Men are afraid to rock the boat in which they hope to drift safely through life’s currents when the boat is stuck on a sandbar. They would be better off to rock the boat and try to shake it loose or, better still, jump in the water and swim for the shore. Thomas Szasz

The Super Rich and the Current Stock Market Complexities

Updated Oct 21, 2023

Let’s delve into this topic within a historical context, for those who learn from history are not destined to repeat past mistakes. Moreover, this approach illuminates our real-time actions and decisions.

The current state of the stock market and the economy presents a complex picture. Despite tepid earnings and a high unofficial unemployment rate, the stock market continues to perform well, supported by aggressive share buyback programs and the perception of a healthy economy. The Bureau of Labor Statistics’ method of calculating unemployment may create a false picture, as it does not account for individuals who have given up looking for work.

However, despite these negative factors, the stock market has shown resilience and upward momentum. Several key factors contribute to this trend. Firstly, hot money, or speculative investments, continues to flow into the market. This influx of capital helps buoy stock prices and sustains the illusion of a healthy economy. The Federal Reserve has also played a crucial role in supporting the market. The central bank has been reluctant to withdraw its support, recognizing that the stock market’s performance is a vital factor in maintaining the perception of economic strength.

Another significant factor is the sentiment of the crowd. This bull market is often regarded as one of the most hated. Many investors remain skeptical and have not fully embraced the market’s upward trajectory. Historically, bull markets tend to end on a euphoric note when the masses are fully invested and exuberant. The fact that there is a substantial amount of cash sitting on the sidelines, estimated at around $50 trillion, indicates that the crowd is far from euphoric, suggesting that a market crash is unlikely until sentiment shifts dramatically.

It is important to note that market conditions can change rapidly, and investors should always exercise caution and consider the potential risks associated with investing. While the current market environment may seem favorable, conducting thorough research, diversifying investments, and consulting with financial advisors to make informed decisions based on individual circumstances and risk tolerance is essential.

BlackRock Reveals a $50 Trillion Cash Trove Ready for Action.

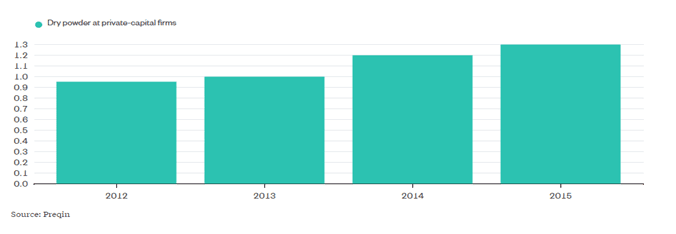

According to BlackRock, there is a significant amount of cash waiting to be deployed in the market, estimated at over $50 trillion. This figure encompasses various sources, including central bank assets, financial firm reserves, and consumer savings accounts. Additionally, private equity firms are accumulating substantial amounts of liquid securities, with Blackstone reporting that nearly one-third of its assets are held in cash. Fund managers, on the whole, have increased their reserve holdings to levels that haven’t been seen since 2001.

The high levels of cash reserves suggest a cautious sentiment among investors and market participants. Cash accumulation may be driven by several factors, including concerns about potential market volatility, uncertainty surrounding economic conditions, and a desire to have liquidity readily available for investment opportunities.

While ample cash reserves can provide flexibility and a sense of security, it also reflects a hesitancy to fully deploy capital into riskier assets such as stocks and bonds. Holding significant amounts of cash can impact investment returns, as money typically generates lower yields than other investment options.

Substantial cash reserves in the market indicate that investors are still exercising caution and may not fully embrace riskier assets. The deployment of this cash into the market could potentially have significant implications for asset prices and market dynamics, depending on how and when it is put to use.

It is essential for investors to closely monitor the allocation and deployment of these cash reserves, as their actions can impact market trends and present potential investment opportunities. However, the timing and manner in which this cash is deployed will depend on various factors, including economic conditions, market sentiment, and individual investment strategies.

Super Rich Are Building Up Cash Reserves

The trend of private equity firms building up cash reserves is indeed notable. It suggests that these firms are holding onto liquidity and waiting for what they perceive as a fair-valued market. However, it’s important to remember that determining a fair value for the market is subjective, and opinions can vary among investors.

The statement about assigning a fair value to the current market being the “Joke of the century” reflects a skeptical view on traditional valuation methods in today’s market environment. It implies that the usual metrics used to assess stock values, such as price-to-earnings ratios, may not accurately reflect the true worth of companies due to potential manipulation of earnings.

In such times, the argument is made to focus more on mass sentiment and technical indicators rather than relying solely on traditional valuation metrics. Mass sentiment refers to the overall mood and sentiment of market participants, as it can influence market trends and direction. Technical indicators, on the other hand, are tools used by traders and analysts to analyze price patterns and market trends based on historical data.

While sentiment and technical indicators can provide valuable insights into short-term market movements, it’s essential to exercise caution and consider a comprehensive range of factors when making investment decisions. Fundamental analysis, which assesses a company’s financial health, industry outlook, and competitive position, should also be taken into account.

Investors should know that various factors, including news events, market psychology, and behavioral biases, can influence market sentiment and technical indicators. Therefore, it is crucial to conduct thorough research, diversify investments, and consider the guidance of financial professionals when navigating the complexities of the market.

Revolutionary Insights: The Psychology Behind the Bull Market’s Soaring Ascent

In the ever-evolving finance and investment landscape, it’s fascinating to note how psychological and sentiment indicators have been whispering a remarkable tale. Though seemingly skittish, the crowd stands in contrast to a market that’s scaling new heights. This striking paradox heralds an unprecedented development, suggesting that the bull market is poised for an ascent that defies conventional wisdom.

