2023 Stock Market Outlook: Low Bullish Sentiment Raises Concerns

Apr 16, 2023

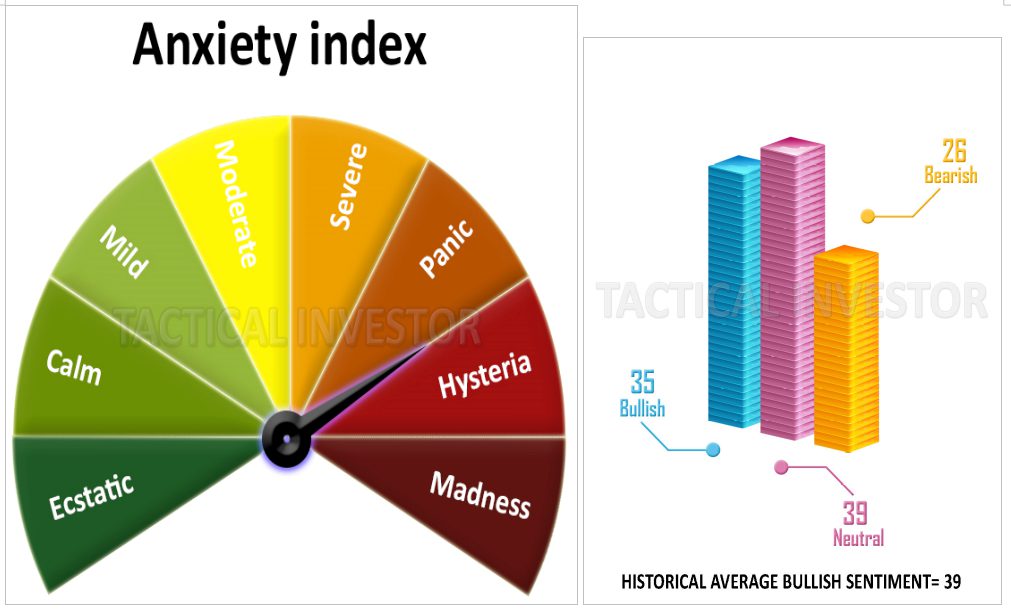

Amidst a vigorous market rally since October 2022, it’s rather curious that bullish sentiment hasn’t quite reached its historical average, firmly remaining below 39. At this stage, one would expect it to be at least around 45. There are merely two plausible explanations. First, the financial masses might be in a state of shock, remaining in this zone for a considerable period, as indicated by subscriber data that reveals concern and unease levels similar to October 2008.

For the gauge to move to the hysteria zone, one of three sentiment measures needs to experience a sharp move. For example, bullish readings dropped to the 10-12 range, or Neutral readings surged to 55. Market update January 30, 2023

Anxiety and uncertainty amongst subscribers now almost mirror the readings of October 2008. What happened subsequently? A single final drop, followed by the market hitting rock bottom, but leaving investors in a psychological limbo for nearly a decade.

If the apprehension among T.I. subscribers reaches an all-time high, it will be integrated into the criteria for FOAB. Moreover, only three more conditions are left; upon their fulfilment, we shall witness the highly elusive FOAB. In such an event, everyone at T.I. would invest all resources at our disposal, and even more through leveraging, into the Market. However, we strongly advise against the use of leverage or margin, except for those prepared to undertake the associated risks. Two criteria are dangerously close to being fulfilled; if they are, it will trigger a MOAB by default.

The second possible explanation is that traders are patiently waiting for better prices. The problem, however, is that the prices they were hoping for have already been reached. If the Market pulls back again, it remains uncertain whether traders will take action or continue to wait, assuming that even better prices will follow.

Articles You’ll Love: Our Top Picks for Curious Minds

Technical Analysis of Trends: Cracking the code

A Sophisticated Approach: Do Bonds Increase Returns When the Stock Market Crashes?

Mastering Your Finances: Why You Need to Learn How to Manage Your Money with Grace

Stock Market Forecast Next 10 Years: Feasible or Not?

Why is the US Dollar Not Backed by Gold? Unveiling its Deadly Impact

Embracing Contrarian Meaning: The Magic of Alternative Perspectives

Best Ways to Beat Inflation: Inspiring Insights from Contrarian Investors

In the Shadows of Crisis: The Stock Market Crash Recession Unveiled

The Long Game: Why Time in the Markets Beats Timing the Markets

Unveiling Falsehoods: Which of the Following Statements About Investing is False

How to Win the Stock Market Game: Cracking the Code

Which of the Following is True When the Velocity of Money Falls? Economic Slowdown

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future