No great genius has ever existed without some touch of madness.

Aristotle

End of Cash: Fed’s Titan Clash

Updated Nov 27, 2023

The impending death of cash, driven by Central bankers worldwide, is akin to a high-stakes game played on a global scale. These financial maestros, intoxicated by the allure of negative rates, are steering the world towards a cashless future. The repercussions of this shift will be severe, particularly for the unprepared masses, who are often the first to bear the brunt of economic upheavals. History remains a constant reminder that the players and their disguises may change, but the game remains the same, leaving the average individual grappling with the aftermath.

The Federal Reserve, despite its attempts to maintain a brave facade, is already retreating from its firm stance of yesteryears. Recognizing the economic challenges, they are inching towards the global trend of negative rates, a path where resistance seems futile.

Central bankers are playing a dangerous game with negative rates in this era of disappearing cash. This potent financial tool amplifies economic vulnerabilities and can lead to dire consequences, especially for the unsuspecting masses, who are usually the hardest hit during financial crises. The Fed’s attempt to maintain a brave front is unravelling as they are pushed towards the inevitable path of aligning with global trends. Resistance, it seems, is futile in the face of shifting monetary policies and economic realities.

The illusion of market freedom is often created by decisions such as the Fed’s move to raise rates. However, the reality is starkly different. The markets are meticulously controlled and manipulated, with every boom and bust cycle strategically planned and executed.

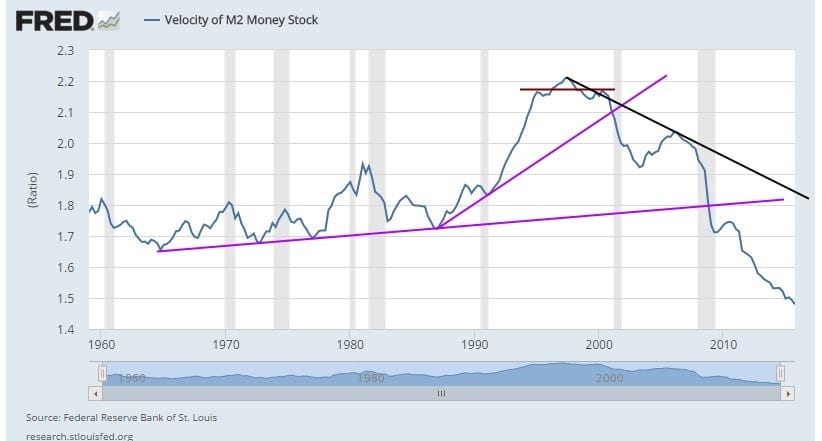

In a thriving economy, the velocity of money increases, indicating a healthy flow of money within the economy. However, recent trends reveal a concerning drop in this crucial indicator. The current market’s mainstay is hot money, and without this influx, the facade of economic recovery quickly crumbles.

The end of cash and the rise of negative rates represent a significant shift in global financial systems. This change, driven by central banks worldwide, will have far-reaching implications, particularly for the unprepared masses. We must understand these changes as we navigate this new economic landscape and adapt accordingly. The stakes are high, and the impact of these changes will be felt far and wide.

War on Cash: Decoding Financial Trends

The chart’s peak in 2000 began a continuous downward trajectory. Although there was a brief respite from 2000-2009, a bearish lower high emerged, leading to a downward spiral.

Amidst the increasing money supply, a covert strategy by the Fed is diverting the funds away from the masses. This tactic aims to mitigate the impact of inflation and has proven effective thus far. We emphasize that for the Fed to fuel a substantial economic bubble, channelling money directly to the public is essential. An ongoing experiment seems evident in the auto market, with an impending burst of the subprime bubble. The next venture could involve injecting funds into the public for various general expenditures, fostering new businesses, or potentially initiating another housing bubble.

While housing demand is rising, mortgage qualification remains a hurdle for many. Envision the impact if acquiring a loan became more accessible— a potential shift from renting to homeownership, given the current cost dynamics.

