Stock Market Sentiment Today: Ignore Noise, Focus on Fundamentals

Aug 10, 2024

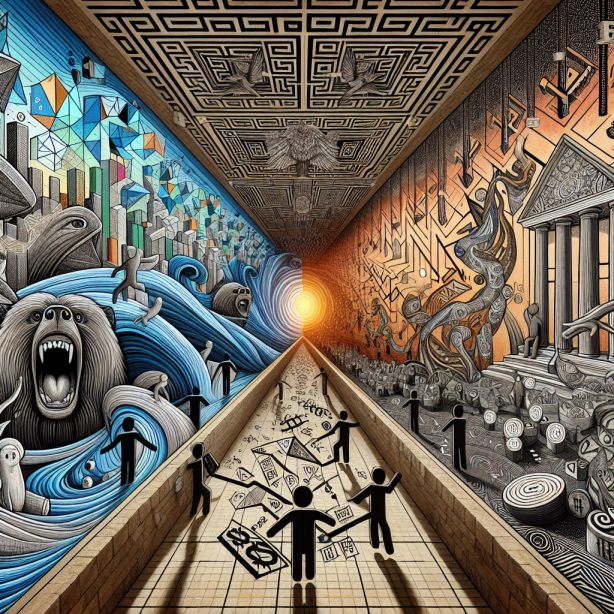

In today’s frenetic financial world, sentiment often sways the stock market more than fundamentals. Investors, driven by mass psychology, frequently fall prey to the bandwagon effect and lemming theory, chasing trends only to find themselves at the precipice of financial ruin. The most astute investors, however, understand the importance of ignoring the cacophony of market noise, focusing instead on the bedrock principles of sound investing. In this essay, we will delve into the intersection of mass psychology and market behaviour, proposing a hybrid investment strategy that combines contrarian principles with scientific data and valid research, ensuring a high probability of success.

The Pitfalls of Mass Psychology

Mass psychology, the study of how larger social groups influence individual behaviour, plays a significant role in financial markets. The bandwagon effect, where investors follow the actions of others regardless of their own beliefs, and the lemming theory, which describes the tendency of individuals to mimic the majority, often lead to irrational market behaviour. This can result in bubbles during excessive optimism and crashes during undue pessimism.

Anaxagoras and Empedocles, ancient Greek philosophers, posited that the universe is composed of fundamental elements that interact in predictable ways. Similarly, the stock market operates on basic principles that can guide investors through turbulent times when understood and applied correctly. Ignoring these principles in favour of following the crowd often leads to disastrous outcomes.

Stanley Druckenmiller, a legendary investor, famously said, “The herd mentality causes people to buy when they should be selling and sell when they should be buying.” This sentiment echoes the wisdom of Democritus, who believed in the existence of atoms and the void, suggesting that proper understanding comes from looking beyond surface appearances.

The Importance of Fundamentals

Fundamentals are the financial metrics that reflect a company’s intrinsic value. They include earnings, revenue, growth potential, and other vital indicators. When investors focus on fundamentals, they base their decisions on solid data rather than fleeting market sentiment.

Prince Shōtoku of Japan, known for his visionary thinking, emphasized the importance of a strong foundation in governance. Similarly, a strong foundation in investing involves a thorough understanding of a company’s financial health. A renowned value investor, Seth Klarman advocates for a disciplined approach to investing, focusing on intrinsic value rather than market noise. He argues that by concentrating on fundamentals, investors can identify undervalued opportunities the market has overlooked.

A Hybrid Investment Strategy

Combining contrarian principles with scientific data and valid research forms the basis of an innovative investment strategy that can navigate the complexities of today’s stock market. This hybrid approach involves the following components:

1. Contrarian Thinking: Contrarian investors go against prevailing market trends, buying when others are selling and selling when others are buying. This approach, championed by David Tepper and Stanley Druckenmiller, requires a deep understanding of market cycles and the ability to remain patient and disciplined.

2. Scientific Data and Valid Research: Incorporating data-driven insights and thorough research ensures investment decisions are based on empirical evidence rather than speculation. This approach aligns with the philosophies of **Anaxagoras** and **Empedocles**, who believed in the power of knowledge and understanding.

3. Fundamental Analysis: Focusing on a company’s financial health, growth potential, and competitive position provides a solid foundation for investment decisions. This principle is rooted in the teachings of Prince Shōtoku and Seth Klarman, who emphasize the importance of solid foundations.

Real-World Examples

To illustrate the effectiveness of this hybrid strategy, consider the following real-world examples:

1. The Financial Crisis of 2008: During the height of the financial crisis, panic and fear dominated the market. However, investors like Warren Buffett and David Tepper saw opportunities in the chaos. Focusing on fundamentals and adopting a contrarian mindset, they identified undervalued assets and made significant gains when the market eventually recovered.