An intriguing term, “inflate to infinity,” might soon break into the mainstream media, unveiling the Federal Reserve’s clandestine slogan. Many await the elusive ‘optimal entry point,’ yet the probability of this wait bearing fruit diminishes by the day. It’s not just a 1000-2000 point pullback they anticipate; expectations run even higher.

From a contrarian perspective, setting aside political biases, a Trump win could be viewed as a positive twist. History reveals that the masses often err in their judgments. Uncertainty looms in the wake of such an event, driving the lemmings toward the exit doors. Markets may momentarily retreat, following the cycle of selling based on fear, paving the way for those who keep emotions in check to seize opportunities.

Moreover, the staggering cash reserve on the sidelines stands as both a floor and a symbol of widespread jitters. This collective unease is a testament to the path of least resistance, pointing upward. In this intriguing interplay of psychology and finance, we witness a story of resilience and the unceasing march of the bull market.

Super Rich Strategies: Navigating Market Risks with Confidence

In the current market environment, there are several potential risks that investors should consider:

1. Market Volatility: Volatility is an inherent characteristic of the stock market. Rapid and significant price fluctuations can occur due to various factors such as economic data releases, geopolitical events, and shifts in investor sentiment. Investors should be prepared for periods of increased volatility and be cautious of potential market downturns.

2. Economic Uncertainty: Economic conditions can change rapidly and unexpectedly. Factors such as inflation, interest rates, trade tensions, and global economic growth can significantly impact market performance. Investors should closely monitor economic indicators and stay informed about potential shifts in the macroeconomic landscape.

3. Policy Changes: Government policies, including fiscal and monetary decisions, can have a significant impact on the market. Changes in tax regulations, trade policies, or central bank actions can create uncertainty and affect specific sectors or industries. Investors should stay informed about policy developments and assess their potential impact on investments.

4. Geopolitical Risks: Geopolitical events, such as political instability, geopolitical conflicts, or trade disputes, can disrupt markets and create uncertainty. These events can have a broad impact across various sectors and regions. Investors should consider the potential implications of geopolitical risks and diversify their portfolios to mitigate exposure.

5. Company-Specific Risks: Individual companies face risks specific to their operations, industry, or competitive landscape. Factors such as management changes, regulatory issues, technological disruptions, or litigation can significantly impact a company’s financial performance and stock price. Investors should conduct thorough research and due diligence on individual companies before making investment decisions.

6. Valuation Concerns: Elevated market valuations can pose risks for investors. If stock prices become disconnected from underlying fundamentals, there is a potential for a market correction or a downward revaluation of assets. Investors should carefully assess valuation metrics and consider the potential for market corrections or adjustments.

7. Liquidity and Market Depth: In times of market stress or heightened volatility, liquidity and market depth can become a concern. Thin trading volumes or a lack of buyers in certain markets can lead to challenges in executing trades at desired prices. Investors should be aware of liquidity conditions and consider the potential impact on their ability to buy or sell investments.

It is important for investors to assess their risk tolerance, diversify their portfolios, and stay informed about market developments and potential risks. Consulting with financial advisors can provide valuable insights and guidance in navigating the current market environment.

Conclusion

In conclusion, as Thomas Szasz wisely stated, “Men are afraid to rock the boat in which they hope to drift safely through life’s currents when the boat is stuck on a sandbar. They would be better off to rock the boat and try to shake it loose or, better still, jump in the water and swim for the shore.”

The Super Rich and the Current Stock Market Complexities, updated on October 21, 2023, prompts us to reflect on the intricate dynamics of the stock market. This exploration within a historical context not only highlights our capacity to learn from the past but also emphasizes the relevance of our real-time decision-making.

The stock market and the economy present a multifaceted scenario characterized by seeming contradictions. The market remains buoyant despite concerns like tepid earnings and a high unofficial unemployment rate. The interplay of speculative investments, central bank support, and cautious investor sentiment has played a pivotal role in this paradoxical situation.

Furthermore, the revelation of a significant cash reserve, estimated at over $50 trillion, indicates that investors are exercising caution. This reserve, held by various entities, reflects the hesitancy to commit fully to riskier assets. While these cash reserves hold the potential to shape market dynamics, their deployment depends on a range of factors.

In the face of this complex landscape, investors must remain vigilant. Market conditions can shift rapidly, and a comprehensive approach, incorporating various indicators, sentiments, and fundamental analysis, is crucial for making informed investment decisions. While psychological and sentiment indicators provide insights, they should be used in conjunction with traditional valuation metrics.

Additionally, navigating market risks with confidence requires an understanding of potential challenges, including market volatility, economic uncertainty, policy changes, geopolitical risks, company-specific issues, valuation concerns, and liquidity considerations. Investors should diversify their portfolios, assess their risk tolerance, and stay informed about market developments to make prudent investment choices.

In this ever-evolving financial environment, embracing complexity and making informed decisions is the key to achieving long-term financial success.

Insanity is often the logic of an accurate mind overtasked.

Oliver Wendell Holmes

Originally published on: November 16, 2016, and continually updated over the years, with the most recent update conducted on October 21, 2023.

Thought-Provoking Articles for the Curious

THS flag IS NOT MY FLAG canada USE TH WAY TO GET power in all over WHEN TH ARE UNDER ACTS SOON TH BE IN NEWS BU FIRE IPRMISE U