Questioning the authenticity of the recovery, the prolonged low-interest rates defy conventional expectations. Instead of direct Fed support, the corporate sector has intervened through questionable practices like illegal stock buybacks. This shift from enhancing the bottom line to prioritizing stock repurchases raises concerns about the sustainability of economic growth.

Corporate Game Plan: The Rise of Stock Buybacks

A paradigm shift is evident in corporate strategy — the focus has shifted from enhancing the bottom line to a singular emphasis on purchasing more shares. This manoeuvre, while artificially boosting earnings per share (EPS), raises questions about the sustainability of such practices. It seems to be a perfect scheme, yielding substantial returns without the effort traditionally associated with improving the fundamental bottom line.

The current low-interest-rate environment further incentivizes companies to borrow substantial sums for these ventures. This trend will likely propel stock buybacks to unprecedented levels, reaching heights that may appear irrational in the future. The allure of significant financial gains, coupled with favourable borrowing conditions, sets the stage for a scenario where the pursuit of short-term gains takes precedence over long-term financial health.

As these corporate manoeuvres unfold, it becomes imperative for investors and observers to scrutinize the implications of these practices on market dynamics and economic stability. The era of prioritizing stock buybacks over fundamental growth introduces a new layer of complexity to the financial landscape, necessitating a careful and informed approach to navigating the evolving terrain.

Navigating the Central Bank’s End Of Cash Narrative

As central bankers embark on a potential war on cash, or what some foresee as the end of the cash era, it becomes imperative for individuals and corporations to develop a robust game plan to counteract the evolving financial landscape.

The initiation of damaging rate wars signals a new chapter, one that our central bankers might soon adopt. In this ultra-low-rate environment, speculation becomes the norm as individuals and corporations seek better returns. The corporate realm, in particular, has taken an assertive stance, indulging in a share buyback spree that shows no signs of abating.

This strategic move allows corporations to borrow at minimal costs, leveraging these funds to repurchase substantial shares and, consequently, elevate the Earnings per Share (EPS). The looming prospect of negative interest rates serves as potent fuel for these share buyback programs. The analogy of offering super crack to an addict highlights the irresistible nature of negative rates, propelling corporate debt to unprecedented levels. What may seem like excessive debt levels today will likely pale compared to the corporate debt landscape shortly.

In this dynamic environment, perceiving strong corrections as buying opportunities becomes a prudent approach. From a mass psychology perspective, this bull market remains one of the most scorned in history. Until there is a collective acceptance, it is poised to reach heights surpassing many people’s expectations. Crafting a resilient strategy that aligns with these shifting dynamics is crucial for individuals navigating the uncharted territory of finance.

“Now, behold the polished narrative—the soft version. Crafted to captivate, popular media presents an enticing perspective. Your discerning decision awaits.”

The Future of Cash: Central Banks’ Digital Currency Push

The future of cash is undergoing a significant transformation as central banks worldwide explore the concept of central bank digital currencies (CBDCs). CBDCs are digital forms of money issued and regulated by central banks, intended to serve as a secure and reliable means of payment.

The potential introduction of CBDCs raises several important considerations:

1. Privacy: The shift towards digital currencies raises concerns about privacy and the potential for increased surveillance. Central banks must carefully design CBDCs to address these concerns and protect individuals’ financial data and transactions.

2. Financial inclusion: CBDCs have the potential to enhance financial inclusion by providing access to financial services for individuals who are currently unbanked or underbanked. However, it’s crucial to address issues such as accessibility, connectivity, and digital literacy to ensure that CBDCs truly benefit all segments of society.

3. Role of traditional banks: The introduction of CBDCs could reshape the banking landscape and impact the role of conventional banks. Depending on the design, CBDCs could allow individuals to hold accounts directly with the central bank, bypassing commercial banks. This could affect banks’ deposit base and ability to create credit.

4. Cross-border transactions: CBDCs could facilitate faster and more efficient cross-border transactions, reducing costs and friction in international payments. However, implementing CBDCs globally would require coordination and cooperation among central banks and regulatory bodies.

