What is Debt Monetization? How the Fed Steals from the Masses

May 24, 2024

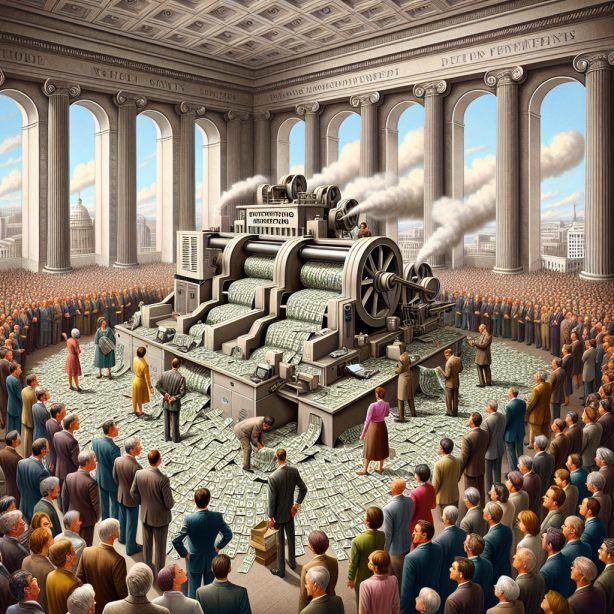

Debt monetization is often discussed in economic circles, yet it remains a complex concept for the general public. At its core, debt monetization is the process by which a government finances its debt by creating new money. A country’s central bank, such as the Federal Reserve (Fed) in the United States, typically facilitates this.

The mechanism involves the central bank purchasing government bonds and injecting newly created money into the economy. While this practice can provide short-term relief for government budgets, it carries significant long-term risks, including inflation and the erosion of purchasing power. In essence, debt monetization can be viewed as a subtle form of theft from the populace, devaluing their savings and income.

Understanding Debt Monetization

Debt monetization occurs when the government issues bonds to cover its deficit, and the central bank buys these bonds, effectively funding the government by printing new money. This process increases the money supply in the economy, which can lead to inflation if the growth in the money supply outpaces economic growth.

To break it down further:

1. Government Issues Bonds: The government issues bonds to finance its spending beyond its revenue.

2. Central Bank Buys Bonds: The central bank purchases these bonds, paying for them with newly created money.

3. Increase in Money Supply:** This transaction increases the overall money supply within the economy.

In theory, debt monetization can help stimulate economic activity by giving the government the funds to invest in infrastructure, social programs, and other growth-promoting activities. However, the crux of the problem lies in the inflationary pressures that arise from an increased money supply.

The Fed and Government: Stealing from the Masses

When the Federal Reserve monetizes debt, it dilutes the currency’s value. Imagine a pie representing a country’s total economic value. When more slices (money) are created without increasing the pie size (economic output), each slice becomes smaller. This phenomenon is known as inflation, where the purchasing power of money decreases, meaning people need more money to buy the same goods and services.

Here’s how the Fed and the government, through debt monetization, essentially “steal” from the masses:

1. Erosion of Savings: Inflation reduces the actual value of savings. For example, if you have $10,000 in a savings account with an interest rate of 1%, but inflation is running at 3%, your real purchasing power decreases by 2% annually. Over time, this erodes the value of your savings significantly.

2. Decreased Purchasing Power: As the money supply increases, prices for goods and services rise. Middle and lower-income families, who spend a larger portion of their income on necessities, are disproportionately affected. Their wages often do not keep pace with inflation, leading to a declining standard of living.

3. **Redistribution of Wealth:** Debt monetization can lead to an unintended redistribution of wealth. Those who hold tangible assets, such as real estate or stocks, can see their wealth increase as these assets typically appreciate inflation. In contrast, those without such assets see their purchasing power diminish, exacerbating income inequality.

Examples of Debt Monetization and Its Consequences

To understand the implications of debt monetization, let’s look at historical examples:

1. Weimar Republic (Germany, 1920s): To pay off war debts and stimulate the economy, Germany’s central bank printed massive amounts of money. This led to hyperinflation, with prices doubling every few days. People’s savings became worthless, and the economy was thrown into chaos.

2. Zimbabwe (2000s): Zimbabwe’s government printed money to finance its budget deficit, leading to one of the worst hyperinflations in history. At its peak, inflation reached 89.7 sextillion per cent per month, rendering the currency worthless and plunging the country into economic turmoil.

3. United States (2020s): During the COVID-19 pandemic, the Federal Reserve engaged in unprecedented levels of quantitative easing, a form of debt monetization, to support the economy. While it helped prevent a deeper recession, it also sparked concerns about long-term inflation and the sustainability of such policies.

