Why the US Dollar Is Set to Rally Alongside the Stock Market

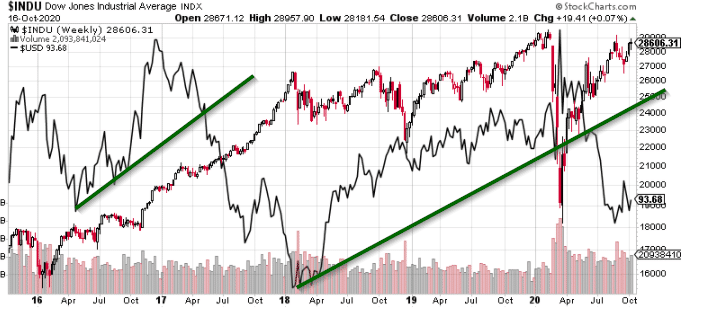

As you can see from the chart, the Dow and the dollar have rallied together in the past, with the green lines representing uptrends in the dollar. Currently, the dollar is consolidating, but once this period is over, we believe the next rally will be even more robust, potentially leading to the dollar trading on par with the Euro. This will be a significant boon for the US stock market, as the strong dollar will attract billions, and eventually trillions, of dollars in capital from outside the country.

How the US Is Set to Win the Currency Wars with China and the EU

The US has several advantages over other nations, including China and the EU, which will enable it to continue to dominate the global economy. These advantages include access to cutting-edge AI-based technologies, a strong currency, and the world’s reserve currency the US dollar. Additionally, the US boasts the strongest military in the world, which further strengthens its position in global affairs.

The Fed has played an essential role in positioning the US to succeed in the global economy. By keeping rates higher than other major players such as the EU and Japan, the US has gained an upper hand in the currency wars that are gaining traction. As a result, the dollar has been trending in tandem with the US stock market, further cementing its position as a global economic powerhouse.

The Fed has also fingered the rest of the world, by keeping rates higher than the other major players out there (EU, Japan, etc.), they now hold the upper hand in the race to the bottom currency wars that are gaining traction today. Sol Palha

Research Articles that support Articles Hypothesis

“Dollar rises as US stocks post best month since 1987” – Reuters

“Why the US dollar could be the big winner of the coronavirus crisis” – CNBC

“Why the US Dollar and Stocks are Diverging” – MarketWatch

Link: https://www.marketwatch.com/story/why-the-us-dollar-and-stocks-are-diverging-2020-09-23

“The US Dollar is Rallying Alongside US Stocks. That’s Not a Coincidence.” – Barron’s

Other Articles of Interest

Stock sentiment and Market sentiment Charts

Investors’ Primal Fear is their inability to deal with Market crashes

The Fear Factor is what Propels Investors to Panic at the Wrong time

Perception Is The Key To Everything-If used correctly