Understanding DOW Theory Forecasts: How Market Trends Shape Investment Strategies

Apr 14, 2025

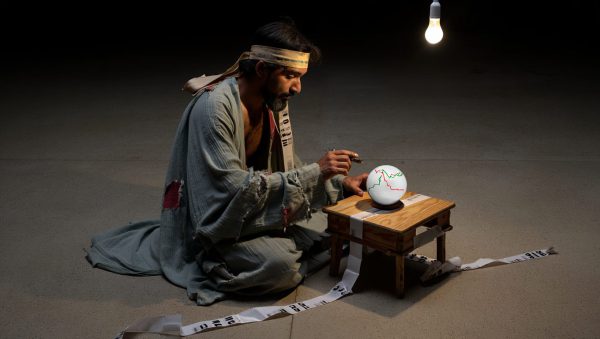

Markets are more than just numbers, charts, and occasional gut-wrenching volatility—they are living, breathing ecosystems. They pulse with the collective hopes, fears, and ambitions of millions of participants, each acting as both a catalyst and a reactionary force. At the heart of this dynamic complexity lies DOW Theory, a century-old framework that offers profound insight into how market trends shape investment strategies. But understanding DOW Theory forecasts isn’t just about memorizing principles; it’s about seeing markets as multidimensional entities, where order and chaos constantly collide to create opportunity.

To truly master this framework, one must dive beyond traditional definitions—beyond the surface of primary trends, secondary reactions, and minor fluctuations. It’s a realm where behavioral psychology meets technical analysis, where the past whispers secrets to the future, and where the uncertain and unpredictable can be tamed, if only briefly. Let’s delve into the intricate dance of DOW Theory and how it can revolutionize your approach to investing.

The Psychology of Market Trends: Riding the Waves of Fear and Greed

At its core, DOW Theory is built on the observation that markets move in trends. But these trends are not driven by pure logic or economic fundamentals—they are propelled by the raw, primal forces of human psychology. Fear and greed are the twin engines of market movement, creating waves that ripple through time and space, shaping everything from the smallest day trade to the grandest economic cycles.

In a bull market, optimism feeds on itself, creating a self-reinforcing loop of higher prices and greater euphoria. In contrast, bear markets are dominated by fear as investors rush to sell, amplifying declines and fueling panic. DOW Theory forecasts rely on recognizing these emotional undercurrents and understanding that markets, like people, are rarely rational. They are governed by cognitive biases—confirmation bias, loss aversion, and recency bias—that distort perception and decision-making.

Consider the crash of 1929 or the global financial crisis of 2008. Both were moments of collective hysteria, where fear overwhelmed reason, and millions of investors succumbed to the herd mentality. Yet, amidst these chaotic selloffs, the seeds of recovery were already being sown. Savvy investors who understood DOW Theory’s principles recognized that every primary trend reversal begins with the faintest whisper of change—a new high after a series of lows, or a quiet consolidation after months of freefall. These are the moments where fortunes are made, not by following the herd, but by anticipating its eventual turn.

Technical Analysis Meets Behavioral Science

If markets are shaped by human behavior, then technical analysis becomes a tool for interpreting that behavior. DOW Theory forecasts rely on the principle that the market discounts everything—that all available information is already reflected in price. But what if the price is more than just information? What if it’s a map of collective psychology, a living record of hope, fear, and indecision?

Technical indicators, such as moving averages, oscillators, and volume patterns, serve as lenses through which we can decode this psychological map. The 200-day moving average, for example, has long been a bellwether for market trends. When prices rise above this threshold, it’s often seen as a sign of bullish momentum; when they fall below, bearish sentiment takes hold. However, the true power of such indicators lies not in their predictive ability but in their capacity to reveal the invisible hand of crowd psychology at work.

Imagine a trader using DOW Theory alongside modern tools like the WaveTrend Oscillator or Adaptive Moving Averages. These indicators visualize the ebb and flow of buying and selling pressure, much like a cardiogram reveals the rhythm of a heartbeat. By synthesizing these tools with DOW Theory’s principles, traders can identify not just the direction of the trend but its underlying emotional drivers. This fusion of technical analysis and behavioral science transforms the act of trading into something almost mythic—a quest to understand and anticipate the collective psyche of the market.

