Bitcoin Price Analysis: Unveiling the Boom or Bust Scenario

Updated Nov 5, 2023

As of November 5, 2023, discover the freshest insights, including updated price targets and expert commentary, thoughtfully presented towards the conclusion.

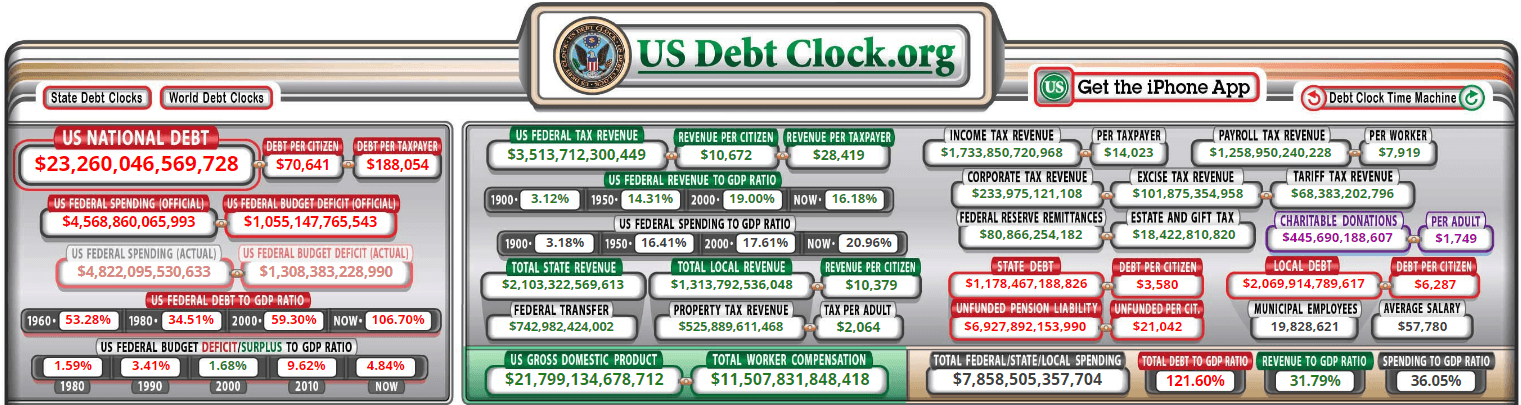

The rapid increase in the US debt has initiated discussions about the potential effects of hyperbitcoinization. Theoretically, Bitcoin (BTC) has the potential to replace any economy, and currently, its value matches that of a small country’s money supply.

If all the BTC in circulation, which is just over 18 million, were used to pay off the current US debt and the next budget, the fair price for BTC would exceed $200,000. The price could escalate to over $260,000 if the debt reaches all its targets. However, this level is still relatively low compared to prices that could match the global economy and fall far short of the $1 million valuation.

The hypothetical price range of $200,000 is quite close to the predictions of BTC, reaching $100,000 within the next few years. BTC cannot predict prices with absolute accuracy, but it has the potential to reach higher levels.

BTC is trading at around $10166.5 +0.17%, gaining momentum from December’s lows as it enters the new year. However, institutions are now more cautious, with hedge funds divesting themselves of crypto assets due to periods of poor performance. Nevertheless, BTC adoption has increased over the last decade, leading to expectations that the leading coin will be much more than a passing trend. Full Story

Bitcoin Price Action

AB Bernstein has formulated a calculation – 1,832% to be precise – by taking into account not only the conventional levels of public debt such as bonds but also financial debt and its complexities, as well as future commitments for entitlement programs like Medicare, Social Security, and public pensions. Nevertheless, comprehending this complete image necessitates nuance. It is crucial to recognize that not all debt obligations are set in stone. We should be aware of where the wiggle room lies, especially in government programs that can be modified by accounting or legislation.

“This distinction is important to recognize because this perspective is frequently employed by those who want to paint a bleak picture about debt,” as stated by Philipp Carlsson-Szlezak, chief U.S. economist at AB Bernstein, in the report. “Although the picture is bleak, such numbers do not demonstrate that we are doomed or that a debt crisis is inevitable.” Full Story

Bitcoin: Soaring in the Face of COVID

Bitcoin’s value has skyrocketed as apprehension about the coronavirus epidemic sends shockwaves throughout global stock markets. One bitcoin (XBT) is now valued at around $9,300. Bitcoin has surged nearly 10% this week and has increased by 30% since the conclusion of 2019, making it the best start to the year for Bitcoin since 2012.

Bitcoin prices are rising due to numerous factors, including ongoing economic uncertainties. Shaun Djie, the chief operating officer of digital token company Digix, stated in remarks e-mailed to CNN Business, “The recent bitcoin rally can be attributed to ongoing economic uncertainties.” Djie indicated that concerns about US-China trade relations, Brexit, and political tensions between Japan and South Korea are among the factors that have boosted bitcoin prices. However, the coronavirus is undoubtedly the most significant catalyst as of late. “The rise in bitcoin price correlates to the ongoing outbreak,” Djie said.

US Debt Out of Control

The latest data indicates that total U.S. household debt rose by 1.3 per cent to reach $17.29 trillion in the third quarter of 2023 1. This figure includes various types of debt such as mortgages, auto loans, credit cards, and other types of loans. The average household debt was reported to be $103,358 as of the second quarter of 2023 The current trend of low unemployment, strong consumer confidence, and cheap borrowing costs is encouraging Americans to take on more debt. However, the figures presented are not adjusted for inflation or the larger size of today’s economy. Mortgages remain the most significant part of household debt, accounting for $9.44tn. Student loans follow, amounting to $1.5tn, and credit card balances at $870bn. Despite the high borrowing levels, the Federal Reserve Chairman expressed little concern about consumer borrowing, despite warnings about historically high business debt levels.

Bitcoin Price Analysis: 2023 and Beyond

The weekly chart of Bitcoin via GBTC

While Bitcoin (BTC) holds the potential to surge to 45K and beyond, it’s currently trading in a highly overbought range on the weekly charts. We believe it could benefit from a cooling-off period, particularly GBTC, which has advanced too rapidly.

There are two possible scenarios at this point. In the first scenario, GBTC could surge beyond the 29 to 30 range, turning the former resistance zone into support. If this pattern plays out, then GBTC is unlikely to drop below 24; even if it does, it may only be intra-day.

The second scenario involves Bitcoin and GBTC experiencing a strong pullback while our indicators also pull back. However, we are primarily looking for one key development: our indicators returning to the oversold range on the weekly charts. Whether BTC experiences a strong pullback or not, we focus on this indicator-driven approach.

If the first scenario unfolds, the odds of Bitcoin surging as high as 51K would increase to 65%. From Market Update Nov 5, 2023

Other Articles of Interest

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market