5. Technological challenges: The development and implementation of CBDCs present technological challenges, including issues related to scalability, security, and resilience. Central banks would need to address these challenges to ensure the smooth and secure operation of CBDC systems.

It’s important to note that the exploration and potential implementation of CBDCs are still in the early stages. Central banks are conducting research, pilot programs, and public consultations to better understand the implications and design considerations of CBDCs. The specific features and functions of CBDCs will likely vary across countries, reflecting different economic, regulatory, and societal factors.

The Rise of Central Bank Digital Currencies (CBDCs)

Central banks worldwide are actively researching and exploring the development of Central Bank Digital Currencies (CBDCs). CBDCs are digital forms of national currencies issued and regulated by central banks.

The potential benefits of CBDCs include:

1. Efficiency and speed: CBDCs aim to provide faster and more efficient payment systems, enabling near-instantaneous transactions. This can enhance the overall efficiency of the payment infrastructure and reduce settlement times.

2. Financial inclusion: CBDCs have the potential to promote financial inclusion by providing access to digital financial services for individuals who are currently unbanked or underbanked. CBDCs can offer a secure and convenient means for these individuals to store and transact with digital currency.

3. Security and trust: CBDCs can leverage advanced cryptographic technology to ensure secure transactions and protect against counterfeiting. A central bank’s involvement in issuing and regulating CBDCs can enhance trust and confidence in the currency.

4. Monetary policy tools: CBDCs could potentially provide central banks with new tools for implementing monetary policy. By directly overseeing the digital currency, central banks could have more control over the money supply, interest rates, and financial stability.

5. Innovation and competition: CBDCs may foster innovation by providing a platform for developing new financial products and services. They could also promote competition by offering an alternative to digital payment providers.

It’s important to note that the design and implementation of CBDCs will vary across countries, reflecting different economic, regulatory, and technological considerations. Some central banks are exploring the use of CBDCs for retail transactions, while others are focusing on wholesale transactions between financial institutions.

While CBDCs offer potential benefits, some important considerations and challenges need to be addressed. These include privacy, cybersecurity, financial stability, cross-border interoperability, and the impact on the existing financial system.

As central banks continue to research and explore CBDCs, it is crucial to closely monitor their developments and assess the potential implications for the economy, financial industry, and society.

Enhancing Financial Inclusion and Efficiency

Enhancing financial inclusion and improving cross-border transactions are two crucial potential benefits of developing CBDCs.

1. Financial inclusion: CBDCs have the potential to provide individuals who are unbanked or underbanked with access to digital financial services. By leveraging digital technology, CBDCs can offer a secure and convenient means of storing and transacting money, even for those who do not have access to traditional banking services. This can empower individuals, particularly in underserved areas, to participate in the formal economy and access financial tools and services.

2. Cross-border transactions: CBDCs can potentially streamline cross-border transactions, making them faster, cheaper, and more efficient. Traditional cross-border transactions often involve multiple intermediaries, high fees, and lengthy settlement times. CBDCs could enable direct peer-to-peer transactions between individuals or entities in different countries, reducing the need for intermediaries and facilitating faster settlement. This can lead to cost savings and increased efficiency in international payments, benefiting businesses, individuals, and the global economy.

However, it’s important to note that realizing these potential benefits requires addressing various challenges and considerations:

1. Infrastructure and connectivity: Infrastructure and connectivity are crucial to fully exploit the benefits of CBDCs for financial inclusion and cross-border transactions. Access to reliable internet services and digital infrastructure is needed to ensure that individuals and businesses can easily access and use CBDCs.

2. Digital literacy and education: Promoting digital literacy and education is essential to ensure individuals have the necessary skills to understand and use CBDCs effectively. Without adequate education and awareness, the potential benefits of CBDCs may not be fully realized, particularly among populations with limited digital literacy.

3. Privacy and security: CBDCs must address concerns related to privacy and security to gain public trust and acceptance. Balancing the need for transparency and regulatory oversight with individuals’ privacy rights is critical in designing and implementing CBDCs.