Paradoxes and Patterns: The Duality of Market Trends

One of the most fascinating aspects of DOW Theory is its paradoxical nature. On the one hand, it asserts that trends are predictable, governed by identifiable patterns and cycles. On the other hand, it acknowledges that markets are inherently unpredictable, subject to sudden shocks and unforeseen events. This duality is not a flaw but a feature—a reflection of the complex, nonlinear dynamics that drive market behavior.

Consider the concept of confirmation, a cornerstone of DOW Theory. According to this principle, a primary trend is only validated when both the industrial and transportation averages move in the same direction. This idea suggests a level of order and symmetry in the market, a harmony between different sectors that confirms the broader trend. Yet, history is rife with examples where this harmony breaks down—where transportation lags behind industry, or vice versa, creating moments of uncertainty and contradiction.

These edge cases are where the real insights lie. They teach us that markets, like nature, thrive on tension and contradiction. Just as a river carves its path through resistance, market trends emerge from the interplay of opposing forces—bulls and bears, fear and greed, order and chaos. Understanding DOW Theory forecasts means embracing this complexity, seeing patterns not as rigid templates but as dynamic, evolving entities shaped by the ever-changing currents of human behavior.

Emergent Properties: The Art of Strategic Adaptation

In the world of investing, strategies that stagnate are destined to fail. Markets evolve, and so must we. DOW Theory, despite its age, remains relevant because it is not a static set of rules but a living framework that adapts to the changing landscape of finance. Its principles are not prescriptive but descriptive, offering a lens through which to interpret the market’s constant state of flux.

Emergent properties arise when individual components interact to create something greater than the sum of their parts. In the context of DOW Theory, these properties manifest as new patterns, trends, and opportunities that emerge from the interplay of various market forces. For example, the rise of algorithmic trading and machine learning has introduced new dynamics into the market, creating feedback loops and amplifying trends in ways that Charles Dow could never have imagined.

Yet, the essence of DOW Theory remains unchanged: the recognition that markets move in waves, that trends are shaped by collective behavior, and that success lies in understanding and anticipating these movements. By integrating DOW Theory with modern tools and insights, investors can develop strategies that are not only adaptive but visionary—strategies that embrace uncertainty and turn it into an advantage.

The Philosophy of Investing: Beyond Profit and Loss

At its highest level, investing is not just about making money—it’s a philosophical endeavor, a way of understanding the world and our place within it. DOW Theory forecasts offer a unique perspective on this journey, challenging us to see markets not as chaotic and unpredictable but as reflections of human nature in all its complexity.

To master this framework is to master oneself. It requires discipline, patience, and the ability to think independently, to resist the siren call of the herd and chart your own course. It demands a willingness to embrace paradox, to see order in chaos and opportunity in uncertainty. And it rewards those who are bold enough to act when others hesitate, to buy when fear is at its peak, and to sell when euphoria reigns.

In the end, DOW Theory is more than just a tool for analyzing market trends. It is a philosophy of life, a reminder that success is not about avoiding risk but about understanding and managing it. It is a call to embrace the unknown, to see the world not as a series of isolated events but as a dynamic, interconnected system where every action creates ripples that shape the future.

Conclusion: The Legacy of DOW Theory

Understanding DOW Theory forecasts is not just about predicting market trends—it’s about seeing the bigger picture. It’s about recognizing the interplay of psychology, behavior, and technical patterns that drive market movements. It’s about embracing complexity, uncertainty, and paradox as essential elements of the investing journey.

At its heart, DOW Theory is a celebration of the human spirit—of our ability to adapt, innovate, and thrive in the face of uncertainty. It is a reminder that the markets, like life itself, are a dance between order and chaos, a constant interplay of opposing forces that creates something greater than the sum of its parts. And in this dance, those who understand the rhythm and move with it will always find their edge.