Updated Oct, 2023

Several months have passed since Alibaba’s groundbreaking acquisition of Lazada, the premier e-commerce platform in Southeast Asia. This strategic move sent shockwaves through the tech and e-commerce world, prompting heated debates among pundits and critics. The acquisition’s implications were multifaceted, sparking discussions on whether both sides struck a mutually beneficial deal, how it would affect competitors such as MatahariMall, Tokopedia, and Orami, and concerns regarding the potential inundation of the region with inexpensive Chinese products.

Alibaba’s acquisition of Lazada was perceived as a masterstroke in expanding its global footprint. Lazada, with its extensive reach in Southeast Asia, offered Alibaba a critical bridgehead into this rapidly growing market. It allowed the e-commerce giant to tap into a vast consumer base in a region with tremendous growth potential. This strategic maneuver not only bolstered Alibaba’s global position but also ignited a fierce battle with its arch-rival, Amazon, in the quest for e-commerce dominance on a global scale.

The deal had a significant ripple effect on Lazada’s regional competitors. Firms like MatahariMall, Tokopedia, and Orami had to reassess their strategies and step up their game to withstand the intensified competition. This acquisition also brought forth concerns about the influx of low-cost Chinese products into the Southeast Asian market, potentially crowding out local businesses. The need for quality control and product differentiation became more pronounced as companies faced the challenge of maintaining their market share.

Alibaba’s entry into Southeast Asia through Lazada’s acquisition marked the beginning of a new era for e-commerce in the region. It signified the unstoppable globalization of e-commerce giants and their determination to capture the hearts and wallets of consumers in every corner of the globe. The long-term impact of this move was yet to be fully realized, but one thing was certain – the e-commerce landscape in Southeast Asia had been forever transformed.

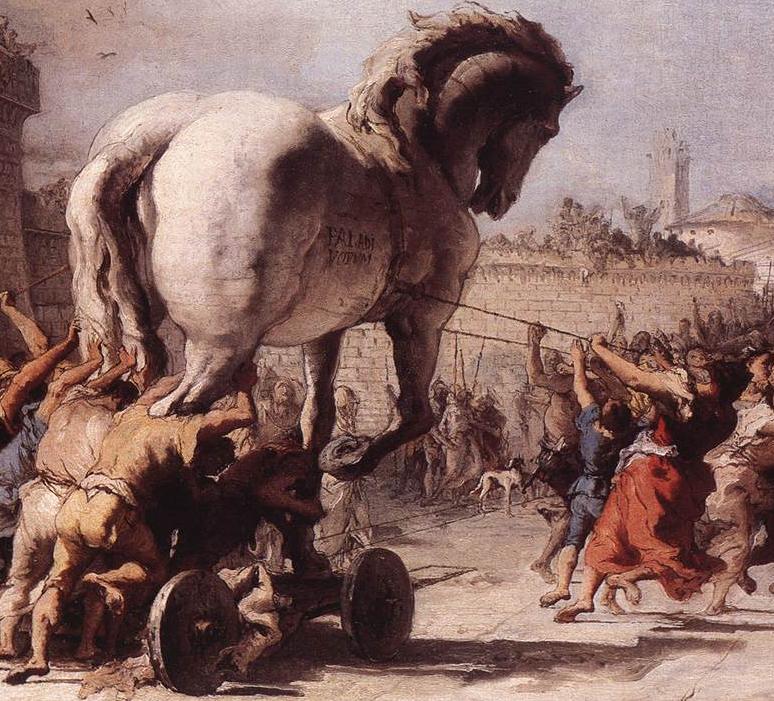

In the fast-paced realm of e-commerce, where giants rise and fall, Alibaba’s latest strategic maneuver has been nothing short of a game-changer. If you think this acquisition is just another case of corporate expansion, think again. Welcome to the world of “Alibaba’s Trojan horse” – a cunning and ambitious plan that is redefining the very landscape of Southeast Asian e-commerce.

The news of Alibaba’s acquisition of Lazada sent ripples of excitement through the startup founders and venture capitalists, who saw this as more than just a business deal. It was a bold statement that thrust the region onto the global stage. Dreams of increased funding and lucrative exits danced in the minds of those who believed in the potential of Southeast Asia’s burgeoning tech scene.

However, if you’ve only scratched the surface of this remarkable development, you’ve missed the grand design at play. Alibaba’s strategy, led by the visionary Jack Ma, transcends the mere increase in retail Gross Merchandise Volume (GMV). It unveils why Ma is often a few steps ahead in the game, and why he’s a titan in the tech world.

Beyond the high-fives and celebrations, especially within the retail sector, a more intricate narrative unfolds. Alibaba’s acquisition of Lazada represents a Trojan horse, a brilliantly disguised game-changer that is poised to reshape the e-commerce landscape. It’s a masterstroke that extends far beyond figures and profits, symbolizing Alibaba’s ambition to secure its dominion over the ever-expanding e-commerce universe.

As we delve deeper into this story, we’ll unravel the true magnitude of this strategic move, its impact on rivals, and how it’s poised to influence every aspect of the Southeast Asian e-commerce experience. It’s a journey that will take us from the boardrooms to the consumer’s doorstep, revealing why Alibaba’s Trojan horse is a tale that will continue to captivate the world of business for years to come. So, fasten your seatbelts, and let’s embark on this riveting journey together.