4. Interoperability and international cooperation: For CBDCs to facilitate seamless cross-border transactions, interoperability between CBDC systems and international cooperation among central banks and regulatory bodies are essential. Standardization and collaboration efforts will be necessary to ensure the smooth functioning of CBDCs in a global context.

Privacy Concerns and Surveillance Risks

While CBDCs offer convenience and accessibility, they raise concerns about privacy and surveillance. Digital currencies can give central banks unprecedented visibility into individuals’ financial transactions. Striking the right balance between privacy and regulatory oversight will be crucial to ensure public trust in CBDCs.

The Role of Traditional Banks

The development and implementation of CBDCs raise valid concerns regarding privacy and surveillance. While CBDCs can offer convenience and accessibility, balancing privacy and regulatory oversight is crucial to maintaining public trust and confidence in these digital currencies.

Here are some key considerations related to privacy concerns and surveillance risks with CBDCs:

1. Financial transaction visibility: CBDCs have the potential to provide central banks with unprecedented visibility into individuals’ financial transactions. This raises concerns about the potential for increased surveillance and the collection of extensive transaction data. Establishing robust safeguards and limitations on collecting, storing, and using transaction data is essential to protect individuals’ privacy rights.

2. Anonymity and pseudonymity: Preserving individual privacy through anonymity or pseudonymity is an important aspect of digital currency design. Striking the right balance between privacy and regulatory objectives, such as anti-money laundering (AML) and combating the financing of terrorism (CFT), is crucial. Designing CBDCs that ensure transaction privacy while allowing for effective regulatory oversight is a complex challenge.

3. Data security and protection: CBDC systems must be designed with robust security measures to protect user data and prevent unauthorized access or data breaches. Strong encryption, secure storage mechanisms, and comprehensive cybersecurity protocols are essential to safeguard individuals’ financial information and control data misuse.

4. Consent and control over data: Individuals should be able to exercise control over their financial data. Providing clear and transparent mechanisms for individuals to give informed consent for data sharing and establishing mechanisms to revoke consent or delete personal data are important considerations.

5. Regulatory frameworks and oversight: Establishing robust regulatory frameworks and oversight mechanisms is crucial to ensure that the collection and use of financial transaction data through CBDCs adhere to privacy laws and regulations. Independent oversight bodies can help monitor and enforce privacy protections.

6. Education and transparency: Promoting public awareness and understanding of the privacy implications of CBDCs is essential. It is important to educate individuals about their rights, the privacy safeguards in place, and the limitations on data collection and use. Transparent communication from central banks regarding the privacy features and policies of CBDCs can help build public trust.

Preparing for a Cashless Future

As we move towards a cashless future, it’s crucial for individuals and businesses to prepare and adapt to the changing financial landscape. Here are some critical steps to consider:

1. Embrace digital payment methods: Get familiar with various digital payment methods, such as mobile payment apps, contactless cards, and online payment platforms. Adopting these methods can provide convenience and efficiency in day-to-day transactions.

2. Secure digital wallets: If you use digital wallets to store and manage your digital currencies or payment information, it’s essential to prioritize their security. Use strong and unique passwords, enable two-factor authentication, regularly update your software and apps, and be cautious of phishing attempts or suspicious links.

3. Stay informed about CBDC developments: Stay updated on the developments and discussions surrounding Central Bank Digital Currencies (CBDCs). Understanding how CBDCs may impact the financial landscape can help you stay ahead and make informed decisions regarding your economic activities.

4. Enhance cybersecurity measures: As digital transactions become more prevalent, prioritizing cybersecurity is essential. Regularly update your devices and software, use reputable security software, be cautious of sharing sensitive information online, and exercise caution when accessing financial services or making transactions on public networks.

5. Educate yourself on financial literacy: Enhancing your financial literacy is crucial in a cashless future. Understand budgeting, managing digital transactions, protecting against fraud, and making informed financial decisions. Many resources, including online courses and educational websites, are available to help improve your financial knowledge.

