting investors such as China to reduce their Treasury holdings. The increasing gold holdings of China indicate their interest in diversifying their investment portfolio.asia.nikkei.com

The surge in copper prices to new heights before the start of the Russia-Ukraine war in 2022 was an early sign that actual inflation, rather than the “manflation” that we have been experiencing, is on the horizon. Our analysis also indicates that the dollar is poised to make a multi-year peak. Years ago, we were the first to become bullish on the dollar when everyone else had given up on it, even predicting that it would trade on par with the euro. It now makes sense to take advantage of dips in precious metals to establish a position.

Conclusion

Our analysis determined that the Gold bullion price will continue to rise over the next 15 to 24 months, with our lowest target falling in the 2500 to 2700 range. However, it is essential to note that there is a possibility that Gold could test the 3000 range before eventually topping out. This prediction is based on several factors, including the ongoing global economic uncertainty, geopolitical tensions, and the continued depreciation of fiat currencies.

In light of these factors, we recommend that investors use any pullbacks in the Gold market as an opportunity to build a solid long-term position in this precious metal. It is also worth noting that we have identified several Key players that we believe hold significant upside potential for investors seeking exposure to the Gold market.

Overall, investing in gold bullion and stocks can provide several benefits for investors, including diversification, inflation protection, a safe haven during market uncertainty, and the potential for capital appreciation.

Gold Investment Benefits: A Data-Driven Research Analysis

- “Why Gold Bullion is Your Financial Lifeline” by Forbes: https://www.forbes.com/sites/oliviergarret/2017/09/28/why-gold-bullion-is-your-financial-lifeline/?sh=576c6e8d6bde

- “Gold Bullion Vs. Gold Stocks: Which Should You Buy?” by Investopedia: https://www.investopedia.com/articles/basics/08/gold-bullion-gold-stocks.asp

- “Why Invest in Gold Bullion” by The Balance: https://www.thebalance.com/why-invest-in-gold-bullion-4164756

- “Why Invest in Gold Stocks” by The Motley Fool: https://www.fool.com/investing/stock-market/types-of-stocks/gold-stocks/why-invest-in-gold-stocks/

- “Gold Bullion or Gold Stocks: Which Is a Better Investment?” by U.S. News & World Report: https://money.usnews.com/investing/investing-101/articles/gold-bullion-or-gold-stocks-which-is-a-better-investment

Other Articles Of Interest:

Oops, we are doing it again; the Subprime Auto Loan Crisis party has begun (12 April)

Federal Reserve’s Game plan; create a new class of slaves (12 April)

China dumping worthless dollars & buying Gold bullion (9 April)

Wall Street Mafia Utilize Psychological War Fare to Con the masses (7 April)

So, in other words, there is no gold rally until there is one. Thanks for the tip.

Gold has not held up well given the amount of new money the world has created it since it topped out in 2011. In fact, we bailed out at the top. Having said that, we have always stated that the current pullback was a good time to add too or open new positions in Gold bullion. Hence the comment in the article

“Prudence dictates that one have a core position in precious metals; Gold, Silver or Palladium.”

Gold has hardly rallied in 2016 when you compare it to oil for example, which we turned bullish on in Feb of 2016. Yet many of the stocks are trading at extremely lofty levels that would be more reflective of Gold trading in the 1650-1700 ranges.

By the way we opened bullion positions in all three, but we are not going to go overboard.

Gold stocks? Why not. High Risk high reward.

Physical gold has yielded less than 1% real return annualized over the last 145 years. Silver has lost value in real terms since 1871 (not a typo EIGHTEEN seventy one):

https://earlyretirementnow.com/2016/06/29/gold-vs-paper-money/