Peter Thiel, PayPal and Why Distribution Matters

Peter Thiel’s ‘Zero to One’ unveils the gripping tale of PayPal’s near-fatal stumble and its miraculous recovery, which ultimately set the stage for its phenomenal growth and acquisition by eBay. This fascinating journey offers profound insights into strategic decisions that transformed PayPal from a precarious startup into a powerhouse.

In the early days, PayPal teetered on the brink of extinction, struggling to find a foothold in the competitive landscape of online payments. But fortune favored the bold, and a serendipitous discovery altered the course of the company’s destiny. That discovery was eBay.

Recognizing an opportunity, PayPal set its sights on eBay’s Power Sellers. These were the linchpins, the architects of the bulk of transactions coursing through eBay’s digital marketplace. By targeting these influential figures, PayPal laid the foundation for a strategic partnership that would be its salvation.

What unfolded next was a stroke of genius. PayPal didn’t stop at merely identifying its target; it actively courted these Power Sellers, offering them a seamless, secure, and efficient payment solution. As a result, these influential eBay entrepreneurs enthusiastically embraced PayPal, recognizing the value it brought to their online businesses. This symbiotic relationship amplified PayPal’s reach and influence.

Yet, the real stroke of brilliance lay in PayPal’s audacious move to accelerate user acquisition. They catalyzed their growth engine by incentivizing users with sign-up bonuses and referral programs. This strategic push effectively transformed PayPal into a mainstream payments platform, drawing users from all corners of the internet.

The fusion of these strategies turned PayPal into a financial force to be reckoned with. It evolved from a fragile entity on the brink of oblivion to a powerhouse that fundamentally altered the landscape of digital transactions. The eventual acquisition by eBay was a testament to PayPal’s meteoric rise, but it was also a reflection of the symbiotic relationship that had blossomed between the two giants of the online world.

Thiel’s narrative serves as a compelling reminder of the unpredictable yet decisive twists that can shape the destiny of tech companies, turning potential tragedy into triumph. PayPal’s journey from near oblivion to industry domination is a testament to the power of innovation and strategic thinking in the ever-evolving digital age.

Distribution, as Peter Thiel ardently emphasizes, plays a pivotal role in a company’s success. Beyond crafting an exceptional product, it’s the ability to effectively disseminate that product to the masses that often determines triumph or failure in the business arena. Thiel’s perspective is a powerful testament to the significance of distribution channels. He unequivocally states, “Poor distribution — not product — is the number one cause of failure. If you can get even a single distribution channel to work, you have a great business. If you try for several but don’t nail one, you’re finished.”

In the context of PayPal, eBay proved to be a catalyst for growth, riding on the coattails of its extensive reach and the sheer velocity of transactions conducted on its platform. The high usage levels were a lifeline that kept the payments company afloat and thriving. It’s a prime example of how strategic distribution can turn a business into a formidable force.

Now, Alibaba’s acquisition of Lazada mirrors this emphasis on distribution, but for what purpose? Many might assume it’s solely to flood the Southeast Asian market with inexpensive Chinese products. However, the true story goes deeper than that. Alibaba’s strategic move isn’t merely about inundating the market with low-cost goods; it’s about redefining the e-commerce landscape in Southeast Asia.

By integrating Lazada into its arsenal, Alibaba secures a significant distribution channel that extends its influence far beyond just products. It’s a gateway to accessing the vast and rapidly growing consumer base of Southeast Asia. This alliance opens the door to a spectrum of services and innovations that can reshape the way people shop, trade, and interact with digital commerce in the region.

In essence, Alibaba’s use of Lazada as a distribution channel is not about flooding markets with cheap Chinese products. It’s about leveraging a gateway to a diverse and promising marketplace, where the fusion of technology, e-commerce, and logistics can create new possibilities and experiences for consumers. The true potential lies in how Alibaba will harness this distribution power to shape the future of e-commerce in Southeast Asia.

Read this story in its entirety for you will understand why China is destined to rule for the next 100 years or more. You will find out how Alibaba strategically teamed up with DIDI and destroyed Uber. However, that was not Alibaba’s goal; their goal was to make Alipay a household name and they succeeded. Alipay is a payment gateway like Paypal that Alibaba acquired and via DIDI they displaced Paypal and all other payment systems in China to become the top player. Alibaba continues to make strategic acquisitions and eventually Alipay is probably going to become the leading player in Asia and through Alipay China is going to bring intense competition to many sectors especially to the banking industry. We also suspect that China’s UnionPay which has already displaced VISA regarding the volume of transactions processed could eventually unseat VISA and its rival Mastercard.

Many individuals think China is only suitable for producing cheap imitations. That was the 1st part of the game plan; become the factory of the world. Now they have succeeded the second part of the plan to attack all hi-tech industries. China will soon dominate the smartphone industry, and in few years it will wreck havoc on Global Chip manufacturers as it will produce high-quality chips and sell them at much lower prices. Chinese have an average IQ of 105 that is one of the highest in the world, by contrast, Americans have an average IQ of 98, and most European nations have an IQ that ranges from 98-101. Interestingly the two countries at the top of the list are Singapore and Hong Kong; both have a predominantly Chinese population; these two countries both have an average IQ of 108.

This content was originally published on Dec 11, 2016, but it has been continuously updated over the years, with the latest update conducted in Oct 2023.