6. Prepare for potential disruptions: While a cashless future offers many benefits, it’s essential to be prepared for them. This includes power outages, network failures, or technical glitches that may temporarily affect digital payment systems. It’s a good practice to have backup payment options like keeping a small amount of cash or having alternative payment methods available.

7. Seek guidance and support: If you have any concerns or questions about transitioning to a cashless future, seek guidance from financial advisors, banking institutions, or relevant authorities. They can provide valuable insights and assistance in navigating the changing economic landscape.

The Cashless Society: Implications for Consumer Behavior

Indeed, the transition to a cashless society has significant implications for consumer behaviour and spending habits.

1. Convenience and speed: Digital payment methods offer convenience and speed, allowing consumers to make transactions quickly and easily. With mobile wallets and contactless cards, individuals can make purchases with a simple tap or scan, eliminating the need for physical cash or card swiping. This convenience can lead to increased impulse buying and spur-of-the-moment purchases.

2. Changing payment preferences: Consumers may prefer digital payment methods as cash becomes less prevalent. They may carry less cash and rely more on mobile payments, online transactions, and digital wallets. This shift in payment preferences can influence how businesses and merchants offer their products and services, emphasizing digital payment options to cater to consumer demands.

3. Data-driven personalization: Digital payment methods generate data that can be used for personalized marketing and targeted offers. With each digital transaction, consumer preferences, spending patterns, and demographic information can be collected, analyzed, and utilized to provide tailored recommendations or promotions. This data-driven personalization can enhance the consumer experience but raises concerns about privacy and data security.

4. Financial tracking and budgeting: Digital payment methods often come with built-in features that allow consumers to track their spending more easily. Mobile banking apps, for example, provide transaction histories and real-time updates on account balances. This can help individuals monitor their expenses, set budgets, and make more informed financial decisions.

5. Reduced reliance on physical banks: The shift towards digital payments can lead to reduced reliance on physical bank branches for routine transactions. Consumers can access their accounts, make payments, and manage their finances through online and mobile banking platforms. This trend may impact how banks and financial institutions operate, prompting them to invest more in digital infrastructure and customer support services.

6. Security concerns: While digital payment methods offer convenience, security concerns are associated with them. Consumers need to be vigilant about protecting their personal and financial information, such as passwords, PINs, and authentication methods. They must also be aware of phishing attempts, malware, and other cyber threats that can compromise their digital payment accounts.

7. Challenges for the unbanked and underserved populations: The transition to a cashless society may pose challenges for individuals who do not have access to digital payment methods or are unfamiliar with technology. This includes unbanked populations and those with limited access to smartphones or internet connectivity. Ensuring financial inclusion and addressing the needs of these populations is crucial during the transition to a cashless society.

Changing Spending Patterns

The shift towards digital payments can impact consumers’ spending patterns.

1. Impulse buying: Digital payment methods, such as mobile wallets and contactless cards, offer convenience and speed, making it easier for consumers to make impulse purchases. With a simple tap or scan, transactions can be completed quickly, often without physical cash or card swiping. This convenience can lead to more impulsive spending as the ease and speed of digital transactions tempt consumers.

2. Small-value transactions: Digital payment methods are particularly convenient for small-value transactions, such as buying coffee or paying for public transportation. With the elimination of the need for exact change or the hassle of carrying coins and notes, consumers may be more inclined to make these small-value purchases, leading to increased spending on such items.

3. Digital subscriptions and recurring payments: The rise of digital payments has also facilitated the growth of subscription-based services and recurring payments. Consumers can quickly sign up for digital subscriptions like streaming services, software, or membership programs. These regular payments can increase over time and impact overall spending if not carefully managed.

4. Online shopping: The convenience of digital payments has contributed to the growth of online shopping. Consumers can purchase from the comfort of their homes or on the go, leading to increased spending on e-commerce platforms. The ease of one-click purchases and stored payment information can make it easier for consumers to make impulse purchases online.

5. Financial tracking challenges: While digital payments offer convenience, they can also make tracking and managing spending challenging. With physical cash, individuals have a tangible representation of their available funds, whereas digital transactions can be less visible. Consumers need to monitor their digital transactions actively, keep track of their spending, and set budgets to avoid overspending or accumulating debt.

