Editor: Philip Ragner | Tactical Investor

This Stock Market Will Crash

The Tactical Investor focuses on multiple arrays of Topics because they are all interrelated. If you fixate on one area, then you will miss the whole picture and those that fail to see the whole picture are the ones left footing the bill.

The stock market crash story is getting boring and annoying to a large degree. Since 2009, there has been a constant drumbeat of the market is going to crash stories. In 2009, many experts felt that the market had rallied too strongly and that it needed to pull back strongly before moving higher up. One day they will get it right as even a broken clock is correct twice a day. In the interim waiting for this stock market crash has cost these experts a fortune, both in lost capital gains and actual booked losses if they shorted this market. Worst Stock Market Crash of our lifetime; is this a possibility?

This Stock Market Will Crash Story Is Getting Boring.

It’s just another broken clock story; the same theme but with a different stench

US STOCK markets could be poised for a crash with asset manager Carlos Hardenberg warning investors are calling for a correction in US stock market as the dollar faces pressure due to the frayed relationships with China.

Speaking to CNBC, Mr Hardenberg said: “I would rather be concerned about the US.

“I think the U.S. market looks very, very toppy. I think it’s right for a more pronounced and more significant correction in the US.

“I also don’t think the strengthening of the U.S. dollar can be justified over the long term.”

“So the dollar from a longer-term perspective to me looks very fragile.” (wrong again, its set to soar)

He added: “If you assume the strengthening of the US dollar is not going to last for very long, that’s actually better news for emerging markets.” Full Story

A more Realistic Take

James Bateman of Fidelity International said the stock market correction was a good thing. “The tech-fuelled rally in the US had long lost any sense of reality in its valuations, the prospect of inflation remaining low forever could not last, and we have a new and untested Fed chair,” he said. “It would be more worrying if markets didn’t react to all of this.” Full Story

This Stock Market Will Crash Scenarios Laid out By Experts

When one examines most of these so-called experts records, the word jackass comes to mind. For all, they can do is bray about the next coming crash but they never focus on the fact that they missed the entire bull run. Every crash has given birth to the next babby bull market.

David Stockman

“There is surely a doozy just around the bend.”

His reasoning: Stockman expects “an epic monetary and fiscal (policy) collision,” he told CNBC. On the one hand, the recent tax cuts enacted by Congress are likely to help push the federal budget deficit to nearly $1 trillion next year. At the exact same time, the Federal Reserve is starting to unwind its sizable bond portfolio — which it amassed in the aftermath of the financial crisis to keep bond yields low to juice economy activity.

Scott Minerd

The markets are potentially on a collision course for disaster.”

His reasoning: Strong fiscal stimulus at the end of this business cycle, at a time when the economy is already at so-called full employment, is likely to force the Federal Reserve to step in and be more aggressive with interest rate hikes to try to keep inflation in check, Minerd fears. Full Story

Tactical Investor Stock Market will crash Update Aug 2019

Market Sentiment is far from bullish

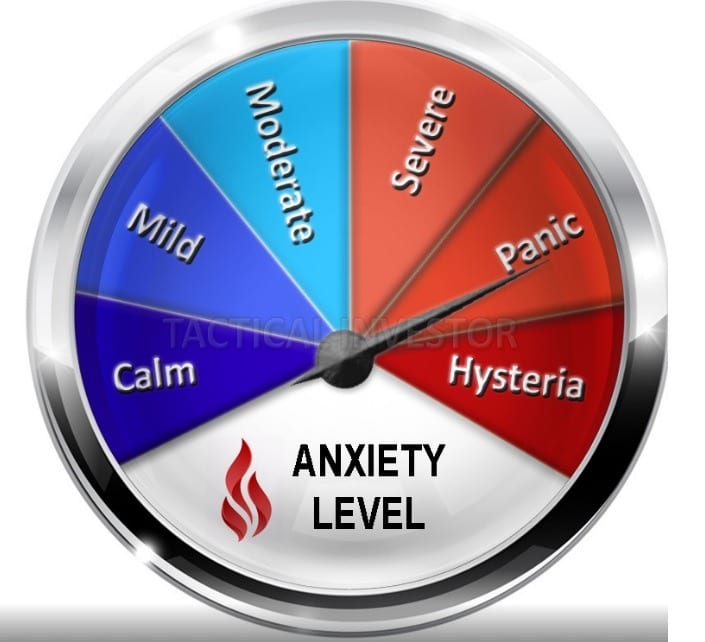

Take a look at the gauges below and it immediately becomes obvious that the only ones that are scared are the ones that historically fare the worst. Anyone with the mass mindset falls under that category. In other words, lemmings will always be lemmings and their only function when it comes to the markets is to be used as cannon fodder.

The long term outlook for the Dow and the overall markets remain unchanged. On the monthly charts, the Dow is still trading in the oversold ranges, so despite the gnashing of teeth, this current pullback has to be viewed through a bullish lens. The only area of focus, therefore, should be directed at finding the best stocks to get into as stocks are not created equal. For example, value investing is almost dead as hot money is chasing momentum-based stocks and if you get into a momentum based stock at the wrong time, despite strong fundamentals you could end up being on the receiving end of the stick.

Other Articles of Interest

Worst Stock Market Crash of our lifetime; is this a possibility? (Aug 23)

Did the Fed Screw up in raising rates; is inflation even an issue (Aug 10)

Electric Car Threat To Big Oil Wildly Overstated? (July 28)

1987 stock market crash: could it happen again? (July 13)

Dow Could Trade to 30K But not before This Happens (July 11)

Fake news & Weak Economy Can’t Stop Stock Market Bull (July 6)