2. The Dot-Com Bubble: In the late 1990s, the dot-com bubble inflated as investors poured money into technology stocks with little regard for fundamentals. When the bubble burst, those who had focused on solid financial metrics and avoided the frenzy could capitalize on the subsequent market correction.

The Hybrid Idea: Contrarian Data-Driven Investing

The hybrid idea that combines contrarian principles with scientific data and valid research is “Contrarian Data-Driven Investing.” This strategy involves:

1. Identifying Market Extremes: Use sentiment indicators, such as the VIX (Volatility Index) and put/call ratios, to identify periods of excessive optimism or pessimism. These indicators provide valuable insights into market sentiment and can signal potential turning points.

2. Conducting Thorough Research: Analyze historical data, financial statements, and industry trends to identify companies with solid fundamentals that are temporarily undervalued due to market sentiment. This research should be grounded in empirical evidence and supported by valid data.

3. Implementing a Contrarian Approach: When sentiment indicators signal extremes, take a contrarian position by buying undervalued assets during periods of pessimism and selling overvalued assets during periods of optimism. This approach requires patience and discipline but can yield significant returns over time.

Insights from Diverse Thinkers

Drawing insights from diverse thinkers can enrich our understanding of stock market sentiment and investment strategies:

Empedocles stressed the importance of fundamental elements. Investing means focusing on key financial metrics that reflect a company’s intrinsic value.

Democritus: Advocated for looking beyond surface appearances. Investing involves identifying opportunities that the market has overlooked or misunderstood.

Akbar the Great: Known for his visionary thinking. Investing involves adopting a long-term perspective and remaining patient and disciplined.

Stanley Druckenmiller Advocates a contrarian approach to investing. This means going against prevailing market trends and identifying opportunities in chaos.

David Tepper emphasizes the importance of patience and discipline. Investing involves waiting for the right opportunities and remaining committed to your strategy.

Seth Klarman: Advocates for a disciplined approach to investing. In investing, this means focusing on intrinsic value rather than market noise.

Rethinking Assumptions

To succeed in today’s stock market, investors must challenge their assumptions and adopt a more analytical and strategic approach. This involves:

1. Ignoring Market Noise: Focus on fundamentals rather than short-term market movements. This requires a deep understanding of a company’s financial health and growth potential.

2. Adopting a Contrarian Mindset: Go against prevailing market trends and identify opportunities in the chaos. This requires patience and discipline but can yield significant returns over time.

3. Conducting Thorough Research: Base investment decisions on solid data and empirical evidence rather than speculation. This involves analyzing historical data, financial statements, and industry trends.

4. Focusing on Long-Term Goals: Adopt a long-term perspective and remain committed to your investment strategy. This requires patience and discipline but can lead to significant gains over time.

Practical, Actionable Strategies

To implement the hybrid strategy of Contrarian Data-Driven Investing, consider the following practical, actionable strategies:

1. Monitor Sentiment Indicators: Monitor sentiment indicators such as the VIX, put/call ratios, and investor sentiment surveys. These indicators can provide valuable insights into market sentiment and signal potential turning points.

2. Conduct Fundamental Analysis: Analyze a company’s financial statements, growth potential, and competitive position. Focus on key metrics such as earnings, revenue, and cash flow to identify undervalued opportunities.

3. Adopt a Contrarian Approach: When sentiment indicators signal extremes, take a contrarian position by buying undervalued assets during pessimism and selling overvalued holdings during periods of optimism.

4. Remain Patient and Disciplined: Stick to your investment strategy and avoid being swayed by short-term market movements. This requires patience and discipline but can lead to significant gains over time.

5. Focus on Long-Term Goals: Adopt a long-term perspective and remain committed to your investment strategy. This requires patience and discipline but can lead to significant gains over time.

Conclusion

In conclusion, today’s stock market is often driven by sentiment and mass psychology, leading to irrational behaviour and market volatility. To succeed as an investor, it’s crucial to ignore the noise, focus on fundamentals, and avoid being swayed by the masses. By adopting a hybrid strategy that combines contrarian principles with scientific data and valid research, investors can navigate the complexities of the market and identify opportunities that others have overlooked.

Drawing insights from diverse thinkers can enrich our understanding of stock market sentiment and investment strategies. By challenging our assumptions and adopting a more analytical and strategic approach, we can focus on practical, actionable strategies that yield significant returns over the long term. Remember, as the saying goes, “The market is a device for transferring money from the impatient to the patient.” Stay patient, stay disciplined, and focus on

Enlightened Explorations: Navigating the World of Ideas