To manage spending responsibly in a cashless society, here are some practical tips:

1. Set a budget and track your expenses: Establish a budget that aligns with your financial goals and track your expenses regularly. Utilize personal finance apps or budgeting tools that can help you monitor and categorize your digital transactions.

2. Practice conscious spending: Before making a purchase, take a moment to consider whether it aligns with your needs and priorities. Avoid impulsive buying by giving yourself time to consider the purchase and evaluate its value.

3. Review your recurring payments: Regularly review your subscriptions and recurring payments to ensure they align with your needs and provide value. Cancel any subscriptions you no longer use or find unnecessary.

4. Be mindful of online shopping: When making online purchases, compare prices, read reviews, and be cautious of impulse buying. Consider using shopping carts to delay purchases and give yourself time to evaluate whether you truly need the items.

5. Regularly review your financial situation: Periodically review your financial situation, including your income, expenses, and overall debt levels. This can help you identify areas where you may need to adjust your spending habits and make necessary changes.

By being mindful of your spending habits, setting realistic budgets, and regularly reviewing your finances, you can responsibly navigate the shift towards a cashless society and avoid excessive debt or financial strain.

Financial Security and Fraud Risks

Financial security and guarding against fraud are crucial considerations in a cashless society. Here are some key measures to help protect your financial information and mitigate fraud risks:

1. Strong and unique passwords: Create strong, unique passwords for your digital payment accounts, online banking platforms, and other financial services. Avoid using common passwords or personal information that can be easily guessed. Consider using a password manager to store and generate complex passwords securely.

2. Two-factor authentication (2FA): Enable two-factor authentication whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a unique code sent to your mobile device or a fingerprint scan, in addition to your password. This helps protect your accounts even if your password is compromised.

3. Keep software and apps up to date: Regularly update your devices, software, and mobile apps to ensure you have the latest security patches. Software updates often include critical security fixes that help protect against vulnerabilities that hackers could exploit.

4. Be cautious of phishing attempts: Be wary of unsolicited emails, text messages, or phone calls requesting personal or financial information. Be careful of clicking on links or downloading attachments from unknown sources. Legitimate organizations typically do not ask for sensitive information through email or text.

5. Use secure networks: When making digital payments or accessing financial services, use safe and trusted networks. Avoid using public Wi-Fi networks, as they can be vulnerable to hackers. If you must use public Wi-Fi, consider using a virtual private network (VPN) to encrypt your internet connection and add an extra layer of security.

6. Monitor your accounts regularly: Review your transaction history and account statements to identify any unauthorized activity or suspicious transactions. Report any discrepancies or fraudulent charges to your financial institution promptly.

7. Be cautious when sharing information: Be mindful of sharing personal or financial information online. Only provide sensitive information on secure websites with a padlock symbol in the address bar or “https” in the URL. Be cautious of sharing personal information on social media platforms, as fraudsters can use it for targeted attacks.

8. Educate yourself about common scams: Stay informed about common scams and fraud techniques. Be cautious of lottery or inheritance scams, phishing attempts, fake payment requests, and other fraudulent schemes. Awareness and knowledge can help you recognize and avoid potential threats.

9. Consider additional security measures: Depending on your needs, you may consider other security measures, such as using biometric authentication (e.g., fingerprints or facial recognition) for unlocking your devices or authorizing transactions. Some financial institutions also offer additional security features, such as transaction alerts or spending limits, to help you monitor and control your digital payments.

Financial Exclusion and the Digital Divide

Transitioning to a cashless society can inadvertently exacerbate financial exclusion and widen the digital divide. Here are some key considerations regarding financial exclusion and the digital divide:

1. Limited access to technology: Not everyone has access to the necessary technology, such as smartphones or computers, to participate in digital payments. This can be due to economic constraints or a lack of infrastructure in certain regions. Without access to these devices, individuals may face barriers to participating fully in the cashless economy.

