Gold Price Forecast: Next 5 years

Updated March 2023

Too much emphasis is placed on trying to time the top or bottom of a given market. This is the most stupid endeavour ever and a waste of time. The entire premise is wrong, and the result will be flawed. The emphasis should be on identifying the trend; once you know the trend the rest is history. Who cares if Gold bottoms tomorrow or not if you know the direction? Would it matter if you got in early or slightly late if you identified the long-term trend? The answer should be; no. It does not matter at all.

This is why at the Tactical Investor, we have always focused on using Mass psychology and technical analysis to spot new trends. That made us bail out of Gold in 2011 when all the experts predicted that Gold would continue trending upwards.

Forecast: Will Gold Prices Soar

- There are many factors, both positive and negative; we tend to focus on the trend as both positive factors and negative factors, in general, tend to be overblown. According to the naysayers, the financial markets should have repeatedly experienced cataclysmic corrections. One of the most significant bullish developments is the emergence of a wealthy middle class in China which is now the world’s largest. China is also home to the most billionaires in the world. The Chinese have a strong affinity for gold; as their wealth increases, they will deploy increasingly large sums of money into Gold. It’s not only China’s Middle Class growing; Asia has experienced a boom. Asia will be the epicentre of economic growth for many decades to come. Asians are generally savers and tend to all favour Gold, so this development is a significant factor in favour of Gold in the long run.

- Central banks (China & Russia) are aggressively purchasing Gold, which must be construed as a long-term bullish signal.

- For those who seek negative factors, we have a few; Student debt is at record levels, and delinquencies are rising. The subprime auto loan market has also exploded, and the current delinquency rate is at a 20-year high. These are just two of many factors that could trigger another financial crisis.

What went wrong in 2011

The fundamental factors were incredibly bullish for Gold running into 2011 and after that, but Gold did not respond. What happened? Even though the money supply was being inflated at a mind-boggling rate, the velocity of money had slowed down. Money was not changing hands fast enough. In other words, the masses had no access to easy money. Hence, Gold tanked as deflationary forces set in. These forces are still at play, so we are neutral on Gold stocks but bullish on Gold and Silver bullion.

Things you should not do when it comes to Gold. Don’t listen to the Naysayers and Doctors of Doom.

One of the guys you should listen to with a barrel of salt is Jim Sinclair, his prediction of 50,000 an ounce is insane, to put it mildly.

What To Expect From Gold in 2023?