Preventing the Dangers of Debt Monetization

Given the inherent risks of debt monetization, individuals must protect themselves against its potential fallout. Here are some strategies:

1. Investing in Good Stocks: Stocks represent ownership in a company and tend to appreciate inflation. By investing in companies with solid fundamentals, individuals can protect their wealth against the eroding effects of inflation. Historically, equities have provided higher returns than other asset classes over the long term.

2. Commodities: Commodities such as oil, natural gas, and agricultural products often rise in price with inflation. Investing in commodities or commodity-based ETFs can provide a hedge against inflationary pressures.

3. Precious Metals: Gold and silver have long been considered safe havens during economic uncertainty. They tend to retain their value and can act as a hedge against inflation. Holding a portion of one’s portfolio in precious metals can provide security against currency devaluation.

Novel Techniques for Higher Return

Beyond traditional investments, there are several innovative strategies that individuals can consider to protect and grow their wealth:

1. Cryptocurrencies: Digital currencies like Bitcoin and Ethereum have gained popularity as alternative stores of value. While highly volatile, cryptocurrencies offer the potential for significant returns and can serve as a hedge against traditional financial systems and inflation.

2. Real Estate Crowdfunding: Platforms like Fundrise and RealtyMogul allow individuals to invest in real estate projects with relatively small amounts of capital. Real estate appreciates inflation and can provide passive income through rental yields.

3. Peer-to-Peer Lending: Peer-to-peer lending platforms like LendingClub and Prosper connect borrowers with individual lenders. By lending money to borrowers at higher interest rates, investors can earn higher returns than traditional savings accounts.

4. Investing in Startups: Platforms like AngelList and SeedInvest enable individuals to invest in early-stage startups. While risky, successful startups can provide substantial returns, often outperforming traditional investments.

Mass Psychology and its Role

Understanding mass psychology is critical in navigating the complexities of debt monetization and its effects. Mass psychology refers to the collective behaviour and thought processes of large groups of people. Here’s how it can help:

1. Market Sentiment: Market sentiment, driven by collective investor behaviour, plays a significant role in asset prices. By gauging market sentiment, investors can decide when to enter or exit investments.

2. Herd Behavior: herd behaviour can lead to significant market movements during economic uncertainty. Understanding this behaviour can help investors avoid panic selling and capitalize on opportunities created by market overreactions.

3. Contrarian Investing: Contrarian investors go against prevailing market trends, buying when others are selling and vice versa. This approach can yield higher returns, especially during market turmoil driven by mass psychology.

4. Education and Awareness: Educating oneself about economic policies, market trends, and investment strategies can mitigate the adverse effects of debt monetization. By staying informed, individuals can make better decisions and avoid falling victim to wealth erosion.

Conclusion

While a tool for governments to manage fiscal deficits, debt monetisation carries significant risks for the general populace. Increasing the money supply can lead to inflation, eroding the value of savings and decreasing purchasing power. Historical examples from the Weimar Republic, Zimbabwe, and recent U.S. policies highlight the potential dangers of unchecked debt monetization.

To safeguard against these risks, individuals should consider diversifying their investments across stocks, commodities, and precious metals. Novel investment strategies like cryptocurrencies, real estate crowdfunding, peer-to-peer lending, and investing in startups can also provide opportunities for higher returns.

Lastly, understanding mass psychology and staying informed about economic and market trends can empower individuals to make sound investment decisions, protecting their wealth from the subtle theft of debt monetization. By taking proactive measures, one can navigate the complexities of the financial system and secure a more stable economic future.

Cerebral Adventures: Exploring Unique Intellectual Terrain

The Mob Psychology: Why You Have to Be In It to Win It

What Is Collective Behavior: Unveiling the Investment Enigma

What is the Rebound Effect? Unlock Hidden Profits Now

Dividend Collar Strategy: Double Digit Gains, Minimal Risk, Maximum Reward

Dividend Capture Strategy: A Devilishly Delightful Way to Boost Returns

BMY Stock Dividend Delight: Reaping a Rich Yield from a Blue-Chip Gem

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

What Is the Velocity of Money Formula?

What is Gambler’s Fallacy in Investing? Stupidity Meets Greed

Poor Man’s Covered Call: With King’s Ransom Potential

How to Start Saving for Retirement at 35: Don’t Snooze, Start Now

The Great Cholesterol Scam: Profiting at the Expense of Lives

USD to Japanese Yen: Buy Now or Face the Consequences?

How is Inflation Bad for the Economy: Let’s Start This Torrid Tale

Copper Stocks: Buy, Flee, or Wait?