2. Lack of internet connectivity: Access to reliable internet connectivity is crucial for engaging in digital payments and financial services. However, in some areas, mainly rural and underserved communities, internet access may be limited or unavailable. This lack of connectivity can hinder individuals from accessing digital payment platforms and conducting online transactions.

3. Technological literacy: Digital payment methods require a certain level of technological literacy to navigate the interfaces, understand the security measures, and use the features effectively. Individuals unfamiliar with technology or lacking digital literacy skills may find it challenging to adopt and use digital payment methods.

4. Financial inclusion for the unbanked: In a cashless society, unbanked or underbanked may face significant challenges. This includes individuals who do not have traditional bank accounts or access to formal financial services. Without access to digital payment methods or banking services, these individuals may be excluded from participating fully in the formal economy.

5. Vulnerable and marginalized populations: Certain vulnerable and marginalized populations, such as low-income individuals, elderly people, people with disabilities, and refugees, may face additional barriers to adopting digital payment methods. These populations may have limited resources, physical limitations, or language barriers, making it difficult to adapt to digital payments and access the necessary support.

Addressing financial exclusion and bridging the digital divide is crucial to ensure that no one is left behind in a cashless society. Here are some steps that can be taken:

1. Improve digital infrastructure: Governments, financial institutions, and technology companies can collaborate to improve digital infrastructure, including expanding internet connectivity and ensuring reliable access to technology in underserved areas. This can involve investing in broadband infrastructure, mobile connectivity, and community technology centres.

2. Promote digital literacy and education: Initiatives promoting digital literacy and educating individuals about digital payments can help bridge the gap. This can include training programs, workshops, and resources to help individuals gain the necessary skills and knowledge to participate in the cashless economy.

3. Develop inclusive digital payment solutions: Financial institutions and technology companies can work together to develop inclusive digital payment solutions that cater to the needs of unbanked and underbanked populations. This can include simplified interfaces, language localization, and alternative authentication methods to ensure accessibility for diverse user groups.

4. Collaboration among stakeholders: Governments, financial institutions, technology companies, and non-profit organizations must collaborate to develop comprehensive strategies for financial inclusion. This can involve sharing resources, expertise, and best practices to address the challenges associated with the digital divide and financial exclusion.

5. Regulatory frameworks and consumer protection: Governments can implement regulatory frameworks that promote financial inclusion and consumer protection in the cashless economy. This can include measures to ensure affordable and accessible financial services, protect consumer rights, and prevent discriminatory practices.

The Importance of Financial Education

Financial education is crucial in empowering individuals to make informed decisions and navigate the complexities of a cashless society.

1. Digital payment literacy: Financial education equips individuals with the knowledge and skills to effectively use digital payment methods. It helps them understand the different types of digital transactions, such as mobile wallets, online banking, and contactless payments, and how to use them securely and responsibly. This includes setting up and managing digital accounts, understanding transaction fees, and being aware of potential risks and fraud.

2. Budgeting and financial planning: Financial education teaches individuals the importance of budgeting and financial planning. It helps them understand how to track their income and expenses, set financial goals, and make informed decisions about spending and saving. In a cashless society, where digital transactions can be more frequent and less visible, financial education becomes even more critical for individuals to maintain control over their finances.

3. Responsible borrowing and debt management: With the convenience of digital payments, individuals may be more prone to borrowing and accumulating debt. Financial education teaches individuals about responsible borrowing practices, such as understanding interest rates, loan terms, and repayment obligations. It also helps individuals develop strategies for managing and reducing debt effectively.

4. Consumer protection and rights: Financial education raises awareness about consumer protection laws, rights, and responsibilities. It helps individuals understand their rights when making digital payments, handling disputes or fraudulent transactions, and dealing with financial service providers. This knowledge empowers individuals to protect themselves and make informed decisions when engaging in digital transactions.

5. Investment and financial product literacy: Financial education helps individuals understand the basics of investing, such as stocks, bonds, mutual funds, and other financial products. It provides them the knowledge to evaluate investment options, understand risks and rewards, and make informed decisions aligned with their financial goals. This knowledge becomes increasingly important in a cashless society where individuals can access a wider range of investment opportunities.