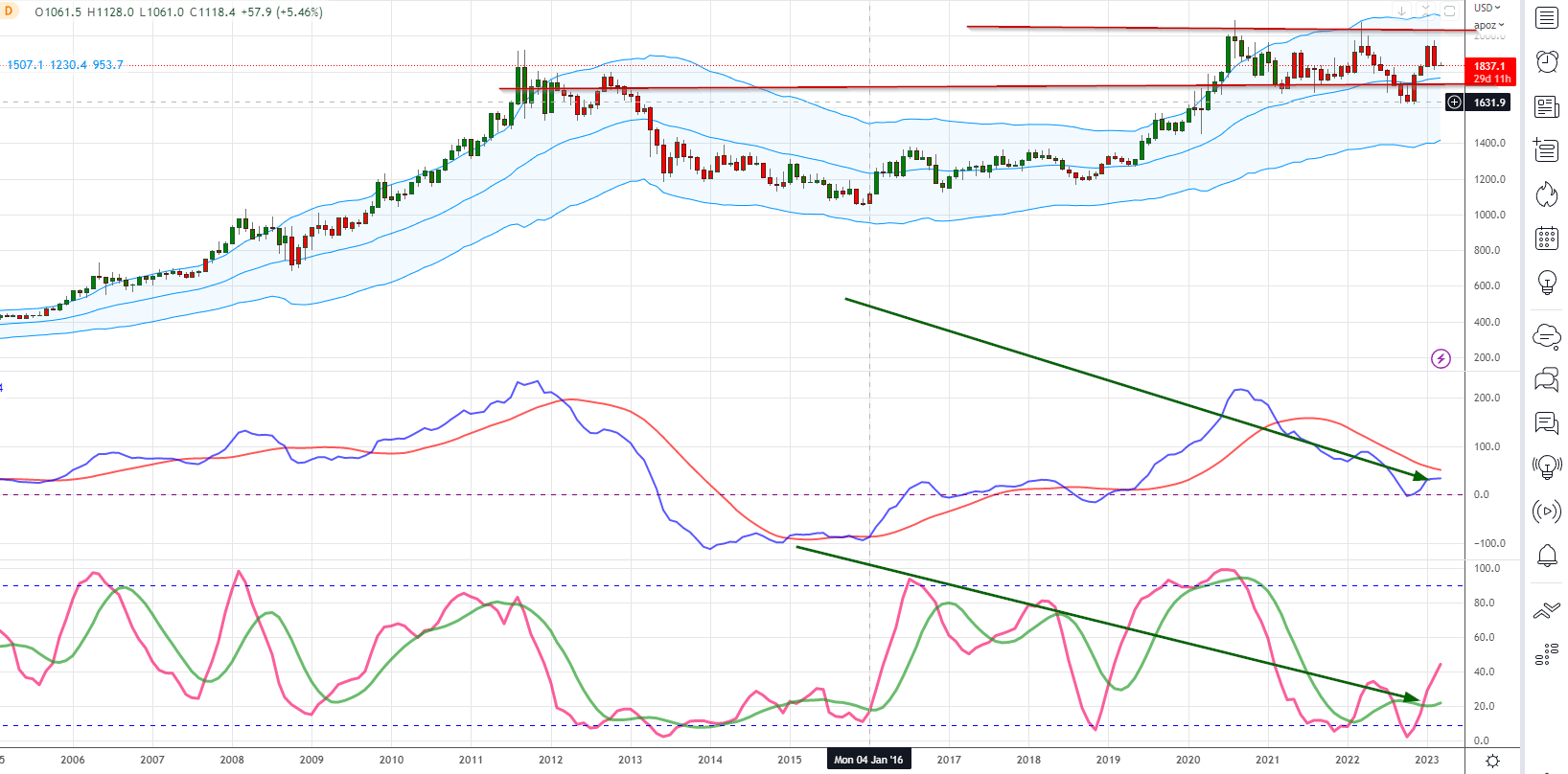

Courstesy of tradingview.com

Despite the ongoing surge in money supply, gold prices have been held in check by the dwindling velocity of money. Such a factor hath contained the value of gold, notwithstanding the prodigious amount of Money brought into existence. Yet, as the world steers away from the dollar, the outlook for gold may be altered.

Behold, China hath already sold off a substantial portion of its U.S. Treasury holdings. Its gold reserves didst expand in December, even as tensions with the U.S. mounted and interest rates climbed. The U.S. Treasury Department reported a significant 17% decrease, worth $173.2 billion, in Chinese holdings of Treasury securities in 2022 – the most significant decline since 2016.

This decline was caused mainly by the swift interest rate hikes of the U.S. Federal Reserve to combat inflation, which led to a drop in bond prices. This, in turn, prompted investors, such as China, to diminish their Treasury holdings. The growing gold holdings of China dost indicate their eagerness to diversify their investment portfolio.

The upsurge in copper prices to unprecedented levels and the commencement of the Russia-Ukraine conflict in 2022 did portend that true inflation, not the illusory “manflation,” is looming. Our analysis further avers that the dollar is poised to attain a multi-year zenith. A score of years past, we were among the initial proponents of the dollar, upholding its merits whilst the rest of the world renounced it, foretelling that it shall trade on par with the euro. Therefore, it would be prudent to seize opportunities and leverage downturns in precious metals to establish a position.

Conclusion

Our analysis has deduced that the value of Gold bullion is poised to soar in the coming 15 to 24 months, with our most modest prediction hovering betwixt the 2500 to 2700 echelon. Nevertheless, it must be observed that there exists a chance that Gold could surpass the 3000 milestones ere it reaches its peak. This prediction is founded upon numerous factors, inclusive of the persistent global economic precariousness, geopolitical friction, and the continued debasement of fiat currencies.

Other Articles of Interest:

Perception Wars; You see what you are directed to see (April 12)

Federal Reserve existence based on Deception & Fraud (April 12)

Central bankers use Monetary Policy as Weapons of Mass Destruction (April 11)

The Nyse Composite Index is signalling higher prices (June 18)

Bear Market History: Buy The Bear Sell The Euphoria (June 14)

Shorting The Market: An Endeavor with Poor Risk To Reward Profile (June 1)

Paradoxes: The Scorpion And The Frog (May 14)

Getting Even With China (May 6)

what is the stock market doing today (May 6)

Google Stock Price Projections For 2020 (April 28)

Stock Manipulation: Is It Good, Bad Or Inconsequential? April 28

It is excellent.

🙂