6. Protection against financial scams and fraud: Financial education is crucial in equipping individuals with the skills to identify and protect themselves against financial scams and fraud. It helps individuals recognize common red flags, such as phishing attempts, fraudulent investment schemes, or identity theft. By understanding these risks, individuals can take proactive measures to safeguard their financial information and avoid falling victim to scams.

7. Long-term financial well-being: Financial education promotes long-term economic well-being by teaching individuals about building an emergency fund, planning for retirement, and making informed decisions about insurance and other financial protections. These topics help individuals develop a comprehensive understanding of personal finance and make decisions that positively impact their financial futures.

Investing in financial education programs at various levels, including schools, workplaces, and community organizations, can help individuals develop the knowledge, skills, and confidence to navigate the complexities of a cashless society. By promoting financial literacy, we can empower individuals to make informed decisions, protect themselves from financial risks, and achieve their financial goals.

Embracing the Cashless Future

Absolutely! Embracing the cashless future can bring about numerous benefits and opportunities. Here are some key points highlighting the advantages and steps for thriving in a cashless society:

1. Convenience and efficiency: Digital payment technologies offer convenience and efficiency by eliminating the need for physical cash and streamlining transactions. With a few taps or clicks, individuals can make payments, transfer funds, and manage their finances from anywhere at any time. This convenience can save time and effort in daily financial transactions.

2. Innovation and financial inclusion: The shift to a cashless society fosters innovation in financial technologies, opening up new possibilities for financial inclusion. Digital payment methods can provide access to financial services for unbanked or underbanked individuals, enabling them to participate in the formal economy. Mobile banking and digital wallets can offer affordable and accessible financial solutions to marginalized populations, promoting economic empowerment.

3. Enhanced security measures: Digital payment technologies often have robust security measures to protect against fraud and unauthorized access. Encryption, tokenization, biometric authentication, and other security features help safeguard financial transactions. Staying informed about these security measures and adopting best practices can help individuals protect their financial information and mitigate risks.

4. Financial management tools: Cashless transactions generate digital records that can be leveraged for financial management. Digital platforms often offer tools for tracking expenses, analyzing spending patterns, and setting financial goals. These tools can provide valuable insights and help individuals make informed financial decisions, ultimately promoting better financial management and planning.

5. Economic growth and digital economy: The transition to a cashless society can stimulate economic growth by boosting digital transactions and facilitating business operations. Digital payments can expedite transactions, reduce costs associated with cash handling, and enable businesses to reach broader customer bases. This can contribute to the growth of the digital economy and create new opportunities for entrepreneurs and companies.

To thrive in a cashless future, consider the following steps:

1. Embrace digital payment technologies: Familiarize yourself with various digital payment methods, such as mobile wallets, online banking, and contactless payments. Explore the options available and choose platforms that align with your needs and preferences.

2. Stay informed about security measures: Educate yourself about the security measures implemented by digital payment providers. Keep up-to-date with best practices for creating strong passwords, enabling two-factor authentication, and protecting your personal and financial information.

3. Adopt financial management tools: Take advantage of financial management tools offered by digital platforms, such as budgeting apps, expense trackers, and personal finance software. These tools can help you monitor your spending habits, set savings goals, and make informed financial decisions.

4. Invest in financial education: Enhance financial literacy by engaging in financial education programs, attending workshops, or accessing online resources. This will empower you to make informed decisions, protect yourself from financial risks, and maximize the benefits of a cashless society.

5. Advocate for financial inclusion: Support initiatives promoting financial inclusion and bridging the digital divide. Encourage access to digital payment infrastructure, financial education programs, and affordable technology for underserved populations.

Originally published on Mar 30, 2016, it was meticulously refined and continually updated, culminating in the latest revision as of Nov 2023.

Provocative Readings for the Curious

Catch the Wave: Decoding Trading Cycles with the Esoteric Edge